Closing Bell: Bad earnings, bad leads and just terrible Chinese monetary policy hit home markets on Monday

News

News

How to spin this for a gentler end to Monday…?

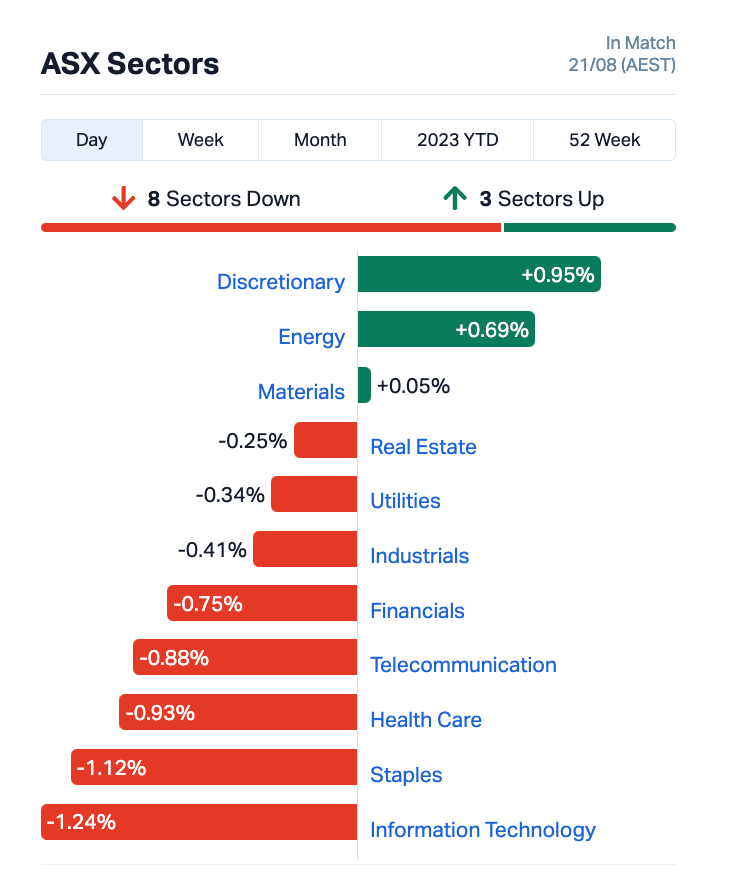

Well, it’s not been a terrible day for a few discreet consumer and energy names, despite the ASX200 landing in a heap after stumbling out the gate this morning. It’s ended around 0.35% lower, but one senses things could’ve been worse.

The benchmark was already down -0.25% by lunch and traders this arvo could hardly stomach another steak and bourbon as brittle US leads were compounded by a bad day of reports and the total infuriating absence of decent Chinese monetary or fiscal policy.

There’s more on that below. But first… At the top end of town, BlueScope Steel (ASX:BSL) found almost 3.5% on decent earnings, while this author’s preferred toastmaker Breville burned about 14% higher after surprising to the upside.

On the smaller scale there was some quality bloodletting early.

The financial software platform-maker Iress (ASX:IRE) took a single step, dropping HY numbers, before itself falling off a cliff this morning, down nearly 35%, largely on disappointing numbers and the sale of its managed funds administration (MFA) business for $52 million, with the deal expected to close in the third quarter of FY2023 and IRE likely to use the proceeds to retire debt.

In its half-year results to June 30, Iress reported underlying net profit after tax (NPAT) of $24.4mn on revenue of $315.3mn and underlying EBITDA of $59.5mn

Iress’ CEO Marcus Price told the market the results represent Iress mid-transformation.

“With many of the benefits, including the cost reduction program and a review of pricing to be recognised in the full year results for 2023 and in FY24.”

“Despite this, revenue increased in a challenging macro environment while EBITDA was impacted by cost pressures, including a significant uplift in tech infrastructure, market data and inflationary salary costs.”

This is where I left them at circa 3.45pm:

Weak numbers and limey guidance also made life difficult for today’s other headline reporters.

