Closing Bell: When doves fly, markets soar

Via Getty

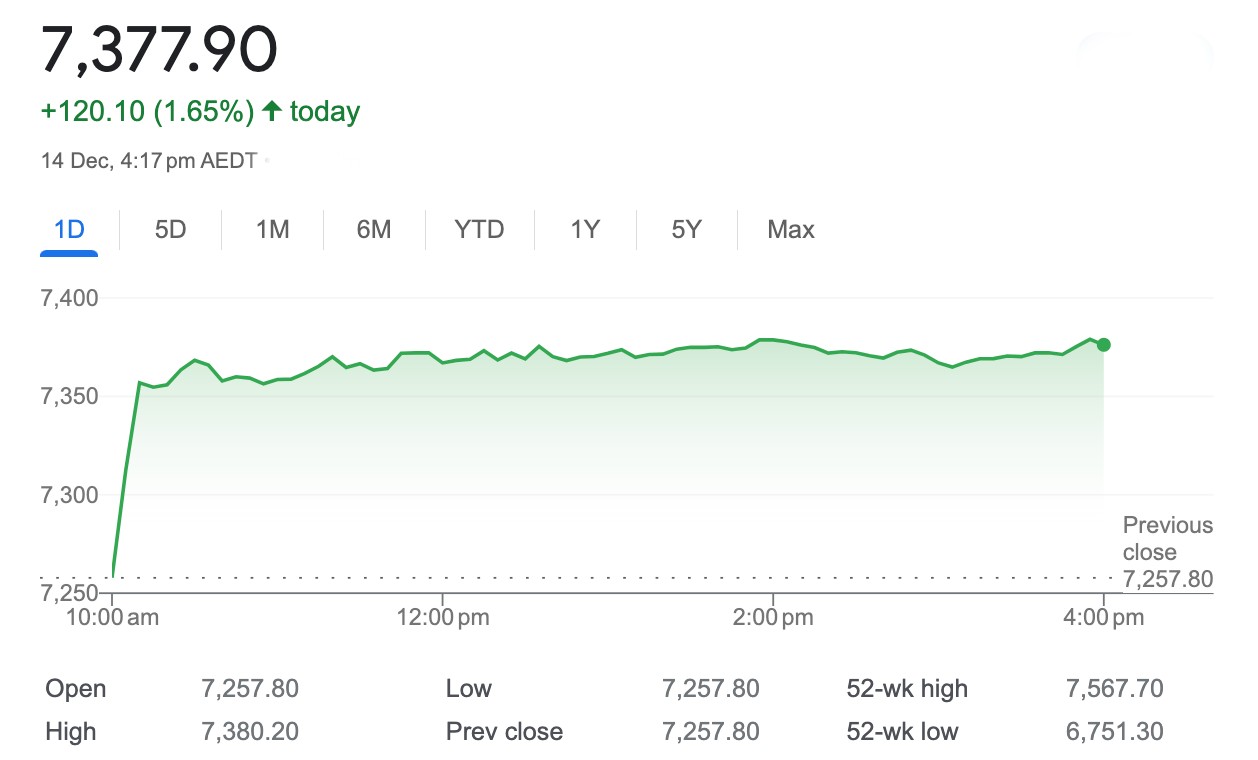

- The ASX benchmark rises +1.66, like Dumbledore’s pet Phoenix

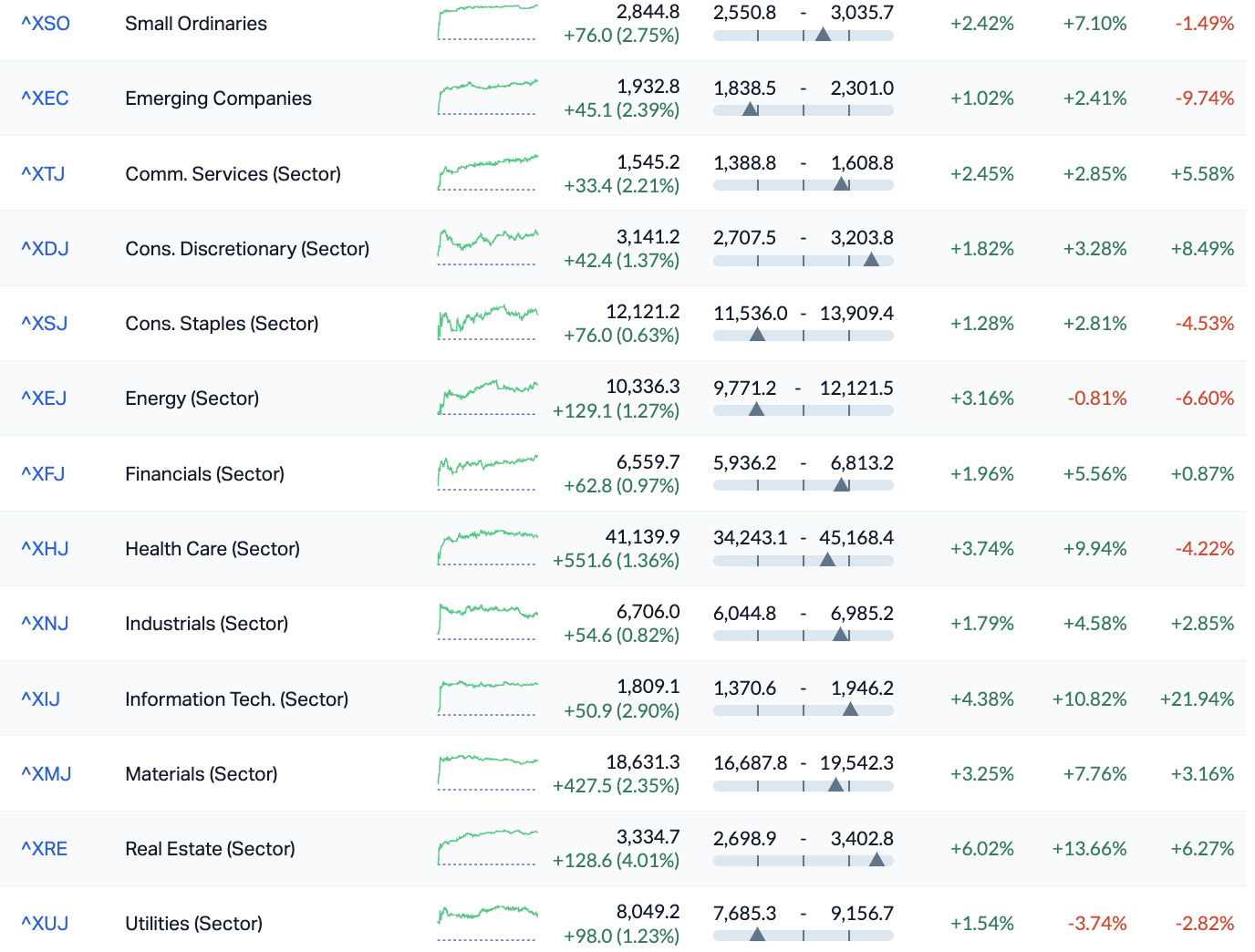

- 11 sectors end higher, Real Estate up +4pc, like a Steve Winwood song

- Small caps led by BAT, up like a bat in the night

Local markets were handed a license to thrill on Thursday and they used it in much the same way Wall Street did unshackled by the US Fed and its bold new plan of three rate cuts next year.

At 4pm on Thursday December 14, the S&P/ASX 200 (XJO) index was up 120 points, or +1.65%.

Traders in Sydney unsurprisingly went for the interest-rate-sensitive stocks off the bat, with tech, property and real estate investment trusts doing nicely thank you very much while the Materials sector also enjoyed a day in the field.

