Depleted Uranium: What’s the half-life on this bull run?

Via Getty

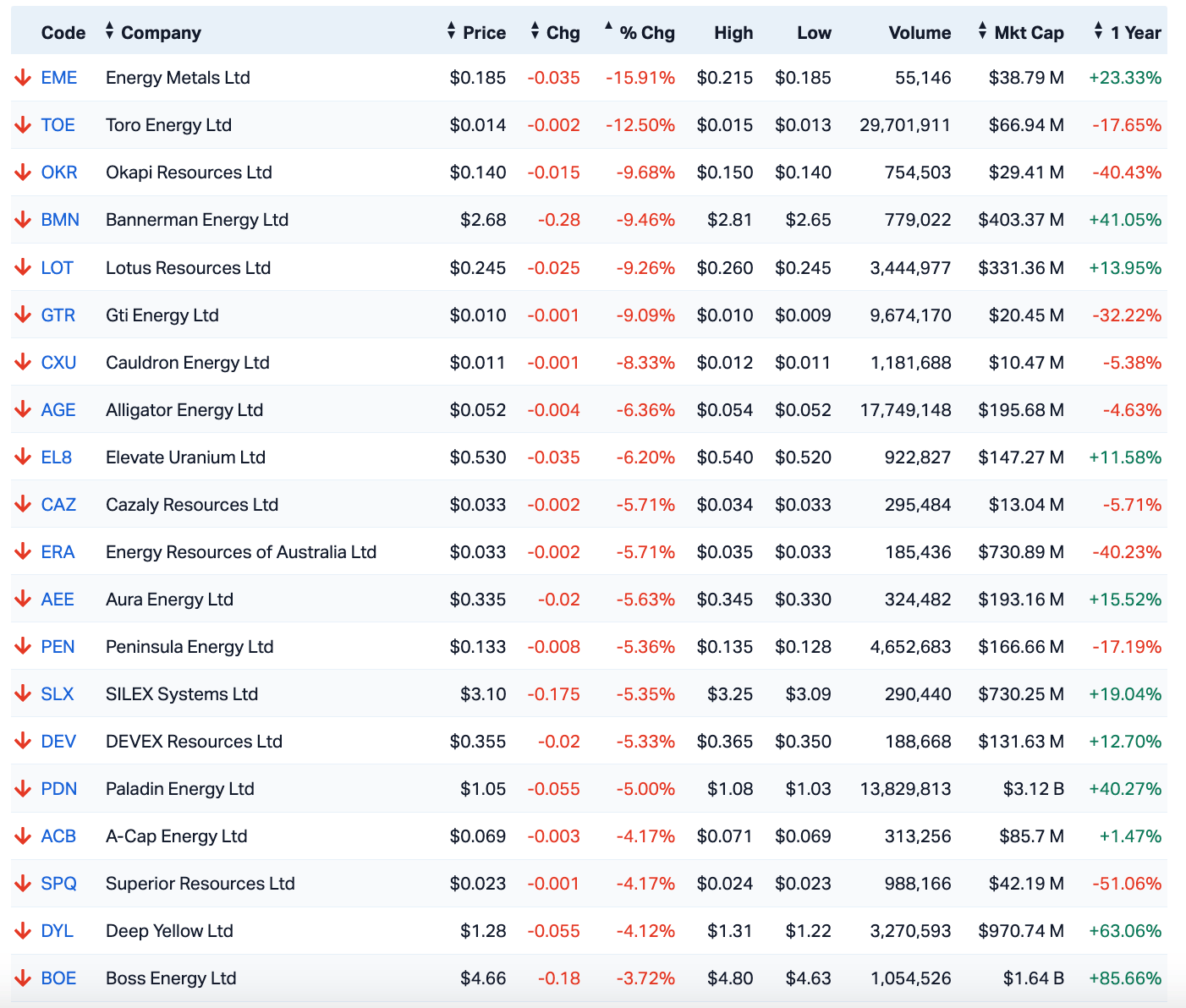

It was around lunchtime on the first Tuesday in October and after a smashing September – when everything went right for our colourful collection of ASX-listed uranium miners – we started seeing something of a pullback.

A pullback, en masse:

But when the animal spirits get in under uranium – and they haven’t for a long time – it’s only natural they tear off a bit for safe keeping.

Because Aussie uranium stocks are right in the midst of a bull market, decades in the making.

