Closing Bell: Benchmark ends an ordinary Monday on a low, despite Dacian’s big gold delivery

News

News

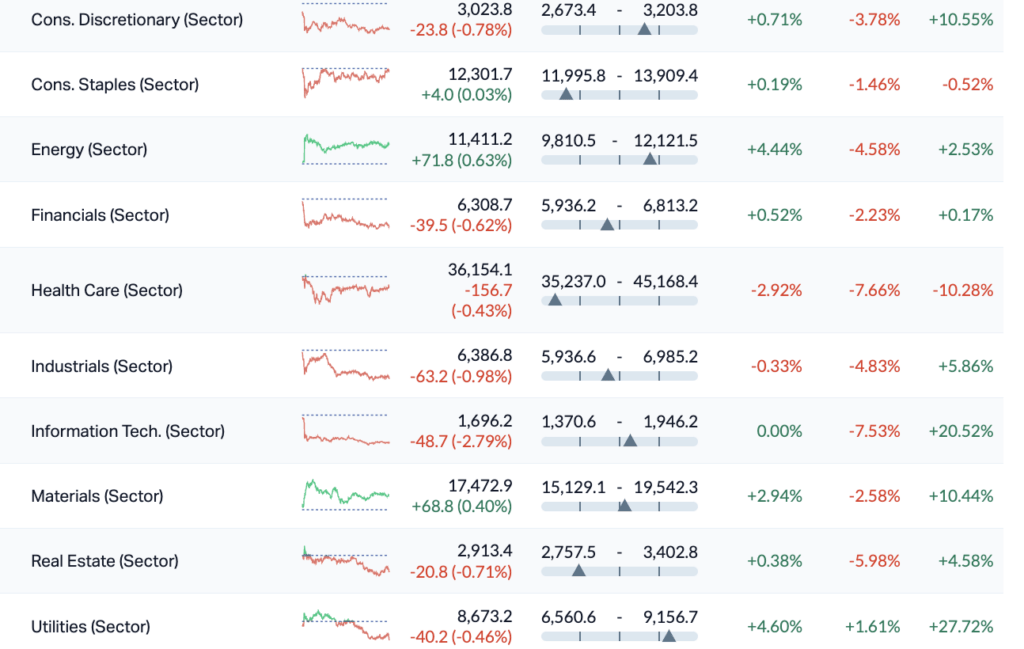

The ASX200 has closed about -0.35% lower on Monday, after the major US indexes climbed high through the Friday intraday session only to hit the brakes hard after a weak consumer read implied more spiky US inflation.

Monday in Sydney started with renewed worries about what the Fed will do next with an extra side of “might not be as close to ending its rate hike cycle” as previously imagined still on the plate.

Hard to believe there was recent confidence that the Fed would begin cutting rates at some point in Q4, but that’s a dream with a pin in it on Wall Street now.

On the ASX200, stocks slid down and sideways for a second straight session, the IT Sector leading losses, while Australia’s major banks also turned in a weak performance.

Local traders might just have too much to worry about right now. Over the weekend, Israeli Prime Minister Benjamin Netanyahu held his first wartime unity cabinet meet and vowed to demolish Hamas.

Israeli forces are massing for a ground invasion of the Gaza Strip, while Iranian President Ebrahim Raisi warned that the war could expand if Israel’s siege of Gaza does not stop.

Rising geopolitical tensions from Europe, Asia and now the Middle East are adding a complex twist to the more persistent concerns about what the Fed might do and what the RBA might do after that.

In tech country the larger capped companies like WiseTech Global (ASX:WTC), Xero (ASX:XRO) and NextDC (ASX:NXT) all shed about 1.5% to 2.0% today, although a special mention goes to Douugh (ASX:DOU), which shed more than 15% this morning.

Stealing most of the column inches, however, was the walk-away call by Albemarle which has left Liontown Resources (ASX:LTR) to the whims of Gina Rinehart, who managed by Friday to snap up enough of the company to retain decisive control.

“Our engagement with the Liontown team has been meaningful and productive. We appreciate the level of cooperation we have received, and we thank the entire team for their efforts,” Albemarle CEO Kent Masters said in a statement. “That said, moving forward with the acquisition, at this time, is not in Albemarle’s best interests.”

Josh Chiat is all over this one.

