Legacy Minerals ventures into unchartered territory to drill Sugarbag Hill, a gold-silver target untouched for 30 years

Legacy Minerals has initiated a first phase diamond drilling program at Black Range to investigate previously unrecognised high-grade feeder zones. Pic via Getty Images

- Legacy Minerals embarks on a diamond drilling program at the Sugarbag Hill gold-silver prospect within the wider Black Range project in NSW

- Targets at Sugarbag Hill have remained untapped for over three decades since Newcrest Mining’s last exploration efforts

- Sugarbag Hill represents a large, underexplored epithermal gold system over 30km of strike

Special Report: A 1,100m diamond drilling program is underway at the Sugarbag Hill prospect – part of Legacy Minerals’ Black Range project – marking the first exploration activity at the site in more than 30 years.

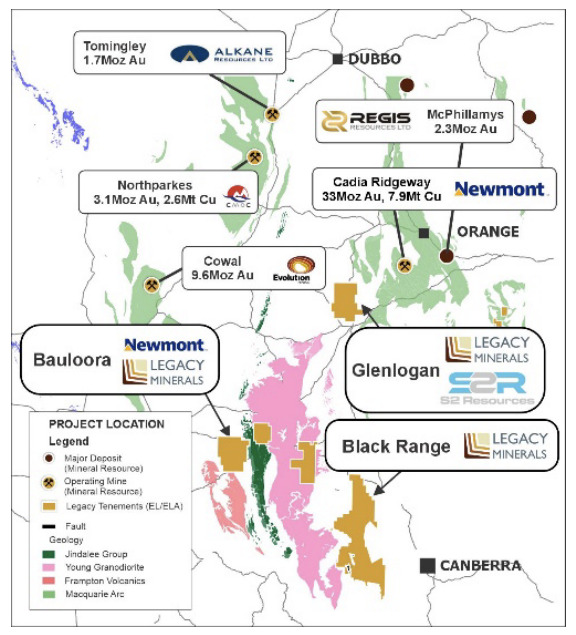

The opportunity to make company making discovery is drawing exploration companies to NSW’s Lachlan Fold Belt, home to more than 105Moz of discovered gold.

It also home to several major gold-copper mines including Cadia Ridgway –one of Australia’s three largest gold producers – and recent new discoveries, like Alkane Resources’ (ASX:ALK) 10.9Moz gold equivalent Boda discovery (2019) which helped put the region on the map for investors.

Legacy Minerals (ASX:LGM) is making strides in its exploration endeavours across its portfolio of projects in the highly endowed region, including Black Range where a 1,100m diamond drilling has kicked off after 30 years of inactivity.

The last drilling program carried out at the Sugarbag Hill prospect was done by Newcrest Mining in 1992 who were unable to find any high-grade feeder zones in their drilling or mapping.

Recent work by LGM uncovered coincident induced polarisation (IP) and geochemical targets that were not previously recognised by previous exploration, leading it to believe in the potential for gold mineralisation at depth.

Legacy Minerals’ Black Range Project and major deposits in NSW. Pic: Legacy Minerals

Sustained growth in gold price increases value of discovery

With gold prices hovering around the US$2400/oz mark, explorers like LGM are more likely to gets boots on the ground to carry out drilling campaigns and find discoveries.

“The gold targets at Sugarbag Hill are large, compelling, and untested since Newcrest ceased exploration in 1992,” LGM CEO and managing director Christopher Bryne says.

“They also remain open as Newcrest’s exploration program did not identify the high-grade feeding targets.

“To Legacy Minerals’ advantage there has been both a significant advance in epithermal mineral system understanding, as well as a sustained growth in the gold price, which increases both the probability of success and the value of a gold discovery,” he says.

“Undrilled prospects of this nature are rare opportunities to test for high-grade gold and silver targets in mineral systems that are globally recognised for their potential to turn into high-margin gold mines.”

Looking ahead

The strong resistive target areas are closely associated with the 2.2km long gold trend in soil sampling >20ppb gold (up to 296ppb gold), which includes a higher-grade gold zone that is 800m long at an average grade of 107.5ppb gold.

Recent rock chip samples collected along the resistivity trend have confirmed altered lithologies to be gold and silver bearing with assays up to 2.27g/t gold and 29.6g/t silver.

LGM says it is looking to follow up these encouraging results in search for a potential nearby feeder structure which demonstrates the potential at depth where an interpreted boiling zone is potentially located.

This article was developed in collaboration with Legacy Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.