To name one among any of the above – the share price of ASX-listed Paladin Energy (ASX:PDN) for example is up 80% since May. A fair rise by any stretch and one which probably goes some way to explaining last week’s PDN downgrade by Bell Potter analysts (see below), even as Paladin nears the restart of work in Namibia.

Uranium has simply soared to end September at US$70, clocking 2011 highs and finally regaining all the losses since Japan’s game-changing nightmare of an earthquake-tsunami-quasi-meltdown at the Fukushima Daiichi disaster in March that year which triggered worldwide dismay and a calamitous descent for uranium demand and an about-face for many nations which had begun leaning into pro-nuclear energy policies.

Now, with Fukushima quietly ejecting water back int the Pacific some 12 years later to no great consternation outside China, uranium’s perennial low inventories and spreadeagled supply lines have once again fallen into sharp relief amid spiking oil prices and collapsing lithium ones.

Yellowcake entered bull market territory around mid-to-late September after the World Nuclear Association (WNA) and uranium specialists Ux Consulting agreed that much more will be needed to meet demand in the next 10-20 years.

According to the WNA, demand from nuclear power plants alone will almost double by 2040.

Investors big on uranium are starting to see a bull run to rival the mid-2000s surge to US$145/lb, while others are urging caution.

The opacity of pricing is particularly pronounced in this business, however, since pounds available on the spot market make up only a small proportion of trades and are liable to surges from buying by funds like the Sprott Physical Uranium Trust and Yellowcake PLC.

Still, there is Doge-like excitement in the Memeverse:

More record setting month-end SPOT #Uranium Prices @quakes99 pic.twitter.com/PJDKaeRD5p

— Uranium Corgi (@UrTokenCorgi) October 1, 2023

Volatile fossil fuel prices, uncertain oil supply, and decarbonisation objectives from the world’s largest economies continued to drive governments to invest in nuclear power production, with yellowcake making a 22% gain across September.

According to Stockhead’s nuclear cannon, Josh Chiat, from 2003 to 2007 prices ran up around 14 times to a record of over US$140/lb.

“This is the way with uranium, which tends to really shoot when the starting gun fires.”

Could we get there again?

Many experts think so.

Analysts at Macquarie and elsewhere have also lifted uranium price decks higher to reflect increased demand and higher incentive prices to bring new mines into production, Josh says, with Ux and the WNA saying new sources will be needed as governments the world over sanction extensions and expansions to nuclear fleets in the face of the energy transition.

Where’s the risk now?

Josh believes those could come from the uncertain geopolitical environment and rebounding supply from incumbents.

With prices running sharply, Kazatomprom has flagged plans to ramp up production by 6000t to a full capacity of 30,500-31,500t by 2025.

It has warned inflationary pressures and supply chain issues could yet hamper those plans.

The price run, which has seen uranium move at times by over a dollar a day, was in part prompted by supply failings from the West’s largest producer Cameco, which owns the world’s highest grade mines in Saskatchewan’s legendary Athabasca Basin.

China is expected to build another 32 nuclear reactors by the end of the decade and Japan allowed plans to restart multiple plants and build new facilities, aligned with the World Nuclear Association’s upward revision for global nuclear power production.

POW! TradeTech September Month-end SPOT #Uranium Prices have soared again for #Nuclear fuel

#U3O8 Up +$11.80 to $73.15

Conversion Up 25c to Record High of $41

#UF6 Up $42 to $232

Enrichment SWU firm at $138

Long-term #U3O8 Up +$2.00 to $62.00/lb ⬆️ ♂️ pic.twitter.com/QhBabTiG3Y— John Quakes (@quakes99) October 1, 2023

The developments coincide with renewed concerns about supply with Canada’s Cameco, the world’s second-largest uranium miner, reducing its production guidance for the current year. Political turmoil in Niger also drove Orano to suspend operations in the country, while Western utilities continued to shun Russian nuclear fuel.

Security of Russian supply, required to keep reactors running globally until alternative sources can be bedded down, has been a source of uncertainty since the Ukraine invasion and another factor in the uranium price’s spectacular increase.

Utilities have been waiting for the US and others to ban Russian supply alongside myriad other sanctions on Russia, but so far that hasn’t happened in the short-term.

TradeTech’s weekly spot price indicator rose US$4.75 to US$73.15/lb.

At the close of September, TradeTech’s term price indicators have risen US$11.50 to US$73.50/lb (mid) and US$2.00 to US$62.00/lb (long).

