Closing Bell: ASX crushed with all 11 sectors deep in the red, but there’s some good news from China

ASX crushed today. Picture Getty

- The ASX declined by almost 2pc

- Stocks were dumped after strong US retail data shot chances of Fed rate cuts any time soon

- China’s GDP came in at 5.3pc, beating estimates

The ASX suffered its worst day this year after closing -1.7% down on Tuesday.

Stocks were hammered after Wall Street traders came back from a weekend where tensions in the Middle East had escalated several notches.

All major indexes in the US were pummelled last night, with the tech heavy Nasdaq plunging by -1.79%.

Sentiment also took a hit after stronger-than-expected US retail sales data – which rose by +0.7% in March following an increase of 0.9% in February – shot down expectations of more than two Fed rate cuts this year.

Safe haven gold traded above US$2,390/oz, while the VIX or Fear Index jumped +11% to 19.23, a level not seen this year.

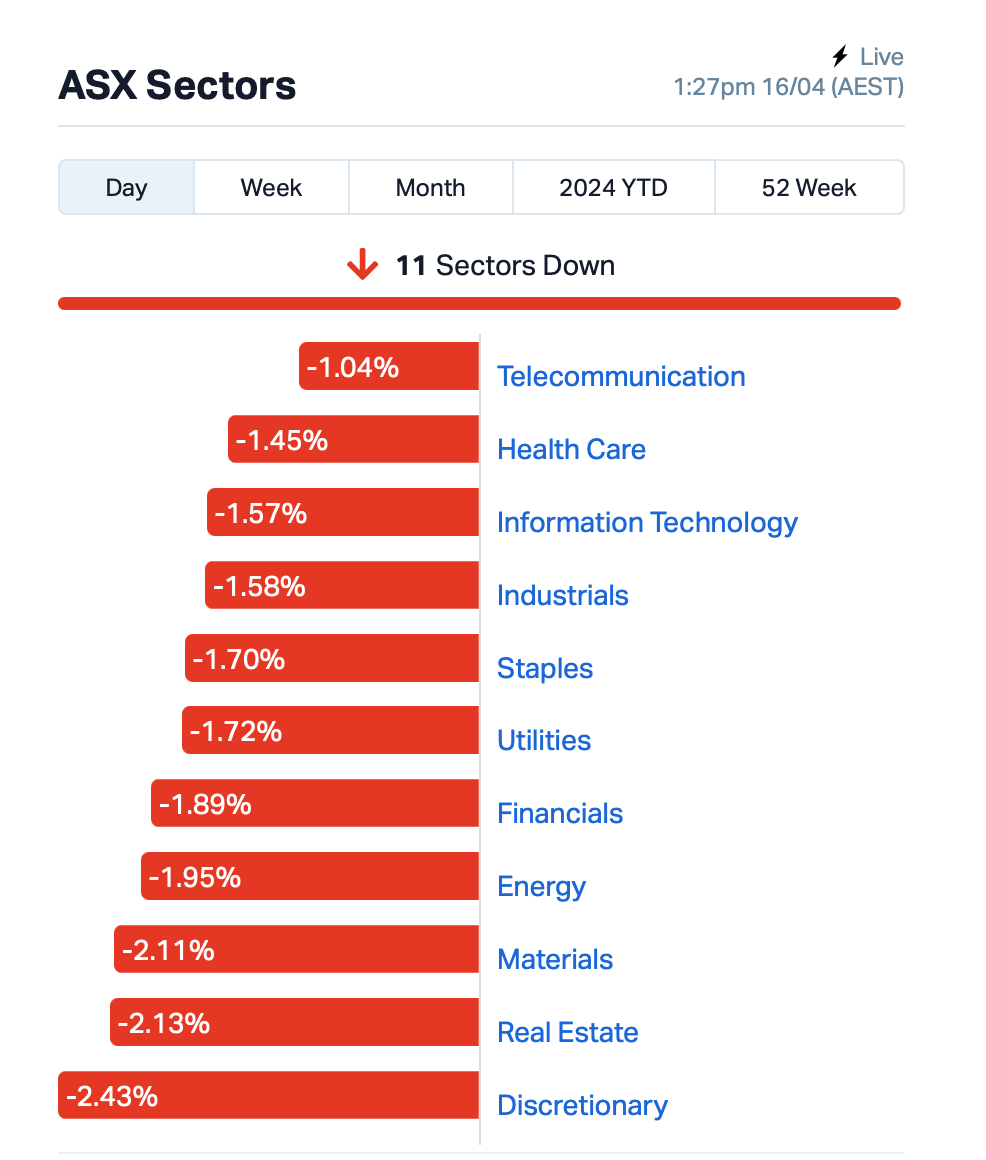

On the ASX today, all 11 sectors were deep in the red, with Mining, Real Estate and Discretionary sectors taking the biggest hits.

The selloff in Mining was led by iron ore plays Rio Tinto (ASX:RIO) and BHP (ASX:BHP), which were down by -3% and -2% respectively.

Bank stocks were also hit hard, with the big four all down by 2% each.

The Star Entertainment Group (ASX:SGR) was the biggest large-cap laggard on the ASX today, down -11% after media reports revealed that former CEO Robbie Cook and current chair David Foster spied on and tried to oust the government-appointed regulator, Nicholas Weeks, who was tasked with investigating the company’s Sydney operations.

Elsewhere today…

Some good news coming out of China today. The country’s GDP has grown by 5.3% in Q1, beating forecasts.

