Closing Bell: Small caps jump over 2.2%, regional markets soar because something silly fixed something stupid

News

News

Regional markets – pretty much led by ours – have risen in rare unison on Thursday thanks mainly to the wonderful stuff-up executed by UK Prime Minister Liz Truss and her Chancellor of the Exchequer Kwasi Kwarteng.

After deciding to pump UK inflation (it is after all only at 9.9%) and skewer their iconic currency, the preferably dormant Bank of England (BoE) left the crypt to declare it’d start snapping up UK government bonds to restore orderly market conditions.

You know you’ve really screwed up when it’s the sleepy BoE and the possibly institutionally insane International Monetary Fund (IMF) and a whole bunch of other, angrier world economists, who have to come and take time out of their own busy world destructing schedules to save your bacon… or is it baking, in England. I just don’t know.

Of course, buying up heaps of bonds for the next fortnight just to restore orderly market conditions isn’t going to restore anything, certainly not order.

But, on the plus side, since fortress GBP just keeps getting its own a new record low arse vs the greenback handed to it every few mins, the BoE’s ‘intervention’ (my air quotes) inspired a rebound on Wall Street.

So. Overnight the Dow Jones Industrial Average jumped 1.9%, the erstwhile S&P 500 gained 2% (but only after blithering to a new low the previous day), while the tech-heavy Nasdaq Composite gained 2.1%.