Energy and gold stocks lifted.

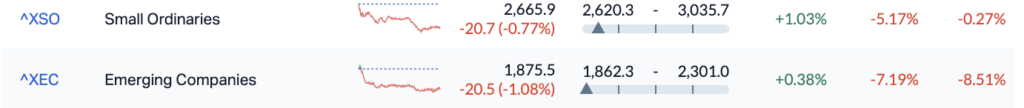

The ASX Small Ords (XSO) and the ASX Emerging Co’s (XEC) index both ended lower.

NickelSearch (ASX:NIS) says it’s collected grab samples from a quarry area on its tenements, where multiple instances of spodumene-bearing pegmatites were observed in surface stockpiles.

Lithium confirmed from assays of pegmatites located on NickelSearch’s Carlingup Project.

Multiple grab samples assayed, highlights include: NSR04389 – 5.19% Li2O, and NSR04388 – 4.99% Li2O.

NickelSearch is collaborating with Allkem (ASX:AKE) to advance lithium exploration on its Carlingup tenements. Allkem is the owner and operator of the Mt Cattlin lithium mine, 10km from NickelSearch’s Carlingup Project. Mt Cattlin’s Ore Reserves aren 7.1Mt at 1.20% Li2O1.

NickelSearch says it’s also received firm commitments to raise $1.2M to fund an accelerated lithium exploration strategy.

NickelSearch Managing Director, Nicole Duncan:

“This is a great start to testing Carlingup for lithium potential, and a strong basis on which to take forward the technical collaboration with Allkem.

“There is a lot of work ahead. The Mt Cattlin geologists continue to share their technical expertise on greenfield lithium exploration in the Ravensthorpe area. We have commenced discussions with the quarry operator on next steps and are aiming to be back at the quarry in the coming days to do further rock chip sampling.”

Lion Selection Group (ASX:LSX) has announced a $3million investment fund raising in Saturn Metals (Saturn Metals (ASX:STN).

This will be its largest deployment of funds into a new investment since exiting Indonesia and will make Lion a substantial shareholder in Saturn (11.45% after the placement ($6M total) and 10.64% after a fully subscribed SPP (a further $2M).

Lion also recently made a smaller investment of $0.25M in Sunshine Metals (ASX:SHN) via the placement announced by Sunshine on September 21, 2023.

Gold prices diminished to near US$1,920 an ounce as traders continued to white knuckle the Israel-Hamas war and its potential impact on the global economy. This is after bullion surged 3% on Friday as the hope for a handy safe-haven was a priority.

Gold also lifted by a pullback in Treasury yields amid growing expectations that the US Federal Reserve is done hiking interest rates. Investors now look ahead to fresh commentary from Fed officials this week for further clues on the US central bank’s rate outlook.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.002 | 100% | 1,108,056 | $7,784,883 |

| DCN | Dacian Gold Ltd | 0.23 | 84% | 7,233,349 | $152,100,117 |

| CLE | Cyclone Metals | 0.0015 | 50% | 27,198,098 | $10,264,505 |

| NVQ | Noviqtech Limited | 0.004 | 33% | 2,500,000 | $3,714,586 |

| KIN | KIN Min NL | 0.049 | 29% | 4,684,374 | $44,769,721 |

| PRX | Prodigy Gold NL | 0.009 | 29% | 348,858 | $12,257,755 |

| BME | Blackmountainenergy | 0.027 | 29% | 8,675,442 | $3,847,708 |

| MHC | Manhattan Corp Ltd | 0.005 | 25% | 2,263,000 | $11,747,919 |

| NMR | Native Mineral Res | 0.056 | 24% | 2,415,770 | $9,069,103 |

| KNG | Kingsland Minerals | 0.255 | 21% | 192,967 | $10,369,633 |

| ALY | Alchemy Resource Ltd | 0.012 | 20% | 2,198,255 | $11,780,763 |

| LSR | Lodestar Minerals | 0.006 | 20% | 3,620,193 | $10,116,987 |

| ME1 | Melodiol Glb Health | 0.006 | 20% | 8,111,070 | $14,736,602 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 395,301 | $2,847,430 |

