Small Caps Lunch Wrap: ASX big boys steal a Tuesday march on Wall St, benchmark up +0.35pc

Via Getty

Local markets are ahead at lunch, in the wake of a mixed overnight session on Wall Street as US punters gawked at a 10-year US Treasury yield, which backtracked but remains a twinkle-toe away from crossing the 5% line for a second time since 2007.

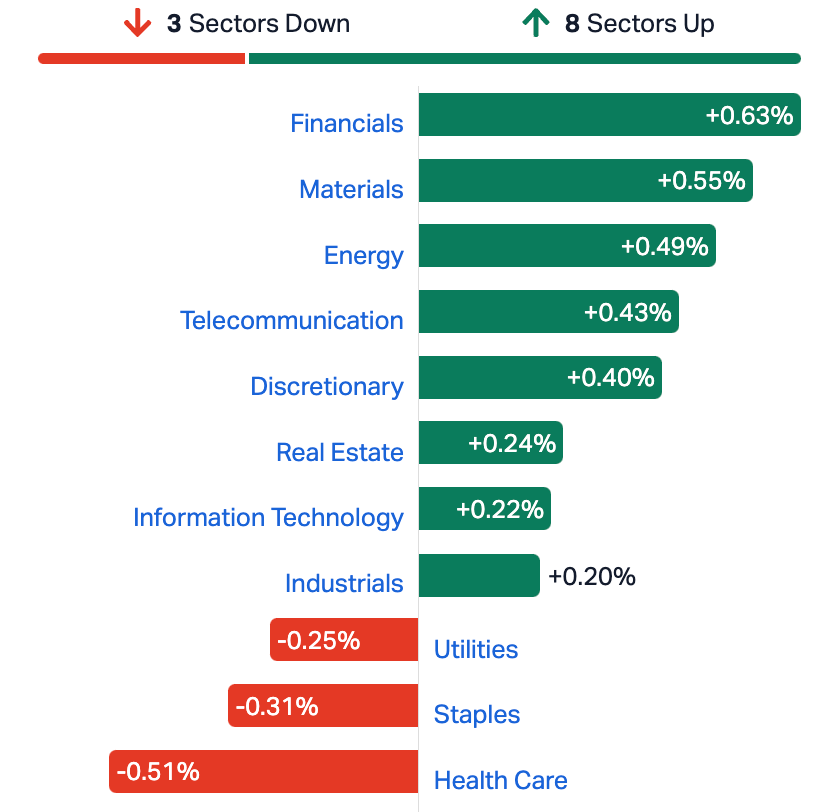

The S&P/ASX 200 (XJO) index had gained about 25 points or 0.35% to 6,868.0 at midday (AEDT).

War, inflation, uncertainty – and the haughty ascent of US bond yields – have dazzled and dismayed traders since the US Fed first signalled its own reinvigorated doubts about the state of the US economy.

But not on Tuesday morning at 20 Bridge St, in Sydney, where oil is on the rise, as are the Big 4 banks.

Viva Energy (ASX:VEA) is ahead by more than 3% on a UBS upgrade. In the Financials, it’s the Commonwealth Bank (ASX:CBA) and Westpac (ASX:WBC) leading gains.

The ASX200 at midday on Tuesday

That’s amped the bond yield to a point where 5% seems a decent bet against the stock market in recent weeks.

Stock futures rose slightly Monday night as investors focused on the upcoming slate of earnings reports from major tech companies.

However, Wall Street futures have moved into positive territory this morning Sydenham time, with measures of the Dow Jones Industrial Average, the S&P 500 futures and Nasdaq 100 futures all up about +0.2%.

The Dow and S&P 500 ended lower last night circa -0.6% and- 0.2%, respectively.

Aussie gains are being led by the IT Sector after the tech-heavy Nasdaq Composite which gained +0.3% last night – as all those fears took a seat in the back ahead of some cracking US earnings reports for mega-tech names this week.

Some big numbers might assuage some of those fears especially as a lot of stocks are looking undervalued compared to the June Quarter.

