Closing Bell: ASX mugged by healthcare losses, down 0.7pc as sector freefalls

An apple a day keeps the… bears away? Not today. Pic: Getty Images

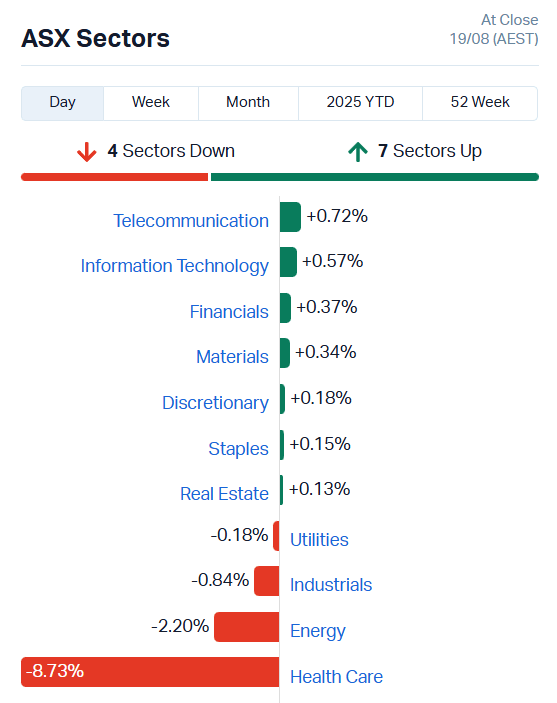

- ASX bulls take a breath as market falls 0.7pc

- Healthcare leads losses, down 8.7pc

- Biotech heavyweight CSL suffers worst single day losses in decades

Healthcare sector in need of resuscitation

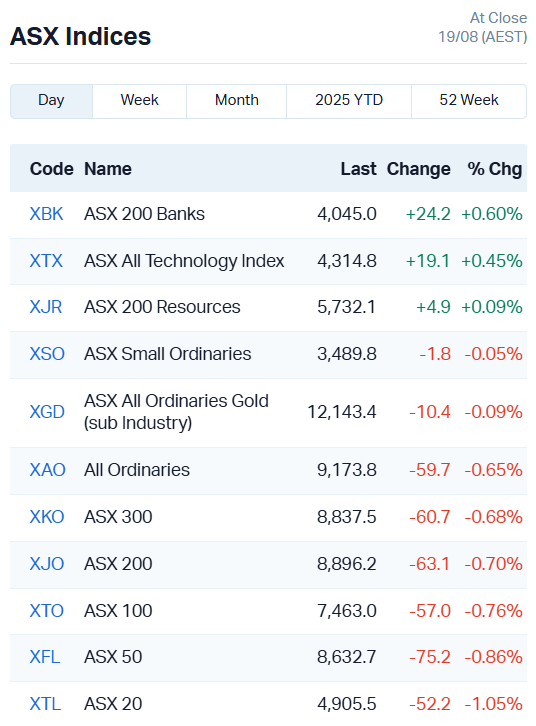

The ASX has given up its bull rush for the moment, retreating 0.7% or 63 points from all-time highs.

All fingers are pointing to healthcare as the culprit, down a shocking 8.73% in a single day. Energy wasn’t helping matters either, shedding 2.2%.

There were signs of life in telecoms, info tech and our top banking stocks, but it wasn’t enough to offset the red side of the ledger.

Earnings season loses a bit of shine

We’re in the thick of full-year results season on the ASX, and things are looking a little less rosy than they were last week.

Our own Eddy Sunarto gave us the lowdown on CSL’s absolutely brutal sell down in the Lunch Wrap, but things have gotten even worse for the biotech since, with shares falling 16.8% to $225.50 each.

If you’re looking for the deets on BHP, Deterra Royalites, Woodside Energy, Seek or Judo Capital Holdings, he’s got you covered.

And if you want an even more granular take on BHP, read this morning’s breakdown from Josh Chiat, here > BHP Results: Big Australian’s profit drops to lowest in five years, but dividend beats forecasts and copper grows

Now, let’s dive into the afternoon’s reports.

The good, the bad and the ugly

SRG Global (ASX:SRG) shares rose 8.4% in trade to $1.74 each after putting in a solid financial performance for FY25, lifting earnings per share 34% to 10.3c each and EBITDA 29% to 127.1m.

The diversified infrastructure company’s forward outlook is looking bright as well, forecasting EBITDA growth of about 10% in FY26 compared to this year.

Monadelphous Group (ASX:MND) lifted revenue 12% to $2.27 billion this year, also achieving a 34.6% uptick in net profit to $83.7 million.

