Closing Bell: ASX lifts as RBA holds; Element 25 boosts its battery plans with big US grant

Element 25 lands us$166m grant talks. Picture Getty

- ASX down as RBA holds rates steady again

- Element 25 lands US$166m grant talks

- Supermarket stocks drop again amid discount claims backlash

The ASX was down 0.3% at one point but rallied to a flattish close after the Reserve Bank kept interest rates steady for the seventh consecutive time today.

After a two-day board meeting in Sydney, the RBA decided to maintain rates at 4.35%, marking 10 months without a change and nearly four years since the last cut. This decision came even after the US Federal Reserve’s recent move to cut its rates by 50 basis points.

“Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range,” said a statement from the RBA.

RBA governor Michele Bullock is currently holding a press conference and will be responding to media questions in a new format introduced this year.

“We retain the view that rates will be on hold until Q2 2025,” said a note from Oxford Economics.

Analysts at Capital Economics agree, saying the RBA sounded marginally less hawkish today but “we still expect the Bank to only lower interest rates in Q2 2025.”

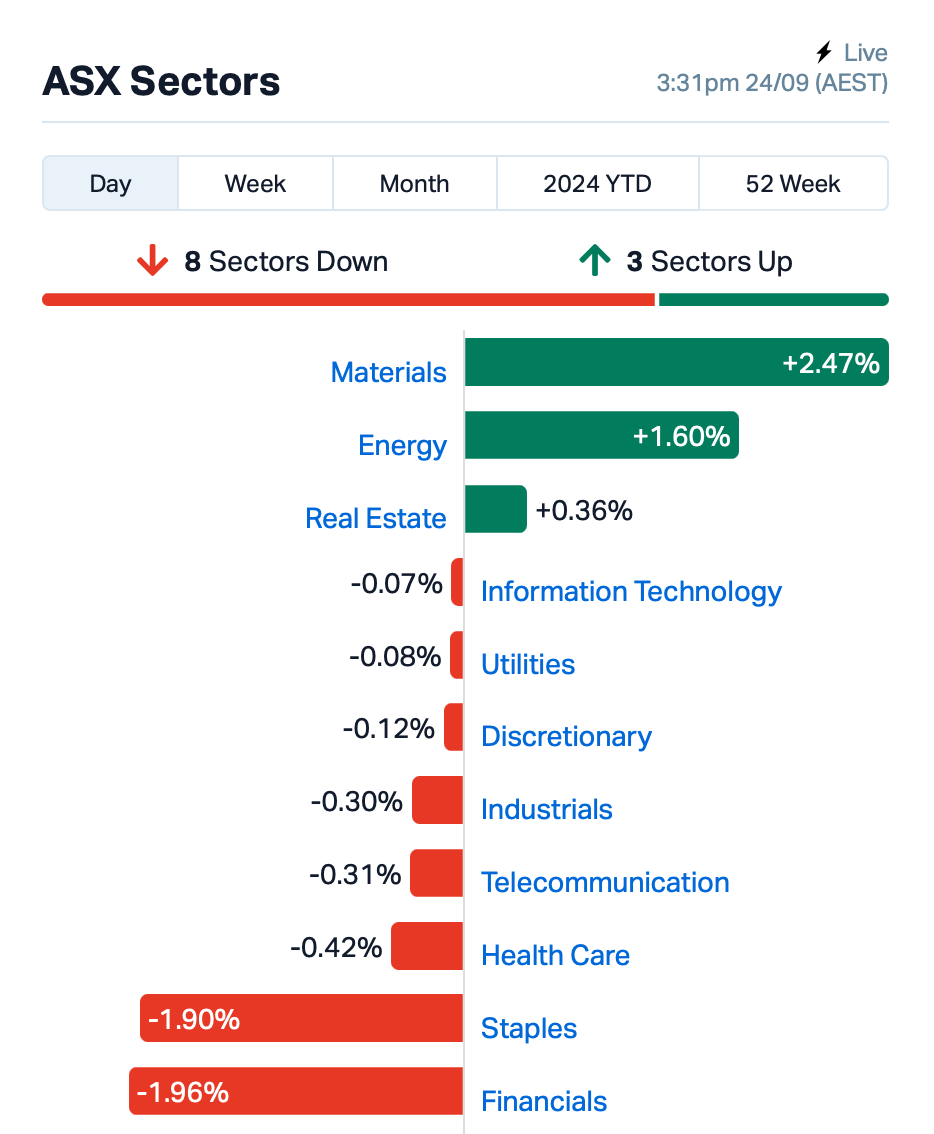

To stocks, mining and energy shares took the lead today, while gains were tempered by losses in banking and consumer staples.

Iron ore futures jumped 4% in Singapore after China announced stimulus measures today (more on that below), pushing related stocks higher.

BHP (ASX:BHP) rose 2.5%, Rio Tinto (ASX:RIO) jumped 3.4% and Fortescue Metals (ASX:FMG) climbed 1.9%.

Uranium stocks rallied again today, while oil prices moved higher throughout the morning as Israel ramped up its attacks on southern Lebanon.

Supermarket stocks took a beating for the second day running after the regulator, the ACCC, accused Woolworths (ASX:WOW) and Coles (ASX:COL) of false discount claims. Both WOW and COL traded down by 3% following the same drop yesterday.

A refresher in case you missed all the fun yesterday: The ACCC has launched separate but similar legal action against the two big supermarket players, accusing them of jacking up prices for short periods before “discounting” them back down, but oftentimes ending up with consumers paying a higher price than before.

Still in the large caps space, gaming company, Light & Wonder (ASX:LNW) plunged 15% after losing a legal battle with rival Aristocrat Leisure (ASX:ALL) over a dragon-themed pokies game in the US.

