Closing Bell: Desert Metals up 127pc… but where was the ASX on Day 1 of Spring?

News

Local markets looked forlorn on Friday, ending the week with a -0.4% loss, but coming home from Monday morning about 1.35% the better.

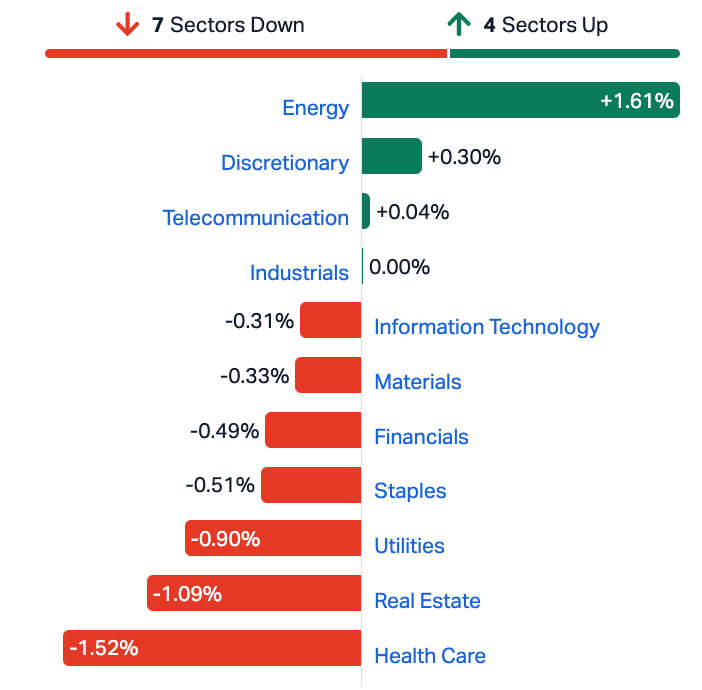

The ASX200 made it to the lunchtime break (no break), down about half a per cent with unhappy overnight Wall Street trade and some worse work by Property and Healthcare stocks keeping the mood and the buying to minimums.

Energy names had a right crack, with Consumer Discretionary adding to recent gains. The Energy Sector (+1.6%) rose after majors Woodside and Santos gained circa 1.5% each and Whitehaven jumped 4.4%.

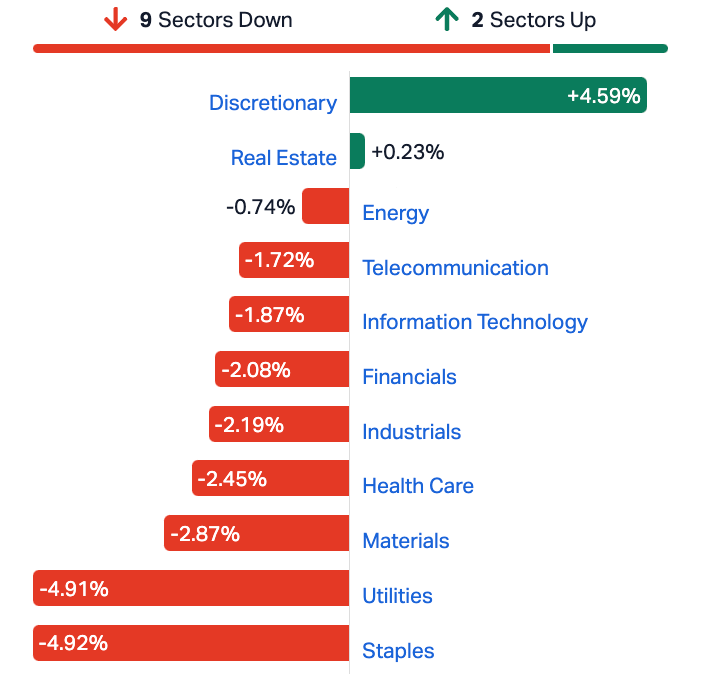

Real estate stocks looked a lot less sexier after Aussie new loan commitments for housing fell by 1.2% in July, according to our Bureau of Statistics boffins.

Business construction loans had a shocker, down 21.5%. Owner-occupied loans walked back -1.9%, and purchase of commercial property crashed 5.1%.

On the health side Mayne Pharma did its bit to flummox Friday (-15%), after thwacking Thursday with some depressing earnings results.

Fortescue also posed a major problem on Friday, with what Gregor today most aptly called ‘the outstanding success of Fortescue’s latest invention, the Semi-Automatic Executive Ejector™.’

He is a funny and most articulate human being.

The ASX Small Ordinaries Index (XSO) ended 0.2% lower, and the ASX Emerging Companies Index (XEC) was 0.5% ahead.

Is China turning it around?

Chinese mainland markets are climbing strongly on Friday, while the Hang Seng has shuttered business as a typhoon approaches Hong Kong.

