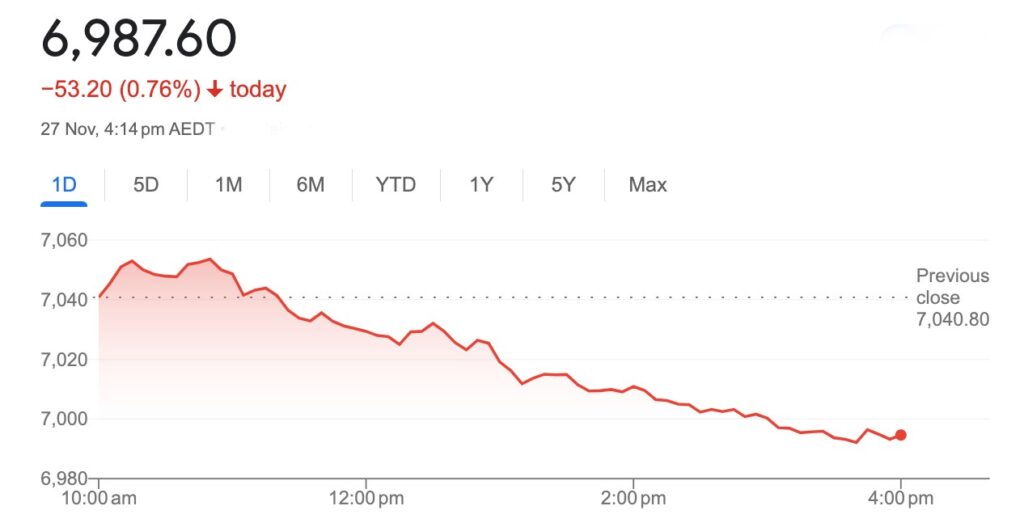

Closing Bell: Yellow cake and gold can’t stop iron ore slide as big miners drive benchmark under 7,000pts

News

News

The local market has come out of the blocks all chipper in the morning on this fine, slightly sultry Sydney Monday and then made a complete goose of itself.

Stumbling at lunch, crashing in the arvo and then – to add insult to injury – the benchmark has plunged after the closing bell to end well under the psychological 7,000 point mark.

It’s psychologically disturbing how quickly that all unravelled.

At match-out on Monday November 27, the S&P/ASX 200 (XJO) index was down 53 points, or -0.76%.

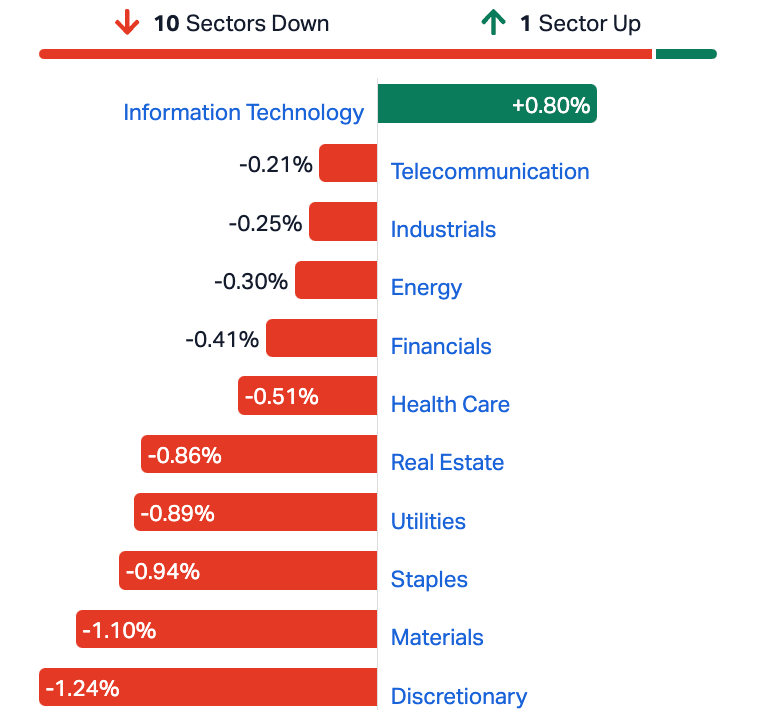

Ten of 11 sectors have failed to bother the scorers on Monday, suggesting broad-based losses, however the major components of the market have dragged the rest lower.

The iron ore diggers and the major banks have sucked the oxygen out of Monday, the benchmark’s largest stocks outside of CSL, all failing to put in a performance for the team.