The judge ruled that L&W misused Aristocrat’s trade secrets and has stopped L&W from selling or promoting Dragon Train.

Read more: Gaming companies are turning the tables on ESG, should you invest?

The biggest mover today, however, was online luxury retailer Cettire (ASX:CTT), which soared 60% after after auditors finally approved the company’s accounts.

The approval came after Cettire spooked the market in August, saying that its auditor Grant Thornton had not yet approved its accounts and was asking for clarification on how and when it recognised revenues. Cettire fell by 20% that day.

What else is happening today?

China’s central bank has unveiled a big stimulus package, as it aims to achieve an annual growth target of about 5%.

Today’s announcement includes cutting bank reserve requirements to their lowest since 2020 and lowering a key interest rate, both for the first time in a decade.

Meanwhile, the US Justice Department is about to take legal action against Visa, claiming the company is breaking the law to block rival payment processors.

The lawsuit will focus on Visa’s payment processing tech, which connects banks and merchants during transactions. According to insiders, the DoJ plans to argue that Visa punishes its customers for trying to use competing services.

Elsewhere, Tesla could face major challenges if the US proceeds with a ban on Chinese software and hardware components in electric vehicles announced overnight.

Experts warn that if China retaliates, it could negatively affect Tesla’s sales in the country. Tesla sold over 600,000 cars in China last year.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | 100% | 1,193,254 | $1,474,734 |

| CTT | Cettire | 2.290 | 72% | 21,169,654 | $507,046,833 |

| E25 | Element 25 Ltd | 0.360 | 67% | 11,315,377 | $47,281,166 |

| EEL | Enrg Elements Ltd | 0.003 | 50% | 320,863 | $2,090,032 |

| ICR | Intelicare Holdings | 0.015 | 36% | 1,058,342 | $5,348,070 |

| ATH | Alterity Therap Ltd | 0.004 | 33% | 2,821,099 | $15,961,008 |

| TIG | Tigers Realm Coal | 0.004 | 33% | 125,000 | $39,200,107 |

| MCT | Metalicity Limited | 0.033 | 32% | 2,663,941 | $11,740,145 |

| SNX | Sierra Nevada Gold | 0.062 | 29% | 1,761,621 | $5,902,384 |

| FRB | Firebird Metals | 0.135 | 29% | 87,535 | $14,947,947 |

| HGV | Hygrovest Limited | 0.050 | 25% | 748,934 | $8,412,424 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 12,805,484 | $57,867,624 |