MND’s shares lifted 4.2% to $21.12 each in response, perhaps in part to a tasty 72c per share dividend, up 24% from last year, with earnings per share reaching 85c.

MyState (ASX:MYS) had a bit more of a mixed response to its performance, with shares ticking up just 0.55% to $4.58 each.

The financial stock improved underlying profit after tax by 17% to $41.3 million, but costs also rose 3.7% across MYS’s MyState Bank and TPT Wealth sectors. Including Auswide Bank, the group’s total operating expenses were $127m.

That said, MYS customer home loans grew 62% over the period to $12.9 billion and customer deposits by 71% to $10.1 billion.

MyState is offering a final dividend of 11c a share, up from 10.5c in H1FY25.

Reliance Worldwide Corporation (ASX:RWC) shares tumbled 6.96% after the plumbing supplier flagged uncertainty for its near-term outlook, declining to offer revenue or earnings guidance for the 2026 financial year.

RWC expects to take some damage from US tariffs, forecasting a US$25-$30 million hit to earnings.

That said, the company’s full-year net profits did rise 13.5% over FY25 to US$125 million, with adjusted EBITDA rising 1.1% to US US$277.7 million. RWC is offering a dividend of 5c a share.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MGTRG | Magnetite Mines - Rights | 0.031 | 675% | 4776110 | $163,410 |

| ITM | Itech Minerals Ltd | 0.072 | 112% | 30046859 | $5,808,403 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | 2542330 | $6,447,446 |

| NTM | Nt Minerals Limited | 0.002 | 100% | 22379052 | $1,210,903 |

| SFG | Seafarms Group Ltd | 0.002 | 100% | 578305 | $4,836,599 |

| RGT | Argent Biopharma Ltd | 0.15 | 74% | 1893170 | $6,207,751 |

| MGT | Magnetite Mines | 0.12 | 69% | 14011589 | $8,701,599 |

| IVX | Invion Ltd | 0.145 | 56% | 891360 | $7,965,176 |

| HCD | Hydrocarbon Dynamics | 0.003 | 50% | 692649 | $2,156,219 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 554111 | $1,874,666 |

| JAY | Jayride Group | 0.007 | 40% | 3530276 | $7,139,445 |

| MBK | Metal Bank Ltd | 0.014 | 40% | 1648531 | $4,974,590 |

| 1AD | Adalta Limited | 0.004 | 33% | 39782324 | $3,463,949 |

| ECT | Env Clean Tech Ltd. | 0.004 | 33% | 1053151 | $12,046,306 |

| HLX | Helix Resources | 0.002 | 33% | 33039035 | $5,046,291 |

| LNR | Lanthanein Resources | 0.067 | 29% | 1315810 | $9,741,893 |

| CAQ | CAQ Holdings Ltd | 0.009 | 29% | 23 | $5,024,504 |

| SRJ | SRJ Technologies | 0.009 | 29% | 2185984 | $7,286,318 |

| LMG | Latrobe Magnesium | 0.028 | 27% | 12878283 | $57,958,981 |

| SNX | Sierra Nevada Gold | 0.025 | 25% | 2405458 | $3,293,182 |

| IMI | Infinitymining | 0.01 | 25% | 315007 | $3,384,126 |

| MSI | Multistack Internat. | 0.005 | 25% | 469878 | $545,216 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 10983586 | $13,483,725 |

| TKL | Traka Resources | 0.0025 | 25% | 12620000 | $4,844,278 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 99500 | $20,444,766 |

In the news…

Magnetite Mines (ASX:MGT) has zeroed in on clay-hosted rare earth mineralisation at the Ironback Hill project, next door to MGT’s magnetite iron ore deposit.

Magnetite’s re-analysis of previous drilling revealed total rare earth oxide results up to 1153 parts per million, which management reckons warrants some low-cost follow up exploration.

Argent Biopharma (ASX:RGT) is in the process of acquiring the core operating assets and IP of AusCann Group Holdings Ltd, including the Neuvis proprietary SEDDS drug delivery platform.

The acquisition will also include any related intellectual property, a 48% shareholding in CannPal Animal Therapeutics Pty Ltd and AC8’s 19.99% shareholding in ECC Pharm Ltd.

RGT says it’s a key step in meeting the financial and qualitative requirements for a planned US national listing for the company.

iTech Minerals (ASX:ITM) is riding the antimony gravy train, identifying two fresh 300m zones of high-grade antimony at the Reynolds Range project in the Northern Territory. The company also identified coincident gold, assaying up to 24 g/t from surface sampling.