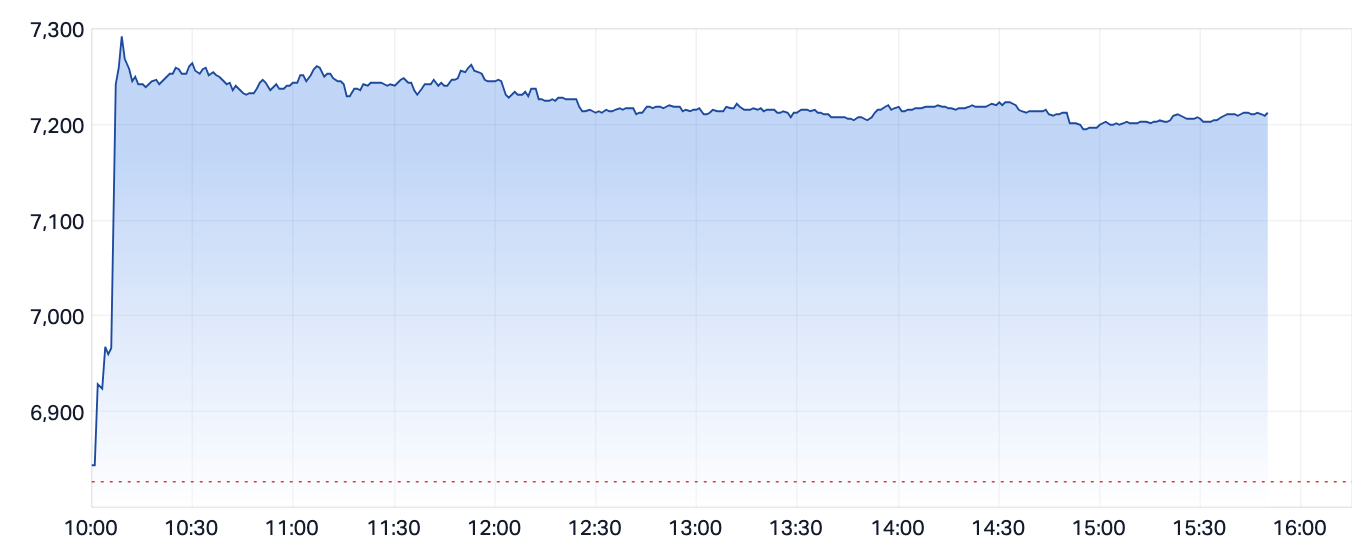

For the diggers it was goldies and lithium that attracted the shoppers.

After a torrid run, the lithium sector has rebounded, as the Fed’s rising tide lifts all boats and as questions continue around the marginal cost of lithium production.

Allkem (ASX:AKE) soared 10.27 per cent, Pilbara Minerals (ASX:PLS), Core Lithium (ASX:CXO) and Liontown Resources (ASX:LTR) were all ahead by double-digits at lunch, with 200 countries signing up to the latest COP28 green energy transition statement.