Adairs lost 14.3%, A2 Milk down 12.9% while the No 2 bank, Australia’s oldest and among the top 4 most boring, Westpac dropped over 2.8% on a cracking world of margins and high rates, masked by weak guidance and nonsense about costs.

Finally, big insurer IAG’s (ASX:IAG) (-0.8%) gross written premium (GWP) grew by 10.7% in FY23, ahead of claims inflation. The commercial division also showed high premium growth, and profitability picked up in the second half of the year. Not everyone is happy (see below).

However, until today, the Aussie reporting season has been a winner, passing the halfway mark in terms of market capitalisation, with 51% of the All Ordinaries in the bag by Friday.

Guidance has been ever cautious and companies are still getting revised lower on the back of corporate uncertainty and a good old fashioned refusal to provide any kind of guidance which might get someone into trouble.

According to AMP Capital, 45% of companies have surprised on the upside, which is just above the norm of 43% and up on the February reporting season when it was just 27%.

The ASX Small Ordinaries Index (XSO) was at parity near the close, the ASX Emerging Companies Index (XEC) was shorter by about 1.1%.

We’ll just get this one out of the way first…

Just when you thought it was safe to go back into stimmy mode, the new, far-more-disappointing China has left its 5-year loan prime rate (5-year LPR) which is the usual for most Chinese mortgages, totally untouched.

The People’s Bank of China this morning left the 5-year LPR, which is the usual choice for most Chinese mortgages, at 4.2%, staggering me and actual economists who, according to Reuters, expected at least a 15 basis point cut.

Then for the most common household and corporate loan – the 1-year loan prime rate (or 1-year LPR) – the obviously memo-less PBoC barely trimmed the standard cost of the 1-year LPR by just 10 basis points – from 3.55% to 3.45%.

That itself was a miss on the 15 basis point consensus according to a Reuters poll.

Needless to say, fears of some kind of horrible liquidity crisis in China bumping into some kind of horrible property disaster grow by the day.

Speaking of property, our market appears to be in fine fighting form even as interest rates remain somewhat toppy.

Kaytlin Ezzy at CoreLogic reports Australia’s combined capital cities just recorded their highest preliminary clearance rate in six weeks, with more than 2,000 homes auctioned.

Hammer activity across the capitals was well up for the second consecutive week, marking the busiest since before Easter and the fifth busiest week of 2023 thus far.

Ms Ezzy says the increase in auction numbers was met with an increase in buyer activity, with six of the seven capitals recording a week-on-week increase in the preliminary clearance rate.

“Sydney narrowly beat out Melbourne as the country’s busiest auction market, with 839 auctions held. The city’s busiest week since early April, auction activity was 9.7% higher than the volume seen the previous week (765) and 31.3% above the 639 held this time last year. With 631 results collected so far, Sydney recorded its highest preliminary clearance rate since late June (78.7%).”

Australia’s biggest general insurer IAG just posted a net profit after tax of $832 million, up 140% on last year’s profit of $347 million. The operator behind names like NRMA and CGU also increased their insurance margin to 9.6%, up from 7.4% from last year.

This growth in profits is even more startling/galling considering the total amount of claims paid out by the company was up 20% on this time last year.

With insurance in the top 5 for the Price Gouging Inquiry, the ACTU Assistant Secretary Joseph Mitchell is not pleased.

“What’s hard to swallow is seeing those bills come in, and then finding out the reason your insurance is rising is because your already profitable insurance company is increasing its profit margins, all when millions of Aussies are under the pump.

“Insurance is an essential. To protect our homes and to get to work we all have to pay those premiums. It’s beyond the pale to expect hard working Australians to continue cop increases to life’s essentials just to have big business creaming from the top.”

Meanwhile in the thick of the cream dept., Westpac has joined its big bank fellows in delivering (an unaudited) Q3 net profit of $1.8bn.

Them margins are as fat as Wagyu, and the interest rates are juicy – easily offsetting anything grim like bad debts or rising costs.