Spotify reports tonight late – but before the bell in New York, alongside what will be a tough read for General Motors.

Then we’ve got both Alphabet and Microsoft.

The Coca-Cola Company drops Q3 data too – personally I’ve had a lot of Vanilla Coke since returning from heathen Europe where Cherry Coke passes for Vanilla and can’t help feel this is going to have a positive impact on the top line.

Later on in this very busy week, we’ve got Meta reporting Wednesday, Amazon on Thursday and Intel on Friday. That last one used to be an important company.

Almost one-third of the S&P500 due to report this week, the latest leg of an earnings season that has so far been better than Wall Street expected.

About 17% of S&P 500 companies have already reported earnings, and 74% have posted earnings beats vs FactSet analyst aggregates.

THE ASX SO FAR

At home, the Aussie benchmark – in clear violation of its “don’t do nuthin’ America doesn’t” treaty – climbed some +0.4% just ahead of the Tuesday luncheon interval (there is no interval). And, hey, when you’re at 12-month lows, we call that a spectacular rebound. Not a dead cat bounce, but let’s say a very ill cat having kittens.

We’re calling one Financials. Another Materials. Another is Telco. One is Discretionary. One’s Mining and Energy etc…

The ASX Kitty Litter at Noon

Firmer commodity prices and the drop in US Treasury yields, playing the midwife (or sage femme in the French) have helped heal the hurt this morning.

Actually, the October Judo Flash manufacturing PMI fell again this morning – to 48, from September’s 48.7. Make of that what you will.

Not a big follower of the Judo Flash myself, but it does make it eight straight months of declining business condition – and the lowest read in six months – reportedly thanks to lower output, lower new orders and weakening demand. The RBA will be pleased although input costs also rose sharply, and the breakout cost of fuel is a big reason.

Can we hold the gains on Tuesday?

Remember tonight the scary new RBA governor Michele Bullock is making more scary public statements – a speech tonight (AEDT), her first prepared address/threats since taking charge.

My spidey-sense suggests that with tomorrow (Wednesday’s) CPI data and Gov M. Bullock making more fever-inducing public statements later this week, traders might sell this arvo what they make this morning.

Among the movers today, everyone’s favourite BNPL survivor Zip Co (ASX:ZIP) … zipped almost 12% higher (been awhile between zip gags!) thanks to a decent quarterly update – Q1 revenue up by almost a third on last year.

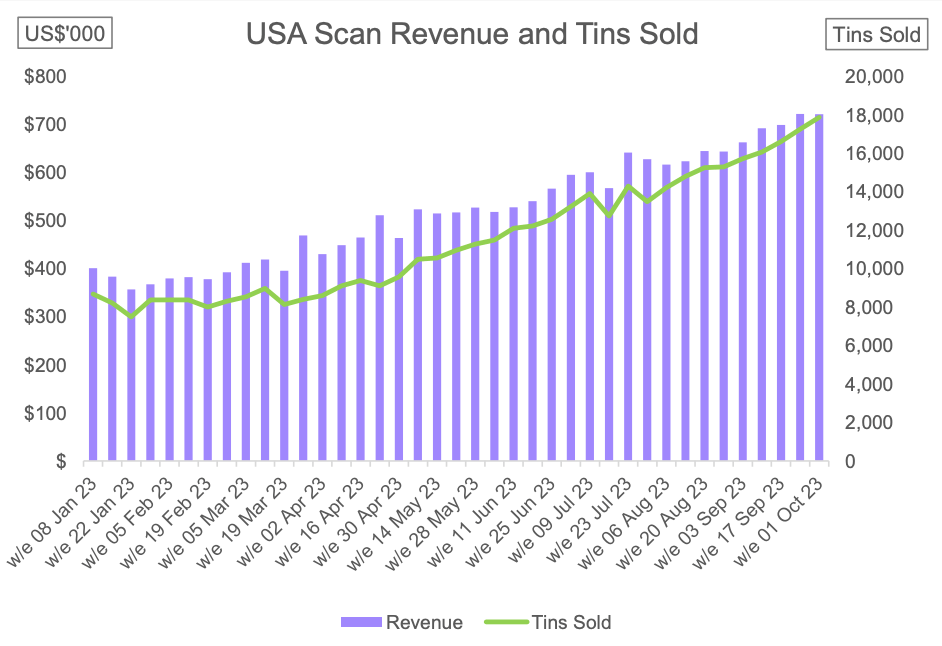

Bubs Australia (ASX:BUB) is also up and about early on Tuesday, thanks to strong US sales trumping weaker Chinese ones.

