Closing Bell: Local markets in a sulk for the cut that won’t come

News

News

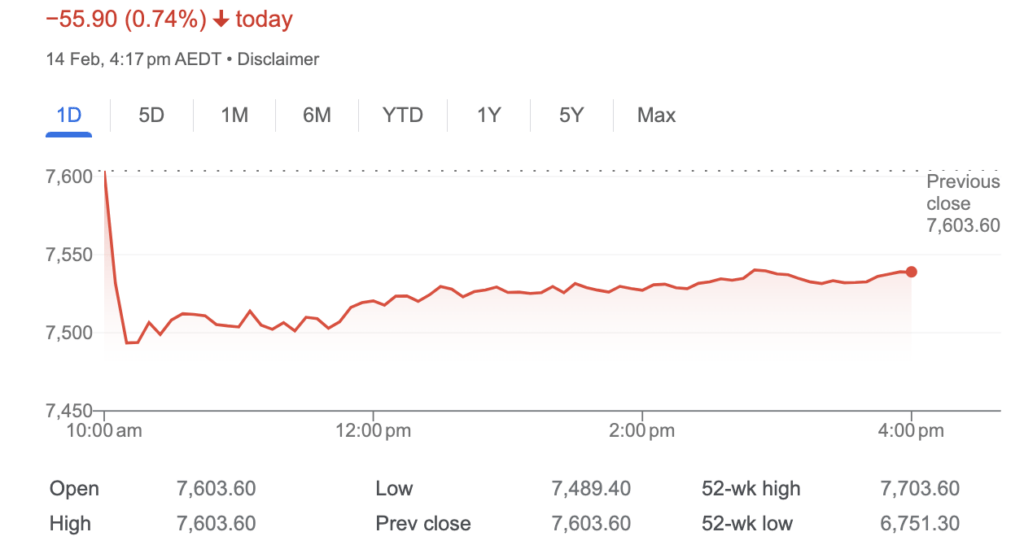

Local share markets trimmed early losses but still ended much lower after an abysmal opening following the 1.5% after a collapse on Wall Street overnight.

At 4.15pm on February 14, the S&P/ASX200 was down 56 points or 0.74% to 7,547.70:

After lunchtime in Sydney the ASX200 was down by almost 1% and looking awfully wobbly at 7530 points, the taste of Wall Street’s bitter CPI miss and the subsequent death of a dream rate cut still redolent in the mouth.

Certainly the Americans were upset – the S&P 500 fell by -1.45%, the Dow Jones index was down by -1.4%, and the tech-heavy Nasdaq slipped by -1.85%.

It’s also not a great time to be the Aussie dollar, which is trading at 3-month lows in the wake of last night’s hotter-than-expected US inflation read.

Bond yields and the US dollar are up, gold and the innocent Aussie are down.

The US dollar spike tore a near 1.5% extra arse in the Aussie dollarbuck which had been growing in confidence since before Christmas.

That said, local government bonds here spiked like a champion – the Aussie 10 year gained 9.50bps, (vs the US 10Y whuch only lost 0.17bps.

