JPMorgan says lithium will crash >40pc but UBS thinks these quality ASX stocks can ride out the storm

News

News

Prices for the metal at the heart of the global energy transition – that’ll be lithium – are in a bit of a pickle and the big names are taking notice.

Analysts at several of the world’s best paid places to be an analyst have pulled the red marker and culled previous Li2O forecasts, with a particularly withering eye on China and a supply response that is thus far meeting demand.

Still, this early-stage draft of the overall lithium narrative largely remains a feel good musical in 3 acts.

The transition is happening. Nevermind the bad PR from the odd lithium battery explosion on the nightly news, battery metals are the at-hand solution.

And adults in the room, like Benchmark Mineral Intelligence, have global lithium demand topping 1.5 million tonnes by 2028 — up from 900,000t this year.

But there are headwinds in the near-term, which have forced the issue for many big name investors.

Both UBS and JPMorgan have downgraded their near-term lithium price forecasts. UBS by 10-30% over FY24-26 and JP Morgan by 37-47%.

This takes UBS’ long-term spodumene forecast to US$1300/t and JPMorgan to $1250/t against the current pricing of $3120/t (having been over $6000/t at the end of last year).

(NB: The latest Fastmarkets spod update is even more bearish, tumbling US$500 last fortnight to US$2250/t).

Burgeoning doubts and fears around the strength of Chinese demand has spot lithium prices galloping back down the hill to their lowest level since mid-pandemic.

Counterpoint Research says in the world’s largest EV market sales growth has fallen sharply: China’s domestic Q2 EV sales grew only 37% year-on-year. Not bad? Well, they’re already well off a trajectory which saw EV sales double in China last year.

Other countries are starting to catch up, but the EV engine room is most def still our largest trading partner.

In China last week, as the country prepped for this week’s giant Golden Week/Autumn Festival mega-hols, prices for lithium carbonate clocked 166,500 yuan a tonne (US$22,820), which is roughly half the peak from the market’s early June rebound.

Bloomberg called the falls ‘precipitous.’

“Less than a year ago, the metal reached a record of 598,000 yuan a tonne.” And the price decline has gone straight for the jugular of stateside lithium producers.

The Sprott Lithium Miners ETF has fallen to its lowest value since starting life as an ETF at the start of the year. The Global X Lithium & Battery Tech ETF is now at over 3 year lows.

It’s this short-term Chinese outlook which has analysts fumbling for their calculators.

While global lithium demand remains fairly robust and both UBS and JPM are keeping their essentially bullish demand outlook over the medium to longer term, the investment giants are much more pessimistic over strong shorter-term supply is keeping up and a maturing supply chain which has inventory to work through.

On a YTD basis, lithium demand appears strong.

One need only peruse the stellar overall pick up in global (and Chinese) EV sales. What’s bothering JPMorgan however, is that on a monthly basis, the numbers highlight “sluggish battery production volumes” October vs September, and that’s currently weighing on consumption.

Chinese companies have been shelling out hard and fast on domestic lithium production rights at Beijing’s behest as China seeks to minimise its reliance on outside supply chains, vulnerable as they are to various geopolitical machinations or retaliations.

An in-house August auction for lithium exploration licences in Sichuan province reportedly attracted more than 11,000 bids; that’s according to data available online at the Sichuan Public Resources Trading Centre.

Still in Sichuan, bidding for two local lithium mines went for what the WSJ says was between 1300 and 1700 times higher than their starting prices, either a measure of intense competition to meet demand or terrible original valuations.

The Journal puts the ‘frenetic bidding’ down to market participants’ expectations that demand for lithium batteries will only continue to grow.

The International Energy Agency, says China’s domestic mines account for roughly 12% of world lithium supply, but some 55% of the world’s lithium is refined there.

In the first five months of 2023, China’s lithium-battery exports reached US$26.7 billion, a 66% jump from the same period a year earlier, according to Chinese customs data.

Given a few sharp nudges of late, China’s Ministry of Natural Resources has been pledging to try harder at finding and developing hometown reserves of battery minerals. Lithium’s number 1 with a bullet. It just needs to find the money to back that up.

But it’s the dry season at home, so already seasonal-based rising supply from brines is helping to unwind a lot of the tension, while Africa has quickly become a handy marginal exporter.

In light of these three rising supply channels, JPMorgan says it is struggling ‘to see a catalyst for lithium prices to rebound’ and from an investment point of view, JPM is unenthusiastic about the sector in the near-term.

Such a revision of near-term price scenarios does not come without its costs.

JPM says some lithium equities at home “have further to fall to recalibrate”, considering it’s a sector where so many have outperformed both the wider market and the commodity itself this year.

This chart shows how far it thinks ASX lithium miners have run beyond fundamentals, compared to Platts spod prices and the ASX 200.

JPMorgan now ranks base metals as its preferred exposure, followed by iron ore, with lithium now least preferred. What a turn up for the books.

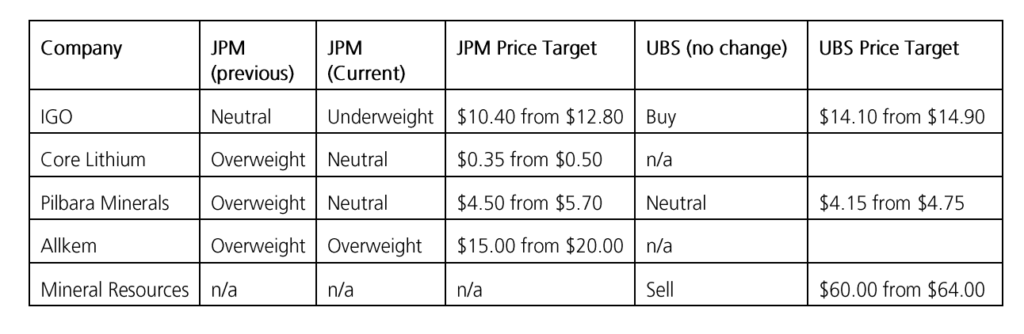

PLS and Core Lithium are now JP neutrals, with an underweight (i.e. sell) label on IGO. Allkem (ASX:AKE) remains a standout for them with a $15-20 price target well beyond the $7b market capper’s current $11.05 price.

Meanwhile, UBS’ preferences are for asset quality. IGO is their preferred buy, with their Greenbushes mine still lowest on the cost curve, followed by Pilbara Minerals in neutral gear with MinRes rated a sell.