The nation’s No #2 lender joined the cavalcade of negative guiders hosing down expectations of more ahead, saying expenses for the second half to date were up by about 5%.

I for one, considering my own life of crime, would still like to come back as a bank.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NMR | Native Mineral Res | 0.04 | 60% | 2,140,991 | $3,674,122 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 4,294,475 | $15,642,574 |

| CT1 | Constellation Tech | 0.003 | 50% | 283,667 | $2,942,401 |

| CHK | Cohiba Min Ltd | 0.004 | 33% | 574,997 | $6,639,733 |

| MTH | Mithril Resources | 0.002 | 33% | 51,962 | $5,053,207 |

| PIL | Peppermint Inv Ltd | 0.012 | 33% | 8,473,205 | $18,340,712 |

| WYX | Western Yilgarn NL | 0.185 | 32% | 436,977 | $6,952,051 |

| MYE | Metarock Group Ltd | 0.14 | 27% | 65,842 | $33,109,034 |

| SCL | Schrole Group Ltd | 0.25 | 25% | 200 | $7,133,517 |

| ROO | Roots Sustainable | 0.005 | 25% | 162,062 | $554,889 |

| 1ST | 1St Group Ltd | 0.011 | 22% | 19,216,277 | $12,752,921 |

| LDX | Lumos Diagnostics | 0.1 | 20% | 44,940,154 | $36,805,761 |

| PTX | Prescient Ltd | 0.071 | 18% | 1,366,146 | $48,316,188 |

| MBK | Metal Bank Ltd | 0.04 | 18% | 525,891 | $9,400,508 |

| FTL | Firetail Resources | 0.175 | 17% | 755,782 | $14,437,500 |

| SIO | Simonds Grp Ltd | 0.175 | 17% | 201,393 | $53,985,968 |

| SPZ | Smart Parking Ltd | 0.35 | 17% | 878,004 | $105,105,900 |

| ECT | Env Clean Tech Ltd. | 0.007 | 17% | 503,016 | $14,859,663 |

| MTB | Mount Burgess Mining | 0.0035 | 17% | 501,429 | $3,046,940 |

| WGR | Westerngoldresources | 0.046 | 15% | 1,902,153 | $3,709,916 |

| ASR | Asra Minerals Ltd | 0.008 | 14% | 66,870 | $10,082,710 |

| KPO | Kalina Power Limited | 0.008 | 14% | 177,041 | $10,606,371 |

| LSR | Lodestar Minerals | 0.008 | 14% | 3,600,834 | $13,008,781 |

| AT1 | Atomo Diagnostics | 0.034 | 13% | 19,599,512 | $19,176,069 |

| ENX | Enegex Limited | 0.026 | 13% | 150,000 | $8,485,068 |

Up well over 30% is the exploration minnow Western Gold Resources (ASX:WGR), after revealing it’s set to acquire a high-grade REE prospect and two high-grade graphite projects in Sweden.