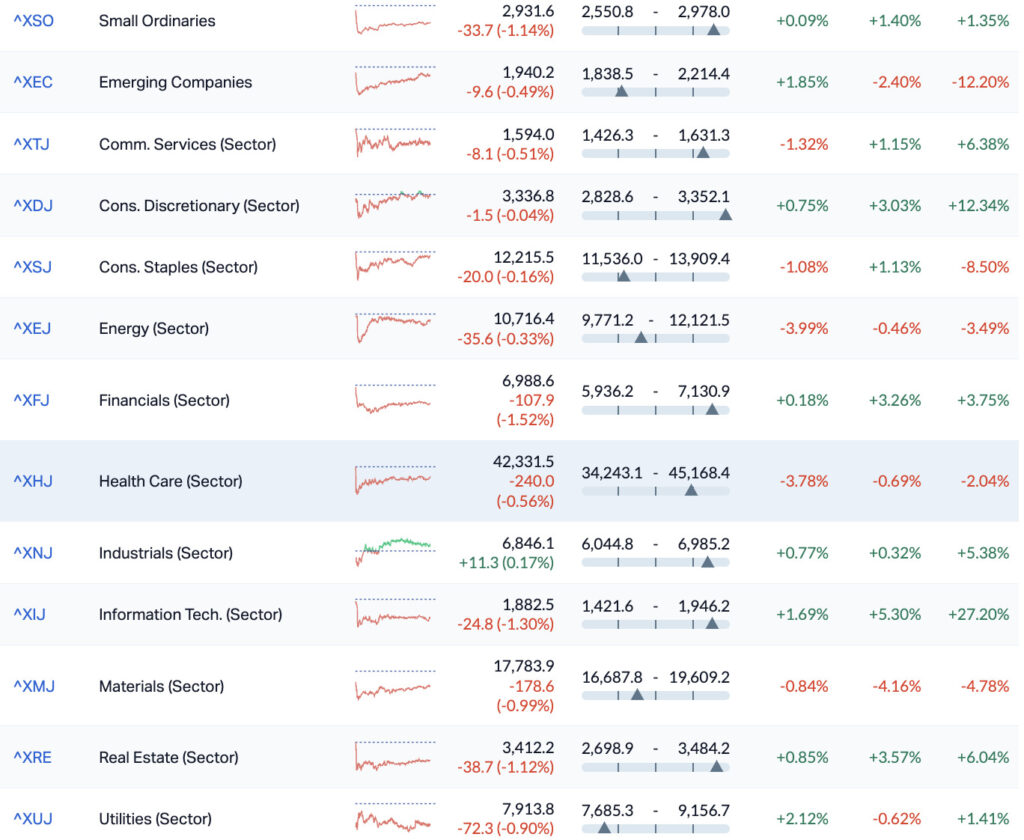

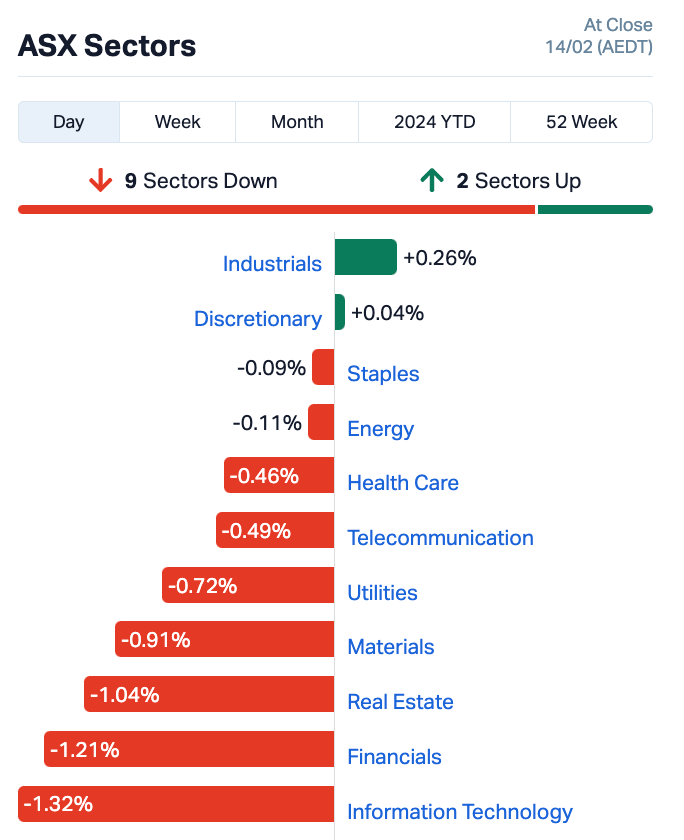

Industrials were in the green, but otherwise all the other 10 sectors were trading significantly lower.

Both major industrial caps – Seven Group Holdings and Computershare – held the ship together with strong share price surges after dropping decent 1H earnings numbers.

The Property, IT and Material sectors were all between 1 and 1.5% lower.

Energy stocks were 1.1% down, although Strike Energy punters would’ve been encouraged to see – after Tuesday’s ‘s 25% collapse – that club chairman John Poynton was up early to buy the dip and boost his stake for the first time since December 2022

It’s not my job to tell you what a big bank does in its own time, but this one’s a decent proxy for everything – from the consumer cash flow to the sense of national fairness.

