Closing Bell: ASX pops on tech, banks, goldies and possible China ‘bazooka style’ stimulus

ASX rallies broad based as tech stocks lead. Picture via Getty Images

- ASX rallies broadly as tech stocks lead

- Commonwealth Bank hits record, Neuren jumps

- Asian markets rise, China stimulus eyed

The ASX was riding the coattails of a strong Wall Street session, with tech stocks leading the charge.

At the close of Friday, the benchmark S&P/ASX 200 surged by 0.9%. For the week, the Index was up over 2%.

The broader market was lifted by optimism around rate cuts from central banks globally, and hopes that China might roll out more economic stimulus to counteract its slowing growth.

The US Fed Reserve and the Bank of England cut their respective interest rates by 0.25% overnight.

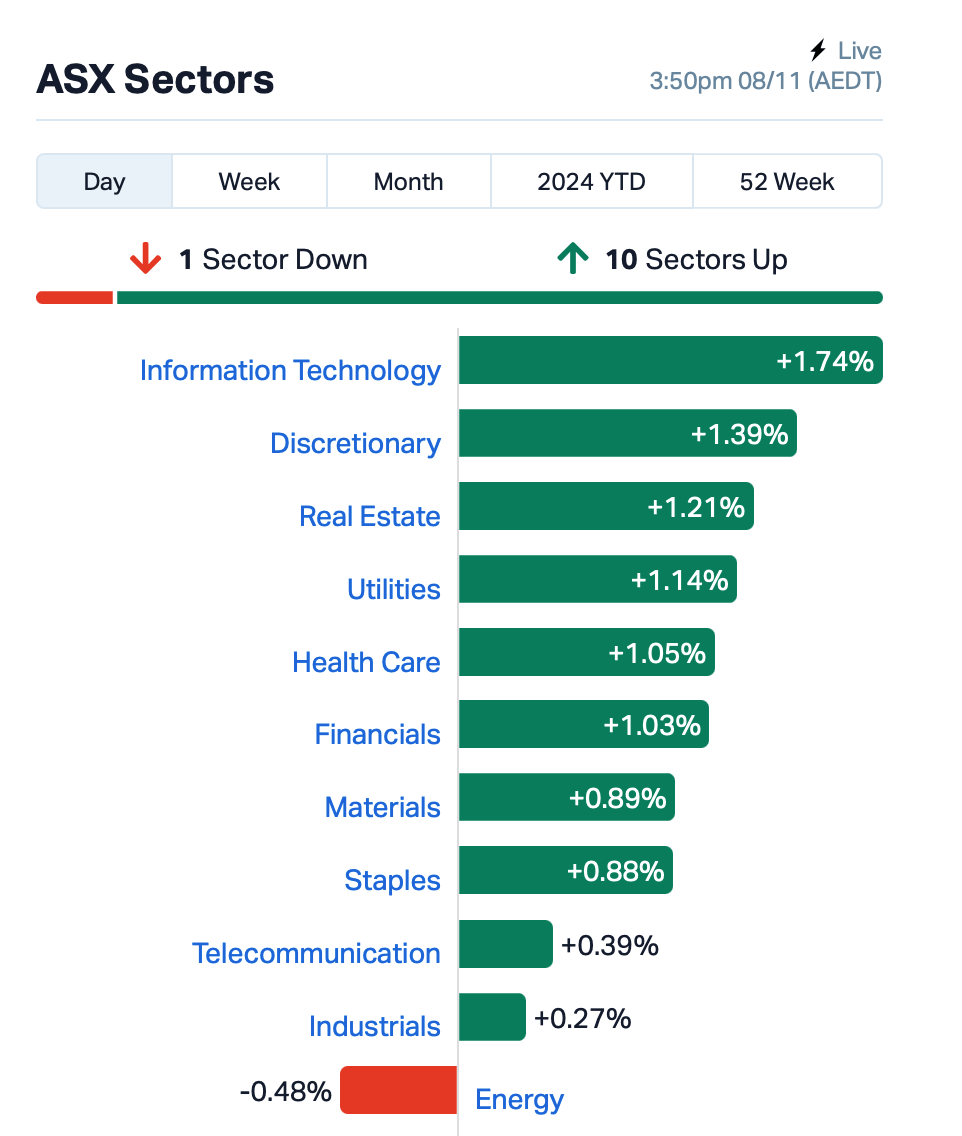

On the ASX today, the rally was broad based, with all sectors in the green except for Energy.

The Information Technology sector was particularly strong, jumping nearly 2% – bolstered by a fresh high for family app Life360 (ASX:360), which lifted by 4%.

There was no official news from Life, but word on the street is that UBS has given the stock a price target upgrade.