However, before we go there, Monday’s seen x2 defining indicators of significance out there, beyond some of the more micro-macro market-moving usual Monday moments.

The first is the unnerving strength in gold, which has stiffened and looks resolute above US$2,000 an ounce.

That’ll be the precious panic button metal’s highest levels in over six months.

It’s a beneficiary of the US dollar‘s weakness – a swag of easy bets are being laid that US interest rates have already peaked.

However, the broader economic indicators are a mixed bag in the US. On one hand, last week’s feebler-than-expected consumer spending data seems to confirm the Federal Reserve’s rate hikes are finally starting to weigh on the broader economy. The question of a hard landing on the other hand is resurgent.

At home, we’re treading water until the monthly CPI data drops on Wednesday, while in the states Wall Street is this week eyeing PCE prices, the ISM PMI as well as personal income and spending data or further guidance.

Until then, either as an easy buck or a reliable safe haven, gold is on the up.

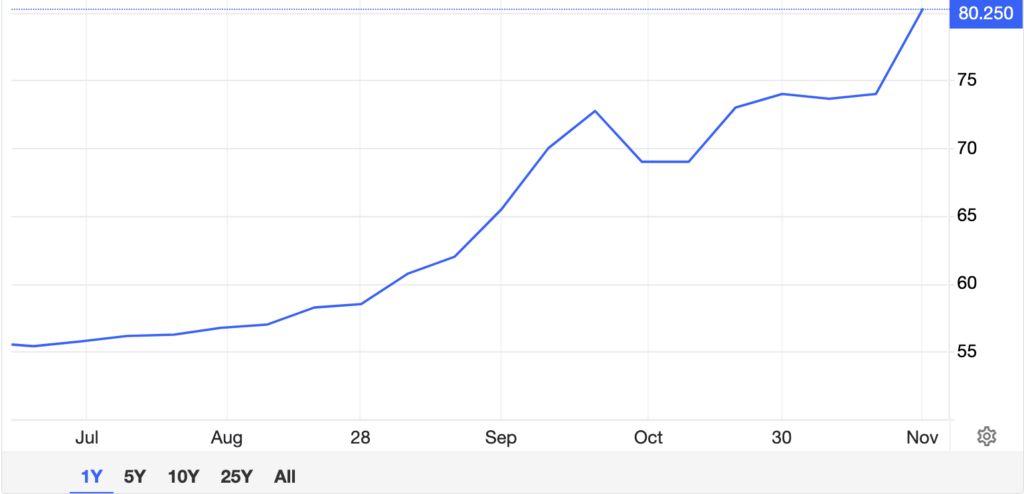

The other eye-popping run – and this has played out on Aussie markets on Monday – the price of uranium has surged past $80 a pound for the first time since January 2008, soaring past pre-Fukushima disaster levels amid high demand and risks to supply. The spot is up over +8.4%

And local traders know it:

A few major uranium movers today…

Aurora Energy Metals (ASX:1AE) +10.53%, Norfolk Metals (ASX:NFL) +7.90%, GTI Energy (ASX:GTR) +6.25%, Australian Vanadium (ASX:AVL) +4.55%.

China says it wants to build another 30 or so nuclear reactors by the end of the decade – and that has been a very handy base-case tailwind.

As has the recent travails unto oil prices.

Of course, we have COP28 playing out again this week – all of which have given a further optimistic bent to uranium demand, aligned with lower inventories, seems to have added weight to big chunks of near-term purchasing activity.

European inventories have reportedly fallen by over 20% since 2018.

Supply of enriched uranium has turned scarce now that Russian nuclear fuel is on the nose, adding to snarled shipping supply lanes and the onerous insurance restrictions that come with them – all apparently stressing capacity limits for other enrichers.

Then, finally miners in Niger are uncertain and suspended with operations out of the picture until there’s a resolution to the country’s latest coup.