| HLX | Helix Resources | 0.005 | 25% | 2,165,654 | $13,056,775 |

| EP1 | E&P Financial Group | 0.500 | 22% | 50,110 | $97,448,837 |

| NSM | Northstaw | 0.017 | 21% | 30,000 | $1,958,261 |

| CLV | Clover Corporation | 0.445 | 20% | 644,958 | $61,789,756 |

| PL3 | Patagonia Lithium | 0.084 | 20% | 20,000 | $3,520,531 |

| EPM | Eclipse Metals | 0.006 | 20% | 2,686,758 | $11,254,278 |

| ROG | Red Sky Energy. | 0.006 | 20% | 1,768,372 | $27,111,136 |

| NC6 | Nanollose Limited | 0.019 | 19% | 120,000 | $2,752,102 |

| ARV | Artemis Resources | 0.013 | 18% | 1,899,424 | $21,085,707 |

| BNL | Blue Star Helium Ltd | 0.004 | 17% | 2,094,730 | $7,293,320 |

| NRZ | Neurizer Ltd | 0.004 | 17% | 14,068,332 | $6,543,358 |

Element 25 (ASX:E25) was up on exciting news that it has been selected for award negotiations for a US$166 million grant from the US Department of Energy (DoE) under the Battery Materials Processing Grant Program. The funding will support the construction of Element’s proposed battery-grade high-purity manganese sulphate monohydrate (HPMSM) facility in Louisiana, USA, and the funding is additional to the US$115 million already committed by offtake partners General Motors and Stellantis.

Recent diamond drilling has confirmed a thick zone of antimony copper mineralisation at West Cobar Metals’ (ASX:WC1) Bulla Park project. The drilling supports further confidence of a large antimony copper system at Bulla Park, alongside previous drilling results that include 33m at 0.47% Cu and 0.15% Sb from 229m.

Clover Corp (ASX:CLV) was up despite delivering an annual report this morning that showed a total revenue of $62.2 million which was in line with guidance, but also marked a decline from the previous year’s $79.9 million. Clover also reported that net profit after tax (NPAT) also saw a significant drop, falling to $1.5 million from $6.2 million in FY23.

E&P Financial Group (ASX:EP1) rose after the company dropped a grab-bag of announcements, first informing the market that it has finalised a $12.5 million conditional placement of 125,000 convertible notes at a face value of $100 per note, mandatorily convertible into fully paid ordinary shares at a conversion price of $0.52, together with free-attaching options to wholesale investors. That was quickly followed by news that the company has officially requested to voluntarily de-list from the ASX, subject to the results of an extraordinary General Meeting, which was announced immediately after the second announcement, at which shareholders will also vote on a proposed an off-market equal access buy-back for up to $25,000,000.

After receiving a $10.7m exploration grant in June for its Cowboy State Mine rare earths project in Wyoming – touted as potentially one of the largest REE deposits on the planet – American Rare Earths (ASX:ARR) has been backed by the US govt’s Export-Import Bank (EXIM) to the tune of up to US$456m.

The Cowboy State Mine has an enormous 2.34 BILLION tonne JORC resource, with 7.48Mt total rare earth oxides (TREO) with a basketful of high-priced magnet metals such as neodymium and praseodymium.In a letter of intent from EXIM, the outlined debt-funding package will go towards the construction and execution of the project’s mining area at Halleck Creek and covers all initial capex that was outlined in a scoping study earlier this year.

EXIM Bank made the offer based on the preliminary information submitted regarding expected US exports and US jobs to be created through the CSM project and indicated a repayment tenor of 15 years under EXIM’s Make More In America Initiative.