Retail sales, however, missed estimates and home sales extended their decline amid poor sentiment in its ailing property market.

“Growth is expected to slow sequentially in the current quarter, bringing the year to a just-below 5% or 4.7% growth,” said Ailing Tan of Economic Data News Asia.

Looking ahead to tonight’s session, the International Monetary Fund (IMF) is expected to release its latest World Economic Outlook.

US-listed stocks scheduled to report earnings tonight include: Bank of America, Bank of New York Mellon, Ericsson, Johnson & Johnson, Louis Vuitton, and Morgan Stanley.

ASX LARGE CAP WINNERS TODAY:

Code Name Last % Change Volume Market Cap CEN Contact Energy Ltd 7.72 4.18% 179 $1,898,300,387 MCY Mercury NZ Limited 6.09 2.35% 970 $8,294,631,605 GOLD Gblx GOLD 34.28 2.21% 173,242 $3,661,835,151 BWP BWP Trust 3.43 1.78% 1,131,669 $2,342,549,038 MEZ Meridian Energy 5.29 1.34% 47,685 $6,613,734,034 VUK Virgin Money Uk PLC 4.13 0.98% 3,548,842 $2,428,530,282 YAL Yancoal Aust Ltd 5.855 0.95% 1,940,211 $7,658,548,735 PXA Pexagroup 11.47 0.88% 296,366 $2,017,299,499 ALX Atlas Arteria 5.295 0.47% 1,699,459 $7,645,893,636 AN3PI Cn 3M Per Q Rd T-28 105 0.47% 3,617 $1,567,650,000 ARF Arena REIT. 3.605 0.42% 245,641 $1,274,988,184 IPH IPH Limited 6.105 0.41% 391,528 $1,506,247,776 LIC Lifestyle Communit. 13.975 0.40% 156,161 $1,694,621,552 AMC Amcor PLC 13.85 0.36% 1,485,262 $8,891,095,409

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DAL | Dalaroo Metals | 0.028 | 75% | 19,746,554 | $1,324,000 |

| DCG | Decmil Group Limited | 0.280 | 65% | 8,038,502 | $26,449,647 |

| RMX | Red Mount Min Ltd | 0.002 | 50% | 798,913 | $2,673,576 |

| LPE | Locality Planning | 0.076 | 41% | 2,418,504 | $9,731,038 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 500,000 | $9,296,169 |