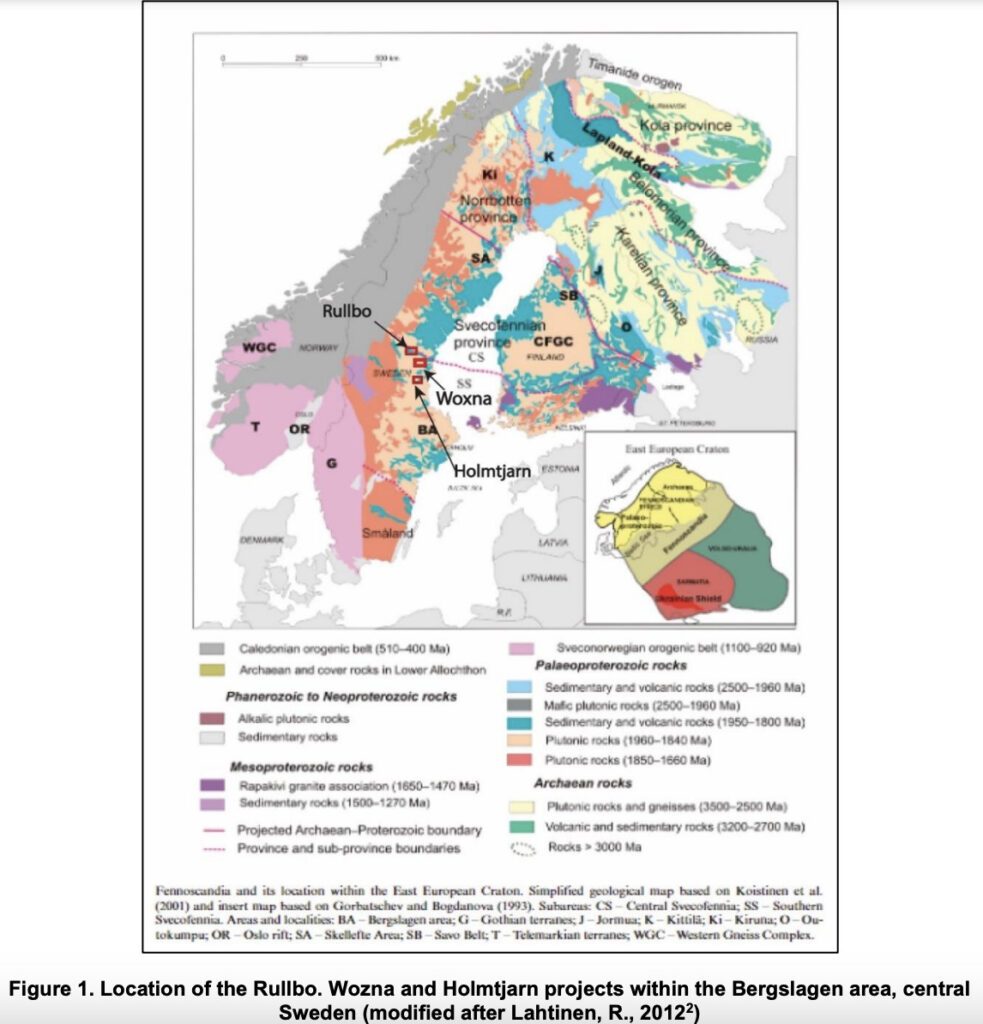

WGR, which holds the Gold Duke Project in WA, is also taking a moment to throw its hat in the rare earths game, entering into a conditional agreement to acquire Euro Future Metals (EFM), a Swedish-Euro mob with the exploration permit applications over not en; not två; but tre (3) high-grade prospects in Sweden – the Holmtjarn REE, Loberget Graphite and Rullbo Graphite Projects.

The Holmtjarn REE project appears to host NYF (niobium, yttrium and REE, fluorine) pegmatites, with WGR today noting that:

“A rock chip sample of greater than 3.45% (34,448ppm) Total Rare Earth Oxide (TREO) with a ratio of Magnetic Rare Earth Oxide (MREO) to TREO of 25% is recorded in historic sampling of pegmatites.”

For anyone not familiar with a topographical representation of Sweden’s geologic make up…

“We believe Sweden’s REE and Graphite potential is still to be unlocked and that these projects can assist making Europe self-sufficient in battery minerals,” said WGR managing director Warren Thorne.

Our Robert Badman, also a rock chip off the old shoulder of pegmatite if ever there was one, says that WGR has a gaggle of mapped pegmatites which await testing for REE potential and that this will be the focus of an upcoming exploration campaign.

“As for the graphite prospects, they’re located in the northern Gävleborg County, which hosts Woxna – the only graphite mine in the European Union.”

“Nearology” vibes? Quite possibly,” Mnsr Badman said earlier today.

Also in the nearology business on Monday is Western Yilgarn (ASX:WYX) declaring go on exploration at its West Julimar project for the very first time.

The dig is within spitting distance of Chalice’s monster Gonneville nickel deposit is trending into the ground next door.

