Closing Bell: Cannabis stocks bounce back; Ovanti soars 275pc after hiring Zip’s ex-CFO

Ovanti rises 275pc after a new CEO hire. Picture via Getty Images

- ASX gains slip after jobs report cools rate cut hopes

- Aussie economy adds 64,100 jobs, unemployment steady at 4.1%

- Ovanti rises 275pc, cannabis stocks surge

Gains on the ASX took a hit after the jobs report dampened expectations for an interest rate cut. The ASX ended the day up 0.6%, easing back from a peak gain of 0.9% earlier in the session.

According to ABS data today, the Aussie economy added a surprising 64,100 jobs in September – way above the 25,200 expected – while the unemployment rate stayed steady at 4.1%.

The data shows that over 10.03 million Australians are now in full-time jobs, marking the first time this milestone has been reached.

“This is evidence of Australia’s two-speed economy,” said Ben Thompson, chief economist and CEO of Employment Hero.

“While sectors such as retail, hospitality, and healthcare saw minimal job growth, the construction sector continues to grow by 2.3 per cent since July, maintaining stable hiring rates.

“Moreover, while our figures have shown resilience in sectors like technology, August saw a -0.3 per cent drop in growth in the sector.”

Following the report, money markets see less than a 30% chance of the Reserve Bank cutting rates by December, down from a near 50% bet before the data came out.