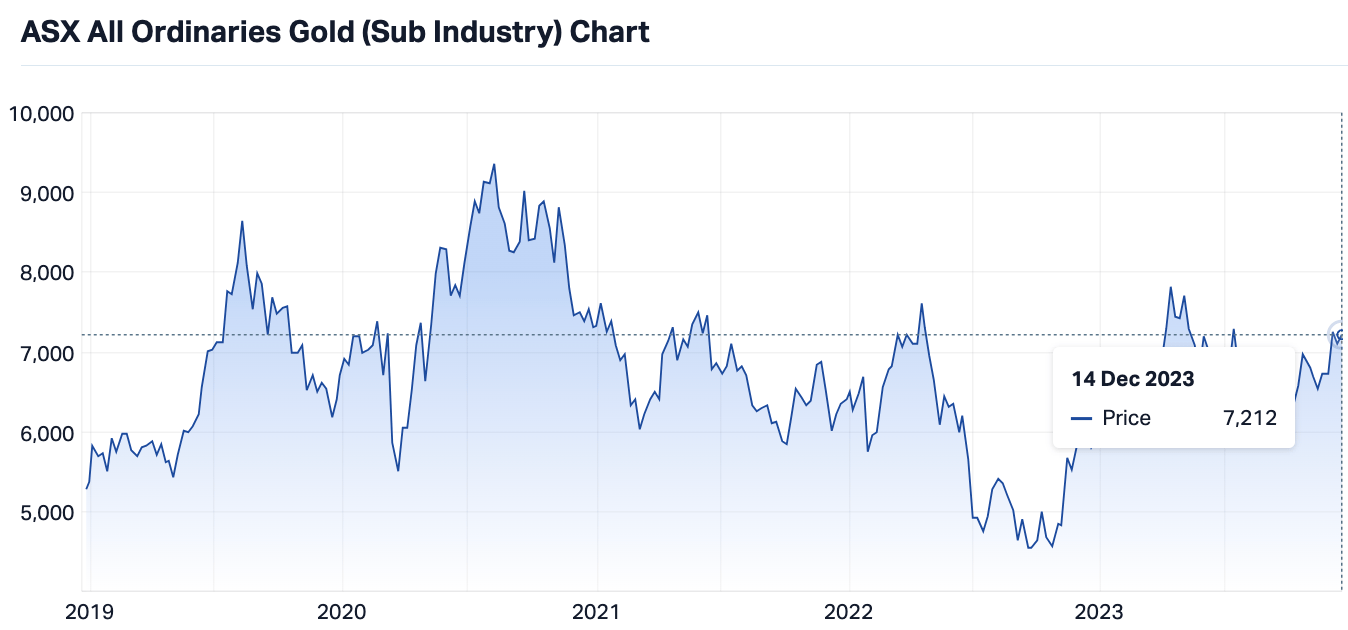

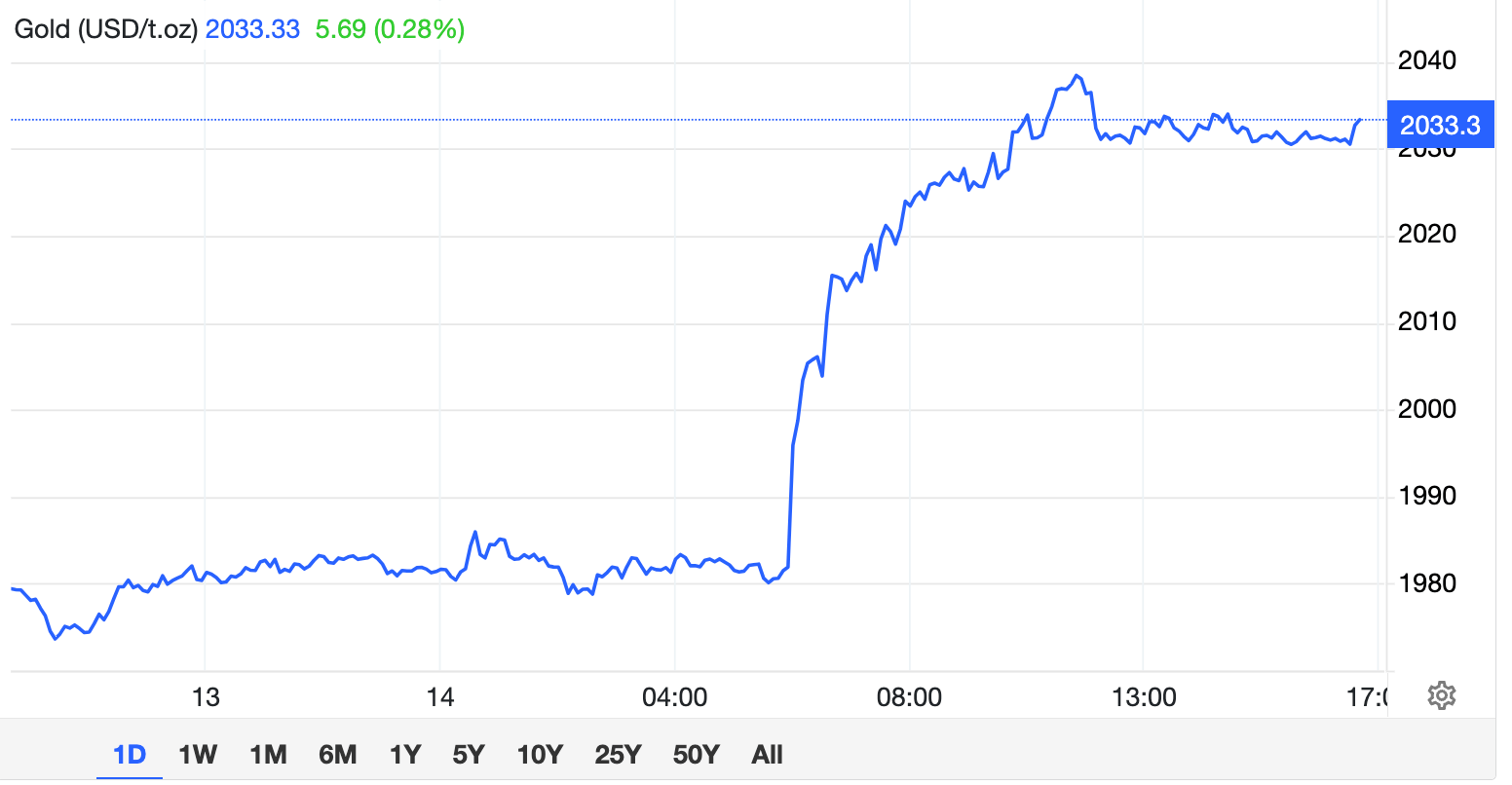

Spot gold is sitting at around $2,030 an ounce at the moment, hitting its biggest and baddest levels so far in a pretty whacky week.

This is how the S&P/ASX All Ords Gold (XGD) index responded on Thursday – up +5.65% at 3.50pm:

This is the XGD over a longer run. There’s legs, you’d reckon…

… leading goldies like Northern Star Resources (ASX:NST) to rally.

And Genesis Energy (ASX:GNE) is up more than 10% after acquiring Kin Mining (ASX:KIN) prospective Bruno-Lewis and Raeside gold projects.

And with the price of iron ore trading at $133 per tonne. the mega miners didn’t miss out either – enter a new, new record high for Fortescue (ASX:FMG) as it gained 1.78% to $27.19, Rio Tinto (ASX:RIO) added 1.24% to $131.10, and BHP (ASX:BHP) gained +1% to $48.40.

Local bond yields were down and the local currency up against a weaker greenback, trade was also utterly unmoved by the jobless data, despite the unemployment rate clocking an 18-month high, according to the bureau of numbers.

ASX Sectors on Thursday

We’re still watching oil…

The doves also flew for oil traders as the latest US Federal Reserve chatter boosted the demand outlook. As it rises for a second straight session – West Texas heading back to US $70 on Thursday amid more bad counting and a large drop in US crude inventories.

This, despite a Norwegian tanker in the Red Sea attracting a few missiles and the odd gunman in a speedboat out of Yemen, illustrating just how fragile the shipping lines are for Middle East oil supplies.

And we’re quite transfixed by gold…

As mentioned, beautiful bullion rose to around US$2,030 on Thursday, as an enfeebled US dollar and collapsing Treasury yields formed a golden rally: leading gold, to rally.

This is gold for the last 20 years or so…

We’re not really watching crypto…

But if we were, we’d note that the big boys – Bitcoin and Ethereum – are back on the move and in the crypto groove.

Bitcoin jumped 4.7% while Ether found 4.1%. They’ve both already given much of that back.

And in the US…

Overnight, the Dow jumped 512 points, or 1.4%, to smash 37,000 pts and slap in the face its previous record high (36,799, made at a more innocent time as 2023 was just beginning).

Let’s say thanks to the US Federal Reserve, which held its temper and projected three rate cuts next year.

Fed officials expect to lower US rates by 75 basis points in 2024 a sharper pace of cuts than indicated in September’s projections. The new projections also showed lower inflation forecasts for this year and next.