| GTI | Gratifii | 0.006 | 33% | 13,646,724 | $7,254,202 |

| HIO | Hawsons Iron Ltd | 0.044 | 29% | 19,107,843 | $31,248,416 |

| SUM | Summitminerals | 0.099 | 27% | 433,601 | $3,717,256 |

| TIG | Tigers Realm Coal | 0.005 | 25% | 9,631,869 | $52,266,809 |

| LYN | Lycaonresources | 0.255 | 24% | 1,311,663 | $9,031,531 |

| WMG | Western Mines | 0.270 | 23% | 907,166 | $16,518,300 |

| CAV | Carnavale Resources | 0.006 | 20% | 3,636,743 | $17,117,759 |

| 1TT | Thrive Tribe Tech | 0.019 | 19% | 222,984 | $4,745,944 |

| GBZ | GBM Rsources Ltd | 0.014 | 17% | 2,066,862 | $13,578,198 |

| NNG | Nexion Group | 0.014 | 17% | 2,380,815 | $2,427,694 |

| TAR | Taruga Minerals | 0.007 | 17% | 600,000 | $4,236,161 |

| LSA | Lachlan Star Ltd | 0.059 | 16% | 104,375 | $10,586,233 |

| APS | Allup Silica Ltd | 0.052 | 16% | 615,933 | $1,731,470 |

| OLY | Olympio Metals Ltd | 0.060 | 15% | 203,192 | $3,653,610 |

| AMO | Ambertech Limited | 0.335 | 14% | 30,549 | $28,144,411 |

| PNT | Panthermetalsltd | 0.034 | 13% | 60,500 | $2,614,985 |

| AXN | Alliance Nickel Ltd | 0.035 | 13% | 80,451 | $22,501,028 |

| AGD | Austral Gold | 0.036 | 13% | 316,991 | $19,593,963 |

| AS1 | Asara Resources Ltd | 0.009 | 13% | 18,017,554 | $7,057,403 |

Explorer Dalaroo (ASX:DAL) rose after reporting a +200m long gold find at Goodbody West, part of the Lyons River project in the Gascoyne region of WA. The best of the results include 5m @ 0.85g/t Au from 9m, including 1m @ 1.83g/t Au from 9m and 1m @ 1.23g/t Au from 12m – a happy amount of gold and not far from the surface.

Hawsons Iron (ASX:HIO) revealed to the market that seven potential strategic investors had been handed a 350-page Information Memorandum, containing a comprehensive review of results from activity undertaken in line with the company’s strategic review, issued in February last year.

Western Mines Group (ASX:WMG) said assay results revealed the company is onto broad zones of nickel sulphide mineralisation – elevated Ni and S coincident with highly anomalous Cu and PGE, including a cumulative assay from one drill hole that totalled 184m at 0.27% Ni, 126ppm Co, 82ppm Cu, 18ppb Pt+Pd with S:Ni 0.9.

Locality Planning Energy (ASX:LPE) was rising on news of an unsolicited and “opportunistic” off-market takeover offer from River Capital, which the company has directed shareholders to ignore.

Alvo Minerals (ASX:ALV) was moving positively on news that it has secured firm commitment from Ore Investments to invest A$4.1 million at $0.175 per share, giving the latter pro-forma ownership of 19.9% in Alvo Minerals. That’s on top of existing substantial shareholder Strata Investment to invest $125,000 as well.

Spartan Resources (ASX:SPR) announced a new high-grade discovery it’s dubbed the Pepper prospect only about a week after announcing visible gold sited 1km under Spartan’s Never Never deposit in the Murchison region of WA. That, reports the company, is a high-grade lode intersected immediately south of Never Never and has revealed similar high-grade mineralisation and grades. The Never Never gold deposit, and this new Pepper find, by the way, falls within the company’s 100%-owned Dalgaranga Gold Project.

Island Pharma (ASX:ILA) has just reported highly positive pharmacokinetic (PK) data and reconfirmed strong safety/tolerability data for ISLA-101 from its 24-subject Single Ascending Dose clinical study. Data analysis has now confirmed that required levels of ISLA-101 concentration in the blood were observed after only a single dose, achieving the study’s purpose. This result is critical for determining how the drug acts in the body, and for establishing appropriate dosing regimens for Island’s planned Phase 2a clinical trial.

IDT Australia (ASX:IDT) has entered into a Master Service Agreement with Sanofi, a global French healthcare company, to support the preclinical formulation development and cGMP manufacture of Sanofi’s messenger RNA (mRNA) for its clinical program. The agreement allows Sanofi to choose services from IDT Australia and allows for follow-on work packages.

