Couch-maker Nick Scali slides despite a 15pc lift in half-year profit

News

News

Shares in Nick Scali fell today despite a 15 per cent lift in profit to $23.5 million over the first half of 2018, driven by improved sales from an expanding network of furniture stores.

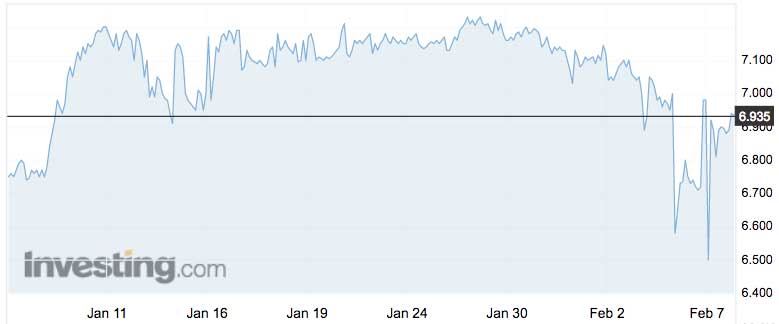

The shares initially fell steeply from $6.98 to $6.50 — but recovered to $6.93 in late Wednesday trade.

The profit growth was driven by an 8.1 per cent increase in sales revenue to $128 million. Same-store sales growth was 2.6 per cent.

“The six new stores opened in first half FY18 have performed above our expectations,” managing director Anthony Scali told shareholders.

“Three of the new stores are located in the Home-Co centres previously occupied by Masters and these centres are generating excellent traffic. We expect to open a number of new stores in other Home-Co centres.”

Most retailers have been reporting quiet Christmas and New Year sales.

The company declared a fully franked dividend of 16c a share, up from 14c.

Nick Scali says recent trading has been volatile with December positive for sales growth but January negative.

“The current expectation is for net profit after tax for the full year to June 2018 to be 5% to 10% higher,” says the company.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.