Closing Bell: Material gains for the ASX on Friday while a good week at work sees Tech Sector gain 7.5pc

Loud sobbing from the bathroom should have told the group that this wasn't the kind of "teepee" Sarah was asking for. Pic via Getty Images.

- ASX adds 0.7pc to close out the week in a positive frame of mind

- IT and materials rise, thanks to a softening US dollar and general commodity weirdness

- Small caps led by NKOTB, Australian Wealth Advisors Group on a solid debut

Materials and IT have driven Australian markets to a positive finish for the week, the benchmark gaining almost 0.7% after US stocks climbed for a second day Thursday, aided by retreating US Treasury notes.

At 4.15pm on February 16, the S&P/ASX200 was up 52.60 points or 0.69% to 7,657.30.

A lift in commodity prices has buoyed the local resources companies, the Materials and Energy sectors leading the way.

The major miners led the players out this morning. The swinging lithium miner Pilbara Minerals (ASX:PLS) was up by a lazy 5.7% around lunch, while both Rio Tinto (ASX:RIO) and BHP (ASX:BHP) were around 1% the better. The former just a day after flagging more than $10 billion in write downs.

Most of the local goldies are making hay today, thanks to a bump in the spot price. Northern Star Resources (ASX:NST) leading the index march, ahead by almost 2.5%.

The price of gold has been on the decline for most of a second consecutive week, but overnight has added a short surge and is looking set at around US$2,000 an ounce on Friday.

The same mixed messages on US inflation look like keeping the precious metal in a tight range for now.

Among the big insurers, QBE Insurance (ASX:QBE) slumped by 2.7% after warning that premium growth would slow while Insurance Australia (ASX:IAG) was down more than 3% after logging a drop in profits.

The standout melodrama on the ASX today certainly goes to Neuren Pharmaceuticals (ASX:NEU) which is short some 13% after lurching out of a trading halt.

The activist short-seller group Culper lobbed a damning report upon NEU’s partner Acadia Pharmaceuticals rebutting the JVs headline claims that its Daybue (trofinetide) is a terrific treatment for Rett Syndrome.

Neuren has told the ASX the claims have been backed by “numerous analyst research reports published on Acadia and on Neuren, many incorporating surveys of US physicians, that present a different view to Culper”.

