Closing Bell: ASX flat, but volatile

News

The ASX Emerging Companies (XEC) index has closed o.2% higher Monday, after fluctuating and flatlining for most of the day.

Likewise, the top 200 index had an exciting morning before this overwhelming, maudlin sense of the inevitable (or was it too much lunch…) took the steam out of its whistle.

At 0.05% lower, flat does not describe this kind of geometric whimper.

Around the grounds, it’s an immense un-surprise to see Hong Kong stocks killing it in morning trade, then petering out as the enormity of life, the universe and everything come knocking around lunchtime on a Monday.

This morning, previously timid investors appeared to just be off buying stuff willy-nilly now Beijing’s promised that it’s back in the businesses of backing business.

But heaps of Covid, heaps of Covid-lockdowns and the reality of a drawn-out war and it’s drawn-out economic pressures reasserted Hong Kong’s pervading sense of exhaustion.

The Hang Seng Index, 2% higher and looking very supported at the open, is -at 1300HK time tracking back in the red.

Both the Shanghai Composite and the Shenzhen Composite Index also yielded some rare progress to be flat, flat, flat.

Oil is up. The Australian Institute of Petroleum (AIP) say national average unleaded petrol prices rose by 14.9 cents a litre last week to 212.5 cents.

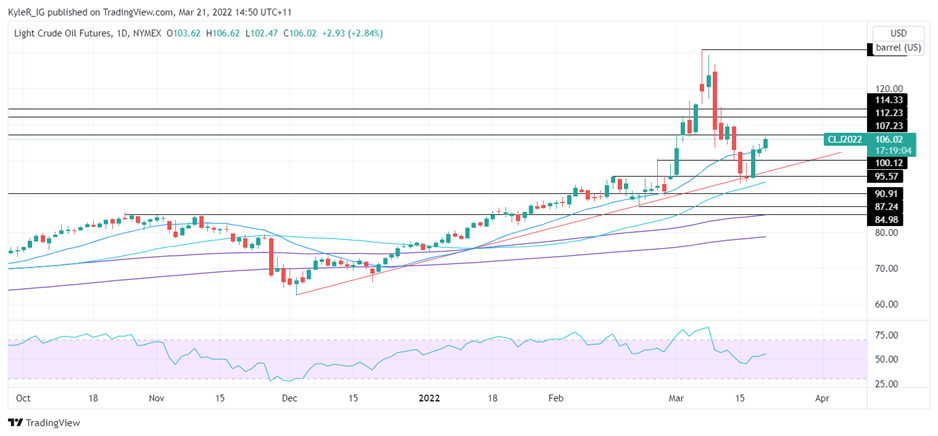

IG’s Kyle Rodda who knows much of the ways of such things, says:

“The next key level of resistance emerges at around $US107 from here, while support might be found around $US107 and $US105.”

And finally, aluminium has jumped about 5% when the London Metal Exchange opened late arvo Sydney time – that was us blocking a shipment to Russia who gets circa 20% of the stuff from Aussie miners like Rio Tinto et al.

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Description | Price | % | Volume |