Commonwealth Bank (ASX:CBA) hit a new record, while other big banks basked in today’s rally. Even Australia and New Zealand Banking Group (ASX:ANZ) rose by almost 1% despite posting an 8% drop in net profit for FY24 and lowering its final dividend.

Meanwhile, traders are looking ahead to a potentially significant stimulus package from China’s National People’s Congress Standing Committee, especially as fears of new tariffs under a second Donald Trump presidency loom.

These expectations have given a boost to iron ore stocks: BHP (ASX:BHP) , Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all added gains.

Gold stocks also found support, thanks to a rally in precious metals overnight. The price of gold surged back above US$2700 per ounce.

The biggest large caps gain came from Neuren Pharmaceuticals (ASX:NEU), which leapt by a further 15% following strong sales of its Daybue drug in the US announced yesterday.

What’s happening elsewhere?

In Asia today, most stock markets rose, continuing the upbeat momentum from Wall Street.

In China, however, the CSI 300 Index lost some ground as investors awaited the outcome of the key meeting of top lawmakers. The focus is on whether China will introduce new ‘bazooka style’ stimulus measures.

Analysts are speculating that the government may offer support for local government debt and consumer spending, although there’s uncertainty about the scale.

Meanwhile, in Tokyo, Nissan’s stock plummeted 6% after the automaker warned of major layoffs and cuts to production due to a sharp drop in profits.

Bitcoin, meanwhile, dipped slightly after a strong run, trading at the time of writing at US$76,065.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.002 | 100% | 359,818 | $4,497,970 |

| MNC | Merino and Co | 1.050 | 54% | 734,126 | $36,092,068 |

| ADD | Adavale Resource Ltd | 0.003 | 50% | 6,007,097 | $2,447,531 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 300,000 | $5,824,681 |

| TKL | Traka Resources | 0.002 | 50% | 1,203,505 | $1,945,659 |

| VPR | Voltgroupltd | 0.002 | 50% | 2,921,688 | $10,716,208 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 340,921 | $1,744,524 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 516,524 | $4,951,252 |

| PAB | Patrys Limited | 0.004 | 33% | 16,898,282 | $6,172,342 |

| XPN | Xpon Technologies | 0.020 | 33% | 2,301,605 | $5,436,622 |

| EQN | Equinoxresources | 0.165 | 32% | 5,052,285 | $15,481,250 |

| PVT | Pivotal Metals Ltd | 0.012 | 28% | 16,962,557 | $7,870,283 |

| ID8 | Identitii Limited | 0.015 | 25% | 1,122,558 | $7,807,290 |

| OVT | Ovanti Limited | 0.030 | 25% | 57,972,382 | $48,723,494 |

| VTI | Vision Tech Inc | 0.135 | 23% | 5,835 | $6,054,011 |

| CUS | Coppersearchlimited | 0.036 | 20% | 568,466 | $3,407,562 |

| OLL | Openlearning | 0.018 | 20% | 99,078 | $6,346,031 |

| ICG | Inca Minerals Ltd | 0.006 | 20% | 1,234,344 | $5,133,613 |

| PRM | Prominence Energy | 0.006 | 20% | 200,000 | $1,945,882 |

| BIS | Bisalloy Steel | 3.670 | 20% | 523,982 | $147,064,055 |

| EMP | Emperor Energy Ltd | 0.025 | 19% | 2,589,646 | $9,507,761 |

| PEC | Perpetual Res Ltd | 0.019 | 19% | 6,447,571 | $11,776,487 |

| PFE | Panteraminerals | 0.026 | 18% | 5,410,148 | $10,004,075 |

Mayne Pharma (ASX:MYX) jumped 10% this morning after responding to the Australian Financial Review‘s speculation regarding its appointment of Jefferies Australia, confirming that Jefferies is its financial adviser.

In the article, the AFR suggested that Mayne, which has seen significant losses, is exploring potential interest from buyers, with Jefferies quietly marketing the company to secure an exit for shareholders. Mayne said today that it continues to work with Jefferies to assess strategies for maximising shareholder value, and will provide updates as required by its disclosure obligations.

Equinox Resources’ (ASX:EQN) shares jumped this morning after the company reported rock chip samples from its Alturas Antimony project in British Columbia, Canada, with assays up to 69.98% antimony (Sb). Equinox said this is one of the highest grades of natural stibnite ever found.

The company has also increased its land holdings by 3.3 km², and the price of antimony has risen sharply to US$36,000 per metric tonne, driven by new export controls from China. Also, rock chip samples indicate potential copper mineralisation, and drilling is underway at the company’s Brazilian projects. CEO Zac Komur said the project has immense potential, and there is a rare opportunity to explore this high-grade asset in a mining-friendly area.

Native Mineral Resources (ASX:NMR) has signed an agreement to acquire advanced gold projects in Queensland, including the Far Fanning and Black Jack deposits. These projects are in a promising mining region, and NMR believes they have significant exploration potential.