Down early in the sesh by more than 2%, Commonwealth Bank (ASX:CBA) dropped its first half earnings, waving about a cash profit of exactly $5.02bn, implying a 1.4% beat to consensus opinion – driven largely by a combo of lower (BDDs) Bad and Doubtful Debts, better non-interest income and lower costs.

The result was a general if very slight improvement on market expectations, although the lower interest margins aren’t going to thrill analysts.

I wouldn’t be too worried if I was CBA. The market’s not fallen over and we’re likely at the peak of the cycle, though it may run longer than expected.

Key CBA numbers for 1H24:

– Cash profit: $5.0bn, -0.1% yoy, +1.4% vs consensus.

– BDD charge: $415m, vs consensus $497m.

– NIM: headline 1H24 NIM -6bps to 1.99%, below expectations (of 2%), driven by deposit costs (-6bps) and asset pricing (-2bps)

– The first half dividend payout was at the lower end of the range at $2.15, and below consensus expectations of $2.17

Elsewhere in the Financial corner we’ve been overdue some kind of rally in AMP shares, and they’d gained double digits on Wedneaday promising to return $295mn through dividends or buying back shares even as its net profit fell 32 per cent, was not enough to boost the rest of the sector.

Both the ASX small ordinaries (XSO) and the (XEC) emerging companies index were in the green.

![]()

Meanwhile, in the States…

US stocks dropped on Tuesday after hotter-than-expected inflation data for January spiked Treasury yields and raised doubts that the Federal Reserve would be able to cut rates several times this year, a key part of the bull case for the equity market.

The US consumer price index rose 0.3% in January from December. CPI was up 3.1 per cent on an annual basis. Economists polled by Dow Jones expected CPI to have increased by 0.2 per cent month over month in January and 2.9 per cent from a year earlier.

Core prices, which cut out the volatile food and energy components, rose 0.4 per cent month over month and 3.9 per cent from a year ago. Core CPI was expected to have increased 0.3 per cent in January and 3.7 per cent from a year earlier, respectively.

The Dow Jones Industrial Average lost 1.35% – its worst session in almost 12 months.

The S&P 500 lost 1.4%, while the Nasdaq Composite fell 1.8%.

The Russell 2000 also suffered, tumbling nearly 4 per cent for its worst session since June 2022.

In corporate news, JetBlue soared 21% after activist investor Carl Icahn reported a nearly 10% stake in the airline. Hasbro lost 1.5% after missing analyst expectations on Q4 earnings, while Avis Budget crashed 22.4% on the back of Q4 weakness.

Bitcoin

Meanwhile, in the cryptocurrency world, Bitcoin extended its winning streak, surging by more than 3% on Monday to break past the $50,000 level for the first time since December 2021.

Bitcoin’s rally in the run up to the ETF approval suffered a sell the fact correction post the actual approval, but renewed interest ahead of its halving in April, when the rate of Bitcoin production is slashed.

BTC still has work to do to get back to its GOAT of $US69,000, but over the past year and half it’s up circa 200% from its 2022 low of $US16,000.

An influx of interest from investors across crypto’s newly launched Bitcoin exchange-traded funds (ETFs) and excitement over the halving has led to a more than $1 billion of inflow to crypto markets over the past week alone, according to some reports.

And US Futures are mixed in Sydney (at 3.30pm on Wednesday).

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| FAU | First Au Ltd | 0.004 | 60% | 18,525,382 | $4,154,983 |

| NVQ | Noviqtech Limited | 0.003 | 50% | 807,186 | $2,618,891 |

| PRX | Prodigy Gold NL | 0.006 | 50% | 14,405,487 | $7,004,431 |

| NRZ | Neurizer Ltd | 0.007 | 40% | 7,336,599 | $7,069,554 |

| TTI | Traffic Technologies | 0.009 | 29% | 385,049 | $5,303,691 |

| BOC | Bougainville Copper | 0.535 | 26% | 144,098 | $170,451,563 |

| CTN | Catalina Resources | 0.005 | 25% | 1,450,000 | $4,953,948 |

| OPN | Oppenneg | 0.01 | 25% | 2,332,266 | $9,033,437 |

| VML | Vital Metals Limited | 0.005 | 25% | 427,949 | $23,580,268 |

| DAF | Discovery Alaska Ltd | 0.023 | 21% | 5,500 | $4,450,459 |

| AHN | Athena Resources | 0.003 | 20% | 3,668,000 | $2,676,169 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 15,402,461 | $3,454,921 |