| LCL | LCL Resources Ltd | 0.033 | 18% | 10,384,667 | $22,240,525 |

| VEN | Vintage Energy | 0.035 | 17% | 1,648,791 | $26,087,948 |

| AYT | Austin Metals Ltd | 0.007 | 17% | 1,070,521 | $6,095,248 |

| HCD | Hydrocarbon Dynamic | 0.007 | 17% | 2,528,665 | $3,897,995 |

| KPO | Kalina Power Limited | 0.007 | 17% | 7,796 | $9,091,175 |

| PUA | Peak Minerals Ltd | 0.0035 | 17% | 3,000,000 | $3,124,130 |

| AGD | Austral Gold | 0.029 | 16% | 20,600 | $15,307,784 |

| SRI | Sipa Resources Ltd | 0.022 | 16% | 349,165 | $4,335,005 |

| BMR | Ballymore Resources | 0.11 | 16% | 102,219 | $13,888,740 |

| MHK | Metalhawk. | 0.097 | 15% | 60,462 | $6,616,765 |

| SPR | Spartan Resources | 0.42 | 15% | 3,162,128 | $320,331,312 |

Dacian Gold (ASX:DCN), has soared after the board told investors to take up the offer from Genesis Minerals (ASX:GMD) for the latter to acquire all the bits of Dacian it doesn’t already own.

It’s a generous offer – 0.1685 Genesis Shares for every one (1) Dacian share, improving to 0.1935 Genesis Shares for every one (1) Dacian share you hold if, during or at the end of the offer period, Genesis acquires a relevant interest in at least 95.1% of Dacian shares on issue.

That values Dacian at around $256 million, at an individual share price of $0.235 to start with, which – should the improved offer come into play – climbs to $328 million at $0.27 per share.

A premium of 116% to Dacian’s closing share price of $0.125 on 13 October, and 127% to Dacian’s 20-day VWAP of $0.119 per share.

Elsewhere, Black Mountain Energy (ASX:BME) has also gained well into the double digits after informing the market that the previously announced sale of 100% of its acreage and its title and interest in the Half Moon prospect, a well in the Permian basin, currently held by subsidiary Seven Rivers, has been settled.

BME will pocket $10.4 million for the sale.

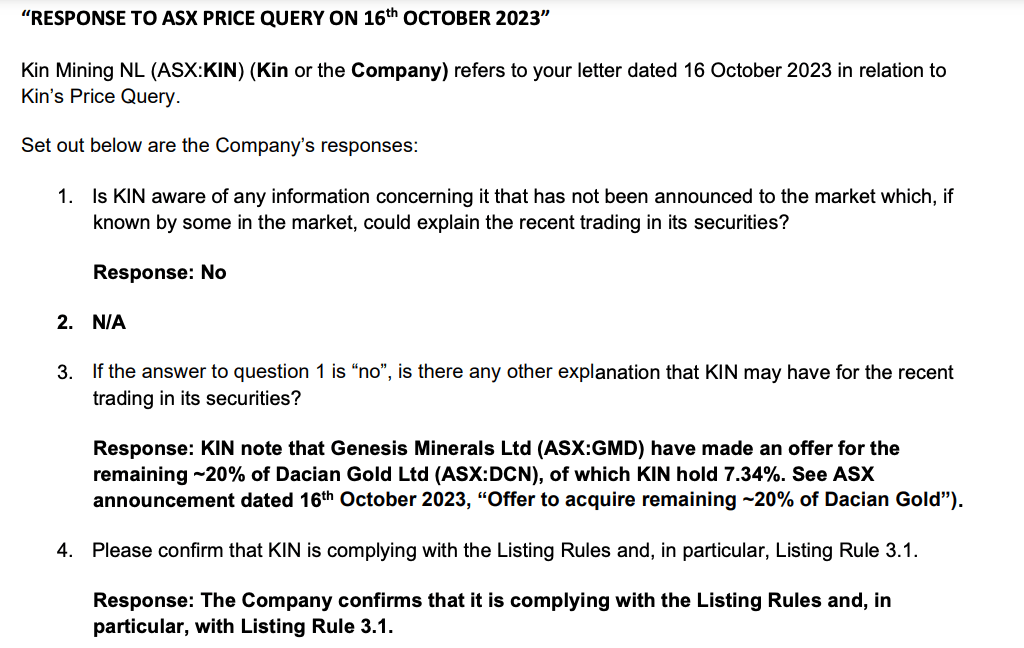

And Kin Mining (ASX:KIN) has jumped over 30% on nothing (although, see today’s Resources Top 5 for a potential clue) and earning itself a “plz explain” postcard from the ASX.

