You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

News

ASX Small Caps Lunch Wrap: Inflation a little higher than expected, but then so is the ASX

Mining

News

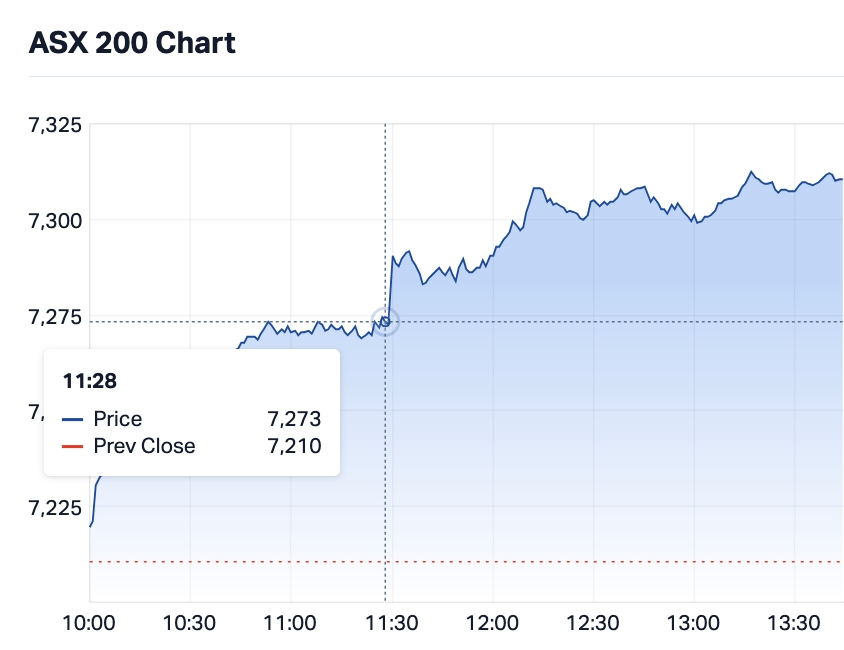

Australian share markets pushed higher on Wednesday, the ASX200 up about 1.2% at 4pm and rising for a hat-trick of sessions after tracking a buoyant night on Wall Street where softer-than-expected consumer sentiment and jobs data encouraged traders to bet on the likelihood of what would be a welcome pause in interest rate hikes from the cats at the Fed.

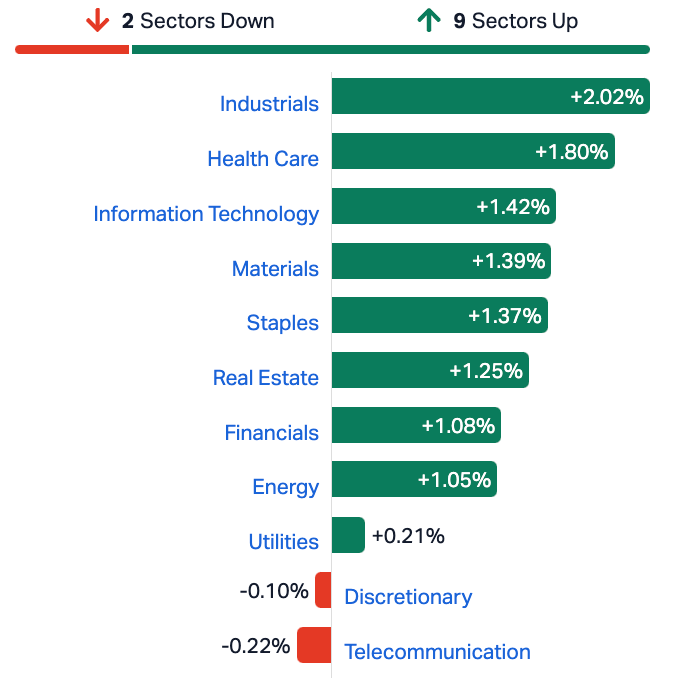

The local benchmark went into the break (there is no break) some 1.25% higher as luncheon was being served here in the Stockhead pavilion. Tremendous early work by the Industrial Sector and the fickle IT Sector was ably abetted by strong gains across the board.