BUBS moving tin

Revenues for Q1 are up over 21% and the infant formula makers’s gross revenue in the US spiked some 25% on last year, now representing almost half of all first quarter revenue.

Bubs held $21.6 million in cash reserves as at 30 September 2023, with an additional $8m of unused headroom on its bank facilities. Bubs’ net cash used in operating activities of $4.4m represents an improvement of $3.5m or 44% lower quarterly cash burn versus pcp.

Altogether, CEO Reg Weine called it a very strong Q1.

“This was an encouraging result given there were a number of one-off expenses during the quarter. Management are delivering on reducing cash burn by implementing tighter working capital management and embedding greater accountability throughout the company.”

Pilbara Minerals (5%), Fortescue Metals (1.9%) and Woodside Energy (0.5%) are having some fun. Heavyweight financial and technology stocks also advanced, while gold and healthcare stocks declined.

NOT THE ASX

Chinese equity markets are at a pre-COVID-19 nadir, the tech-heavy Shenzhen index shed almost 1.5% on Monday, slinking back to around 2019. The benchmark gauge has fallen about 15% year-to-date.

Beijing has tried – well, more toyed with – propping up its once stellar stock market with tidbits of encouragement here and there, but it’s all been a bit like pissing in a vat of beer against fragile economic growth and the more recent geopolitical tensions.

Let me explain that strange segue in further depth. What probably didn’t help is this prime example of China’s liquidity crisis which has become an absolute viral sensation in China right now – apparently showing a worker in Qingdao taking a break at his important role at the Tsingtao Brewer with a revivifying whizz into the next batch of China’s most popular and most globally recognised beer.

Tsingtao stock did initially get flushed when the Shanghai Stock Exchange opened on Monday morning but like the beer itself, was largely flat by the arvo.

Fortunately the Hang Seng in Hong Kong, where Tsingtao is dual listed, was closed on Monday for the Chung Yeung Festival holiday.

Unsurprisingly the vid’s been a great hit in China, where any distraction from an evaporating economy, youth employment prospects and societal freedoms is welcomed.

Tsingtao – the No 2 Chinese brewer – said on Weibo that it’s looking into it. And welcomes customer supervision. For which I put my hand up, the domestic version of the beer being quite delicious…

Incredibly – and I’m not taking this piss here – the brewer made a big deal this year of its 120th jubilee.

Here’s a taste of what they unfortunately decided to call a ‘golden milestone’…

On board the #Tsingtao jubilee to celebrate another golden milestone. Cheers to a #120thAnniversary! #TsingtaoWorldTour pic.twitter.com/EnDuhfY1iM