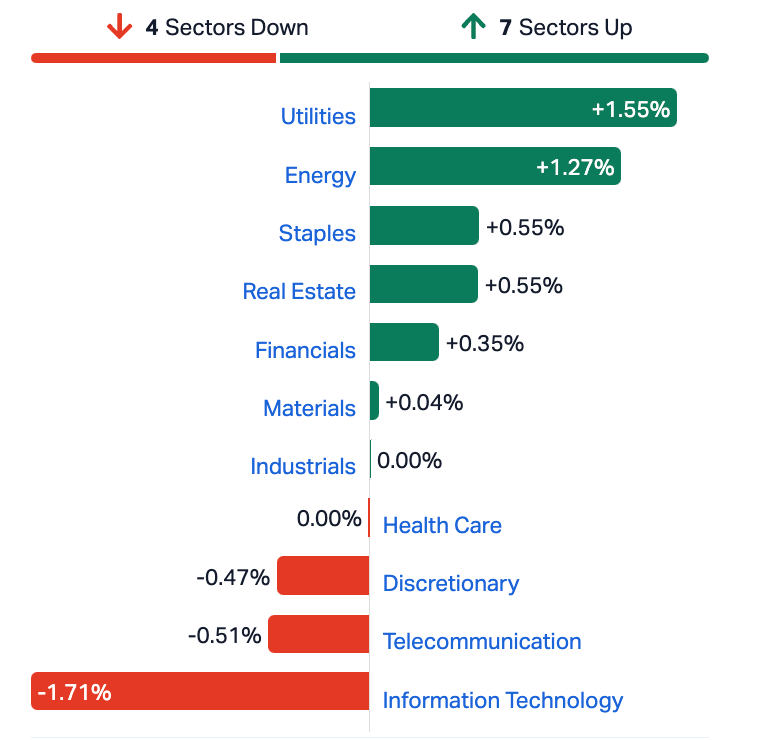

All that said, it wasn’t enough to lift either the Materials or the Energy Sector’s out of short-term rotation which – along with the major iron ore diggers – has dominated local trade.

The three iron ore majors plunged between -1.5% to -2% on Monday after the price in Singapore fell following the steel-making ingredient’s recent rise on the whiff of a Chinese stimulus. That’s not played out and those bets are unwinding very suddenly.

Here’s where the benchmark ended at 4pm on Monday through the prism of its 11 sectors.

For a market in something of a holding pattern, something of a holding pattern is emerging…

Local traders have a lot to keep them occupied this week – the main market moving headache comes in the form of the monthly consumer price index (CPI) which AMP reckons will likely be up 5.2% y-o-y but down from last month’s 5.6%.

There’s private sector credit. Building approvals (expected to bounce back by 5% after a fall last month). October retail sales and September quarter GDP components are also due for release.

None of which will be missed by the new, hawkish RBA Governor Michele Bullock even though she’s in Hong Kong on a panel at the HKMA-BIS High-Level Conference.

US Futures for the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite were all lower on Monday night in New York:

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SHN | Sunshine Metals Ltd | 0.021 | 91% | 143,839,744 | $13,464,093 |

| BP8 | BPH Global Ltd | 0.0015 | 50% | 2,469,341 | $1,615,563 |

| PHO | Phosco Ltd | 0.073 | 46% | 480,182 | $13,720,668 |

| RGL | Riversgold | 0.015 | 36% | 50,607,653 | $10,463,876 |

| AVM | Advance Metals Ltd | 0.004 | 33% | 1,590,000 | $2,167,040 |

| CC9 | Chariot Corporation | 0.955 | 32% | 1,892,875 | $53,165,387 |

| UBI | Universal Biosensors | 0.25 | 32% | 263,955 | $40,350,193 |

| TG1 | Techgen Metals Ltd | 0.105 | 27% | 4,966,522 | $6,404,967 |

| WYX | Western Yilgarn NL | 0.125 | 25% | 117,856 | $4,965,750 |

| ATH | Alterity Therapeutics | 0.005 | 25% | 1,233,482 | $9,759,590 |

| EPM | Eclipse Metals | 0.01 | 25% | 1,632,244 | $16,350,434 |

| FGL | Frugl Group Limited | 0.01 | 25% | 1,536,667 | $7,688,496 |

| GTG | Genetic Technologies | 0.0025 | 25% | 205,268 | $23,083,316 |

| ME1 | Melodiol Global Health | 0.0025 | 25% | 5,546,409 | $8,436,084 |

| BTH | Bigtincan Holdings | 0.18 | 24% | 2,940,318 | $88,051,698 |

| AUN | Aurumin | 0.026 | 24% | 989,960 | $6,687,305 |

| NFL | Norfolk Metals | 0.315 | 24% | 2,605,188 | $7,732,874 |

| RNE | Renu Energy Ltd | 0.016 | 23% | 686,700 | $5,817,358 |

| HIQ | Hitiq Limited | 0.023 | 21% | 29,206 | $5,587,207 |

| NAG | Nagambie Resources | 0.03 | 20% | 705,994 | $14,543,158 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 1,924,461 | $24,182,996 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 300,000 | $2,947,430 |

| AGH | Althea Group | 0.039 | 18% | 750,204 | $13,069,450 |

| GIB | Gibb River Diamonds | 0.039 | 18% | 2,564 | $6,979,812 |

| 4DX | 4Dmedical Limited | 0.92 | 18% | 3,386,333 | $270,244,018 |

Still on a roll after a fabulous week, last week is Sunshine Metals (ASX:SHN).