A strong read for Caixin’s China Manufacturing PMI did the trick. The general manufacturing read hit 51.0 in August from 49.2 in July, whacking market estimates of 49.3.

This was the strongest pace of expansion in factory activity since February, also marking the fifth increase since the start of the year amid multiple efforts from Beijing to revive a weakening post-pandemic recovery.

We wanted to stop Twiggy Watching this week, but he’s making it very hard.

Mr Forrest’s Fortescue Metals Group (ASX:FMG) has dragged it’s feet again on Friday, following the highest profile departure from his various ventures yet – Guy Debelle former RBA power man and now ex-Director at Fortescue Future Industries.

Guy is the the fourth high-profile guy person to exit inside one week for Andrew Twiggy Forrest. Paul Slaughter followed Fortescue’s CEO Fiona Hick on Monday and its CFO Christine Morris last night.

Our missives at The Australian spoke with the former central banker, who said his role as Fortescue Future’s director was ‘incompatible’ with a new gig at a green-focused developer.

But Guy Debelle did tell The Oz that he ‘learned a hell of a lot’ from the iron ore billionaire during his 18 months on the FFI board.

Guy actually officially quit Fortescue Future Industries on Thursday, so that was one exec a day for McForresty. Not good. Quite bad really, should it become a long-term pattern.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DM1 | Desert Metals | 0.097 | 126% | 11,534,613 | $3,119,266 |

| AXP | AXP Energy Ltd | 0.002 | 100% | 237,619 | $5,824,681 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | 500,000 | $3,295,156 |

| VPR | Volt Power Group | 0.0015 | 50% | 250,114 | $10,716,208 |

| TVN | Tivan Limited | 0.076 | 33% | 6,754,146 | $89,534,390 |

| KNO | Knosys Limited | 0.047 | 31% | 117,832 | $7,780,993 |

| ACM | Aus Critical Mineral | 0.42 | 29% | 4,656,948 | $9,662,656 |

| CSX | Cleanspace Holdings | 0.41 | 28% | 85,229 | $24,662,453 |

| BCT | Bluechiip Limited | 0.025 | 25% | 1,633,421 | $14,273,409 |

| OLH | Oldfields Holdings | 0.05 | 25% | 284,522 | $7,990,238 |

| GTG | Genetic Technologies | 0.0025 | 25% | 500,000 | $23,083,316 |

| OPN | Oppenneg | 0.01 | 25% | 333,148 | $8,933,437 |

| BTC | BTC Health Ltd | 0.026 | 24% | 777,892 | $5,918,773 |

| MRZ | Mont Royal Resources | 0.215 | 23% | 321,229 | $14,401,614 |

| DOC | Doctor Care Anywhere | 0.055 | 22% | 710,159 | $16,498,901 |

| BPH | BPH Energy Ltd | 0.023 | 21% | 8,424,002 | $17,674,474 |

| REZ | Resourc & En Grp Ltd | 0.019 | 19% | 196,321 | $7,996,893 |

| TGH | Terragen | 0.026 | 18% | 20,000 | $5,335,853 |

| T92 | Terrauraniumlimited | 0.165 | 18% | 221,133 | $7,224,723 |

| DUB | Dubber Corp Ltd | 0.135 | 17% | 4,007,271 | $41,113,302 |

| ARV | Artemis Resources | 0.034 | 17% | 6,519,063 | $45,527,633 |

| TRE | Toubaniresourcesinc | 0.14 | 17% | 213,305 | $12,263,880 |

| TIG | Tigers Realm Coal | 0.007 | 17% | 2,791,804 | $78,400,214 |

| CGO | CPT Global Limited | 0.15 | 15% | 389,457 | $5,446,657 |

| 1AG | Alterra Limited | 0.008 | 14% | 553,007 | $4,875,868 |

Desert Metals (ASX:DM1) up at lunch over 150% and ending at a respectable 129%, after some happy results from recent aircore drilling at Dingo Pass, which show the Krakatoa Resources (ASX:KTA) clay hosted rare earth element (REE) mineralisation extends all the way into DM1’s licence area.

The company says says KTA’s good news heads at least 9km into Desert Metals’ territory, after drilling returned samples of this nature:

An unexpected winner from all this is vanadium minnow Tivan (ASX:TVN), which gained 20% because these are the green venture dudes which ex-central banker and now ex-Fortescue guy, Guy Debelle left last night for. Debelle is a big fish for a little company. Well. They’re on the map now.

The ASX-newcomer Australian Critical Minerals (ASX:ACM) announced earlier this week its maiden exploration program has been successfully completed at the Cooletha lithium project in the Pilbara.

ACM stock is continuing a confident rise on the ‘highly encouraging mineralisation, including visible spodumene sites and manganese mineralisation’.

The company has only covered approximately 15% of the pegmatite prospective region, and the results from the first batch of 94 rock samples from Cooletha submitted to the laboratory are still about 6-8 weeks away.