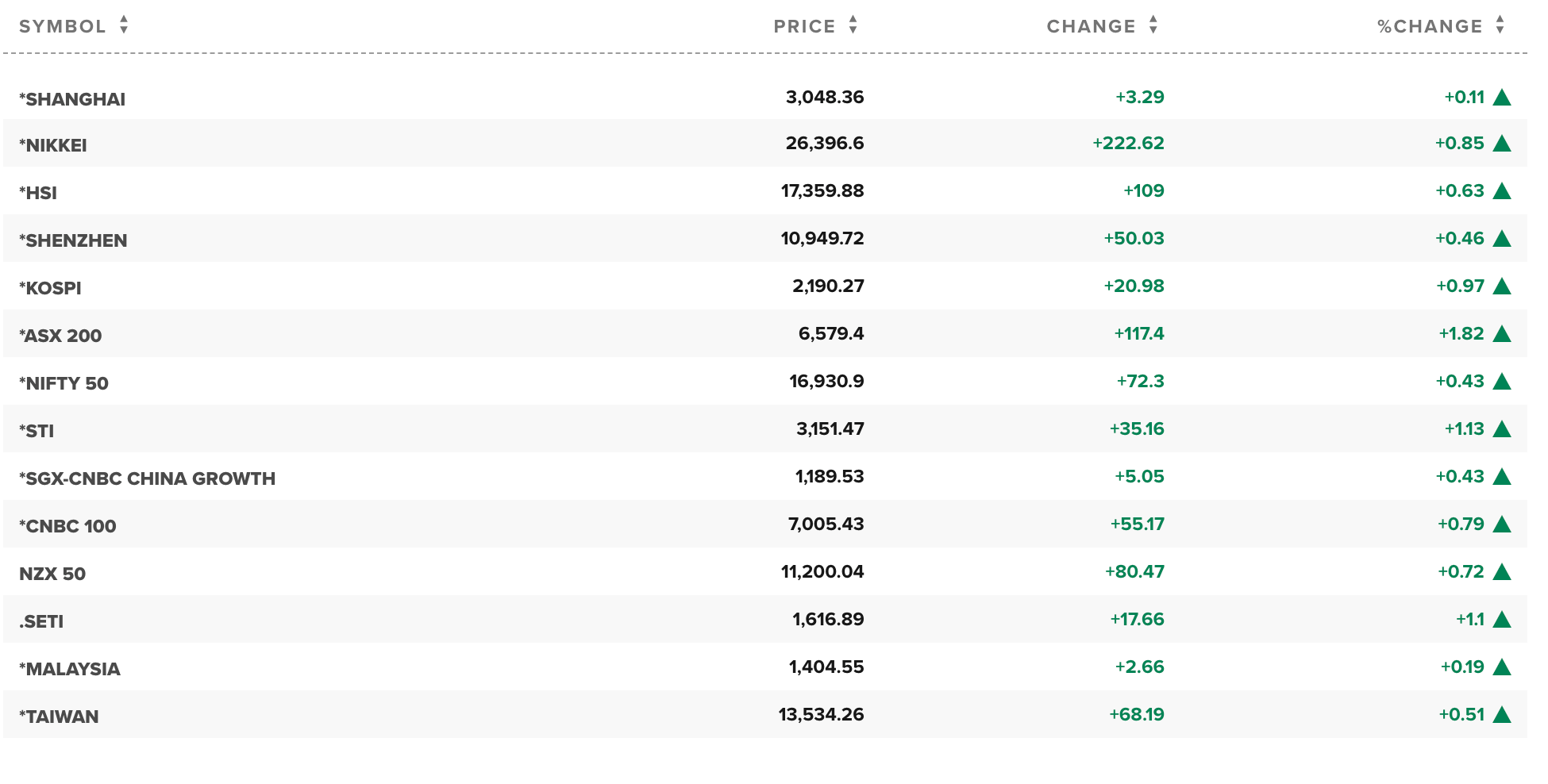

That started this:

Isn’t it nice to see the neighborhood doing well.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ARE | Argonaut Resources | 0.0015 | 50% | 7,160,949 | $5,428,537.94 |

| FGL | Frugl Group Limited | 0.015 | 36% | 171,821 | $2,229,174.15 |

| MGG | Mogul Games Grp Ltd | 0.002 | 33% | 2,469,230 | $4,895,161.81 |

| MCM | Mc Mining Ltd | 0.45 | 29% | 110,885 | $68,685,067.33 |

| BTR | Brightstar Resources | 0.02 | 25% | 435,453 | $10,349,773.90 |

| CLE | Cyclone Metals | 0.0025 | 25% | 134,631 | $12,233,473.96 |

| SYN | Synergia Energy Ltd | 0.0025 | 25% | 22,631,188 | $16,835,581.41 |

| VPR | Volt Power Group | 0.0025 | 25% | 84,777 | $18,689,067.12 |

| RDN | Raiden Resources Ltd | 0.0105 | 24% | 100,325,515 | $12,618,690.90 |

| KRR | King River Resources | 0.016 | 23% | 7,621,944 | $20,195,824.31 |

| GES | Genesis Resources | 0.011 | 22% | 520,000 | $7,045,571.65 |

| DEL | Delorean Corporation | 0.07 | 21% | 403,687 | $12,511,813.07 |

| ARD | Argent Minerals | 0.018 | 20% | 341,659 | $13,278,875.13 |

| NXM | Nexus Minerals Ltd | 0.21 | 20% | 511,349 | $50,868,217.93 |

| DMG | Dragon Mountain Gold | 0.012 | 20% | 99,315 | $3,936,716.65 |

| FAU | First Au Ltd | 0.006 | 20% | 723,699 | $4,657,054.75 |

| MTH | Mithril Resources | 0.006 | 20% | 83,333 | $14,701,165.21 |

| RNX | Renegade Exploration | 0.006 | 20% | 510,250 | $4,448,133.19 |

| CAF | Centrepoint Alliance | 0.255 | 19% | 168,985 | $42,114,606.14 |

| PKD | Parkd Ltd | 0.026 | 18% | 12,724,491 | $2,204,402.93 |

| RMX | Red Mount Min Ltd | 0.0065 | 18% | 1,493,260 | $9,033,001.22 |

| VR8 | Vanadium Resources | 0.091 | 18% | 1,492,993 | $36,460,452.80 |

| MIO | Macarthur Minerals | 0.165 | 18% | 172,658 | $22,575,488.32 |

| RBX | Resource B | 0.1 | 18% | 73,062 | $3,483,002.25 |

| CHK | Cohiba Min Ltd | 0.007 | 17% | 1,846,881 | $9,765,964.85 |

Look, I’m not going to over think the 30% rise for retail analytics (but not spelling) experts over at Frugl Group (ASX:FGL).