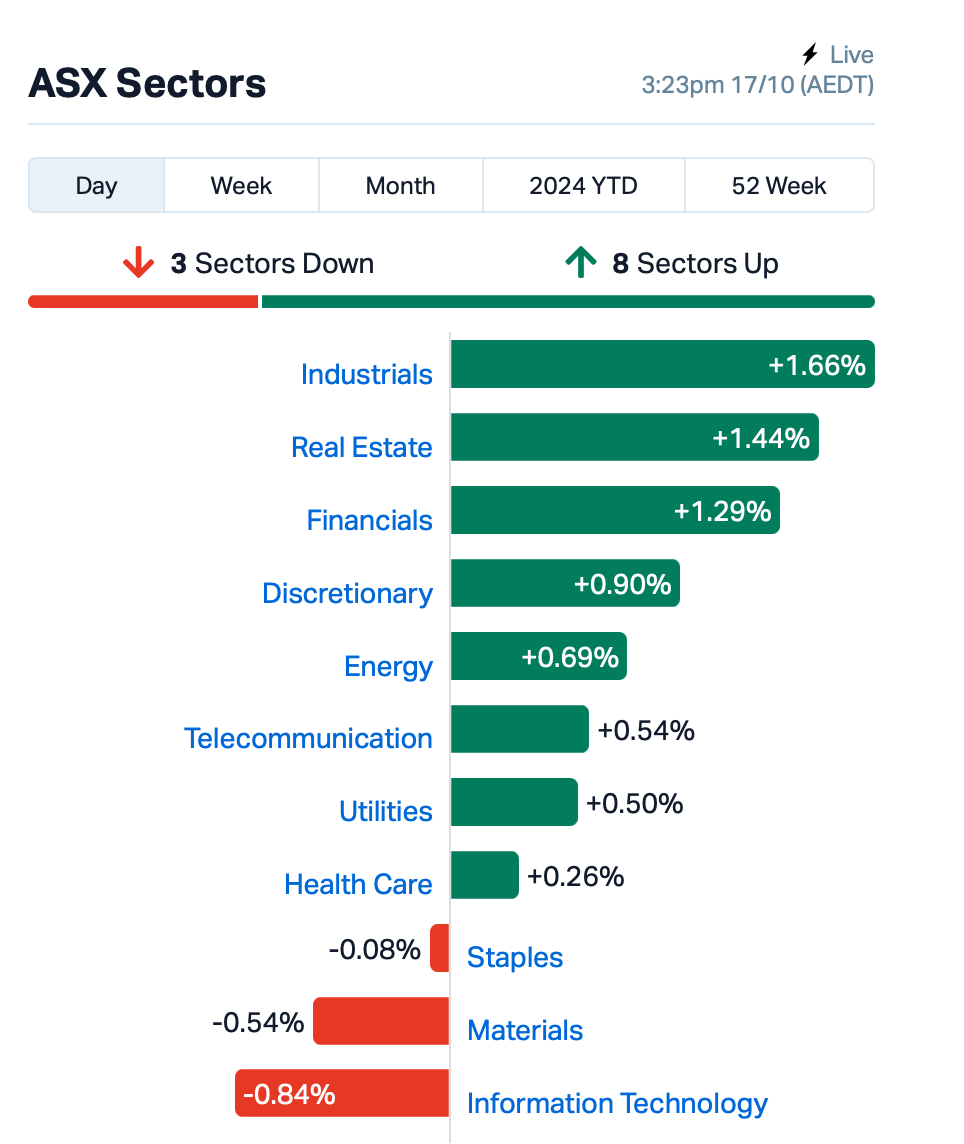

Interest-rate-sensitive sectors including Real Estate, Banking, and Discretionary were up on the jobs data. Industrials led after sector giant Worley (ASX:WOR) jumped 3% on no news.

Tech meanwhile was weighed down by an almost 2% drop in sector leader WiseTech Global (ASX:WTC) on no specific news.

Commonwealth Bank (ASX:CBA) rose 0.8% after agreeing to an Enforceable Undertaking with the ACMA (Australian Communications and Media Authority) and paying a $7.5 million fine for improperly mishandling customer messages, which led to spam violations.

Star casino operator, Star Entertainment Group (ASX:SGR), has entered a trading halt after learning it can keep its struggling Sydney casino open, but it will face a significant fine and continue to be monitored by a government-appointed manager. Pre-trading activity shows the shares will jump by 4% when the halt is lifted.

Meanwhile, uranium stocks surged today after after Amazon Inc and billionaire Ken Griffin announced a US$500 million investment in small modular reactors (SMRs), a new type of nuclear technology. This investment aims to support the development of over 5 gigawatts of power in the US by 2039, driven by the growing energy needs of data centres especially for AI systems.

Amazon’s move, along with Google’s recent backing of nuclear power, has boosted optimism in uranium stocks despite ongoing debates about nuclear economics and environmental impacts.

China still ‘at the bottom’, says Jun Bei Liu

Chinese stocks dropped after a key briefing on property support failed to deliver expected stimulus measures.

The CSI 300 Index, which had risen 1.5% earlier, reversed course as investors were left disappointed.

Despite plans to expand a support program from 2.23 trillion yuan to 4 trillion, traders had hoped for more substantial measures, leading to a sharp pullback in other markets like the Nikkei.

Chinese President Xi Jinping has been urging his officials to push hard in the last quarter to hit the country’s annual growth target of around 5%.

“The challenge right now is that we don’t have a big enough package to get people excited,” Jun Bei Liu at Tribeca told Bloomberg TV.

“Right now the Chinese economy is sitting at the bottom – but to reignite the growth, they really need to reignite confidence,” she said.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OVT | Ovanti Limited | 0.015 | 275% | 216,366,925 | $6,225,393 |

| CY5 | Cygnus Metals Ltd | 0.138 | 72% | 9,557,385 | $30,382,791 |

| CDE | Codeifai Limited | 0.002 | 50% | 2,304,580 | $2,641,295 |

| KNB | Koonenberry Gold | 0.017 | 42% | 24,223,371 | $3,453,450 |

| RC1 | Redcastle Resources | 0.011 | 38% | 4,415,346 | $3,282,607 |

| HAR | Harangaresources | 0.056 | 37% | 168,430 | $3,670,704 |

| LGP | Little Green Pharma | 0.120 | 36% | 1,220,628 | $26,554,933 |

| NSM | Northstaw | 0.030 | 36% | 450,994 | $3,537,067 |

| AOK | Australian Oil. | 0.004 | 33% | 289,999 | $2,833,920 |

| ATH | Alterity Therap Ltd | 0.004 | 33% | 37,921,859 | $15,961,008 |

| JAV | Javelin Minerals Ltd | 0.004 | 33% | 792,033 | $12,830,539 |

| MOM | Moab Minerals Ltd | 0.004 | 33% | 2,014,938 | $2,426,443 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 5,249,739 | $9,863,776 |