By the way… Apple (APPL) also closed overnight at another, another all-time Apple high. Punch me, but the company, which at the start of the year was worth more than the entire German stock market, has now added a full one trillion US dollars in market cap this year alone.

It’s heading to Xmas valued at US$3 trillion.

At 4pm in Sydney, Futures tied to the 3 major US indices were ahead of the Thursday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BAT | Battery Minerals Ltd | 0.135 | 61% | 11,644,396 | $11,286,618 |

| NVQ | Noviqtech Limited | 0.004 | 60% | 2,853,181 | $3,273,613 |

| MRQ | Mrg Metals Limited | 0.003 | 50% | 3,326,681 | $4,411,837 |

| WEL | Winchester Energy | 0.003 | 50% | 139,999 | $2,040,844 |

| WEC | White Energy Company | 0.049 | 44% | 135,000 | $2,325,810 |

| VHT | Volpara Health Tech | 1.1 | 42% | 7,850,750 | $197,140,089 |

| ADY | Admiralty Resources. | 0.007 | 40% | 625,835 | $6,517,896 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 1,000,000 | $8,549,503 |

| JAV | Javelin Minerals Ltd | 0.004 | 33% | 5,863,498 | $3,264,347 |

| RGS | Regeneus Ltd | 0.004 | 33% | 130,000 | $919,311 |

| FGL | Frugl Group Limited | 0.009 | 29% | 353,621 | $6,913,428 |

| DXB | Dimerix Ltd | 0.17 | 26% | 4,084,283 | $57,520,785 |

| CNJ | Conico Ltd | 0.005 | 25% | 2,685,016 | $6,280,380 |

| DCL | Domacom Limited | 0.02 | 25% | 486,320 | $6,968,028 |

| GTI | Gratifii | 0.01 | 25% | 1,162,000 | $10,590,058 |

| JTL | Jayex Technology Ltd | 0.01 | 25% | 20,000 | $2,250,228 |

| CBL | Control Bionics | 0.041 | 24% | 140,990 | $4,780,764 |

| CPM | Coopermetalslimited | 0.345 | 23% | 757,281 | $17,809,582 |

| TSI | Top Shelf | 0.2 | 21% | 557,525 | $34,233,517 |

| WOA | Wide Open Agricultur | 0.175 | 21% | 344,210 | $25,325,753 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 315,860 | $3,563,346 |

| AUE | Aurumresources | 0.245 | 20% | 186,403 | $7,482,500 |

| RDN | Raiden Resources Ltd | 0.037 | 19% | 52,163,741 | $82,248,812 |

| BGE | Bridgesaaslimited | 0.031 | 19% | 25,000 | $3,104,323 |

| RTG | RTG Mining Inc. | 0.032 | 19% | 597,372 | $29,307,947 |

Doing well was Battery Minerals (ASX:BAT), which has been on a tear for the past few days and appears to be gathering even more steam since announcing it had completed a private placement to two strategic investors at $0.038 per share, with 14.76 million new fully paid ordinary shares issued to raise $560,880 on 8 December.

Since then, Battery Minerals has raced well beyond that valuation, and at the time of writing is sitting at $0.110, making the 08 December buy-ins one of the most remarkably prescient transactions of the month.

Breast cancer detection tech company Volpara Health Technologies (ASX:VHT), climbed more than 42% today on news that Korean-listed cancer detection tech company Lunit wants to spend up big on a total takeover.

Lunit has offered Volpara shareholders $1.15 per share in cash, giving the deal an implied value of around $300 million, which the Volpara board has very enthusiastically endorsed.

Kore Potash (ASX:KP2) is up nicely this morning, on slim volume, a few days beyond an after-hours announcement of management changes at the company, which saw acting CFO Amanda Farris resign and new CFO Andrey Maruta step in to replace her.

And RTG Mining (ASX:RTG) is having a belter this morning as well, on the back of news that the company has confirmed more encouraging gold and copper grades along 6.5km of skarns and new structures at its 90% owned Chanach gold-copper project in the Kyrgyz Republic.