I’m going to freestyle it as we say in music circles.

We last came across FGL back in July when they launched their seemingly harmless grocery price index (GPI). Which they called the Frugal GPI.

The concept was good enough to attract the highly critical and pretty excellent investment team over at News Limited. Their investments are typically spot on.

Anyway, the FGL GPI was to provide quarterly updates on price changes of everyday items. Like… giving inflation insights into a range of grocery categories and different household shopper types.

The plan was to release the Frugl GPI report a week before the official CPI and inflation announcement, giving an early indicator of inflation movements. Unfortunately, I could only get hold of the July version.

Anyway, anyway FGL says it’s just raised some $630K with shareholders representing a 61% take up rate of FPO Shares under the Entitlement Offer, and the FGL Directors also took what they could get.

Now, I could look this up, but I’m not going to, dear reader, but here’s what I reckon: (Eddy gave me this idea and I’m running with it)

…the strongest gains year on year came from fruit & veg, new dwellings & fuel. But fuel slowed with price falls into Aug.

Inflation ex fruit, veg & fuel rose from 5.5%yoy in June to 6.2%yoy.

(ABS table) pic.twitter.com/CbesUHrope— Shane Oliver (@ShaneOliverAMP) September 29, 2022

Fruit and Vege are driving local inflation and our inflation indicators have always been considered too sparse and too far apart (See, also: Mousina D, AMP) … these guys may’ve found their niche and someone really clever – like News Ltd – but with money has seen it too.

Thus up 30% or so. (out of curiosity, if you do know the actual reason – [email protected] – all emails are charged at the usual rate.

Raiden Resources (ASX:RDN) meanwhile, has found visible things. Visible is a great word in the digging dept.

RDN says four holes perpetrated on an unsuspecting Mt Scholl have intercepted between 40m-65m of pentlandite (source of nickel), pyrrhotite (contains copper and nickel), and chalcopyrite (source of copper) mineralisation.

“All four of the initial drill holes are intercepting visible Nickel and Copper sulphide mineralisation on the B2 deposit and in line with our modelling,” MD Dusko Ljubojevic says.

Delorean Corporation (ASX:DEL) has achieved full commissioning and client handover of the Blue Lake Milling Bioenergy Project in South Australia.

The bioenergy plant uses anaerobic digestion technology to process milling byproduct (ground oat milled fines or ‘GOMF’) for production of renewable electricity.

It has the capacity to process 12,000 tonnes per annum of GOMF, delivering a baseload power supply of up to 1.2MW of renewable electricity and thermal energy per hour.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SIH | Sihayo Gold Limited | 0.002 | -33% | 1,458,506 | $18,306,384.27 |

