ASX Small Caps Lunch Wrap: Can somebody rid Germany of these turbulent mutant hyper-pigs?

They may look cute, but these beasts are actually 27 feet tall. Pic via Getty Images.

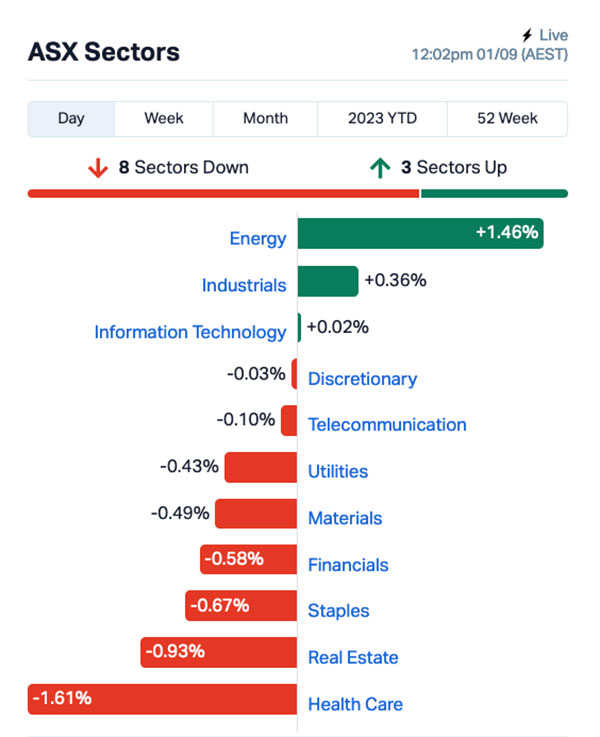

Local markets are down at lunchtime today, with the benchmark sagging 0.4% thanks to a combination of factors, including (but not limited to) Wall Street bricking it late in the session, sour performances from local Health Care and Real Estate stocks, and the outstanding success of Fortescue’s latest invention, the Semi-Automatic Executive Ejector™.

If you haven’t seen it in action yet, just wait about six hours – but for those of you who are a bit impatient, I can tell you that it looks like a large, shiny trebuchet, and smells like losing billions of dollars.

I’ll get into the details of the local market shortly, but before I do, there’s some concerning news out of Europe that looks like it might actually give Japan a run for its money in the ‘massive radioactive monster’ stakes.

By now, you should all be across the terrifying prospect of super-massive angry prawns emerging from the sea near Japan’s doomed Fukushima nuclear plant, after that country decided that the best way to deal with all the wastewater trapped inside it was to simply drain it into the ocean.

While that all looks terrible, Germany has gently let the world know that it’s got a small issue of its own, quietly brewing in the country’s southern regions.

Roving bands of wild boars are reportedly “wreaking havoc”, attacking humans by biting them and trying to slash them with their tusks. Which isn’t all that unusual, as wild pigs can generally be relied upon to be utter bastards at the best of times.

The clear solution to a wild boar problem is to set up a hunting program and, ideally, put the meat to good use in some form or another – but that’s where this story comes off the rails.

The pigs that have laid siege to parts of Germany are actually radioactive, and not just a little bit, either.

They are reportedly so radioactive, that they’re unfit for consumption by man, or beast, and the issue has actually been of massive concern for decades.

Researchers have recently published a report called “Disproportionately High Contributions of 60 Year Old Weapons-137Cs Explain the Persistence of Radioactive Contamination in Bavarian Wild Boars.”.

As the super-catchy title suggests, the radioactivity has been building in the wild pig population as a result of nuclear accidents and weapons testing throughout Europe, which means that all of the crazy conspiracies you’ve heard about a breeding program for mutant hyper-pigs are, technically, true.

There are no clear plans for how to deal with the animals, as the population continues to grow – and it’s only a matter of time before the right (or wrong, depending on your outlook) gene expression gets switched on by the radiation, and southern Germany turns into a catastrophically dangerous version of Orwell’s Animal Farm.

TO MARKETS

Local markets have fallen this morning, after Wall Street got spooked and investors started tipping everything out of their pockets as fast as they could, like munted punters in the middle of a nightclub raid.

The Energy sector, which took an ex-div hammering yesterday, has bounced back happily this morning to help keep some buoyancy for the benchmark, but it’s not quite enough to off-set a fairly profound slump among Health Care and Real Estate stocks.

The XTX All Ords Tech index is being all dirty and volatile again this morning, jumping rapidly to an early gain, before realising around 10:30am that everyone else had decided to go the other way.

Fearful that it might be assaulted for its wallet, high-tech watch and fancy new sneakers, the XTX dutifully fell into line to sink below zero.