The total acquisition is valued at $18.9 million, payable over 33 months, with no new shares issued. NMR has also secured 100% ownership of 17 mining leases and the Black Jack processing plant. Recent sampling from the Far Fanning project showed promising gold grades, and NMR plans further drilling and studies. To fund this acquisition, NMR is planning a capital raise through a placement and entitlement offer, aiming to raise up to $14 million.

Bisalloy (ASX:BIS) shares rose following the chairman’s address this morning, where he highlighted a 20% increase in profit for the year, driven by strong domestic performance, improved margins, and reduced costs.

He also pointed to key developments, including Bisalloy’s successful qualification for supplying steel for the AUKUS submarines, the positive outcome of the anti-dumping review, and the company’s joint ventures, particularly in China. Also, the company’s focus on expanding its armour and protection steel business, new product innovations, and increased export demand contributed to an optimistic outlook for the year ahead.

Flynn Gold (ASX:FG1) shares rose after the company announced its maiden JORC-compliant Exploration Target for its Golden Ridge Project in Tasmania.

The target estimates between 449,000oz and 520,000oz of gold across three prospects, with significant potential for further expansion as the mineralisation is open in all directions. This marks a key step towards defining a maiden Mineral Resource and has raised investor confidence in the project’s growth potential.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AKG | Academies Aus Grp | 0.105 | -38% | 3,550 | $22,544,459 |

| T3D | 333D Limited | 0.006 | -33% | 40,006 | $1,075,004 |

| RNE | Renu Energy Ltd | 0.001 | -33% | 522,879 | $2,590,993 |

| TMK | TMK Energy Limited | 0.002 | -33% | 19,131,887 | $25,177,217 |

| VML | Vital Metals Limited | 0.002 | -33% | 16,217 | $17,685,201 |

| SAN | Sagalio Energy Ltd | 0.005 | -29% | 80,000 | $1,432,621 |

| AIV | Activex Limited | 0.013 | -28% | 350,256 | $3,879,046 |

| PKO | Peako Limited | 0.003 | -25% | 947,970 | $3,513,899 |

| RGL | Riversgold | 0.003 | -25% | 45,000 | $6,509,850 |

| RML | Resolution Minerals | 0.002 | -25% | 900,000 | $3,220,044 |

| TAS | Tasman Resources Ltd | 0.003 | -25% | 1,050,000 | $3,220,998 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 1,126 | $7,923,243 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 30,000 | $6,620,957 |

| CAV | Carnavale Resources | 0.004 | -20% | 3,863,282 | $20,451,092 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 99 | $1,781,089 |

| PLC | Premier1 Lithium Ltd | 0.009 | -18% | 5,891,878 | $1,920,315 |

| CBY | Canterbury Resources | 0.025 | -17% | 199,426 | $5,923,227 |

| ERA | Energy Resources | 0.003 | -17% | 1,441,518 | $66,444,898 |

| NOR | Norwood Systems Ltd. | 0.032 | -16% | 216,360 | $18,106,500 |

| ASR | Asra Minerals Ltd | 0.003 | -14% | 50,000 | $7,810,453 |

| PPY | Papyrus Australia | 0.012 | -14% | 14,880 | $6,897,696 |

Premier1 Lithium (ASX:PLC) dropped this morning after announcing $1.5 million cap raise through a combination of a Placement and a fully underwritten Entitlement Offer. The Placement, at $0.008 per share, raised around $209,000, while the Entitlement Offer aims to raise $1.3 million by issuing up to 167.3 million shares. The funds will be used to advance exploration at the Yalgoo and Abbotts North projects, including geophysics, drilling and heritage work. Canaccord Genuity is managing and underwriting the offer.

IN CASE YOU MISSED IT

Weebit Nano’s ASX:WBT) research team is making significant strides in advancing high-temperature automotive qualification tests and testing its 22nm FD-SOI silicon, which has been showing promising reliability.

The company filed more than 70 patent applications, fortifying protections around its R&D efforts, with an additional nine patents granted last quarter. Weebit is now in discussions with over a dozen leading foundries and integrated device manufacturers (IDMs) as potential clients, in addition to many leading product companies.

Equinox Resources (ASX:EQN) has received the results of ultra high-grade antimony samples from its Alturas project in Canada’s British Columbia province.

The first set of 26 rock chip samples returned stonker grades of just under 70% antimony amid a spread of 14 results above 10%. EQN’s tenure has been mined before, with more than 100t of antimony ore averaging 57.2% Sb historically produced from the on-site Alps-Alturas Antimony mine.

The company says it is in talks with potential partners and stakeholders looking to maximise the value of its new asset, and now has its first assays on deck to inform the plan of attack.

At Stockhead we tell it like it is. While Weebit Nano and Equinox Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.