| 3DA | Amaero International | 0.088 | -30% | 2,406,882 | $31,984,593.13 |

| TD1 | Tali Digital Limited | 0.003 | -25% | 8,063,980 | $4,930,522.10 |

| AJL | AJ Lucas Group | 0.12 | -23% | 9,564,855 | $185,424,428.43 |

| AUK | Aumake Limited | 0.004 | -20% | 33,168 | $3,857,234.62 |

| AYM | Australia United Min | 0.004 | -20% | 1,659 | $9,212,887.43 |

| JTL | Jayex Technology Ltd | 0.008 | -20% | 24,493 | $2,492,285.39 |

| PNX | PNX Metals Limited | 0.004 | -20% | 9,012,500 | $22,220,289.04 |

| GFN | Gefen Int | 0.057 | -19% | 427,220 | $4,767,008.89 |

| S66 | Star Combo | 0.18 | -18% | 5,999 | $29,718,255.82 |

| DVL | Dorsavi Ltd | 0.014 | -18% | 173,913 | $7,395,106.18 |

| BMM | Balkanminingandmin | 0.34 | -17% | 312,533 | $13,427,500.00 |

| IRE | IRESS Limited | 8.74 | -17% | 2,821,344 | $1,964,196,763.88 |

| TTI | Traffic Technologies | 0.015 | -17% | 489,784 | $12,999,063.37 |

| YPB | YPB Group Ltd | 0.005 | -17% | 102,632 | $2,439,276.92 |

| 1AG | Alterra Limited | 0.011 | -15% | 269,900 | $9,042,183.12 |

| BTC | BTC Health Ltd | 0.044 | -15% | 29,881 | $14,656,010.41 |

| OZM | Ozaurum Resources | 0.085 | -15% | 229,691 | $6,971,600.00 |

| AJQ | Armour Energy Ltd | 0.006 | -14% | 4,370,497 | $15,809,156.13 |

| BUR | Burleyminerals | 0.12 | -14% | 66,168 | $4,805,226.86 |

| GTG | Genetic Technologies | 0.003 | -14% | 100,000 | $32,318,878.00 |

| RIE | Riedel Resources Ltd | 0.006 | -14% | 840,000 | $7,501,949.43 |

| ROG | Red Sky Energy. | 0.006 | -14% | 5,025,407 | $37,115,590.38 |

| BOA | Boadicea Resources | 0.11 | -14% | 652,976 | $9,906,736.61 |

| BMO | Bastion Minerals | 0.079 | -13% | 596,932 | $6,909,562.66 |

Reuben notes that Evolution Energy Minerals (ASX:EV1) are having a thrilling Thursday.

The West Coast rock whisperer says that back in May 2022, Evolution Energy Minerals signed a binding off-take agreement with China’s Yichang Xincheng Graphite Co (YXGC) to supply 30,000 tonnes per annum of flake graphite concentrate (from +100 mesh up to +32 mesh) for three years from first production at the Chilalo Graphite Project.

In addition to this off-take, both parties are now seeking to establish downstream manufacturing outside China which allows Evolution to capture greater margins.

EV1 says a binding term sheet envisages the establishment of a processing facility for the processing of 25,000tpa of coarse flake concentrate into high-value graphite products including graphite foil, bi-polar plates, and seals for electric vehicles.

A preliminary review of suitable locations, with a focus on Europe and the Middle East, has been undertaken and EV1 believes it is in a strong position to capitalise on the opportunity for international expansion.

Lord Resources Limited (ASX:LRD) says that field work has started at the Horse Rocks Lithium Project, with a surface geochemical sampling program designed to cover the entire tenement area.

The results of the multi-element analysis will aim to identify near surface anomalies, which will assist with drill targeting. Concurrently, the Lord Resources technical team will carry out geological mapping and rock sampling, to verify the historically mapped pegmatites, and expand known occurrences.

The company says it’s the first exploration for lithium in the Horse Rocks project area, located within the Bald Hill Lithium Super-Province. About 8kms from Mineral Resources’ (ASX:MIN) Mt Marion Lithium Mine.

Infinity Lithium Corporation (ASX: INF) – Pending an announcement in relation to a permitting update at its San José Lithium Project

Widgie Nickel Limited (ASX:WIN) – Pending the release of an announcement regarding exploration results at its Mt Edwards Project

QEM Ltd (ASX:QEM) – Capital raise

Red 5 (ASX:RED) – Capital raise

Danakali (ASX: DNK) – Regarding a potential asset disposal

Fiji Kava (ASX:FIJ) – Capital raise

Yandal Resources (ASX:YRL) – Actually suspended from quotation (immediately under Listing Rule 17.2, at the request of YRL), – pending the release of an announcement regarding an application with the Federal Court of Australia or Supreme Court of Western Australia seeking declaratory relief.