| AIV | Activex Limited | 0.009 | 29% | 591,568 | $1,508,518 |

| GRV | Greenvale Energy Ltd | 0.028 | 27% | 438,577 | $10,422,035 |

| PV1 | Provaris Energy Ltd | 0.028 | 27% | 1,352,086 | $13,881,281 |

| PAR | Paradigm Bio. | 0.260 | 27% | 3,124,865 | $71,799,066 |

| GTI | Gratifii | 0.005 | 25% | 19,185,914 | $8,596,785 |

| SLM | Solismineralsltd | 0.100 | 23% | 628,623 | $6,267,966 |

| AUZ | Australian Mines Ltd | 0.011 | 22% | 2,794,031 | $12,586,609 |

| EG1 | Evergreenlithium | 0.085 | 21% | 230,231 | $3,936,100 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 13,000,000 | $3,142,791 |

| BXN | Bioxyne Ltd | 0.012 | 20% | 6,406,147 | $20,466,454 |

Ovanti (ASX:OVT) was up after revealing that, following a lengthy search, the company has appointed former US CFO of Zip Co Simon Keast as CEO, which will take effect from November 1 2024. This is, apparently, big news – Ovanti was up more than 200% by lunchtime.

Cygnus Metals (ASX:CY5) was up early in the session this morning, on news that the company has received firm commitments for A$11 million via a share placement to institutional and sophisticated investors amid “overwhelming demand” ahead of Cygnus’ planned merger with TSXV-listed Doré Copper Mining Corp. The placement was priced at A$0.072 per share, being a 10% discount to the last sale price of A$0.08.

Koonenberry Gold (ASX:KNB) was up for a few reasons today, most notably its decision to acquire 100% of the Enmore gold project in New South Wales from Global Uranium and Enrichment (ASX:GUE), in exchange for 35 million fully paid ordinary shares in KNB.

On top of that, KNB is also buying the Lachlan Project from Gilmore Metals, taking KNB’s landholding in NSW to 4,410km2, while building a “one of the most significant portfolios in NSW” across “a portfolio of projects in frontier, emerging and world class terranes”. To help fund it all, Lion Selection Group (ASX:LSX) has committed $350,000 towards the $4.5 million fundraising and transformation for Koonenbery.

North Stawell Minerals (ASX:NSM) was up after it announced the completion of the Shortfall Bookbuild which concludes the four for five non-renounceable pro-rata entitlement offer at an Offer Price of $0.01 per New Share, fully underwritten by Henslow, to raise approximately $1.1 million.

Redcastle Resources (ASX:RC1) was up on news that the company is set to increase its tenement footprint in the highly prospective Redcastle–Queen Alexandra gold corridor following the acquisition of a strategic tenement, allowing it P access to new multiple exploration targets along a trend of historical workings at the site.

Little Green Pharma (ASX:LGP) jumped after it delivered a heathy quarterly report, showing record revenue of $10.2 million (unaudited), up 40% on prior quarter and cash receipts of $10.8 million, up over 30% on prior quarter. The company’s net operating cash inflow of over $1.0 million has resulted in a cashflow positive quarter of $0.6 million.

Blaze Minerals (ASX:BLZ) was up on news it has has executed a binding agreement with Gecko Minerals, an Australian unlisted public company, to acquire a 60% interest in Gecko Minerals Uganda, the legal and beneficial owner of the Ntungamo project (three granted exploration licences) and the Mityana Project (one granted exploration licence) which are prospective for critical metals including beryllium, rubidium, lithium, tin and tantalite in western and central Uganda. The company also has an option to acquire the remaining 40% of Gecko Uganda within a two-year period.

Bioxyne (ASX:BXN) was rising after delivering a quarterly this morning that showed quarterly revenue of $4.6 million, up 48% on Q4 FY2024 and an 119% increase on Q1 FY2024, and quarterly cash receipts of $5.8 million, generating positive operating cash flow for the quarter of $1.2 million.

Hubify (ASX:HFY) climbed after the company released a statement from chairman Anthony Ghattas, noting a promising start to FY25.

Shares in Deep Yellow (ASX:DYL) were up after it notified the ASX that global metals investment manager Sprott increased its shareholding in the yellowcake hunter from 5.96% to 7.82%.