While the positive medium-long term story remains intact for listed uranium producers and soon-to-be producers, market analysts are beginning to feel the spot price, which has risen 52% year on year and 30% in the last three months, may be due for a blow-off top.

Yet, according to a recent Canaccord Genuity note, contracts are outpacing volumes with UxC reporting 121 million pounds of uranium have been put under long-term contract YTD vs. a total of 114 million pounds in calendar 2022.

So. Fundamentals. Suggesting any snippy pullback in share prices would be seen as more of an opportunity than a setback.

Local uranium leaders Boss and Paladin Energy have enjoyed September and the return of support from brokers with positive average target price lifts, though both just copped late September ratings downgrades. Bannerman is attracting attention at Canaccord Genuity, as is Lotus Resources.

Here’s a few of the ASX uranium moves from last week.

Boss Energy (ASX:BOE)

Macquarie Downgrades BOE to Neutral from Outperform

Boss Energy is due to re-start the Honeymoon uranium mine, expected to ramp up to 2.45mlb/per annum. Macquarie notes there is potential upside to production levels and the life of the mine, given strong recent results from exploration.

Higher long-term uranium forecasts and increasing the life of mine by four years drives 7-20% increases to the broker’s estimates for EPS from FY27 onwards.

Adjusting the valuation methodology to reflect momentum means a downgrade to Neutral from Outperform, while the target is raised to $4.50 from $3.50.

Paladin Energy (ASX:PDN)

Bell Potter Downgrades PDN to Speculative Hold from Buy

Ahead of the re-start of Langer Heinrich, Bell Potter updates its valuation on Paladin Energy, arguing that operations like this should trade at a premium in the current market, given the relatively low risk versus greenfield developments and increased liquidity versus smaller cap peers.

There is also the potential for strategic consolidation. Langer Heinrich is a proven asset in a known jurisdiction for uranium mining and at full capacity will be a top 10 producer. Rating is downgraded to Speculative Hold from Speculative Buy. Target is raised to $1.31 from $1.12.

Uranium prices have increased by 32% in the last three months and shares of Boss and Paladin have risen by 49% and 53%, respectively, highlighting material leverage to upside from uranium prices, noted Macquarie.

As both companies are within six months of restarting production, they are considered well positioned to benefit from higher uranium prices and should further re-rate into production. The broker downgraded its rating for Boss Energy to Neutral from Outperform on valuation.

Bell Potter has raised the target price for PDN to $1.31 from $1.12, although the downgrade came on valuation reckoning with PDN’s stock price surge since May.

The analysts noted the Langer Heinrich mine is a proven asset in a known uranium mining jurisdiction with a comparatively low restart risk. At full capacity the mine is expected to be a top 10 producer supplying 6mlbs per year by FY26.

Macquarie also highlights the various offtake agreements PDN has secured with offshore partners.

Bannerman Energy (ASX:BMN) and Lotus Resources (ASX:LOT)

Canaccord Genuity Rates BMN as Speculative Buy and Canaccord Genuity Rates LOT as Speculative Buy

Canaccord Genuity remains “fundamentally bullish” on the uranium sector, noting the market is in structural deficit and secondary supplies are on the decline, while inventory levels are near recent lows.

Uranium equities are up 16% as price momentum continues with the spot price currently at US$70/lb, a 12-year high. The broker increases demand forecasts and envisages risks in bringing new supply on line at targeted rates given ongoing supply chain issues and labour constraints.

Canaccord analysts lifted their base case yellow cake demand outlook to a CAGR of 3.6% through 2023 and 3.2% through 2035 – which is a 30% increase in annual uranium demand through 2030 and 46% through 2035, although nothing is a total lock considering the supply side risks.

Depleted uranium

Current mine supply ‘continues to be challenged’ like the military coup in Niger where some 4% of global supply is currently sourced, as well as restart delays and lower production guidance out of Canada’s Cameco’s Athabasca projects

Inventories are depleting as demand is growing, placing pressure on existing inventory levels. The US, for example, held 104 million pounds at the end of 2022, down 4% year-on-year or approximately two years of forward coverage, according to the EIA.

Physical funds like the Sprotts out there which have stocked up on buying uranium to sit on until ready to play – are ‘set to return to the market’ Canaccord believes, saying they can now compete with utilities, ‘in what is already an extremely tight market.’

Speculative Buy rating remains for Bannerman and the price target PT is lifted to $3.59 from $3.33.

And it’s a Speculative Buy rating also retained for Lotus and the PT is tweaked higher to $0.45 from $0.39.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.