The value of the services to be provided under the initial order, which is nearing finalisation, is estimated to be between $3 to 3.5 million (excluding costs relating to storage, shipping and any equipment purchase).

Macmahon looks to acquire civil engineering firm Decmil (ASX:DCG) for 30c/sh cash – a premium of 76.5% to most recent closing price and 81.8% to the 30-day VWAP of DCG shares.

Embattled coal play Tigers Realm (ASX:TIG) announced it would sell its Russian operations for $49m. An assessment by the Department of Foreign Affairs and Trade indicated that the operations were likely to be prohibited by, or subject to authorisation under, Australian sanctions regulations.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.001 | -50% | 599,282 | $15,569,766 |

| YPB | YPB Group Ltd | 0.001 | -50% | 10,000 | $1,580,923 |

| LPD | Lepidico Ltd | 0.003 | -38% | 84,029,996 | $30,553,232 |

| ATH | Alterity Therap Ltd | 0.005 | -29% | 12,005,646 | $36,666,125 |

| IEC | Intra Energy Corp | 0.002 | -25% | 4,341,250 | $3,381,563 |

| LSR | Lodestar Minerals | 0.002 | -25% | 408,236 | $4,046,795 |

| RIL | Redivium Limited | 0.003 | -25% | 49,097 | $10,923,419 |

| 88E | 88 Energy Ltd | 0.005 | -25% | 302,482,384 | $150,744,375 |

| NPM | Newpeak Metals | 0.017 | -23% | 1,122,931 | $2,198,938 |

| MCL | Mighty Craft Ltd | 0.014 | -22% | 109,990 | $6,572,379 |

| PLL | Piedmont Lithium Inc | 0.223 | -22% | 16,726,118 | $109,392,263 |

| ALM | Alma Metals Ltd | 0.008 | -20% | 5,616,812 | $13,108,133 |

| GMN | Gold Mountain Ltd | 0.004 | -20% | 13,920,685 | $14,877,528 |

| ME1 | Melodiol Glb Health | 0.004 | -20% | 3,726,448 | $2,690,966 |

| MKL | Mighty Kingdom Ltd | 0.004 | -20% | 2,494,084 | $3,306,333 |

| RML | Resolution Minerals | 0.002 | -20% | 75,000 | $4,024,992 |

| TX3 | Trinex Minerals Ltd | 0.004 | -20% | 17,858 | $8,724,546 |

| ERG | Eneco Refresh Ltd | 0.009 | -18% | 50,467 | $2,995,942 |

| SUH | Southern Hem Min | 0.033 | -18% | 11,415 | $23,621,030 |

| LDR | Lode Resources | 0.091 | -17% | 340,467 | $11,746,256 |

| BM8 | Battery Age Minerals | 0.100 | -17% | 122,235 | $11,011,238 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 142,000 | $7,711,148 |

IN CASE YOU MISSED IT

Adavale Resources (ASX:ADD) is poised to launch maiden uranium exploration at its Mundowdna and Mundowdna South licences in South Australia, leveraging historical geophysical data to identify potential paleochannels rich in uranium deposits.

Alvo Minerals (ASX:ALV) has attracted a $4.1m strategic investment at a 25% premium from Brazilian natural resources equity group Ore Investments, which has deep technical expertise in Brazil’s resources sector.

Aura Energy (ASX:AEE) has secured a significant boost to the economic potential of its Tiris uranium project in Mauritania after a key customer accepted a 70% hike in future contract prices to secure yellowcake from its planned mine.

Fin Resources (ASX:FIN) has found a new spodumene-bearing outcrop at its White Bear lithium discovery in Canada while gearing up to start maiden drilling.

Impact Minerals (ASX:IPT) has started maiden drilling at its Arkun REE and copper project in WA to test the large +3km2 Hyperion +1000ppm TREO soil geochemistry anomaly.

Legacy Minerals (ASX:LGM) is carrying out first phase diamond drilling at the Sugarbag Hill prospect in NSW to test coincident gold-silver geochemical and IP anomalies.