There were no Large Caps near the top of the winners list this morning, but there are a couple of noteworthy top-dollar laggards today.

Hardest hit was Chalice Mining (ASX:CHN), which has taken a most unfortunate pounding this week, off the back of the company’s scoping study for its Gonneville nickel, copper and PGE discovery.

Chalice is down another 9.5% this morning, dragging its weekly loss to more than 35%, leaving it nearly 50% lighter than it was at the beginning of 2023.

And, I’d like to inform our readers that the Stockhead team we have currently deployed on Twiggy Watch has raised the alert level from “concerned” to “actually a bit worried”, after Fortescue Metals Group (ASX:FMG) was dealt another blow overnight.

Yesterday evening, FMG’s chief financial officer Christine Morris left the company abruptly, joining former CEO Fiona Hicks outside the FMG circle as the company sheds executives like a poorly-groomed puppy at the start of spring.

That news alone was enough to shave $3.3 billion off the company’s value, but in a case of appalling timing, FMG was back in the headlines again, with news breaking of former CFO Guy Debelle jumping ship as well.

Word on the street is that Debelle had actually left a couple of weeks ago, but the news that he’s landed at minnow vanadium player Tivan (ASX:TVN) hit the market this morning, the day that Debelle’s joining the board as a non-executive director came into force.

Debelle spoke with our stablemates at The Australian this morning, saying that his decision to leave FMG was because Tivan is “a bit too much in the same space and even in the same geographic space in the Northern Territory. It was better to have a clean break.”

Tivan is up 19.3% so far today. FMG is down more than 5%.

NOT THE ASX

Wall Street threw a spanner in the works overnight, after US investors got spooked by the sun disappearing over the horizon and The Darkness encroached, resulting in a rough’n’tumble late-session sell off that left the S&P 500 lower by -01.6%, with blue chips Dow Jones down by -0.48%.

But the tech-heavy Nasdaq climbed +0.11% to end the month, because it’s a total rebel, and likes to go its own way, and you can’t tell it what to do, because you’re not even its real dad it hates you it hates you… or whatever.

There’s renewed mumblings about a possible rate rise in the US, after the Fed Reserve’s preferred measure of inflation, the core PCE or personal consumption expenditures index, posted another modest back-to-back increase from last month, Earlybird Eddy said this morning.

The mumbling is coming from the likes of Barclays Capital, which still reckons the Fed will hike ze rates, because – and I quote – “we remain sceptical that inflation is on track to return to the Fed’s 2% target without a significant easing of labour market conditions.”

In US stock news, Salesforce jumped 3% after an earnings beat and an optimistic forecast, while cybersecurity company CrowdStrike gained 9% on a bullish forecast.

Dollar General shares slumped 12% after cutting its forecasts, blaming a spending slump and “theft”, which has become something of a trope for US retailers, because they are dealing with an absolute horror show, if news reports are to be believed.

In Japan, the Nikkei is up around 0.5% on news that nine Royal Australian Air Force aircraft, including six F-35A fighters, and about 140 personnel have landed to take part in the first of a series of drills since the recently signed bilateral treaty to strengthen security cooperation took effect.

The RAAF pilots are there to help the Japanese airmen learn how to land their aircraft in a manner other than “very heavily, on top of another country’s navy”.

In return, Japan will be adding massive spoilers, some not-at-all subtle underbody LED lighting and giant NISMO stickers on the windows of every Australian aircraft that takes part.

In China, Shanghai markets are up slightly (+0.62%), and there’s no news out of Hong Kong because markets there are closed due to“super typhoon” Saola, which is making its enormous, destructive way towards southern China.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 01 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DM1 Desert Metals 0.1 133% 9,258,263 $3,119,266 VPR Volt Power Group 0.0015 50% 250,000 $10,716,208 SPD Southern Palladium 0.365 30% 165,756 $12,061,932 BCT Bluechiip Limited 0.025 25% 739,742 $14,273,409 BTC BTC Health Ltd 0.026 24% 412,892 $5,918,773 TVN Tivan Limited 0.068 19% 2,424,712 $89,534,390 CGO CPT Global Limited 0.155 19% 375,025 $5,446,657 TGH Terragen 0.026 18% 20,000 $5,335,853 T92 Terra Uranium 0.165 18% 139,053 $7,224,723 ACM Aus Critical Mineral 0.38 17% 2,187,499 $9,662,656 TRE Toubani Resources 0.14 17% 183,905 $12,263,880 AYT Austin Metals Ltd 0.007 17% 250,015 $6,095,248 MEL Metgasco Ltd 0.014 17% 910,375 $12,766,641 RKN Reckon Limited 0.63 17% 29,905 $61,179,209 MRZ Mont Royal Resources 0.2 14% 221,181 $14,401,614 KNO Knosys Limited 0.041 14% 96,641 $7,780,993 KLI Killi Resources 0.042 14% 270,995 $2,204,277 CUS Copper Search 0.26 13% 87,240 $12,142,826 HVY Heavy Minerals 0.13 13% 20,000 $4,868,554 MME Moneyme Limited 0.087 13% 1,673,759 $61,606,043 AUK Aumake Limited 0.0045 13% 3,486,666 $5,949,038 IPB IPB Petroleum Ltd 0.009 13% 29,134 $4,520,980 OPN Oppen Negotiation 0.009 13% 48,148 $8,933,437 TOY Toys R Us 0.009 13% 50,000 $7,383,344 FOS FOS Capital Ltd 0.15 11% 33,333 $7,263,829