A 190m-long antimony intercept has West Cobar Metals (ASX:WC1) shares flying today as diamond drilling confirms a thick zone of antimony-copper mineralisation at Bulla Park with structural control from a major WSW trending fault.

The explorer says the find provides further confidence of a large antimony-copper system with strong economics, with antimony up around the US$22,700/t mark and red metal prices recovering up to ~US$9,300/t. Additional drilling is being planned to prove up a maiden antimony copper mineral resource estimate at Bulla Park.

Earlier, Poseidon Nickel (ASX:POS) was up after it reported finding several gold anomalies extending over multiple soil traverses (between 400m to 800m) following reconnaissance soil sampling at its Black Swan project. The company also said a coherent gold anomaly has been defined (up to 54ppb Au) that is 1.4km by 1km in size and remains open to the south at its Wilson’s prospect.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WTM | Waratah Minerals Ltd | 0.305 | -34% | 10,035,982 | $86,862,336 |

| CDE | Codeifai Limited | 0.001 | -33% | 908,178 | $3,961,942 |

| RNE | Renu Energy Ltd | 0.001 | -33% | 6,543 | $1,206,201 |

| TX3 | Trinex Minerals Ltd | 0.002 | -33% | 2,735,155 | $5,485,957 |

| VPR | Voltgroupltd | 0.001 | -33% | 9,814 | $16,074,312 |

| ERL | Empire Resources | 0.003 | -25% | 630,000 | $5,935,653 |

| SMM | Somerset Minerals | 0.003 | -25% | 28,631 | $4,123,995 |

| VRC | Volt Resources Ltd | 0.003 | -25% | 298,701 | $16,634,713 |

| VKA | Viking Mines Ltd | 0.007 | -22% | 145,165 | $9,563,326 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1,637,948 | $15,000,000 |

| EXL | Elixinol Wellness | 0.004 | -20% | 321,170 | $6,605,912 |

| RGL | Riversgold | 0.004 | -20% | 5,161,885 | $6,637,313 |

| VML | Vital Metals Limited | 0.002 | -20% | 740,914 | $14,737,667 |

| WBE | Whitebark Energy | 0.008 | -20% | 173,784 | $2,523,335 |

| MAT | Matsa Resources | 0.031 | -18% | 436,468 | $24,703,325 |

| FBM | Future Battery | 0.018 | -18% | 96,892 | $14,637,830 |

| LNW | Light & Wonder Inc. | 135.230 | -18% | 558,190 | $3,967,693,034 |

| NOX | Noxopharm Limited | 0.100 | -17% | 111,957 | $35,068,554 |

| PFT | Pure Foods Tas Ltd | 0.015 | -17% | 165,432 | $2,197,661 |

| AD1 | AD1 Holdings Limited | 0.005 | -17% | 200,000 | $6,584,090 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 371,868 | $3,671,296 |

| LPD | Lepidico Ltd | 0.003 | -17% | 2,178,568 | $25,767,375 |

IN CASE YOU MISSED IT

Arizona Lithium (ASX:AZL) has uncovered another new lithium-enriched formation at its Prairie project in Saskatchewan, Canada. Well #2 on Pad #1 has also been drilled and in turn to become a disposal well, with the company on track for 2025 production.

Just weeks after acquiring the Alturas antimony project in Canada, Equinox Resources (ASX:EQN) says exploration revealed a ‘significant’ shear zone expansion and copper discovery. Managing director Zac Komur says the findings, combined with the project’s historical ultra-high-grade antimony mining, reaffirm its potential for both antimony and polymetallic mineralisation.

Sun Silver (ASX:SS1) has returned more high-grade results of up to 113g/t silver from inaugural drilling at its Maverick Springs silver-gold project in Nevada, USA. The company is aiming to drill a further ~18 holes as part of the inaugural program, with a resource upgrade planned later this year.