17m at 22.14g/t from 67m…

That’s the headline from drilling at Sunshine Metals’ Ravenswood Consolidated Project in North Queensland, where the heavily diluted $24 million micro cap may have struck paydirt in a gold and copper rich feeder zone to its 2.3Mt zinc, gold, copper, lead and silver VMS resource at the Liontown deposit.

It’s a bit of a game changer and why the stock price just doubled today.

“The stunning intercepts at Liontown are a great reward for the solid geological work completed by the team,” MD Damien Keys said.

“The decision was made to target the gold-copper rich footwall and feeder zones to the Liontown Resource with a high impact, shallow RC program. The feeder zones have not been recognised by past explorers and are often difficult to target.”

Another 11 holes have already been drilled to target these feeder zones and footwall lodes, with assays due in December this year.

ClearVue is rising quickly on Monday, with no breaking news, however the sustainable materials company last week struck a new distributor deal, expanding its footprint into large parts of the US mid-west – via Colorado, Missouri and Arizona.

Under a five-year agreement 8G Solutions secures a non-exclusive distribution rights for ClearVuePV solar integrated glass units (IGUs) for those regions with the potential for exclusive rights, subject to performance.

8G Solutions has around 150 staff operating across three US states, with projects typically falling within the US$2million to US$15 million range.

Martin Deil, Global CEO of ClearVue, said last week that the agreement “strengthens our presence in the US, our primary market for growth, and builds on our growing network of manufacturers and distributors throughout the US including previously appointed AIT Group in Florida and Massachusetts, and Graboyes in Pennsylvania.”

Deil adds that the US represents a significant market opportunity, driven by government incentives “enabling the construction and building sectors to become environmentally sustainable.”

Meanwhile, Riversgold (ASX:RGL) is another stock living in the past on Monday, but living quite well.