Lycaon Resources (ASX:LYN) has received approval for a key land access permit, taking it another step closer towards drilling at its Stansmore project in WA’s highly prospective West Arunta region

Melodiol Global Health (ASX:ME1) has generated $4.1 million in unaudited revenues for Q1 FY24, a 79% increase on the prior corresponding period, due to the strong performance of its wholly-owned recreational cannabis subsidiary Mernova Medicinal.

Pure Hydrogen (ASX:PH2) has leased an industrial site at Archerfield airport in Brisbane, for its first demonstration green hydrogen micro-hub to service commercial transport operators and the aviation industry.

Riversgold’s (ASX:RGL) next drill program at its Northern Zone project near Kalgoorlie is aimed at delivering a maiden gold resource. It currently has an exploration target of between 2.5Moz and 4.8Moz of contained gold.

Spartan Resources’ (ASX:SPR) diamond drilling has uncovered a new gold prospect just 90m south of the 952,000oz Never Never deposit after initial results returned a huge 17.52m interval grading 15.86g/t gold.

Thrive Tribe Technologies (ASX:1TT) has debuted its health and wellbeing platform Kumu, aimed at empowering creators and connecting members with trusted experts, after a thriving beta period.

Venture Minerals’ (ASX:VMS) Stage One drilling at its Jupiter clay-hosted rare earths prospect in WA’s Mid-West region has returned a standout intersection of 60m at over 2000ppm TREO from the third and final batch of assays.

Eagle Mountain Mining (ASX:EM2) has raised $1.1m through a placement of shares priced at 6c each to sophisticated and institutional investors. Proceeds from the placement, which comprises the residual shortfall placement from the recently closed renounceable entitlement offer that raised $4.18m, will boost exploration at its Silver Mountain uranium project and studies at the Oracle Ridge project. Each share includes one free attaching option exercisable at 20c and expiring on 31 March 2027.

New World Resources (ASX:NWC) is cashed up to accelerate exploration drilling, reserves definition drilling, project development and mine permitting at its high-grade Antler copper project in Arizona after raising $20m through a successful share placement. The placement of shares priced at 3.6c each, which represents a 17.5% discount to the 15-day volume weighted average price, received strong stupport from domestic and international institutional investors. “Funds raised from the placement will allow us to continue to advance our high-grade Antler copper project against the backdrop of a favourable outlook for the copper market,” managing director Mike Haynes said.

Raiden Resources (ASX:RDN) has completed heritage surveys over its Andover North and Andover South projects on scheduled and within budget. It is now waiting on preliminary reports for both projects with final reports pending approval by the Ngarluma Aboriginal Corporation. The company will outline the timetable for drilling once the final reports are received.

Titanium Sands (ASX:TSL) is raising up to $2.1m through a placement of shares priced at 0.75c each to sophisticated and professional investors. It has received firm commitments for $1.5m worth of shares and is looking to finalise the issue of a further 80 million shares for another $600,000 in funding. The placement includes the issue of one option exercisable at 2.3c expiring 16 February 2026 for every two shares subscribed for. Proceeds will be used to further the environmental and stage 2 & 3 EIA processes for the Mannar heavy mineral sands project in Sri Lanka.

TRADING HALTS

Summit Minerals (ASX:SUM) – ending an announcement, as Summit is in the process of the finalisation of an acquisition.

Alpha HPA (ASX:A4N) – pending the release of an announcement regarding a material development in relation to financing support for Stage 2 of the HPA First Project.

Macquarie Technology Group (ASX:MAQ) – pending an announcement in connection with a strategic land acquisition and a proposed equity raising.

Challenger Gold (ASX:CEL) – pending the release of a material announcement in relation to a capital raising.

Titan Minerals (ASX:TTM) – pending the release of an announcement in relation to a proposed joint venture transaction.

RPM Automotive (ASX:RPM) – pending an announcement by the Company in relaƟon to a capital raising.

Cobalt Blue Holdings (ASX:COB) – pending an announcement regarding a capital raising.

At Stockhead, we tell it like it is. While are Adavale Resources, Alvo Minerals, Aura Energy, FIN Resources, Impact Minerals, Legacy Minerals, Lycaon Resources, Pure Hydrogen, Riversgold, Spartan Resources, Thrive Tribe Technologies and Venture Minerals, Eagle Mountain, New World Resources, Raiden Resources and Titanium Sands are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.