Closing Bell: Break out the canaries – world waits for war as ASX small caps crash

News

News

The ASX200 closed lower Tuesday, shedding 72 points or 1.0%. The ASX Emerging Companies index (XEC) fell 3.3% to its lowest ebb since September last year.

Tech stocks were hammered, most sectors fell hard. Safe havens did ok.

That’s largely because the confusion and bloodshed of another war in the Crimea appears in the post, as Russian President Vladimir Putin ordered troops into Ukraine’s twin eastern breakaway regions.

Fighting for peace

Earlier today, the Kremlin said Putin ordered Russian forces to “maintain peace” in eastern Ukraine, but did not specify when any such deployment would take place.

It’s about 1am in New York as this goes to press, which means a multilateral decision around sanctions will require some global coordination yet.

First canary to smell rank

I would like to volunteer the perennially loathed and lusted-after Russian aluminium giant Rusal as the conflict’s first Canary in the Coal Mine.

Shares in the giant Russian aluminium maker crashed circa 20% on the Hang Seng earlier today – and this despite a global aluminium shortage which has led most analysts to suggest Rusal might be officially ‘off-limits’ for western sanctions which now look pretty imminent.

As Stockhead’s Josh Chiat writes, global aluminium prices have already been nudging insanity.

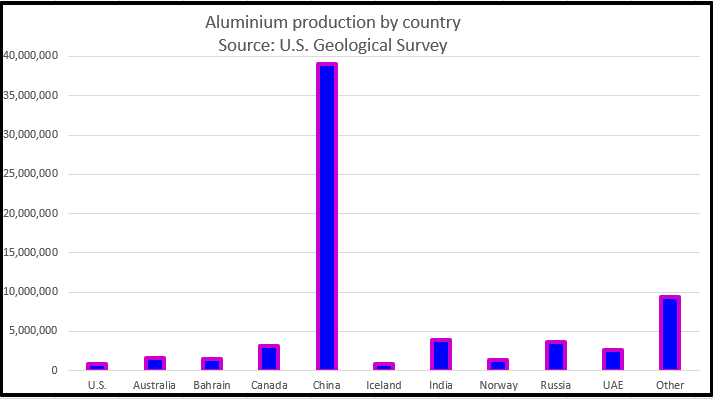

Rusal produces some 7% of the entire global aluminium supply which is thought to be circa 70 million tonnes this year.

Macquarie analyst Marcus Garvey reckons the bank’s ‘base case’ is there’ll be no disruptions to Russian supply – and I’m really paraphrasing here – due to just how goddamn tight the current global market is.

The mere thought of the market losing Rusal pushed aluminium prices on the London Metal Exchange (LME) to close to record highs at $3,380.15 a tonne.

It’s not only the world’s largest producer outside of China, but the company is run from this fishing boat by totally ex-KGB billionaire, oligarch and industrialist Oleg Deripaska.

The company and its boss are a constant target for sanctions and its deep roots into Europe make it the first target the US and its European allies argue about.

The Irish in particular would rather you just left this one alone.

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| ANW | Aus Tin Mining | 0.0015 | 50% | 10,620,921.00 |

| LKO | Lakes Blue Energy | 0.0015 | 50% | 5,976,920.00 |

| WOO | Wooboard Tech Ltd | 0.0015 | 50% | 1,084,366.00 |

| RMI | Resource Mining Corp | 0.02 | 33% | 6,791,968.00 |

| CWX | Carawine Resources | 0.2175 | 32% | 8,746,411.00 |

| OVT | Ovato Limited | 0.23 | 31% | 46,500.00 |

| OEX | Oilex Ltd | 0.005 | 25% | 719,628.00 |

| IS3 | I Synergy Group Ltd | 0.18 | 20% | 9,000.00 |

| QHL | Quickstep Holdings | 0.435 | 18% | 472,361.00 |

| IMB | Intelligent Monitor | 0.35 | 17% | 20,630.00 |

| TPD | Talon Energy Ltd | 0.008 | 14% | 6,359,096.00 |

| XST | Xstate Resources | 0.004 | 14% | 1,458,500.00 |

| ANR | Anatara Ls Ltd | 0.12 | 14% | 31,082.00 |

| IVT | Inventis Limited | 0.12 | 14% | 20,023.00 |

| CLE | Cyclone Metals | 0.0045 | 13% | 4,030,002.00 |

| KFE | Kogi Iron Ltd | 0.009 | 13% | 4,916,757.00 |

| PHO | Phosco Ltd | 0.12 | 12% | 27,181.00 |

| AHN | Athena Resources | 0.01 | 11% | 500,000.00 |

| DDT | DataDot Technology | 0.01 | 11% | 1,910,932.00 |

| NCR | Nucoal Resources Ltd | 0.01 | 11% | 1,250,002.00 |

| FMS | Flinders Mines Ltd | 0.52 | 11% | 3,825.00 |

| ECG | Ecargo Hldg | 0.032 | 10% | 926,309.00 |

| MND | Monadelphous Group | 10.96 | 10% | 1,545,207.00 |

| RIE | Riedel Resources Ltd | 0.011 | 10% | 4,288,482.00 |

| NZO | New Zealand Oil&Gas | 0.46 | 10% | 1,150.00 |

First up, the Charlie Sheen stocks — winning on no discernible news:

Resource Mining Corp (ASX:RMI)

Then there’s Carawine Resources (ASX:CWX) which has jumped after an all-cash takeover play by major shareholder (Australia’s #41 richest) the coal baron Christopher Wallin. He’s putting CWX at 21c a share — a 27.27% premium to its last trading price. CWX has already climbed 33% post-announcement.