ITM’s historical geological data suggests the zones may be about 14m thick, grading up to 30.6% antimony (Sb) in rock chips at the Sabre prospect and up to 15.9% Sb at Falchion.

The company is moving to obtain drilling approvals to test all three identified antimony targets at Reynolds later this year.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AQX | Alice Queen Ltd | 0.003 | -25% | 100001 | $5,538,785 |

| CR9 | Corellares | 0.003 | -25% | 1296010 | $4,029,079 |

| M2R | Miramar | 0.003 | -25% | 4750000 | $3,987,293 |

| ROG | Red Sky Energy. | 0.003 | -25% | 369717 | $21,688,909 |

| MPP | Metro Perf.Glass Ltd | 0.03 | -25% | 472056 | $7,415,123 |

| 8CO | 8Common Limited | 0.02 | -23% | 300851 | $5,826,467 |

| FNX | Finexia Financialgrp | 0.14 | -22% | 75000 | $11,214,714 |

| AOK | Australian Oil. | 0.002 | -20% | 115000 | $2,594,457 |

| ERA | Energy Resources | 0.002 | -20% | 3716953 | $1,013,490,602 |

| MRD | Mount Ridley Mines | 0.004 | -20% | 1771749 | $4,476,312 |

| RWL | Rubicon Water | 0.17 | -19% | 600 | $50,545,971 |

| CSL | CSL Limited | 225.5 | -17% | 5026031 | $131,376,433,212 |

| FL1 | First Lithium Ltd | 0.1 | -17% | 179827 | $9,558,432 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 16206856 | $18,756,675 |

| MTB | Mount Burgess Mining | 0.01 | -17% | 11051070 | $5,107,660 |

| PIL | Peppermint Inv Ltd | 0.0025 | -17% | 1435000 | $6,994,230 |

| SER | Strategic Energy | 0.005 | -17% | 297800 | $5,020,150 |

| NME | Nex Metals Explorat | 0.022 | -15% | 9013 | $8,717,339 |

| FRB | Firebird Metals | 0.145 | -15% | 570632 | $24,201,438 |

| ANX | Anax Metals Ltd | 0.006 | -14% | 218880 | $6,179,653 |

| NWM | Norwest Minerals | 0.012 | -14% | 1597355 | $14,421,497 |

| PFM | Platformo Ltd | 0.06 | -14% | 26667 | $6,643,581 |

| RLG | Roolife Group Ltd | 0.006 | -14% | 2677143 | $11,149,469 |

| RNX | Renegade Exploration | 0.003 | -14% | 5180000 | $5,608,272 |

| M79 | Mammothmineralsltd | 0.099 | -14% | 509060 | $51,235,717 |

In Case You Missed It

Mammoth Minerals (ASX:M79) has rebranded and kicked off exploration at the newly acquired Excelsior Springs and Bella projects in the US.

Star Minerals’ (ASX:SMS) infill drilling has increased the confidence in the geological continuity of resources at its Tumblegum South gold project near Meekatharra, WA.

Magnetic Resources (ASX:MAU) has taken in a $35 million backing for a strategic placement to drive its Lady Julie gold project into production.

Asra Minerals (ASX:ASR) has hit 14m at 7.49g/t gold in initial RC drilling at Leonora South near Kookynie in WA, confirming shallow mineralisation.

Miramar Resources (ASX:M2R) has uncovered shallow gold results from aircore drilling at the 8 Mile prospect, pointing to potential northward extensions of mineralisation.

Trigg Minerals (ASX:TMG) has acquired 20 new mining claims in Utah’s Antimony Canyon in a bid to tap into US interest in domestic antimony production.

Trading halts

Atomo Diagnostics (ASX:AT1) – material supply contract

Aspermont (ASX:ASP) – cap raise

BWE Drilling (ASX:BWE) – application to be removed from official list

Cannindah Resources (ASX:CAE) – cap raise

Castle Minerals (ASX:CDT) – transaction and cap raise

Desert Metals (ASX:DM1) – exploration results (Adzope Gold Project)

Hancock & Gore (ASX:HNG) – material acquisition

Kali Metals (ASX:KM1) – cap raise

Melbana Energy (ASX:MAY) – cap raise

Orbital Corporation (ASX:OEC) – cap raise

Prominence Energy (ASX:PRM) – acquisition of hydrogen & helium projects

WIN Metals (ASX:WIN) – cap raise

Right then, to roughly paraphrase that noted financial analyst Porky Pig… “EBITDA, EBITDA, EBITDA… that’s all folks.”

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.