Stocks came out firing after lunch, with the Australian bureau of Stats dropping the best CPI read we’ve had in yonks (February 2022).

Here’s a nice close up pic from Market Index of the benchmark actually spiking for a moment:

Exciting.

Annual Aussie headline inflation hit 4.9%, down on the previous month, under market expectations by a bit and a seeming long way from Decembers more than 8% peak.

Emanuel Datt CIO at Datt Capital had this for RBA Governor P. Lowe to chew over at his final rates decision meeting on Tuesday”

“Prima facie, the declining CPI figure appears positive given the trend towards the RBA’s CPI target range of 2-3%. However, worryingly, the significant contributors to CPI are Housing and Food segments which were up +7.3% and 5.6 % respectively. Unemployment appears to be trending up, with the latest print in mid-August of 3.7% – still robust but something to be aware of.

“We expect the RBA to hold rates this month in light of positive movement in real rates (nominal cash rates – CPI).”

And that’s Datt on the subject of inflation.

The ASX Small Ordinaries Index (XSO) ended 1.1% higher, and the ASX Emerging Companies Index (XEC) was about 1.4% the better.

Oil prices made it five straight days of rises on upbeat markets led by hopes of an imminent rate rise pause from the US central bank and signals that US officials might like to dip into their inventories again.

West Texas Intermediate was clocked above $US81 a barrel as US stockpiles fell by 11.5 million barrels, according to data from the American Petroleum Institute. They like that, all its members are petroleum co’s.

On that note, the states are waiting on a key inflation read, Friday morning Sydenham time, when the government releases its personal consumption and expenditures (PCE) report for July. This is the Federal Reserve’s preferred measure and it’s been easing off for a good few months now.

Eddy Sunarto reports that, according to CME Group’s FedWatch tool, interest rate futures are currently signalling an 87% chance the Fed will keep rates steady in September, and a 54% chance it will hold this rate through to November.

But we’ll see on Friday. A further easing might see fireworks.

We’re on Twiggy watch

…here at Stockhead this week, so a big shout out to Paul Garvey at The Oz for the breaking and disturbing news that the ever-under-self-fire Fortescue Metals Group (ASX:FMG) exec chair Andrew ‘Twiggy’ Forrest has already shrugged off his lack of executives this week to warn of the imminent danger to humanity from “lethal humidity”.

Speaking at the Boao Forum in Perth, Dr Forrest used his first public statement to draw attention to atmospheric moisture in deadly amounts, helping draw attention away from Monday’s unexpected exit of 6-month CEO Fiona Hick, as well as the departure of that other guy, yesterday… Although, I’m certain his remarks will make more sense with some further context, which I’m not going to provide.

And – not done – Twiggy’s dream of one day digging up piles of iron ore in Africa have just copped the kind of setback which FMG is currently ill-equipped for, as the Gabonese military seem to be launching a bit of a coup d’etat.

According to the BBC, army officers in Gabon are popping up on TV saying they’ve assumed power and were intent on cancelling the weekend election – which saw President Ali Bongo son of the previous President Bongo power – extend the family’s 53-year grip on power.

FMG is tight with the Bongo’s. They’re already building a new iron ore mine at the Belinga project which FMG took off the hands of global iron ore amateurs BHP (ASX:BHP) , some ten years ago… remarking, on the way to the airport, that while the iron ore was nice, the political risk was a bit of a hassle.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KEY | KEY Petroleum | 0.0015 | 50% | 6,000 | $1,967,928 |

