Confessions of a Day Trader: $7220 in a day – the data doesn’t lie!

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

There are a few of the stocks on the watchlist going ex-div this week, so will see if I can make a dividend profit out of them.

Mondays always feel a bit ‘groggy’ to me, after a weekend of no stock action and then having to wait till 10am to get a little action in.

Decide to go for a coffee and beach walk and let the market open and settle down, without me eyes watching.

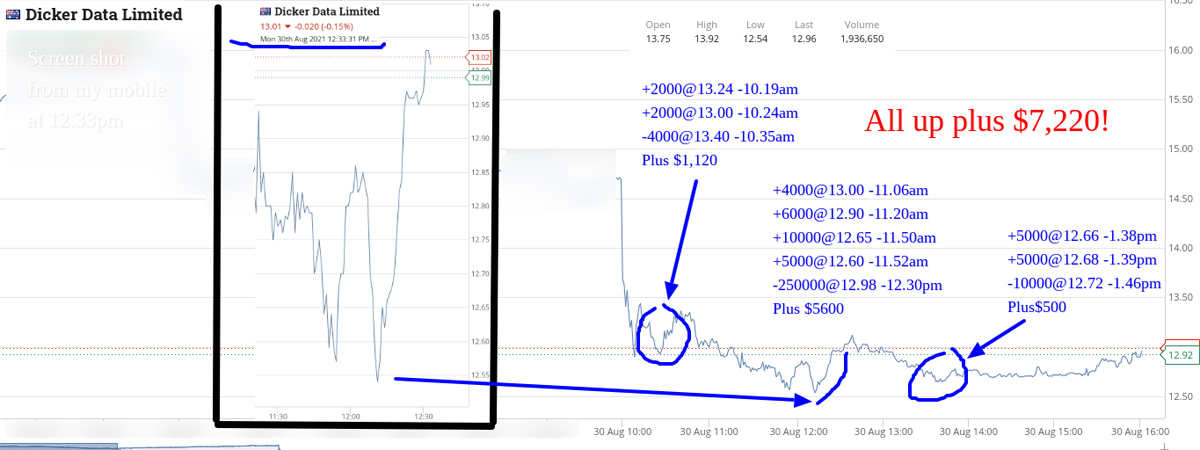

Then it all kicks off. The day’s two biggest fallers are Dicker Data (ASX:DDR) and Altium (ASX:ALU) and I’m into DDR. Make $1,210 in 16 min and it’s only 10.35am.

I can’t understand why they are down 20% on a founder sale of shares and as I’m explaining this to a fellow trader, I want to go big, if they come back.

And I mean big!

Then back in as they do fall.