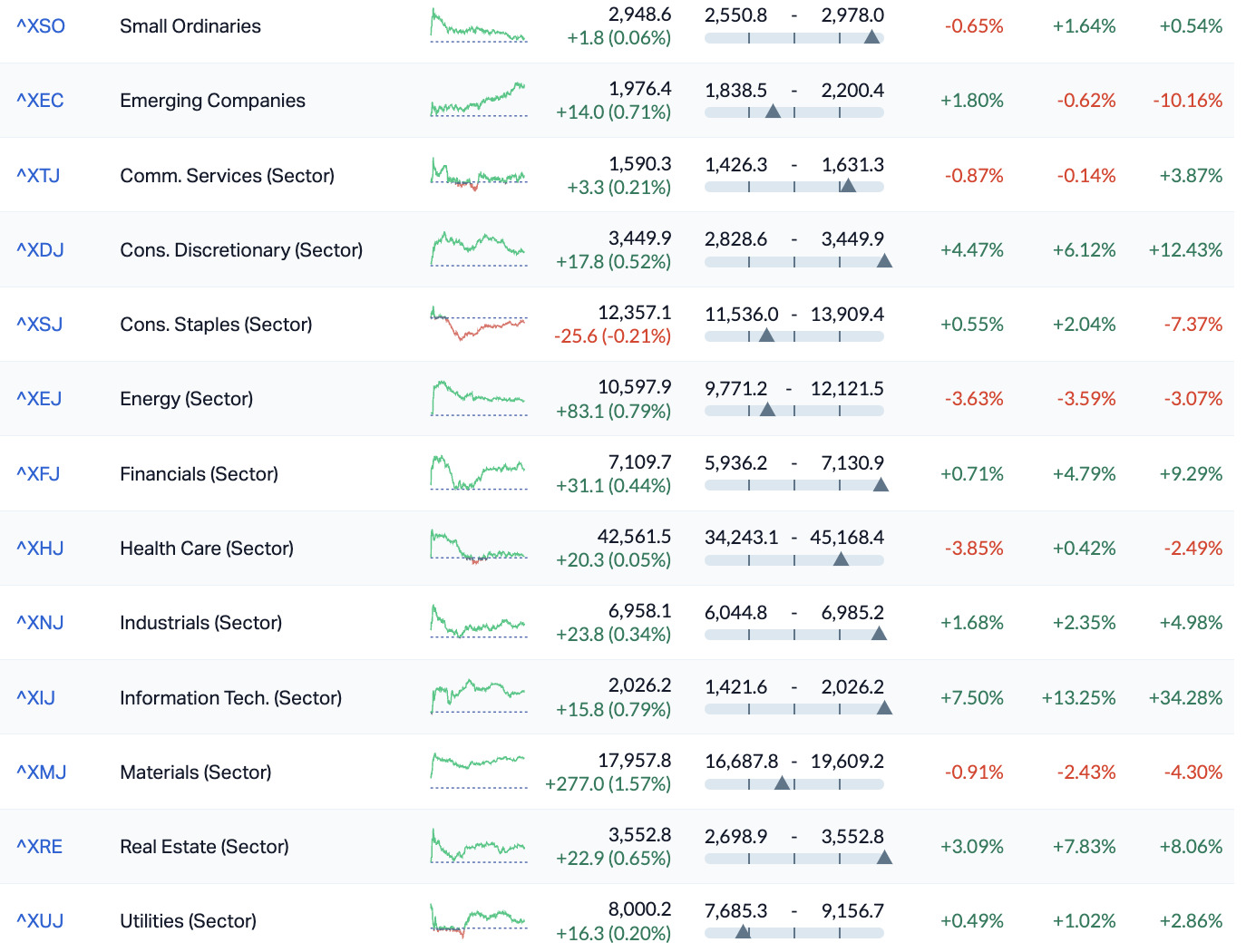

This week the local IT Sector lifted by more than 7.5%.

ASX Sectors on Friday

Both the ASX Small Companies (XAO) and Emerging Companies (XEC) indices were in the green on Friday.

I’m watching oil…

Oil prices fell slightly during the trading day across Asia after WTI crude futures steadied around $77.5 per barrel, Friday morning and remained on track for a second straight week of gains.

There’s genuine concern on trading floors of the slowing demand – padticularly from Asia – following a warning from the International Energy Agency (IEA).

Still, crude prices were set for mild weekly gains after clocking volatile swings through the week. A softer offered oil prices some relief, after the greenback fell sharply from three-month highs tracking weak US retail sales.

Oil prices also jumped more than 1% on Thursday as weaker-than-expected US retail sales data prompted a selloff in the dollar. Meanwhile, the International Energy Agency warned in its monthly report that global oil demand is losing momentum, flagging a sharp drop in Chinese demand.

In the States…

Overnight, Wall Street clawed back the steep losses suffered earlier in the week as investors equivocated over the health of the US economy, with indicators unable to decide what’s happening either.

US Treasury yields hit reverse. The benchmark 10-year Treasury slipped 3 basis points to 4.24%. The 2-year Treasury yield fell 2 basis points to 4.56%

Last night it was retail sales falling 0.8% over January – monstering the expected 0.3% slip which drove action poking holes in the current economic bustle thus sticky inflation and thus higher interest rates… and thus the retreat in Treasury yields.

The broad stock index climbed 0.58 per cent, settling at 5,029.73, while the Nasdaq Composite added 0.30 per cent to close at 15,906.17.

The Dow Jones Industrial Average traded 348.85 points higher, or 0.91 per cent, to end at 38,773.12.