Sprott did the same with Lotus Resources (ASX:LOT), which also rose after the metals investor took up a greater position in the junior from 7.32% up to 8.32% on the back of a reduction in held shares by JP Morgan earlier in the month. Overall, Lotus is up >30% for the month as it looks to accelerate the restart of the 19.3Mlb Kayelekera mine in Malawi after reducing capex to production from US$88m down to US$50m. DYL on the other hand is progressing development of its two advanced projects: its flagship 121Mlb Tumas project in Namibia and the 104.8Mlb Mulga Rock in WA.

Global Uranium and Enrichment (ASX:GUE) and Koonenberry Gold (ASX:KNB) were rocketing up the charts tvia KNB’s proposed acquisition of the Enmore gold project in NSW’s Lachlan Fold Belt, 20km from Larvotto Resources’ (ASX:LRV) 1.7Moz Hillgrove gold-antimony mine. KNB is also snapping up 10 granted exploration licences and one exploration licence west of its current projects through the acquisition of Gilmore Metals.

It will pay GUE 35 million shares for the Enmore project and will issue Gilmore Metals’ shareholders with 95 million shares, as well as grant GUE a 2% net smelter royalty. Enmore covers 134km2 about 30km from Armidale town and sits within the New England Fold Belt that holds large deposits such as the 8Moz Ravenwood mine, the 7.7Moz gold and 0.36Mt copper Mt Morgan mine, and the 2.5Moz Cracow project. Despite this, the region remains underexplored, with the NSW segment considerably less explored than the Queensland segment.

Meanwhile, Stockhead’s Tim Boreham reports that the ASX cannabis sector, once struggling, is now showing promising signs of growth. Bioxyne (ASX:BXN) is on track to hit its annual revenue target of $20 million, reporting a 48% revenue increase from the previous quarter, driven by strong sales of its gummies.

Little Green Pharma (ASX:LGP) also reported record revenue of $10.2 million, a 40% increase from the previous quarter, thanks to high demand from Europe. LGP’s shares rose by 42% today.

Elsewhere, Althea Group (ASX:AGH) is shifting focus by selling its UK clinics to invest in cannabis beverages, while still maintaining some product sales in the UK market.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.001 | -50% | 692,500 | $7,814,946 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 2,449 | $8,737,021 |

| EEL | Enrg Elements Ltd | 0.002 | -33% | 2,656,666 | $3,135,048 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 626,000 | $4,942,733 |

| OFX | OFX Group Ltd | 1.545 | -32% | 9,802,672 | $547,138,919 |

| TGH | Terragen | 0.042 | -30% | 4,650 | $22,144,868 |

| ALR | Altairminerals | 0.003 | -25% | 3,081,075 | $17,186,310 |

| CDT | Castle Minerals | 0.003 | -25% | 10,000 | $5,491,256 |

| CTN | Catalina Resources | 0.003 | -25% | 19,588 | $4,953,948 |

| PAB | Patrys Limited | 0.003 | -25% | 808,448 | $8,229,789 |

| TX3 | Trinex Minerals Ltd | 0.002 | -25% | 291,789 | $3,657,305 |

| GCR | Golden Cross | 0.002 | -20% | 399 | $2,743,140 |

| IVX | Invion Ltd | 0.002 | -20% | 3,846,844 | $16,916,479 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 2,629,962 | $5,831,140 |

| SFM | Santa Fe Minerals | 0.030 | -19% | 479,786 | $2,694,295 |

| PVW | PVW Res Ltd | 0.019 | -17% | 133,344 | $4,574,810 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 452,362 | $3,671,296 |

| LPD | Lepidico Ltd | 0.003 | -17% | 2,120,791 | $25,767,375 |

| MEL | Metgasco Ltd | 0.005 | -17% | 1,620,182 | $8,745,520 |

| KLI | Killiresources | 0.143 | -16% | 1,981,383 | $23,838,036 |

| A1G | African Gold Ltd. | 0.093 | -15% | 16,674,377 | $39,485,547 |

IN CASE YOU MISSED IT

Altech Batteries’ (ASX:ATC) Silumina Anodes battery material technology has reached a massive milestone after achieving a breakthrough 55% surge in energy capacity. The company’s proprietary technology also demonstrated good stability and cycling performance.