— Tsingtao (@tsingtao) July 21, 2023

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 24 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SDG Sunland Group Ltd 0.079 44% 4,124,145 $7,531,119 NMR Native Mineral Res 0.043 39% 973,322 $6,247,604 ERW Errawarra Resources 0.13 31% 270,015 $6,880,896 HOR Horseshoe Metals Ltd 0.009 29% 150,000 $4,504,351 LML Lincoln Minerals 0.009 29% 6,614,303 $9,944,983 OAR OAR Resources Ltd 0.0045 29% 10,430,660 $9,145,975 1ST 1st Group Ltd 0.01 25% 480,500 $11,335,930 ADV Ardiden Ltd 0.005 25% 1,075,544 $10,753,341 LNU Linius Tech Limited 0.0025 25% 66,143 $8,459,581 WOA Wide Open Agriculture 0.18 24% 708,521 $20,775,857 BTN Butn Limited 0.14 22% 1,000 $21,047,139 AR9 Archtis Limited 0.115 21% 383,765 $27,130,131 SYR Syrah Resources 0.9 20% 28,861,524 $506,923,298 GTI Gratifii 0.012 20% 83,300 $13,237,572 KPO Kalina Power Limited 0.006 20% 8,661 $7,575,979 LVT Livetiles Limited 0.006 20% 766,770 $5,885,553 UCM Uscom Limited 0.048 20% 43,077 $7,621,342 CRS Caprice Resources 0.037 19% 200,000 $3,619,465 DCC Digitalx Limited 0.037 19% 3,058,792 $23,111,090 CHM Chimeric Therapeutic 0.044 19% 2,354,007 $19,765,509 EVR Ev Resources Ltd 0.013 18% 901,389 $10,392,578 BFC Beston Global Ltd 0.007 17% 166,666 $11,982,281 EEL Enrg Elements Ltd 0.007 17% 154,411 $6,059,790 KGD Kula Gold Limited 0.014 17% 351,000 $4,478,543 PIL Peppermint Inv Ltd 0.014 17% 1,326,787 $24,454,282

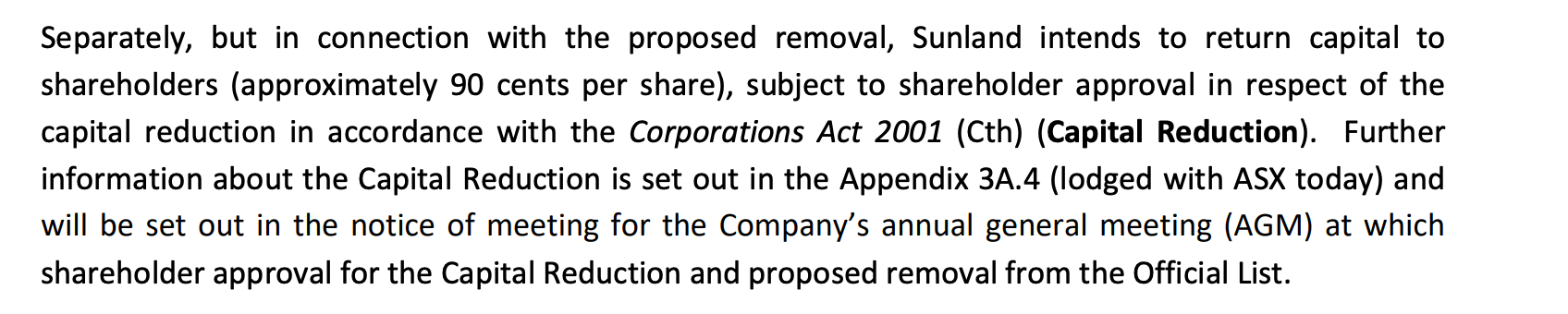

Up on the Gold Coast it is sayonara to the long-listed developer Sunland Group (ASX:SDG) which formally applied for delisting from the ASX after near 28 years, during which it adorned the Golden Corner of southern Queensland with landmarks like ‘Q1’ and ‘Palazzo Versace.’

The timing is getting close, and the stock price is up about 35% today. Sunland’s founders, the Abedian family, have been buying back shares with a plan to getting off the ASX since the pandemic.

The group has been busy indeed – flogging assets and returning the cash to shareholders via some meaty divs – some $200mn paid last financial year.

Australian B2B lender Butn (ASX:BTN) has jumped after dropping record quarterly revenue and originations.

BTN backs SMEs with cash through leveraging the end debtor’s credit. The blurb is:

“With a vision of ‘Your money, today’ Butn delivers cashflow funding solutions at the click of a Butn, having funded over $1.5 billion to Australian businesses.”

Q1 FY24 bullies:

– Quarter originations of $124.1 million, up 21% on the pcp, the 2nd successive record for quarterly originations

– Record quarterly revenue of $3.4 million, up 31% on pcp at a 2.7% revenue margin (2.5% in the pcp)

– Quarterly platform originations exceeded $30 million for the second successive quarter, up 53% on pcp

Last week, Superior Resources Limited (ASX:SPQ) jumped after starting its Phase 2 drilling program at the SPQ flagship Greenvale Project.

