Closing Bell: What a lovely, lovely day. More mindless optimism, please

News

News

On the ASX today, this has to be a good sign:

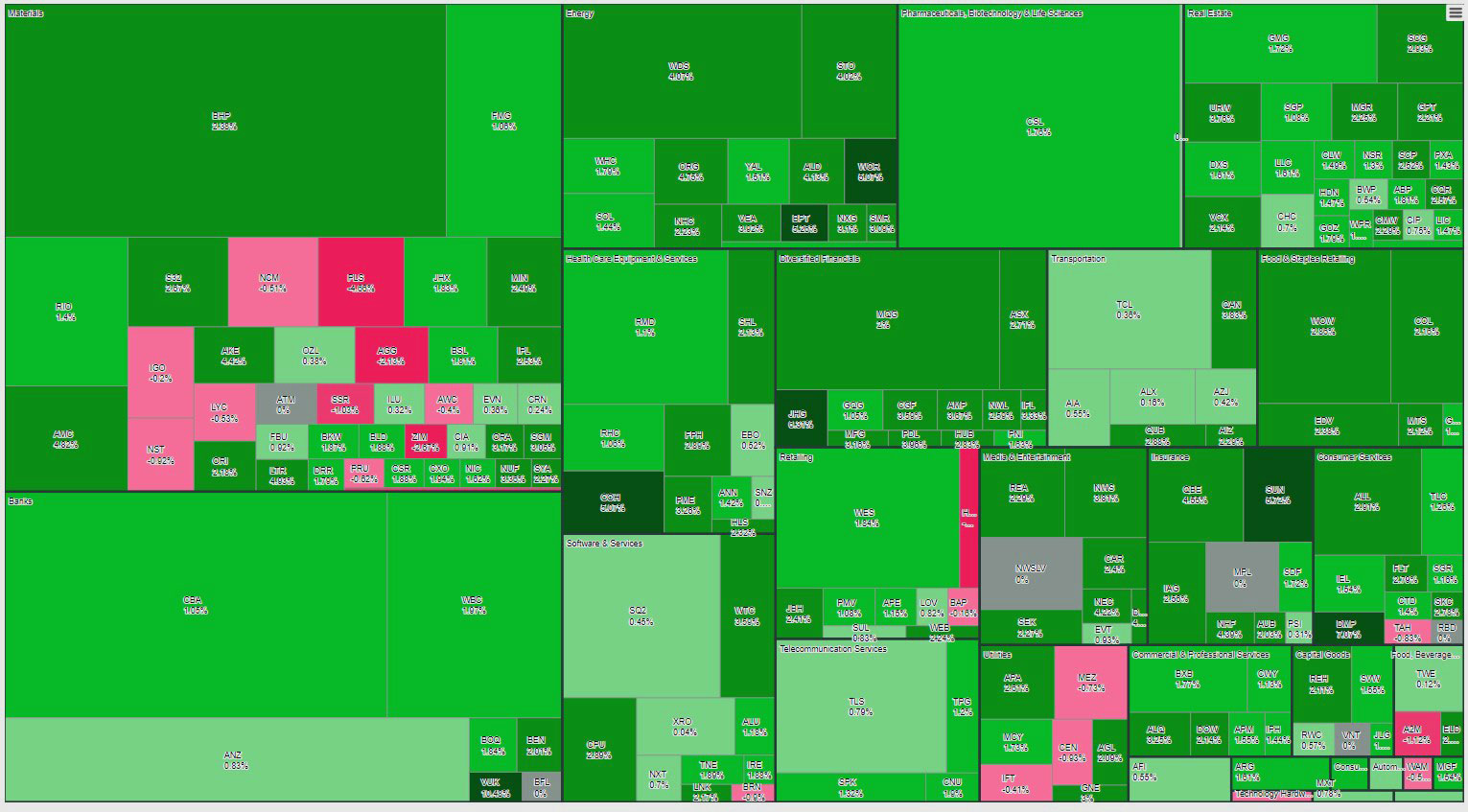

Either that or I’m subconsciously optimising my settings. Where’s the one with the coloured boxes in it… here:

Congratulations to Energy (3.68% on the back of a 2-2.6% lift in oil overnight) and Utilities (3.52%). Virgin Money (+10%) and Domino’s (7.60%) led stocks for the day.

Virgin Money UK (ASX:VUK) and Janus Henderson (ASX:JHG) both rallied for Team Pom after British PM Liz Truss agreed to take a major U-turn on her signature corporation tax cut announced just a couple of weeks ago.

Great. Any excuse to roll this out again:

Truss: “Your Majesty… Lovely to see you again.”

King: “Back again. Dear oh dear. Anyway…”

This is one of the greatest things I’ve ever seen. 😂😂pic.twitter.com/ENP8pPl9kO

— Brendan May (@bmay) October 12, 2022

Eddy Sunarto notes Truss’ Chancellor Dr Kwasi Kwarteng is on the next plane home from the IMF meeting in Washington D.C. as we speak.

Only Newcrest Mining (ASX:NCM) lost out in the top 20 today, shedding 1.20%. Even Block (ASX:SQ2) broke even.

Not a lot changed since the early rise though, and the S&P/ASX200 closed up nicely for a Friday, gaining 1.75% to 6,758.80 and crossing above its 20-day moving average.

Still down 9.21% for the last year to date though.

China’s inflation figure dropped today as well, and came in at 2.8% in September, the highest since April 2020. Still way below that of the US.