Tesla and Meta Platforms outperformed, rising 6% and 2.5%, respectively. Nouveau Monde Graphite’s shares soared 25% following key off-take agreements with General Motors and Panasonic Energy, but on the whole US earnings continue to send an uncertain message to an uncertain market America:

- Tripadvisor up 10% after beating estimates

- Cisco down 2% after calling for layoffs and offering weak forward sales projections

- Deere down 6% after the agricultural machinery maker lowered guidance

US Futures were mixed in Sydney at 4pm on Friday.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.002 | 100% | 1,715,977 | $1,633,729 |

| RBR | RBR Group Ltd | 0.003 | 50% | 7,977,562 | $3,236,809 |

| YPB | YPB Group Ltd | 0.003 | 50% | 333,333 | $1,580,923 |

| R8R | Regener8Resourcesnl | 0.18 | 44% | 54,928 | $3,207,031 |

| WAG | Theaustralianwealth | 0.35 | 40% | 399,234 | $18,591,250 |

| ADS | Adslot Ltd. | 0.002 | 33% | 7,086,018 | $4,836,743 |

| NET | Netlinkz Limited | 0.004 | 33% | 500,000 | $11,635,345 |

| RML | Resolution Minerals | 0.004 | 33% | 150,000 | $3,779,990 |

| LCL | LCL Resources Ltd | 0.013 | 30% | 2,973,988 | $9,552,255 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 207,512 | $17,531,019 |

| KNM | Kneomedia Limited | 0.0025 | 25% | 367,747 | $3,066,543 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 113,005 | $2,850,677 |

| TOY | Toys R Us | 0.01 | 25% | 523,497 | $7,859,708 |

| NVX | Novonix Limited | 0.86 | 23% | 9,613,063 | $342,206,054 |

| EAX | Energy Action Ltd | 0.225 | 22% | 14,152 | $5,571,016 |

| ARR | American Rare Earths | 0.37 | 21% | 10,763,041 | $136,159,106 |

| BRN | Brainchip Ltd | 0.345 | 21% | 35,640,368 | $514,657,185 |

| RLG | Roolife Group Ltd | 0.006 | 20% | 863,087 | $3,612,791 |

| TRI | Trivarx Ltd | 0.025 | 19% | 423,147 | $7,103,852 |

| WR1 | Winsome Resources | 0.76 | 18% | 2,698,802 | $123,056,358 |

| BMM | Balkanminingandmin | 0.08 | 18% | 430,156 | $4,830,755 |

| SP3 | Specturltd | 0.02 | 18% | 660,290 | $3,942,655 |

| LPM | Lithium Plus | 0.2 | 18% | 63,818 | $14,617,994 |

| CCR | Credit Clear | 0.235 | 18% | 569,740 | $83,471,173 |

| ATC | Altech Batt Ltd | 0.088 | 17% | 15,523,002 | $123,999,442 |

According to Stockhead’s own Samwise Gregory, The Australian Wealth Advisors Group (ASX:WAG) made its debut this morning, and was leading a clumsy rush up the small cap ladder through the afternoon session, up close to 50% from its $0.25 IPO price that brought in $5 million.

The company, which refers to itself as AWAG, was “founded in Melbourne in September 2021 by a group of experienced financial market professionals as a holding company”, and has a stated mission to “acquire and build upon sound, profitable and complementary Australian financial services businesses.”

Adslot (ASX:ADS) was up on news of the launch of a new wholly-owned subsidiary called Br1dge, a New York based tech company “established to capitalise on the significant opportunities emerging with the imminent deprecation of 3rd party cookies”.

Third party cookies are the privacy-invading snippets of code that websites leave on your computer so advertisers can continue beaming you ads for monster-sized sex toys long after you’re done with that part of your browsing for the evening and scuttled back to Reddit in shame.

Big tech is phasing out the use of those cookies – most browsers won’t accept them by the end of the year – but by the looks of things, Adslot (via Br1dge) has found a workaround that will keep the targeted ads rolling in, so… hooray?

Olympio Metals (ASX:OLY) saw a bit of a rush in the morning, after the company advised the market that it’s current diamond drilling programme at the Cadillac Project is “well advanced and ahead of schedule”, with 22 holes completed to date on four separate pegmatite targets.

Mighty Kingdom (ASX:MKL) climbed higher after informing the market after hours on Thursday of its intention to buy back all MKL shares held by Gamestar Studios – all 59,657,143 of them – for the princely sum of $1.