Emerging from the shell of Pacific Bauxite (ASX:PBX), Western Yilgarn listed on the ASX in 2022 with portfolio of critical minerals assets in WA.

Most of PBX’s old bauxite projects were flicked off but one stood out; E705111, or Julimar West, just east of Perth in WA.

After years of planning delays, WYX looks ready to go.

On the medtech front, 1ST Group (ASX:1ST) rose by more than 20% in early trade after its virtual care technology company, Visionflex, received an order with an initial value of $1.1m in upfront revenue.

The WA Primary Health Alliance (WAPHA) wants 1ST to deliver virtual healthcare across 75 Commonwealth-funded Residential Aged Care Facilities (RACF) across WA.

The initial purchase represents $1.1m in upfront revenue in H1FY24, of which $660k has been received.

Additional orders from WAPHA, for other RACFs in Western Australia, are expected to materialise within FY24, the company says.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 799,685 | $20,529,010 |

| IRE | IRESS Limited | 6.52 | -35% | 8,448,094 | $1,866,026,845 |

| MXC | Mgc Pharmaceuticals | 0.002 | -33% | 3,662,822 | $11,677,079 |

| VPR | Volt Power Group | 0.001 | -33% | 10 | $16,074,312 |

| MCT | Metalicity Limited | 0.0015 | -25% | 6,430,933 | $7,472,172 |

| MEB | Medibio Limited | 0.0015 | -25% | 3,013,100 | $12,201,488 |

| NZS | New Zealand Coastal | 0.0015 | -25% | 6,080,139 | $3,308,020 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | 1,000,000 | $24,408,512 |

| SIT | Site Group Int Ltd | 0.003 | -25% | 43,736 | $10,409,961 |

| KGD | Kula Gold Limited | 0.015 | -21% | 1,043,713 | $7,091,026 |

| ALV | Alvomin | 0.195 | -20% | 1,337,992 | $18,210,832 |

| IBG | Ironbark Zinc Ltd | 0.008 | -20% | 894,998 | $14,667,843 |

| LM1 | Leeuwin Metals Ltd | 0.285 | -19% | 892,862 | $15,674,750 |

| PPY | Papyrus Australia | 0.022 | -19% | 403,244 | $13,212,925 |

| AN1 | Anagenics Limited | 0.018 | -18% | 62,643 | $8,043,639 |

| ZLD | Zelira Therapeutics | 1.03 | -18% | 30,403 | $14,183,944 |

| BAT | Battery Minerals Ltd | 0.08 | -18% | 764,094 | $11,601,636 |

| B4P | Beforepay Group | 0.4 | -17% | 41,956 | $16,804,473 |

| CTQ | Careteq Limited | 0.025 | -17% | 96,700 | $4,372,538 |

| 14D | 1414 Degrees Limited | 0.04 | -17% | 470,771 | $9,863,302 |

| HLX | Helix Resources | 0.005 | -17% | 3,656,812 | $13,938,875 |

| FLN | Freelancer Ltd | 0.21 | -16% | 340,138 | $112,728,721 |

| NSX | NSX Limited | 0.042 | -16% | 20,040 | $20,059,903 |

| OXT | Orexploretechnologie | 0.084 | -16% | 4,159,253 | $10,366,420 |

| G1A | Galena Mining | 0.11 | -15% | 1,903,268 | $97,833,929 |

Azure Minerals (ASX:AZS): Regarding the finalisation of a capital raise.

Firetail Resources (ASX:FTL): Regarding exploration results and a response to an ASX price query

4DS Memory (ASX:4DS): Whilst the company undertakes a review of new data regarding additional testing cycles to guarantee a comprehensive analysis of the Fourth Platform Lot. Err…shall we say, pending a trading update?

Parkway Corporate (ASX:PWN): Pending news of a potential capital raise.

Centrex (ASX:CXM): Pending news of a capital raise.

Rox Resources (ASX:RXL): Pending news of a capital raise.