| CHK | Cohiba Min Ltd | 0.003 | 20% | 1,000,000 | $6,325,575 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 5,868,300 | $65,333,512 |

| KIN | KIN Min NL | 0.074 | 19% | 5,406,667 | $73,045,334 |

| BNL | Blue Star Helium Ltd | 0.013 | 18% | 27,266,702 | $21,364,918 |

| ODE | Odessa Minerals Ltd | 0.007 | 17% | 1,166,666 | $6,259,695 |

| RGS | Regeneus Ltd | 0.007 | 17% | 20,000 | $1,838,621 |

| NKL | Nickelxltd | 0.044 | 16% | 1,054,906 | $3,336,976 |

| PCL | Pancontinental Energ | 0.022 | 16% | 12,988,061 | $153,281,983 |

| SYA | Sayona Mining Ltd | 0.044 | 16% | 165,710,082 | $391,145,249 |

| ATS | Australis Oil & Gas | 0.015 | 15% | 1,937,469 | $16,599,252 |

| AUZ | Australian Mines Ltd | 0.015 | 15% | 42,202,918 | $13,854,798 |

| ICR | Intelicare Holdings | 0.015 | 15% | 400,601 | $3,052,718 |

| SOV | Sovereign Cloud Hldg | 0.053 | 15% | 198,096 | $15,612,431 |

Blue Star Helium (ASX:BNL) got off to a good start early in the day, after the company revealed results from initial testing and evaluation at Bolling #4 SESW well, which resulted in gas to surface flow of >4% helium under vacuum with flow up to 268.4 mscf/d. The company has engineers evaluating well production potential.

Rox Resources (ASX:RXL) had good news, revealing that it has recently completed geophysical Gradient Array Induced Polarisation (GAIP) surveys at its Mt Fisher and Mt Eureka gold projects in Western Australia, identifying numerous high-priority, walk-up drill targets in the process.

The new targets add to a previous result from its 100% owned Mt Fisher project, which the company reported as 9m @ 34.34g/t Au, with work continuing on both that project and the 51% (with an avenue for earn-in up to 75%) owned Mt Eureka site.

Bastion Minerals (ASX:BMO) was also making news on Wednesday morning, announcing that 53 samples from old mine workings have confirmed that the strategic 115km2 Gyttorp land holding in Southern Sweden is highly prospective for high-grade REE, with laboratory results to 6.8% (68,078 ppm) total REE + yttrium and elevated results throughout the property.

The company says that other high-grade Total REE+Y samples that exceeded 1.0% (10,000 ppm) include: 3.09%, 2.85%, 2.46%, 2.09%, 1.52%, 1.49%, 1.45%, 1.29% and 1.1%.

Hammer Metals (ASX:HMX) announced that its JV partner, Sumitomo Metal Mining Oceania, has reached a $6 million (60% interest) earn-in milestone and has elected to continue to fund the JV, with drilling of the Shadow South IOCG target scheduled to commence in early March.

As such, Hammer has elected to dilute its position in the MIEJV in accordance with the JV agreement, noting that it can elect to contribute to the Joint Venture in the future to maintain its interest at that point in time.