MKL said last month a “definitive proposal” – ie: restructuring, cap raising and board appointments was expected to be put to another EGM no later than February 28.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| PRX | Prodigy Gold NL | 0.005 | -38% | 10,801,156 | $14,008,863 |

| BP8 | Bph Global Ltd | 0.001 | -33% | 928,307 | $2,931,174 |

| MTL | Mantle Minerals Ltd | 0.002 | -33% | 55,555 | $18,592,338 |

| JCS | Jcurve Solutions | 0.026 | -28% | 313,559 | $11,820,364 |

| NVQ | Noviqtech Limited | 0.003 | -25% | 315,960 | $5,237,781 |

| AUK | Aumake Limited | 0.004 | -20% | 11,800 | $9,572,034 |

| GMN | Gold Mountain Ltd | 0.004 | -20% | 5,170,000 | $11,389,393 |

| PUR | Pursuit Minerals | 0.004 | -20% | 767,373 | $14,719,857 |

| RR1 | Reach Resources Ltd | 0.002 | -20% | 2,432,539 | $8,025,743 |

| NEU | Neuren Pharmaceut. | 18.845 | -18% | 2,130,108 | $2,935,317,832 |

| WWG | Wisewaygroupltd | 0.05 | -17% | 13,530 | $10,037,632 |

| AMM | Armada Metals | 0.02 | -17% | 273,810 | $4,992,000 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | 849,475 | $3,124,130 |

| PHL | Propell Holdings Ltd | 0.011 | -15% | 956,863 | $2,669,622 |

| SHO | Sportshero Ltd | 0.011 | -15% | 263,535 | $8,031,827 |

| RSH | Respiri Limited | 0.023 | -15% | 124,844 | $28,616,461 |

| FRB | Firebird Metals | 0.12 | -14% | 247,091 | $19,930,596 |

| IS3 | I Synergy Group Ltd | 0.006 | -14% | 400,143 | $2,128,563 |

| RGS | Regeneus Ltd | 0.006 | -14% | 125,000 | $2,145,058 |

| 8CO | 8Common Limited | 0.043 | -14% | 165,704 | $11,204,745 |

| CBY | Canterbury Resources | 0.026 | -13% | 72,659 | $5,152,227 |

| DGR | DGR Global Ltd | 0.013 | -13% | 234,615 | $15,655,402 |

| ZMI | Zinc of Ireland NL | 0.013 | -13% | 20,000 | $3,197,164 |

| RKT | Rocketdna Ltd. | 0.007 | -13% | 121,501 | $5,248,919 |

ICYMI – PM Edition

East Coast Research believes Altech Batteries (ASX:ATC) is undervalued at present, valuing the company at 15-21c, substantially higher than its current share price of 8.7c thanks to the company’s two revolutionary battery technology projects progressing towards commercialisation in Germany.

Australian Mines (ASX:AUZ) has kicked off Phase 2 exploration at its Brazilian critical minerals projects – the Jequie project in Brazil’s Bahia state, and a lithium project in the Minas Gerais state, Resende, to identify additional priority targets ahead of an expected drill program.

PharmAust (ASX:PAA) has successfully completed a Pre-IND meeting with the US Food and Drug Administration (FDA) with a path outlined to potentially receive accelerated and full approval of its lead drug monepantel for the treatment of motor neurone disease/amyotrophic lateral sclerosis (MND/ALS).

Queensland Pacific Metals (ASX:QPM) plan to produce high purity alumina for use in batteries has received a shot in the arm after demonstration testing successfully produced extremely pure 5N HPA using just one stage of purification.

TRADING HALTS

Pinnacle Investment (ASX:PNI) – pending an announcement in relation to a proposed acquisition.

Symbio Holdings (ASX:SYM) – pending the outcome of today’s court hearing, at which Symbio will seek orders of the Federal Court of Australia approving Aussie Broadband‘s 100% acquisition of Symbio.

Toys R Us (ASX:Toy) – pending release of an announcement by TOY in connection with a private placement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.