Native Mineral Resources (ASX:NMR) rose strongly on Monday after reporting some positive assays from its first pass field work program at the newly acquired McLaughlin Lake Lithium Project in Manitoba in Canada.

These initial sampling results confirm the presence of high-grade lithium at McLaughlin Lake, with two assays from one of the known “Barry” pegmatite occurrences returning assays of 2.25% and 2.77% Li20 respectively.

NMR’s Managing Director, Blake Cannavo said the maiden field work program, albeit limited, has been able to confirm the presence of high-grade lithium.

“The stand-out takeaway for our team is the fact that the historic 1.5-metre channel sample of 1.77% Li2O from the “Barry” pegmatite dyke was replicated with a higher grade of 2.25% Li2O returned from our sampling.

“These impressive assays will form the foundation for our maiden drilling program at McLaughlin Lake, with our technical team currently advancing our planning and target generation work.”

There’s a bunch of other small caps moving without fresh news, including Norwest Energy (ASX:NWE) and Noxopharm (ASX:NOX) – up 24% and 21% respectively.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AYM | Australia United Min | 0.002 | -33% | 128,049 | $5,527,732 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 9,766,523 | $31,285,147 |

| ENT | Enterprise Metals | 0.003 | -25% | 131,718 | $3,197,884 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 4,850,167 | $8,855,936 |

| EMP | Emperor Energy Ltd | 0.01 | -23% | 3,158,078 | $3,495,212 |

| NGS | NGS Ltd | 0.014 | -22% | 1,941,680 | $4,522,093 |

| FHS | Freehill Mining Ltd. | 0.003 | -22% | 16,057,830 | $10,904,692 |

| RNO | Rhinomed Ltd | 0.028 | -20% | 202,000 | $10,000,189 |

| AMD | Arrow Minerals | 0.002 | -20% | 2,204,545 | $7,559,413 |

| CNJ | Conico Ltd | 0.004 | -20% | 1,742,932 | $7,850,475 |

| IEC | Intra Energy Corp | 0.004 | -20% | 12,992,218 | $8,303,908 |

| NZS | New Zealand Coastal | 0.002 | -20% | 1,089,985 | $4,167,525 |

| BNL | Blue Star Helium Ltd | 0.022 | -19% | 21,463,801 | $42,826,592 |

| JRL | Jindalee Resources | 1.425 | -17% | 104,910 | $98,691,822 |

| JCS | Jcurve Solutions | 0.034 | -17% | 216,966 | $13,462,081 |

| DOU | Douugh Limited | 0.005 | -17% | 98,980 | $6,341,852 |

| HOR | Horseshoe Metals Ltd | 0.01 | -17% | 752,618 | $7,721,744 |

| ROG | Red Sky Energy. | 0.005 | -17% | 15,003,618 | $31,813,363 |

| TKL | Traka Resources | 0.005 | -17% | 1,653,087 | $5,227,976 |

| LYN | Lycaonresources | 0.215 | -16% | 68,521 | $10,217,531 |

| STM | Sunstone Metals Ltd | 0.0135 | -16% | 5,079,785 | $49,311,758 |

| HIO | Hawsons Iron Ltd | 0.05 | -15% | 7,263,874 | $54,225,192 |

| QXR | Qx Resources Limited | 0.023 | -15% | 2,324,059 | $24,345,550 |

| RNT | Rent.Com.Au Limited | 0.018 | -14% | 1,055,000 | $10,818,557 |

| NKL | Nickelxltd | 0.053 | -13% | 163,569 | $5,356,725 |

XReality Group (ASX:XRG) – Pending an announcement by the Company to the market regarding a capital raising

Larvotto Resources (ASX:LRV) – Pending the release of an announcement to the market in relation to a proposed material acquisition and capital raising

Liontown Resources (ASX:LTR) – Pending the finalisation of funding associated with the Kathleen Valley Project

Anatara Lifesciences (ASX:ANR) – Pending an announcement in relation to an update on the analysis of secondary endpoints from the GaRP Irritable Bowel Syndrome Trial Stage 1 data (GaRP Trial)