The WA-based explorer is into lithium and REEs, and was up a further 25% by early arvo.

Highlights ripped from its latest ASX announcement:

• Highly encouraging mineralisation identified

• Visible spodumene sites discovered on E45/4990

• Manganese mineralisation identified on E45/5228

• Reconnaissance has covered approximately 15% of the pegmatite prospective region

Visible #spodumene mineralisation in maiden #lithium #exploration program at Cooletha Project, Pilbara, which covered ~15% of the prospective pegmatite region. Results expected in 6-8 weeks. Drill planning at Rankin Dome #REE project underway.

Read: https://t.co/PQPa78LNhu$ACM pic.twitter.com/TcR6dYpHYC— Australian Critical Minerals (@AusCriticalMin) August 28, 2023

MD, Dean de Largie also said this:

“We are very encouraged by the visible spodumene identified during this program and whilst we wait for the results of the first batch of rock samples within 6-8 weeks, reconnaissance sampling will continue. Having only covered 15% of the prospective pegmatite region so far, we are excited about the potential for exploration success.

“We are also eagerly anticipating the commencement of our first drilling program at Rankin Dome which will target anomalous rare earth prospects. Final approvals and landowner access to allow this program to begin are imminent.”

ACM share price

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PVS | Pivotal Systems | 0.004 | -33% | 6,138,000 | $4,610,276 |

| WSI | Weststar Industrial | 0.145 | -31% | 1,937,650 | $23,260,700 |

| DEL | Delorean Corporation | 0.021 | -30% | 2,052,462 | $6,471,627 |

| MCT | Metalicity Limited | 0.0015 | -25% | 750,000 | $7,472,172 |

| UCM | Uscom Limited | 0.042 | -22% | 9,750 | $10,288,812 |

| WNR | Wingara Ag Ltd | 0.031 | -21% | 28,765 | $6,846,158 |

| PHL | Propell Holdings Ltd | 0.02 | -20% | 464,967 | $3,008,888 |

| TZL | TZ Limited | 0.02 | -20% | 597,395 | $6,418,953 |

| RCW | Rightcrowd | 0.018 | -18% | 1,329,521 | $5,790,220 |

| MRI | Myrewardsinternation | 0.0115 | -18% | 119,643 | $5,828,873 |

| TG1 | Techgen Metals Ltd | 0.03 | -17% | 575,498 | $2,778,058 |

| APC | Aust Potash Ltd | 0.005 | -17% | 2,932,113 | $6,232,137 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 775,333 | $17,085,331 |

| EEL | Enrg Elements Ltd | 0.005 | -17% | 3,497,145 | $6,059,790 |

| LML | Lincoln Minerals | 0.005 | -17% | 3,123,385 | $8,524,271 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 12,911,169 | $11,677,079 |

| NES | Nelson Resources. | 0.005 | -17% | 95,000 | $3,681,566 |

| ROG | Red Sky Energy. | 0.005 | -17% | 546,396 | $31,813,363 |

| MFD | Mayfield Childcr Ltd | 0.87 | -16% | 434,466 | $67,272,086 |

| MLG | Mlgozltd | 0.51 | -15% | 29,107 | $88,076,498 |

| BCK | Brockman Mining Ltd | 0.023 | -15% | 80,700 | $250,566,268 |

| KCC | Kincora Copper | 0.035 | -15% | 144,008 | $6,600,437 |

| SKF | Skyfii Ltd | 0.036 | -14% | 283,166 | $17,626,903 |

| LRL | Labyrinth Resources | 0.006 | -14% | 689,224 | $8,312,806 |

| RGS | Regeneus Ltd | 0.006 | -14% | 1,245,009 | $2,145,058 |

Austral Resources (ASX:AR1) – Pending the release of an announcement in relation to a corporate financing.

Iceni Gold (ASX:ICL) – Pending an announcement regarding a proposed capital raise.

Kingsland Minerals (ASX:KNG) – Pending the release of an announcement in relation to drill assay results from the Leliyn Graphite project in the Northern Territory.

BikeExchange (ASX:BEX) – Pending an announcement regarding a proposed capital raise.

American West Metals (ASX:AW1) – Pending the release of exploration results at the Company’s Storm Project.

High-Tech Metals (ASX:HTM) – Pending material acquisitions by the Company.

Bio-Gene Technology (ASX:BGT) – Pending an announcement by the Company to the market in relation to the outcome of a capital raising.

Sarama Resources (ASX:SRR) – Pending the release of an announcement in relation to correspondence received by the Company from the Minister of Mines in Burkina Faso concerning the status of the Tankoro 2 Exploration Permit.

Southern Cross Gold (ASX:SXG) – Pending an announcement by the Company to the market in relation to material exploration results at the Company’s Sunday Creek Project.