Desert Metals (ASX:DM1) is waaaaay out in front of the market at lunchtime today, up more than 155% on news that analysis from recent aircore drilling on the company’s Dingo Pass licence has demonstrated that a find from the resource next door extends well into DM1’s licence area.

The company says that clay hosted rare earth element (REE) mineralisation extends from the Tower resource belonging to Krakatoa (ASX:KTA) for at least 9km into Desert Metals’ territory, after drilling returned samples that look like this:

- 3m @ 4512 TREO from 21m, Hole DGAC 059

- 4m @ 3700 TREO from 21m, Hole DGAC 017

- 12m @ 1363 TREO from 24m, incl 3m @ 2078 TREO from 24m, Hole DGAC 081

- 17m @ 1101 TREO from 21m, incl 3m @ 1988 TREO from 21m, Hole DGAC 010

Australian Critical Minerals (ASX:ACM) is up 29.2% so far today, continuing its recent climb on news that a maiden recon program has identified highly encouraging mineralisation, including visible spodumene sites and manganese mineralisation at the company’s Cooletha project in the Pilbara, Western Australia.

Investors seem pretty enthused by the prospect, even though the recon has only covered approximately 15% of the pegmatite prospective region, and the results from the first batch of 94 rock samples from Cooletha submitted to the laboratory are still about 6-8 weeks away.

In third place worth mentioning this morning – and which I already mentioned before, but I’m including here in case you skipped over the bits of this story where I waffled on endlessly for no apparent reason, but was probably because I’ve had too much coffee this morning and I am afraid that if I stop typing I will die – is vanadium minnow Tivan (ASX:TVN).

Tivan has jumped 19.3% this morning on news that former Fortescue Future Industries CFO Guy Debelle has stepped down from FMG to take up a role on the Tivan board, a huge scoop for the little company.

Did I just repeat myself? I need more coffee. No, less coffee. I’ll grab less coffee as soon I’ve had another coffee.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 01 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MXC MGC Pharmaceuticals 0.002 -33% 3385472 11677078.9 WSI Weststar Industrial 0.145 -31% 1694789 23260700.2 WNR Wingara Ag Ltd 0.031 -21% 22150 6846157.66 PHL Propell Holdings Ltd 0.02 -20% 464967 3008888 TZL TZ Limited 0.02 -20% 597395 6418952.85 MKL Mighty Kingdom Ltd 0.015 -17% 175862 5871952.71 APC Aust Potash Ltd 0.005 -17% 2782113 6232136.94 ECT Environmental Clean Technologies 0.005 -17% 25333 17085330.7 EEL ENRG Elements Ltd 0.005 -17% 585761 6059790.17 LML Lincoln Minerals 0.005 -17% 2710999 8524270.85 PVS Pivotal Systems 0.005 -17% 1000000 4610275.67 ROG Red Sky Energy 0.005 -17% 446396 31813363.2 MFD Mayfield Childcr Ltd 0.86 -17% 332726 67272086.2 AJQ Armour Energy Ltd 0.105 -16% 11569 12890014.3 TTT Titomic Limited 0.016 -16% 1788857 16447239.3 BCK Brockman Mining Ltd 0.023 -15% 68200 250566268 KCC Kincora Copper 0.035 -15% 144008 6600436.91 LRL Labyrinth Resources 0.006 -14% 689224 8312805.91 MYX Mayne Pharma Ltd 3.15 -14% 758424 312222637 IMI Infinity Mining 0.125 -14% 5000 11259450.8 MGL Magontec Limited 0.45 -13% 105776 40721482.4 OJC The Original Juice 0.091 -13% 21415 25682033.1 MPG Many Peaks Gold 0.26 -13% 3039 10912344.9 AL8 Alderan Resource Ltd 0.007 -13% 500 4933557.15 EDE Eden Innovations 0.0035 -13% 545159 11987880.7

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.