Dimerix (ASX:DXB) climbed quickly late in the day on no news, while Cooper Metals (ASX:CPM) put on more value on the back of Tuesday’s news that the Raven Cu-Au prospect at the Mt Isa East Cu-Au project had been extended, thanks to fresh RC drilling.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ZMM | Zimi Ltd | 0.026 | -35% | 41,618 | $4,815,896 |

| KNM | Kneomedia Limited | 0.002 | -33% | 16,062 | $4,599,814 |

| AOA | Ausmon Resorces | 0.003 | -25% | 1,433,333 | $4,027,997 |

| GMN | Gold Mountain Ltd | 0.004 | -20% | 1,604,669 | $11,345,393 |

| ARU | Arafura Rare Earths | 0.1625 | -19% | 36,670,079 | $422,672,938 |

| NKL | Nickelxltd | 0.039 | -19% | 502,139 | $4,215,128 |

| BUX | Buxton Resources Ltd | 0.155 | -18% | 1,333,858 | $32,916,909 |

| MXR | Maximus Resources | 0.033 | -18% | 2,251,233 | $12,824,231 |

| AMD | Arrow Minerals | 0.0025 | -17% | 21,044,366 | $9,071,295 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 1,712,209 | $1,327,908 |

| KRR | King River Resources | 0.013 | -16% | 7,651,866 | $24,079,637 |

| NVO | Novo Resources Corp | 0.13 | -16% | 326,170 | $6,965,410 |

| HXG | Hexagon Energy | 0.011 | -15% | 286,863 | $6,667,907 |

| ANR | Anatara Ls Ltd | 0.023 | -15% | 667,609 | $4,410,773 |

| RNX | Renegade Exploration | 0.006 | -14% | 169,166 | $6,998,066 |

| VAL | Valor Resources Ltd | 0.003 | -14% | 280,000 | $13,556,672 |

| RVT | Richmond Vanadium | 0.28 | -14% | 26,348 | $28,017,537 |

| AXN | Alliance Nickel Ltd | 0.048 | -13% | 660,495 | $39,921,179 |

| ALM | Alma Metals Ltd | 0.007 | -13% | 504,179 | $8,912,006 |

| AYT | Austin Metals Ltd | 0.007 | -13% | 59,146 | $8,126,997 |

| IBG | Ironbark Zinc Ltd | 0.007 | -13% | 845,400 | $11,790,981 |

| PAB | Patrys Limited | 0.007 | -13% | 1,986,952 | $16,459,579 |

| BIM | Bindimetalslimited | 0.14 | -13% | 2,589 | $4,628,400 |

| OEQ | Orion Equities | 0.07 | -13% | 25,000 | $1,251,938 |

| SLM | Solismineralsltd | 0.14 | -13% | 93,697 | $12,558,273 |

TRADING HALTS

InteliCare (ASX:ICR) – pending an announcement to the market regarding a capital raising.

Sarama Resources (ASX:SRR) ) – pending the release of an announcement in relation to an equity raising.

Kaiser Reef (ASX:KAU) – ending an announcement regarding a capital raising and board appointment.

SensOre (ASX:S3N) – pending an announcement regarding a placement.

Neuren Pharmaceuticals (ASX:NEU) – pending an announcement in relation to the top line results of its Phase 2 clinical trial in Phelan-McDermid syndrome.

Traka Resources (ASX:TKL) – pending the release of an announcement relating to a capital raising.

Arizona Lithium (ASX:AZL) L) – pending an announcement regarding a capital raising.

Tamboran Resources (ASX:TBN) – pending an announcement by the Company concerning a strategic partnership and a capital raising.

Superior Resources (ASX:SPQ) – pending an announcement in relation to a proposed capital raising.

Alumina (ASX:AWC) – pending an announcement from the Western Australian government in respect of mining approvals for Alcoa of Australia’s (AofA) Western Australian operations.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.