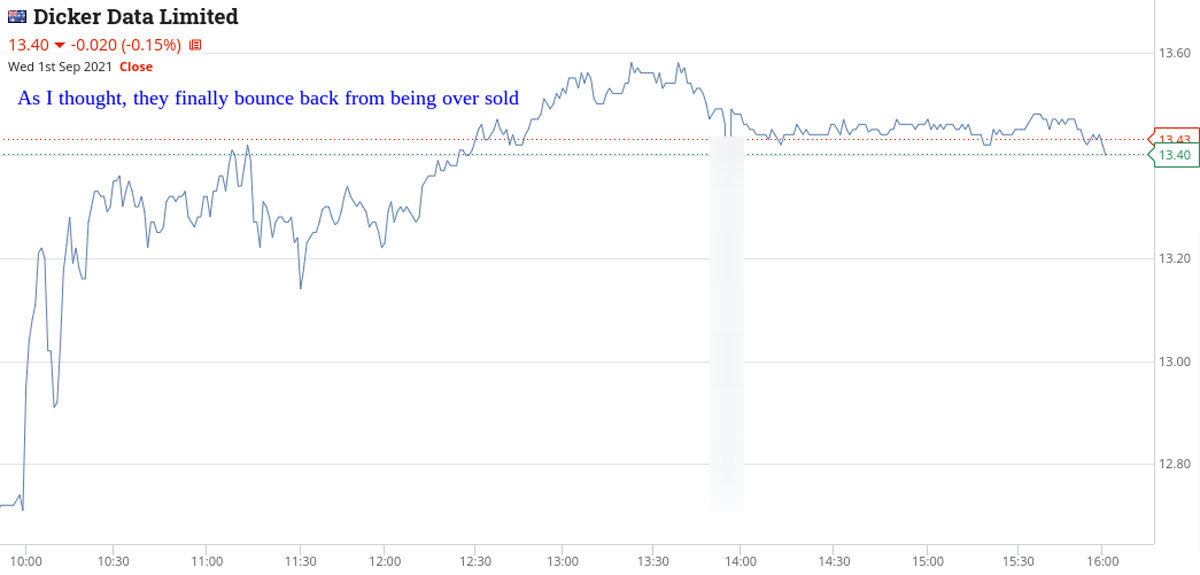

See graph, as I make $7,220 from this market madness. The stock still pays a dividend and makes a profit and should not, in my simple opinion, be down 20% in the last three trading days.

With ALU, they cost me about $1,500 on paper, before I can concentrate on what to do after I am out of my DDR. Double down is my solution and book $1,610 profit.

I think this Monday turned out to be Bottom Picker’s best day so far but as it’s in lockdown, can’t go out to celebrate. Maybe COVID is not so bad after all. Plus $8,830 for the day.

Now what should I do tomorrow?

I get up at 4am to check the markets and manage to stub my left middle toes on the leg of the bed. The screaming and swearing almost meant yesterday’s profit was transferred directly to the swear jar.

My God it hurt – and the elephant-strength pain killers knock me out so much that I miss the opening by an hour.

So my day was sort of made up for me, as missing the opening trend and nursing a couple of badly bruised toes leaves me out of any chance of getting into my mental state of the ‘Trading Zone’.

Have added some charts.

Z1P very boring, DDR’s volume falls by 70% and BHP’s trading ahead of going ex-div on Thursday, getting smashed down at the close.

At least tomorrow is the first day of spring.

The birds are singing and the sky is blue and the coffee is fresh. Let’s see what today brings.

It turns out that out of 16 trades today, I don’t have to double down on any. That feels like a first.

I have to say, my trading today is like Feder’s backhand at Wimbledon – almost faultless.

Make $1,385 today, mainly from Rio and BHP. $180 comes in via REC and RWC. The latter was the morning’s biggest faller.

I had six trades in RIO, with the first buy at $110.17 and sale at $110.37.

Then back in at $109.95 and back out at $110.15, and finally, last buy was at $109.67 and sale at $109.98. All in parcels of 1000 shares.

Only four trades in BHP, with the first trade cut at a $10 loss as was going out and didn’t want to be watching anything. In at $45.19 and out at $45.18 in 1000.

Then back in at $44.90 and out at $45.01 at ALDI in queue.

Old lady in front of me has like 80 tins of cat food and one bottle of scotch.

She tells me she is 90, so I’m thinking of changing my diet, though forgot to ask if she actually has a cat.

Anyway, a great day today and BHP going ex div tomorrow first thing gives me something to look forward to.

Going to mix it up a bit today, what with BHP going ex a fully franked US$2.00 per share amount. They open up and I buy 1000 at $41.89 and 1000 at $41.99 and I wait.

They are the biggest faller of the day, down over 6%.

Then I buy 1000 RIO at $108.45 and also wait. Prepared to play a bit of a longer game for a change, today.

When you see the graphs, you will see that they are both all over the place.

Buy another 2000 BHP at $41.76, before selling all $4000 at 41.96 and booking a $440 gross profit.

Also had to add to RIO position, so buy another 1000 at $107.70, before selling the 2000 at $108.32 and pocketing $590 gross.

Up $1,030 from only five trades today and very relaxed.

Have a crack early on in APT, which turns out not to be too smart a move, even when they open down $2 or so.

Buy 1000 at $131.33, then another 1000 at $130.84 and wait for a bounce that doesn’t come, so double down on 2000 at $130.50.

Cut them before the close at $130.71 for a $330 loss before commission.

The only other trade today was in BHP. Bt 2000 at $42.44 and sold them at $42.53. Left me down $150 for the day.

Always knew my luck would run out at some point this week, after such a cracker on Monday. Plus $11,095 gross for the week and $10,120 net with the Dicker Data being a once in six-month event. (Kogan normally offers the same opportunity, when their founders sell down.)

Can’t go out to celebrate, so kind of a bittersweet end to the week but at least winter is over and FMG go ex-div on Monday, so that will be exciting for Monday morning.