The Chinese producer price index (PPI), which reflects the prices that factories charge wholesalers for products, also rose by 0.9 per% in September year on year.

But if that all puts you in a spending kind of mood, and you’re in Melbourne next week, the 11th Annual Australian Microcap Investment Conference on the 18th and 19th of October might float your boat a bit. It’s an exciting opportunity to hear firsthand from the CEOs of Australia’s leading microcap companies.

AND Stockhead readers have an exclusive discount offer ($300 off the ticket actually) using the code: STOCKHEAD2022

$300!

But first, there’s another whole day of trading elsewhere besides Australia to come yet. And given what happened last night, we wouldn’t miss it for the world.

Let’s see if the US can make any sense. Results season starts properly tonight with some big names kicking off the action. How’s Citigroup, Morgan Stanley, Wells Fargo and JPMorgan for starters?

Datawise Stateside, US retail prices and Euro trade balance data are scheduled, while Fed’s Cook will speak.

Here are the best performing ASX small cap stocks for October 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ANL Amani Gold Ltd 0.0015 50% 761,517 $23,693,441.13 ARE Argonaut Resources 0.0015 50% 300,000 $5,428,537.94 MEB Medibio Limited 0.0015 50% 2,362,500 $3,320,593.79 CFO Cfoam Limited 0.004 33% 203,683 $2,201,521.90 WFL Wellfully Limited 0.03 30% 324,874 $6,410,036.29 TOY Toys R Us 0.031 29% 9,838,600 $20,684,668.42 TSC Twenty Seven Co. Ltd 0.0025 25% 1,589,244 $10,643,255.62 CTT Cettire 1.3 24% 3,948,409 $400,300,131.00 HT8 Harris Technology Gl 0.018 20% 2,131,883 $4,474,432.22 DMG Dragon Mountain Gold 0.012 20% 17,582 $3,936,716.65 MRD Mount Ridley Mines 0.006 20% 12,454,326 $29,757,863.15 SI6 SI6 Metals Limited 0.006 20% 26,800 $7,440,945.40 BPH BPH Energy Ltd 0.026 18% 12,429,580 $17,441,583.63 1CG One Click Group Ltd 0.014 17% 942,327 $7,114,295.84 FOD The Food Revolution 0.028 17% 5,436,537 $22,722,280.13 AGD Austral Gold 0.043 16% 67,984 $22,655,520.06 E25 Element 25 Ltd 1.04 16% 719,580 $137,439,332.10 E33 East 33 Limited. 0.038 15% 31,550 $17,074,142.84 OMX Orangeminerals 0.084 15% 507,619 $3,512,325.43 MGU Magnum Mining & Exp 0.04 14% 1,840,173 $18,654,680.31 STK Strickland Metals 0.04 14% 901,627 $48,386,403.38 HXL Hexima 0.024 14% 200,144 $3,354,513.77 GED Golden Deeps 0.017 13% 7,173,606 $17,328,400.71 FTZ Fertoz Ltd 0.175 13% 113,072 $39,680,230.64

Here are the most-worst performing ASX small cap stocks for October 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PRM Prominence Energy 0.0015 -25% 272,094 $4,849,218 CT1 Constellation Tech 0.004 -20% 200,200 $7,356,002 KFE Kogi Iron Ltd 0.004 -20% 2,817,595 $8,160,389 MGG Mogul Games Grp Ltd 0.002 -20% 12,644,486 $8,158,603 SYN Synergia Energy Ltd 0.002 -20% 1,244 $21,044,477 ENV Enova Mining Limited 0.014 -18% 551,913 $6,242,656 PRS Prospech Limited 0.028 -18% 938,158 $2,216,154 GLV Global Oil & Gas 0.0025 -17% 622,553 $5,620,064 PFE Pantera Minerals 0.105 -16% 20,181 $6,437,640 MKG Mako Gold 0.042 -16% 7,204,926 $19,112,080 HIQ Hitiq Limited 0.049 -16% 97,776 $6,563,059 NNL Nordic Nickel 0.24 -15% 741,715 $16,499,884 RAN Range International 0.006 -14% 707,352 $6,575,032 MCM Mc Mining Ltd 0.2575 -14% 7,802 $59,296,461 ZMM Zimi Ltd 0.063 -14% 271,508 $5,773,904 IVZ Invictus Energy Ltd 0.16 -14% 11,978,223 $162,104,604 BEL Bentley Capital Ltd 0.06 -13% 100,000 $5,252,826 AUH Austchina Holdings 0.007 -13% 875,000 $16,294,662 NZS New Zealand Coastal 0.0035 -13% 1,140,000 $4,508,020 CR1 Constellation Resources 0.14 -13% 2,110 $7,984,868 LKY Locksley Resources 0.07 -13% 191,208 $2,755,780 UBI Universal Biosensors 0.255 -12% 27,034 $61,434,886 KAL Kalgoorlie Gold Mining 0.11 -12% 201,389 $9,054,325 LRV Larvotto Resources 0.22 -12% 1,091,002 $10,383,125

Looks like Friday is the day for going into trading halts “pending release of an announcement”.

Insurance Australia Group Limited (ASX: IAG): is being put into a trading halt pending release of an announcement.

Minbos Resources Limited (ASX:MNB): will be placed in a trading halt again pending releasing an announcement.

And finally, Findi Limited (ASX:FND): will be placed in a trading halt… pending releasing an announcement.

That’s quite enough. Have a great weekend.