| AOA | Ausmon Resorces | 0.004 | 33% | 1,025,000 | $2,907,868 |

| RKT | Rocketdna Ltd. | 0.013 | 30% | 136,709,122 | $5,338,926 |

| ZNC | Zenith Minerals Ltd | 0.115 | 29% | 1,073,304 | $31,361,899 |

| PGM | Platina Resources | 0.029 | 26% | 2,070,165 | $14,333,148 |

| MRI | Myrewardsinternation | 0.015 | 25% | 3,722,864 | $4,996,177 |

| BCC | Beam Communications | 0.235 | 24% | 1,104,384 | $16,420,165 |

| MTO | Motorcycle Hldg | 2.1 | 22% | 549,906 | $126,356,499 |

| KGD | Kula Gold Limited | 0.017 | 21% | 870,719 | $5,224,967 |

| NAG | Nagambie Resources | 0.034 | 21% | 129,501 | $16,288,337 |

| SOV | Sovereign Cloud Hldg | 0.115 | 21% | 97,503 | $32,243,064 |

| TON | Triton Min Ltd | 0.0265 | 20% | 1,588,510 | $34,349,823 |

| ALA | Arovella Therapeutic | 0.059 | 20% | 7,301,639 | $44,196,275 |

| CUP | Count Limited | 0.625 | 20% | 103,553 | $57,995,022 |

| CLU | Cluey Ltd | 0.12 | 20% | 129,067 | $20,161,357 |

| PFT | Pure Foods Tas Ltd | 0.12 | 20% | 85,125 | $10,973,991 |

| AMD | Arrow Minerals | 0.003 | 20% | 19,715,876 | $7,559,413 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 5,019,578 | $1,787,583 |

| M4M | Macro Metals Limited | 0.003 | 20% | 2,652,713 | $4,967,694 |

| ROG | Red Sky Energy. | 0.006 | 20% | 12,780,364 | $26,511,136 |

| RPM | RPM Automotive Group | 0.125 | 19% | 163,905 | $19,465,281 |

| CSX | Cleanspace Holdings | 0.3 | 18% | 63,252 | $19,652,892 |

| GBZ | GBM Rsources Ltd | 0.02 | 18% | 214,576 | $10,471,340 |

| TFL | Tasfoods Ltd | 0.027 | 17% | 341,458 | $10,053,197 |

| IMI | Infinitymining | 0.14 | 17% | 99,692 | $9,318,166 |

Up 50% on nada today, is the absolute wisp of a small cap oil explorer Key Petroleum (ASX:KEY).

While waiting on some license renewals to break stuff open for oil, we last heard from KEY in June when a quarterly activities update said that the licenses were ‘imminently pending,’ and until then:

Just worth noting, maybe they’re onto something. Up half to 0.0015 cents.

RocketDNA (ASX:RKT), also jumped circa 50% in morning business on news that the company has been granted Australian Civil Aviation Safety Authority approval for the use of its “drone-in-a-box” product.

The approvals cover two autonomous drone systems (DJI Dock System and Hextronics Global Drone Station), which includes Beyond Visual Line of Sight (BVLOS) and Remote Operations, making RKT the first company in Australia to receive approval for DJI’s new to market Dock System.

Triton Minerals (ASX:TON) is enjoying a morning in the sun, climbing nearly 23% after revealing that it has been granted a 25-year Mining Concession for the Cobra Plains graphite deposit in Mozambique.

That gives Triton access to an existing, globally significant graphite JORC Compliant Inferred Mineral Resource estimate of 103 Million Tonnes (Mt) at an average grade of 5.2% TGC, containing 5.7Mt of graphitic carbon, expanding the company’s portfolio to world class graphite projects with a diversified mix of flake sizes.

Motorcycle Holdings (ASX:MTO), is up strongly after dropping its earnings report after-hours last night.

MTO says that it’s seen a 25% jump in revenue to $580 million, built gross profit by 17% to $154.6 million and, while its NPAT has stayed steady on $23 million, the company has seen its Net Assets climb 27% to $197.6 million.

MTO Managing Director David Ahmet:

“I am pleased to report a solid FY23 performance in a challenging macro-environment which reflects the strength of our business model and consolidates our market leading position.

“Our strategically aligned acquisition of Mojo Group contributed further accretive growth and this delivered an eight month contribution to the full year result.

“The growth of the business and the strength of market share gains show that we are achieving what we set out to.