Medicinal cannabis products supplier Bioxyne (ASX:BXN) has marked a strong start to the new financial year after reporting Q1 FY25 revenue of $4.6 million, up 48% on Q4 FY25. This growth is attributed to granting of GMP licence for medicinal cannabis products and licence to manufacture psilocybin and MDMA.

Koonenberry Gold (ASX:KNB) is acquiring a suite of gold and copper exploration assets that will give it a commanding 4410km2 land position across frontier, emerging and world class terranes in NSW. This includes the promising Enmore gold project and two existing farm-in JVs with Newmont.

IP surveys conducted outside Strickland Metals’ (ASX:STK) 5.4Moz Rogozna gold resource in Serbia have discovered the potential for porphyry-hosted gold-copper at Jezerska Reka and skarn-hosted gold at Obradov Potok prospects. Four rigs are currently drilling at the Shanac, Medenovac and Gradina prospects.

Anson Resources (ASX:ASN) has raised $2.3m via an oversubscribed share purchase plan following the company’s $5m institutional placement. Funds from the placement and SPP will be spent towards developing existing assets in the Tier 1 jurisdictions of Australia and the US.

“We are very encouraged by the response to the SPP,” ASN executive chairman and CEO Bruce Richardson said.

“The number and value of applications is a strong endorsement of our growth strategy for Anson and the development of our flagship assets.”

Besra Gold’s (ASX:BEZ) Jugan project leader, Matthew Antill, has kicked off work as managing director. Antill will have responsibility for moving the Jugan project in Malaysia towards commercialisation, through pilot plant production and delivery of a definitive feasibility study (DFS). He will also implement a greater focus to the tailings recovery project.

“I am excited to join the Besra team ahead of schedule,” Antill said.

“I see enormous potential for the Bau projects with an immediate focus on Jugan – it is a rare opportunity to be able to join a company like Besra that has as many ounces in resource and is so well capitalised with ambitious, but realistic, production aspirations.”

Godolphin Resources (ASX:GRL) has raised $614,000 through a strongly supported share purchase plan (SPP), providing the company with funding to advance exploration at the Lewis Ponds gold-silver-base metals project in the Lachlan Fold Belt. Activities will include diamond drilling and metallurgical test work to increase the confidence level in the upper portion of the resource and update the 2012 inferred resource of 6.20 Mt at 2.0g/t gold, 80g/t silver, 2.7% zinc, 1.6% lead and 0.2% copper. The explorer exceeded its expectations, initially targeting to raise $300,000 via the SPP.

The issue price of $0.0125 represented a 17.8% discount to the volume average market price of shares traded on ASX in the five days on which sales of the shares were recorded by the ASX prior to Monday, 23 September 2024.

TRADING HALTS

Kinetiko Energy (ASX:KKO) – pending the release of an announcement in relation to results of drilling at well 271-23PT.

Star Entertainment Group (ASX:SGR) – an announcement in relation to correspondence from the NICC.

Cannindah Resources (ASX:CAE) – pending the release of an announcement to the market in relation to a proposed capital raising.

Siren Gold (ASX:SNG) – security holders’ meeting to vote on a resolution to approve the proposed sale of the company’s shares in Reefton Resources to Rua Gold.

Genetic Technologies (ASX:GTG) – GTG is currently assessing its strategic options, operational review and progress on its fundraising.

Chariot Corporation (ASX:CC9) – pending an announcement regarding a proposed capital raising.

Otto Energy (ASX:OEL) – pending an announcement to ASX in relation to the drilling results of F5-ST Well at SM 71.

IperionX (ASX:IPX) – pending an announcement regarding a proposed capital raising.

Asra Minerals (ASX:ASR) – in light of legal advice regarding the need to seek orders from the Supreme Court of Western Australia under section 1322 of the Act in respect of the share issues the subject of the cleansing notices.

Botala Energy (ASX:BTE) – pending an announcement in respect of a proposed capital raising.

At Stockhead, we tell it like it is. While Altech Batteries, Anson Resources, Besra Gold, Bioxyne, Godolphin Resources, Koonenberry Gold and Strickland Metals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.