Quickstep Holdings (ASX:QHL) has flagged strong first half sales, and a more than 80% bump in underlying profit – it’s claim is to be the largest independent Aussie aerospace composite business.

Kaiser Reef (ASX:KAU) says it’s started commercial production at the Queens Lode with the last four weeks of mined grade returning a smashing 20 g/t gold with an estimated 98% gold recovery, after milling and processing.

Kaiser’s MD Jonathan Downes, said, “achieving a 20 g/t gold head grade delivered to the mill is a great outcome. Shares jumped by double digits in Tuesday trade.

“As we reach lower levels in this mine, we can expect to see increasing amounts of this high-grade material, which is also very exciting.”

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| RCP | Redbank Copper Ltd | 0.036 | -36.8% | 14,910,359.00 |

| CCE | Carnegie Cln Energy | 0.002 | -33.3% | 11,288,488.00 |

| EN1 | Engage:Bdr Limited | 0.001 | -33.3% | 540,774,931.00 |

| BAS | Bass Oil Ltd | 0.0015 | -25.0% | 3,100,080.00 |

| EVE | EVE Health Group Ltd | 0.003 | -25.0% | 85,765,997.00 |

| SAN | Sagalio Energy Ltd | 0.018 | -25.0% | 177,973.00 |

| DOR | Doriemus PLC | 0.105 | -22.2% | 56,317.00 |

| AT1 | Atomo Diagnostics | 0.1425 | -20.8% | 8,668,562.00 |

| CRR | Critical Resources | 0.076 | -20.8% | 49,369,300.00 |

| POW | Protean Energy Ltd | 0.008 | -20.0% | 3,827,266.00 |

| LRV | Larvottoresources | 0.21 | -19.2% | 1,163,746.00 |

| RTH | Ras Tech | 0.865 | -19.2% | 80,376.00 |

| EUR | European Lithium Ltd | 0.085 | -19.0% | 28,727,418.00 |

| AZL | Arizona Lithium Ltd | 0.11 | -18.5% | 31,971,927.00 |

| ZGL | Zicom Group Limited | 0.077 | -18.1% | 263,691.00 |

| KGD | Kula Gold Limited | 0.041 | -18.0% | 728,801.00 |

| XRG | Xreality Group Ltd | 0.066 | -17.5% | 2,283,823.00 |

| CPM | Coopermetalslimited | 0.49 | -16.9% | 1,023,623.00 |

| COO | Corum Group Limited | 0.049 | -16.9% | 525,305.00 |

| 99L | 99 Loyalty Ltd. | 0.015 | -16.7% | 821,704.00 |

| BME | Blackmountainenergy | 0.125 | -16.7% | 209,002.00 |

| OMX | Orangeminerals | 0.125 | -16.7% | 142,999.00 |

| PTX | Prescient Ltd | 0.15 | -16.7% | 6,106,232.00 |

| THR | Thor Mining PLC | 0.0125 | -16.7% | 40,454,348.00 |

| GTG | Genetic Technologies | 0.005 | -16.7% | 11,992,184.00 |

Empire Resources (ASX:ERL) says it’s covered the shortfall from its recent rights issue, raising ~$674k before costs in a successful placement, issuing ~56 million fully paid ordinary shares and 28 million new options. Each new option has an excise price of 1.6 cents with an expiry date of November 30, 2023.

Qube Holdings (ASX:QUB) says an employee has died in a single vehicle rollover driving near Mt Gambier in South Australia this morning.

Operations in the area have ceased, while investigations into the accident are underway and MD Paul Digney said staff counselling was available and he expressed condolences to the man’s family.

GBM Resources (ASX:GBZ) has announced all remaining assays from its 2021 Glen Eva Easter Siliceous (GEES) drilling program with MD and CEO Peter Rohner saying the results underline the outright bigness of the GEES system for gold-silver mineralisation.

And finally, Metarock Group Limited (ASX:MYE) shares rose 1.35% to an outrageous 0.01 cents in afternoon trade after the company said its subsidiary, Mastermyne (CC) Operations, executed a deal to become the contract operator at Cook Colliery for Constellation Mining, itself a subsidiary of QCoal Group Pty Ltd.

The contract term is for four years with a further two-year option.

MoneyMe (ASX:MME) – capital raise

Ora Banda (ASX:OBM) – potential capital raise