“The Mojo acquisition further demonstrates the continued success of the Group’s disciplined acquisition strategy to enhance shareholder returns.”

Ahmet added that ‘reflecting the strength of the FY23 result,’ the MTO Board went in for a final shareholder payout of 12 cents per share (20 cents for the full year), in line with 20 cents per share in the prior year.

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AO1 | Assetowl Limited | 0.001 | -50% | 551,206 | $3,894,260 |

| CLE | Cyclone Metals | 0.001 | -33% | 564,771 | $15,396,757 |

| LNU | Linius Tech Limited | 0.002 | -33% | 554,289 | $12,689,372 |

| WEL | Winchester Energy | 0.002 | -33% | 27,175 | $3,061,266 |

| ENV | Enova Mining Limited | 0.007 | -30% | 933,082 | $3,909,293 |

| ANO | Advance Zinctek Ltd | 1.06 | -29% | 54,401 | $93,023,261 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 20,000,000 | $4,267,580 |

| CHN | Chalice Mining Ltd | 3.78 | -25% | 16,271,491 | $1,954,119,777 |

| VMM | Viridismining | 0.51 | -20% | 453,927 | $19,973,759 |

| BPP | Babylon Pump & Power | 0.004 | -20% | 750,000 | $12,288,857 |

| CTN | Catalina Resources | 0.004 | -20% | 36,000 | $6,192,434 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 80,000 | $8,256,420 |

| ICN | Icon Energy Limited | 0.004 | -20% | 5,177 | $3,840,068 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | 8,000,000 | $5,464,797 |

| SPA | Spacetalk Ltd | 0.025 | -19% | 1,103,586 | $9,648,531 |

| CCO | The Calmer Co Int | 0.005 | -17% | 5,315 | $4,902,716 |

| HLX | Helix Resources | 0.005 | -17% | 4,387,049 | $13,938,875 |

| NAE | New Age Exploration | 0.005 | -17% | 4,179,288 | $8,615,393 |

| TKL | Traka Resources | 0.005 | -17% | 1,433,895 | $5,227,976 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 1,000,000 | $10,270,828 |

| BET | Betmakers Tech Group | 0.11 | -15% | 11,855,585 | $122,660,408 |

| BMM | Balkanminingandmin | 0.175 | -15% | 1,170,003 | $12,519,763 |

| TMG | Trigg Minerals Ltd | 0.018 | -14% | 93,557 | $4,229,077 |

| 1MC | Morella Corporation | 0.006 | -14% | 43,506,969 | $42,690,063 |

| CRB | Carbine Resources | 0.006 | -14% | 20,250 | $3,862,164 |

Orora (ASX:ORA) has been granted a voluntary suspension (Pursuant to ASX Listing Rule 17.2, you can lookitup) because of:

1. Ongoing discussions with Olympe SAS, the holding company of Saverglass SAS, regarding a potential material transaction involving the acquisition of Saverglass SAS. Orora considers that negotiations will take some days to finalise due to a number of factors including the size and global nature of the target business, the number of connected vendors in the seller group and the need to finalise funding arrangements.

2. The voluntary suspension is requested to enable Orora to manage its continuous disclosure obligations while Orora progresses negotiations regarding the Potential Transaction and is in a position to provide a further update to the market.

As reported by The Australian’s DataRoom, Carlyle Group is understood to be working with Rothschild & Co on the sale of the $1bn-plus European based Saverglass. Orora has tapped Citi and Macquarie Capital for an equity raise to fund the transaction.

Voila. No biggie.

Culpeo Minerals (ASX:CPO) – Pending the release of an announcement regarding a capital raise.

Dreadnought Resources (ASX:DRE) – Pending a material release regarding exploration results at the Company’s Mangaroon Ni-Cu-PGE Project.

NRW Holdings (ASX:NWH) – NRW is seeking the trading halt pending an announcement regarding settlement of the Primero – Wartsila litigation.

29Metals (ASX:29M) – Pending a potential announcement in connection with a proposed equity capital raising comprising an accelerated non-renounceable pro rata entitlement offer.