Anson Resources (ASX:ASN) has received a non-binding letter of interest from the US EXIM Bank for up to US$330M in long term debt financing to fund the construction of a lithium production plant in Utah, USA. Anson management says the LoI from EXIM signals a material step forward in funding its direct lithium extract plans in Utah’s Paradox Basin.

Summit Minerals (ASX:SUM) is expanding its niobium foothold in Brazil at its Equador project in the country’s northeast Borborema Pegmatitic Province. The new tenement will directly adjoin the company’s existing mining lease. Previous due diligence at the new tenement has turned up encouraging rock chip samples such as 42.93% niobium, 11.39% tantalum and 33,310 ppm PREO.

Lanthanein Resources (ASX:LNR) has completed six MLEM survey lines over gold, copper and nickel geochemical targets at its Lady Grey project at Mt Holland in Western Australia’s Yilgarn Province. Company technical director Brian Thomas says Lanthanien management is particularly buoyed in confidence due to the historical, nearby Bounty Gold Mine which produced roughly 1.3moz during its tenure.

Does Spartan Resources (ASX:SPR) have a potential “belt-scale” opportunity on its hands? The gold player certainly thinks so following new discoveries at the Pepper gold deposit off the back of exceptional drill results. Standout hits included 20.61m at 10.02g/t gold from 512.54m downhole, and 13.79m at 46.32g/t gold from 601.59m downhole. Spartan interim executive chair Simon Lawson says such results pave the way to a potential multimillion ounce operation.

Koba Resources (ASX:KOB) has recommenced drilling at its Yarramba uranium project in South Australia, following a small hiatus due to a an unforeseen mechanical issue. A new rig has been mobilised to site and is currently drilling at the Oban deposit following up on previously intersected high-grade mineralisation including 7.5m at 831 ppm eU3O8, 2.1m at 2,236ppm eU3O8, 3.9m at 1,104ppm eU3O8, and 4.5m at 964ppm eU3O8.

“With a new rig now on site, drilling is currently focusing on the Oban uranium deposit, where another 70 holes are planned with the aim of growing the resource base by delineating high-grade trends both within and beyond the current resource boundaries,” MD and CEO Ben Vallerine said.

“The rig will then move to the Mt John prospect, which is located just 4km north of Boss Energy’s 10.7Mlb Jason uranium deposit, where we have another 30 holes planned to target discovery of new mineralisation.”

Red Metal (ASX:RDM) plans to commence multiple drill programs in Northwest Queensland over the next month.

These programs will test two standout base metal targets on the separate Gidyea and Lawn Hill projects and complete infill resource definition on our Sybella rare earth oxide discovery. In addition, RDM will offer eligible shareholders the opportunity to participate under a share purchase plan at $0.10 per share targeting to raise $2m to fund the drilling programs.

“We’re thrilled about the upcoming drilling programs on these three exceptional projects, any one of which has the potential to significantly transform Red Metal,” MD Rob Rutherford said.

“We’re also delighted to offer our loyal existing shareholders a discounted share purchase opportunity before this intense period of drilling activity begins, as they continue to be our strongest supporters.”

TRADING HALTS

Cassius Mining (ASX:CMD) – pending a further announcement in relation to the Soalara Limestone Project in Madagascar.

Pacgold (ASX:PGO) – pending an announcement to the market in connection with a capital raising.

IXUP (ASX:IXU) – pending an announcement regarding a proposed capital raising.

Godolphin Resources (ASX:GRL) – pending an announcement to the market in relation to a capital raising.

Lachlan Star (ASX:LSA) – pending an announcement in respect of a capital raising.

FireFly Metals (ASX:FFM) – pending the release of an announcement regarding a capital raising.

Mantle Minerals (ASX:MTL) – pending the release of a fundraising and exploration update.

At Stockhead, we tell it like it is. While Koba Resources, Red Metal, Arizona Lithium, Equinox Resources, Sun Silver, Anson Resources, Summit Minerals, Lanthanein Resources and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.