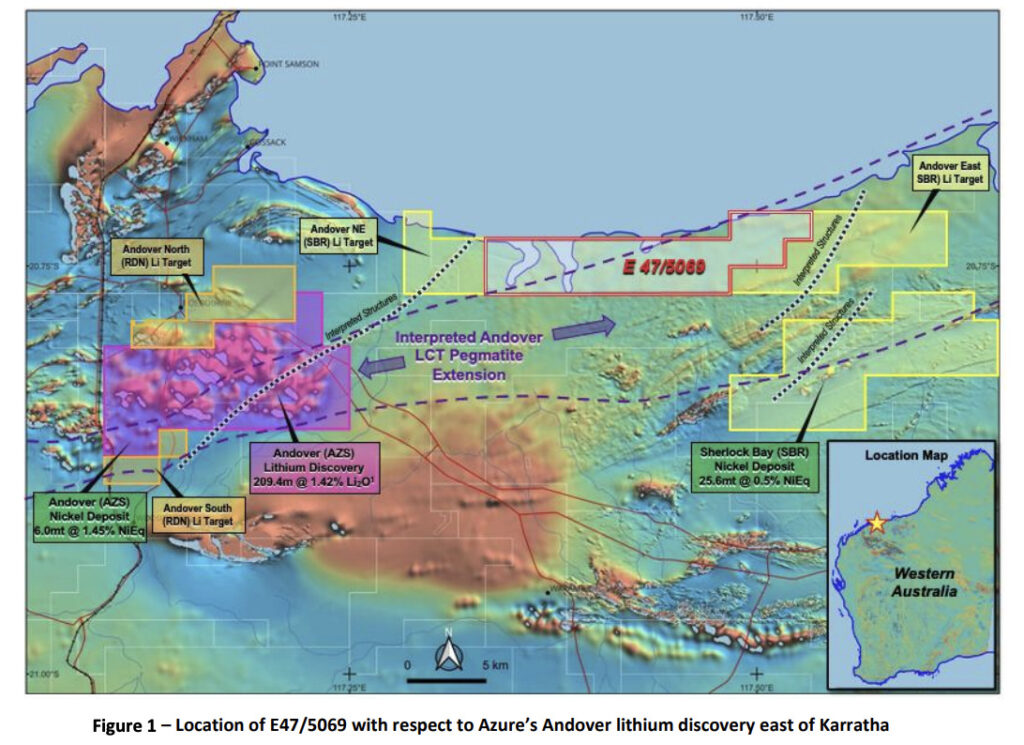

The diverse explorer made headlines late in the week having acquired ‘a key 74 square kilometre tenement application directly along strike – just 8km northeast of the major Andover lithium (spodumene) pegmatite discovery of Azure Minerals (ASX:AZS).’

Consultants will be commencing exploration efforts ‘in earnest within the week.’ RGL said last week.

Nice. And worth a pretty picture to boot.

That’s the spot in the lithium-famous Andover Corridor where AZS struck spodumene glory with drilling intersections of up to 209.4m at 1.42% Li2O.

Also worth a mention, Haranga Resources (ASX:HAR)is up on no news in particular other than the cut of its jib – well managed, well located and in the right business, at the right time – the uranium spot price last week punching through the US$80/lb mark for the first time in 12 years.

Haranga’s difference here might be the Saraya uranium project in Senegal where a major auger drilling program is currently under way.

As my colleague Michael Washbourne lays bare – it’s make and break time for HAR…

“It has been a busy few months for the relative newcomer to the niche pod of ASX-listed uranium players with an inferred resource of 12.5Mt @ 587ppm eU3O8 for 16.1Mlb defined over Saraya, $2.86 million raised for the next phase of exploration and experienced uranium executive Peter Batten joined the company as managing director, all since the beginning of September, ” Michael says.

Formerly MD of Bannerman Energy (ASX: BMN), it’s apparent – as Batten says – that he couldn’t have timed his return to the yellowcake sector any better.

“This next bull run in uranium has been coming since 2010.”

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CSS | Clean Seas Ltd | 0.265 | -25% | 1,836,682 | $58,748,777 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 521,001 | $15,569,766 |

| BUB | Bubs Aust Ltd | 0.13 | -21% | 10,015,791 | $124,265,466 |

| YOJ | Yojee Limited | 0.004 | -20% | 51,300 | $6,527,426 |

| AKM | Aspire Mining Ltd | 0.061 | -19% | 43,647 | $38,072,774 |

| ADVDB | Ardiden Ltd | 0.195 | -18% | 96,863 | $14,785,844 |

| C1X | Cosmos Exploration | 0.12 | -17% | 413,284 | $6,883,875 |

| GHY | Gold Hydrogen | 0.8 | -17% | 2,151,259 | $54,646,102 |

| PAB | Patrys Limited | 0.0075 | -17% | 7,526,404 | $18,517,026 |

| CT1 | Constellation Tech | 0.0025 | -17% | 11,200 | $4,413,601 |

| NGY | Nuenergy Gas Ltd | 0.02 | -17% | 656,413 | $35,542,932 |

| NRX | Noronex Limited | 0.011 | -15% | 540,182 | $4,917,923 |

| SHO | Sportshero Ltd | 0.017 | -15% | 13,501 | $11,500,022 |

| HYD | Hydrix Limited | 0.018 | -14% | 218,077 | $5,338,596 |

| CTN | Catalina Resources | 0.003 | -14% | 366,566 | $4,334,704 |

| ETR | Entyr Limited | 0.006 | -14% | 1,058,385 | $13,881,727 |

| HCD | Hydrocarbon Dynamic | 0.006 | -14% | 680,003 | $4,547,661 |

| AR3 | Austrare | 0.16 | -14% | 598,258 | $28,520,703 |

| AMM | Armada Metals | 0.052 | -13% | 700,518 | $10,354,084 |

| PRM | Prominence Energy | 0.013 | -13% | 324,116 | $2,308,146 |

| CYG | Coventry Group | 1.175 | -13% | 9,101 | $128,235,684 |

| ZEU | Zeus Resources Ltd | 0.011 | -12% | 842,841 | $5,741,013 |

| MHK | Metalhawk | 0.2 | -11% | 326,123 | $18,050,750 |

| DDT | DataDot Technology | 0.004 | -11% | 1,413,647 | $5,449,288 |

| KP2 | Kore Potash PLC | 0.008 | -11% | 58,941 | $6,021,518 |