The stock is climbing sharply again right now; here’s what Superior’s MD Peter Hwang said, which covers all the upbeat thinking:

“We are naturally, very excited to see the rig turning again at Bottletree and we have a program that takes us to the south of last year’s line of holes to target a high priority interpreted central porphyry core.

“In addition, we will also be defining the strike-extent of the significant wall rock mineralisation zone that extends from surface at the Discovery Outcrop to at least 850 metres down-dip depth with a thickness of at least 250 metres. With the zone open at depth and along strike, this represents a potentially sizeable wall rock copper deposit in its own right.

“The wall rock mineralised zone, including a potential second wall rock zone located along the south western boundary of the prospect, would separately lead to one or more source porphyry intrusion centres. However, under the current program we aim to test the wall rock zones that lie above 500 metres depth.

“Current reports from site are that the rig is progressing…”

Oh God, you get it. Sorry. That got granular on me, quick.

Australian cybersecurity firm archTIS (ASX:AR9) is climbing – up over 21% this morning after mega tech Microsoft pledged $5bn into turbo boosting its operations Down Under over the next two years.

The plan is to upgrade Australia into a defendable digital fortress.

Today Microsoft are announcing an additional $5 billion to build more data centres across the country, and partner to train Australians for the jobs of the future.

This partnership will ensure Australia’s place as a world-leading digital economy. pic.twitter.com/HRyQDMEpSU

— Anthony Albanese (@AlboMP) October 23, 2023

The PM is in Washington and is already hanging out with Microsoft bosses as his four-day state of mates visit with US President Joe Biden begins on a high note for fans of big tech and bilateral military and technological ties.

Albanese said MSFT’s huge commitment was “a major investment in the skills and workers of the future, which will help Australia to strengthen our position as a world-leading economy”.

This morning, as news of the software giant’s ‘major digital infrastructure, skilling and cybersecurity investments in Australia’ hit the street, cybersecurity-related ASX stocks surged higher.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 24 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SDG Sunland Group Ltd 0.079 44% 4,124,145 $7,531,119 NMR Native Mineral Res 0.043 39% 973,322 $6,247,604 ERW Errawarra Resources 0.13 31% 270,015 $6,880,896 HOR Horseshoe Metals Ltd 0.009 29% 150,000 $4,504,351 LML Lincoln Minerals 0.009 29% 6,614,303 $9,944,983 OAR OAR Resources Ltd 0.0045 29% 10,430,660 $9,145,975 1ST 1st Group Ltd 0.01 25% 480,500 $11,335,930 ADV Ardiden Ltd 0.005 25% 1,075,544 $10,753,341 LNU Linius Tech Limited 0.0025 25% 66,143 $8,459,581 WOA Wide Open Agriculture 0.18 24% 708,521 $20,775,857 BTN Butn Limited 0.14 22% 1,000 $21,047,139 AR9 Archtis Limited 0.115 21% 383,765 $27,130,131 SYR Syrah Resources 0.9 20% 28,861,524 $506,923,298 GTI Gratifii 0.012 20% 83,300 $13,237,572 KPO Kalina Power Limited 0.006 20% 8,661 $7,575,979 LVT Livetiles Limited 0.006 20% 766,770 $5,885,553 UCM Uscom Limited 0.048 20% 43,077 $7,621,342 CRS Caprice Resources 0.037 19% 200,000 $3,619,465 DCC Digitalx Limited 0.037 19% 3,058,792 $23,111,090 CHM Chimeric Therapeutic 0.044 19% 2,354,007 $19,765,509 EVR Ev Resources Ltd 0.013 18% 901,389 $10,392,578 BFC Beston Global Ltd 0.007 17% 166,666 $11,982,281 EEL Enrg Elements Ltd 0.007 17% 154,411 $6,059,790 KGD Kula Gold Limited 0.014 17% 351,000 $4,478,543 PIL Peppermint Inv Ltd 0.014 17% 1,326,787 $24,454,282

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.