|---|---|---|---|---|

| AHI | Adv Human Imag Ltd | 0.375 | 50.0% | 3,073,448 |

| JAV | Javelin Minerals Ltd | 0.002 | 33.3% | 1,514,926 |

| FNT | Frontier Resources | 0.033 | 26.9% | 124,831,728 |

| KNI | Kunikolimited | 1.39 | 26.4% | 1,169,603 |

| TZN | Terramin Australia | 0.063 | 26.0% | 2,965,056 |

| RAB | Adrabbit Limited | 0.03 | 25.0% | 550,000 |

| CLA | Celsius Resource Ltd | 0.025 | 25.0% | 35,931,322 |

| BAS | Bass Oil Ltd | 0.0025 | 25.0% | 2,101,017 |

| GL1 | Globallith | 2.47 | 22.9% | 3,125,462 |

| GGE | Grand Gulf Energy | 0.042 | 20.0% | 21,344,673 |

| ECT | Env Clean Tech Ltd. | 0.03 | 20.0% | 18,434,790 |

| ARL | Ardea Resources Ltd | 1.21 | 18.6% | 2,388,282 |

| PEK | Peak Rare Earths Ltd | 0.77 | 18.5% | 1,181,301 |

| HPR | High Peak Royalties | 0.045 | 18.4% | 125,000 |

| CML | Chase Mining Limited | 0.013 | 18.2% | 285,586 |

| AVL | Aust Vanadium Ltd | 0.059 | 18.0% | 95,415,002 |

| LRS | Latin Resources Ltd | 0.067 | 17.5% | 48,026,541 |

| S3N | Sensore Ltd | 0.74 | 17.5% | 13,682 |

| FIN | FIN Resources Ltd | 0.027 | 17.4% | 821,360 |

| TMT | Technology Metals | 0.405 | 17.4% | 1,042,451 |

| MIO | Macarthur Minerals | 0.48 | 17.1% | 175,518 |

| QXR | Qx Resources Limited | 0.062 | 17.0% | 21,073,615 |

| DDD | 3D Resources Limited | 0.0035 | 16.7% | 6,228,885 |

| ONE | Oneview Healthcare | 0.22 | 15.8% | 376,303 |

| TYM | Tymlez Group | 0.052 | 15.6% | 27,894,016 |

Monday has a Charlie Sheen winner: winning for no discernible reason – although it’s fair to say Terramin Australia (ASX:TZN), has had it’s fair share of ups and down – TZN climbed by circa 40% in morning trade – another day at the office for s company whose stock – as pointed out by Stockhead’s Samuel Jacobs, has now risen by more than 200% since it was bestowed regulatory approval at it’s Algerian zinc JV, Tala Hamza.

Frontier Resources (ASX:FNT) jumped a cool 30% this morning after digging up some fab, top-notch rare earths inside rock chip assays at its Gascoyne project in WA.

Ardea Resources (ASX:ARL), did the same after its Kalgoorlie nickel project secured Major Project Status from the Australian government.

“This recognition will assist in advancing the KNP towards development through streamlining the approvals process and providing access to additional sources of potential project funding,” ARL MD Andrew Penkethman said.

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| VMG | VDM Group Limited | 0.001 | -50.0% | 512 |

| TSC | Twenty Seven Co. Ltd | 0.003 | -25.0% | 2,530,307 |

| IS3 | I Synergy Group Ltd | 0.063 | -20.3% | 257,856 |

| MAY | Melbana Energy Ltd | 0.14 | -20.0% | 81,596,635 |

| EVE | EVE Health Group Ltd | 0.002 | -20.0% | 1,806,078 |

| GTG | Genetic Technologies | 0.004 | -20.0% | 744,496 |

| SBR | Sabre Resources | 0.005 | -16.7% | 2,037,253 |

| BIR | BIR Financial Ltd | 0.028 | -15.2% | 1,451,340 |

| CTE | Cryosite Limited | 0.47 | -14.5% | 10,742 |

| PNT | Panthermetalsltd | 0.205 | -12.8% | 43,808 |

| BUD | Buddy Tech | 0.007 | -12.5% | 2,741,129 |

| MR1 | Montem Resources | 0.035 | -12.5% | 1,212,695 |

| CLH | Collection House | 0.11 | -12.0% | 245,293 |

| N1H | N1 Holdings Ltd | 0.185 | -11.9% | 58,609 |

| KWR | Kingwest Resources | 0.155 | -11.4% | 1,017,143 |

| PCK | Painchek Ltd | 0.039 | -11.4% | 1,339,708 |

| MMC | Mitremining | 0.16 | -11.1% | 15,000 |

| CXU | Cauldron Energy Ltd | 0.016 | -11.1% | 6,578,040 |

| TPD | Talon Energy Ltd | 0.008 | -11.1% | 6,971,926 |

| BMG | BMG Resources Ltd | 0.033 | -10.8% | 809,019 |

| SIO | Simonds Grp Ltd | 0.3 | -10.4% | 104,955 |

| ENA | Ensurance Ltd | 0.225 | -10.0% | 14,000 |

| GMN | Gold Mountain Ltd | 0.009 | -10.0% | 1,214,644 |

| PAR | Paradigm Bio. | 1.13 | -10.0% | 514,120 |

| AHK | Ark Mines Limited | 0.24 | -9.4% | 202,889 |

Melbana Energy (ASX:MAY) is cooling its Monday jets, down 15% in the early arvo after it triggered the issue of almost 32m shares of Performance Rights to executive chairman Andrew Purcell.

Around half of those vested because Melbana stock has jumped more than 200% in a 20-day trading period.

The other ~15m vested when MAY shares topped 400% over the same period. So technically, it’s a loser. But perhaps not a big one.

Austsie electricity generation company Genex Power (ASX:GNX) has raised ~$7 million from the issue of more than 48 million shares at an issue price of ~14 cents. Genex says funds will be used for the Bouldercombe Battery Project, a bit of the l’ debt and some working capital.

Queensland-based silica sand developer, Metallica Minerals (Metallica, ASX: MLM) has completed a pre-feasibility study (PFS) of its 100%-owned Cape Flattery Silica Sand Project. The PFS includes reporting of a maiden ore reserve of 46Mt @ 99.18% Si0₂.

Golden Mile Resources Limited (ASX: G88) has entered into a binding agreement to acquire the rights to three Exploration Licences near Marble Bar, situated in WA’s lithium rich East Pilbara.

The company says the acquisition strategically expands its portfolio of grass root exploration projects focussed on critical green metals that includes copper, nickel and lithium to service the predicted high growth in the electric vehicle (EV) sector.

Carnarvon Energy (ASX:CVN) – trading halt, pending an announcement in relation to results at its Pavo-1 well

Los Cerros Limited (ASX:LCL) – trading halt, pending the release of a maiden JORC compliant Mineral Resource for its Tesorito Gold Porphyry