Kin Mining (ASX:KIN) surged more than 19% on no news, earning itself a speeding ticket from the ASX, while Sovereign Cloud Holdings (ASX:SOV) jumped around 24% in after-lunch trade, also without much in the way of news for the market.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| SSR | SSR Mining Inc. | 7.16 | -52% | 357,790 | $82,519,141 |

| GTE | Great Western Exp. | 0.0255 | -36% | 1,825,786 | $13,920,425 |

| MTL | Mantle Minerals Ltd | 0.002 | -33% | 33,735,059 | $18,592,338 |

| EDE | Eden Inv Ltd | 0.0015 | -25% | 5,162,997 | $7,356,542 |

| IS3 | I Synergy Group Ltd | 0.006 | -25% | 1,497,052 | $2,432,643 |

| MRQ | Mrg Metals Limited | 0.0015 | -25% | 1,840,000 | $4,942,682 |

| TOT | 360 Capital REIT | 0.41 | -25% | 1,599,920 | $79,696,680 |

| BNZ | Benz Mining | 0.135 | -21% | 171,982 | $18,922,016 |

| ROG | Red Sky Energy | 0.004 | -20% | 17,893,010 | $27,111,136 |

| RR1 | Reach Resources Ltd | 0.002 | -20% | 301,777 | $8,025,743 |

| EYE | Nova EYE Medical Ltd | 0.215 | -20% | 1,075,381 | $51,047,435 |

| AUA | Audeara | 0.03 | -19% | 56,611 | $5,350,486 |

| REC | Rechargemetals | 0.065 | -18% | 65,529 | $8,796,806 |

| HVY | Heavy Minerals | 0.081 | -17% | 108,434 | $5,647,109 |

| ABE | Ausbondexchange | 0.024 | -17% | 248,498 | $3,267,375 |

| BEO | Beonic Ltd | 0.025 | -17% | 265,306 | $12,734,848 |

| EMT | Emetals Limited | 0.005 | -17% | 111,000 | $5,100,000 |

| NMR | Native Mineral Res | 0.021 | -16% | 400,040 | $5,243,763 |

| FXG | Felix Gold Limited | 0.033 | -15% | 215,392 | $8,081,389 |

| SHO | Sportshero Ltd | 0.011 | -15% | 1,092,963 | $8,031,827 |

| ASR | Asra Minerals Ltd | 0.006 | -14% | 1,854,545 | $11,455,470 |

| ICG | Inca Minerals Ltd | 0.006 | -14% | 664,794 | $4,114,784 |

| LPD | Lepidico Ltd | 0.006 | -14% | 10,000 | $53,468,156 |

| YOJ | Yojee Limited | 0.043 | -14% | 93,196 | $8,485,231 |

PharmAust (ASX:PAA) has begun an open-label extension (OLE) study for monepantel (MPL) in patients with Motor Neurone Disease (MND)/Amyotrophic Lateral Sclerosis (ALS) at Calvary Health Care Bethlehem in Melbourne as a statistical review shows the drug “defied the odds”.

Soil sampling results from St George Mining’s (ASX:SGQ) Mt Alexander project have discovered multiple new, large-scale lithium soil anomalies – the largest of which has a strike length of >2.7km – 120km south-west of the Agnew-Wiluna belt, which hosts numerous world-class lithium deposits such as Delta Lithium’s (ASX: DLI) 14.6Mt Mt Ida resource.

Pan Asia Metals (ASX:PAM) has increased the area covered by exploration concessions at its Tama Atacama lithium project in Chile to ~996km2 after it was granted a fourth series of concessions in the highly prized Pampa del Tamarugal Basin in Chile’s Atacama Desert.

Norwest Minerals (ASX:NWM) has scored the closest ground to WA1 Resources’ exciting Luni niobium-rare earths discovery in the West Arunta region, adding a further 360km2 of ground – including tenement E80/5846 – to its current 1,560km2 project.

Torque Metals’ (ASX:TOR) drill program to test and extend the maiden exploration target at its New Dawn lithium project in WA’s Goldfields region looks to have met its objectives after intersecting thick spodumene intervals to add to its existing exploration target of 8-14Mt @ 1-1.2% Li2O.

NickelX (ASX:NKL) has staked the highly prospecting Elliot Lake uranium project in Ontario, Canada, along strike from major historic producing mines, as part of its pivot from a retreating nickel price to a huge value-add of demand into the yellowcake sector.

Gold explorer Spartan Resources (ASX:SPR) is targeting rapid resource growth by mid-2024 as recent drilling highlights 20.5m of ‘Never Never’ style mineralisation logged 871.5m down-hole in further proof the mineralisation extends at depth.

Kin Mining (ASX:KIN) – pending the release of a response to a price query dated 14 February 2024.