Because you never asked for it: Stockhead’s October RBA cash rate pain predictor

News

News

- Annual retail sales growth slumps, volumes decline, challenging consumption outlook

- Job vacancies fell circa 9% over the last qtr, indicating a cooling labour market

- T. Rowe Price, Westpac, AMP Capital, CBA say data points to RBA on hold next week

On Wednesday, that heaps anticipated August CPI indicator came in on time and as expected, ticking up to 5.2%/yr. The pain was a 5 or a 6.

The increase was driven largely by higher fuel prices, IG Markets’ analyst Tony Sycamore told Stockhead.

Fuel price pain right now, as I’m sure you’ve noted, is sharp and located most fiercely around the arse.

But Tony says it won’t move the central bank.

“And we expect the RBA to ‘look through’ this uptick and continue to keep rates on hold.”

“(Wednesday’s) inflation data won’t move the dial for the October RBA meeting, where the RBA is widely expected to stay on hold. However, jobs data for September (October 20th) and Q3 inflation data (October 25th) will decide whether the RBA hikes rates in November or keeps its cash rate on hold until year-end. For the record, we are still calling for a November 25bp rate hike.”

Westpac chief economist Bill Evans reckons next week’s meet has already been decided:

“We are certain that the board will decide to continue the pause that began at the July meeting.”

Just how certain, Bill?

“After holds across August and September, a move in October would be very surprising, with the market currently giving around a 40% chance of a rate hike in November, lifting to 90% in March,” Bill says.

“Despite this market pricing, which is also indicating no rate cuts until 2025, we expect that the cash rate will remain on hold until August next year when the first rate cut can proceed.”

“Our forecast for the conditions the board will be facing by then will be an inflation rate that has fallen from 4.1% to 3.4%; an unemployment rate of 4.5%; and economic growth through the year to June of 1.0%,” Mr Evans adds.

Scott Solomon, co-portfolio manager of the T. Rowe Price Dynamic Global Bond Strategy, expects the Reserve Bank of Australia (RBA) to remain on pause for new Guv’nah, Michele Bullock’s first meeting, suggesting that there’s been ‘little impetus to disrupt the path’ her predecessor – the very outgoing Dr P. Lowe – laid out in blood over the last 16 months.

“While data has by and large been strong, it has not necessarily exceeded market expectations. However, we are eager to examine the first statement for hints of changes in outlook as well as other policy changes via a potentially new Statement on the Conduct of Monetary Policy. So while we are unlikely to see changes to the policy rate, there is some heightened interest in the upcoming meeting,” Scott says.

“Looking ahead, we are concerned that the RBA will have to hike again as the economy remains robust: home prices up, employment high, government spending resilient with capacity for more. In other words, Bullock’s job won’t be any easier than Philip Lowe’s and will face the same struggles as her central bank counterparts: navigating appropriate policy response in a data-dependent world.”

ANZ is also digging in on the “extended pause” theme, saying the RBA will maintain the OCR at 4.1% well into 2024, when it will consider a “modest easing cycle”.

ANZ senior economist, Adelaide Timbrell, says if inflation meets the RBA’s target band, the bank could choose to cut the cash rate by 0.25% to 3.85% in late 2024.

That said… Adelaide says given recent strength in petrol prices there’s still a wee possibility that while monthly inflation upticks as it did in August (although at the second-lowest pace since early 2022), there’s remains a touch of upside risk, but “not enough risk to warrant the RBA hiking rates in October.”

Over at HSBC, the erstwhile chief economist Paul Bloxham is going in for a further 25 basis point (bps) bump – but he’s pegged it for sometime during Q4.

Paul’s feeling is that Wednesday’s inline CPI drop hasn’t done quite enough for the RBA to hold its fire next week.

“We think the RBA is more likely to wait for the official quarterly CPI to get a more-comprehensive read, alongside the next labour market print. However, today’s inflation print highlights some risks, and we cannot rule out the chance that a rate hike is on the table next week.”

It’s not all about the CPI read, however.

The rubber hits the road for the RBA on economic action and jobs.

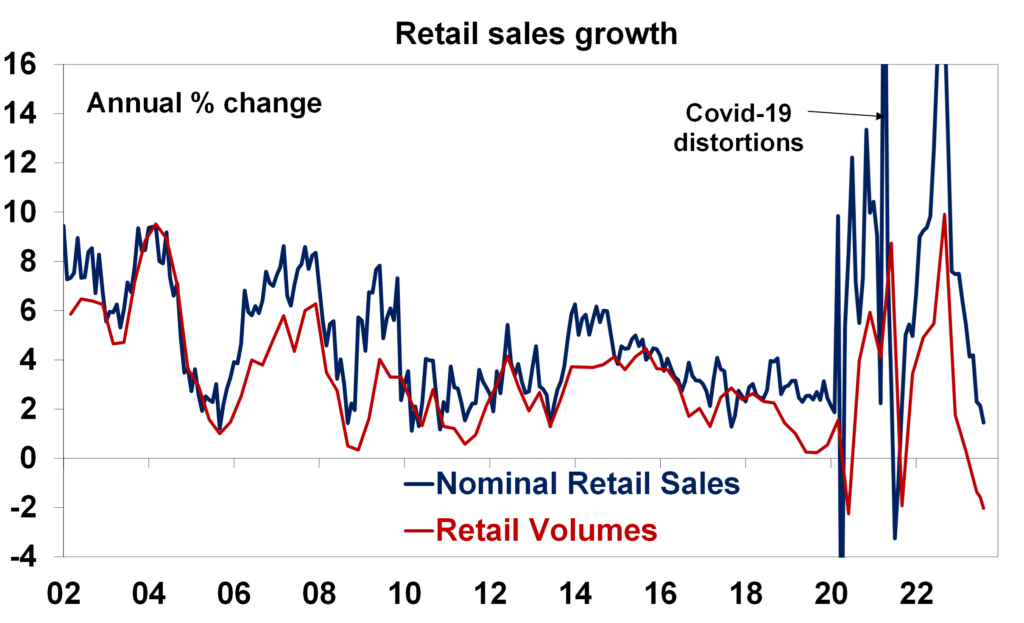

Retail trade rose by 0.2%/mth in August 2023.

Through the year, retail spending is just 1.5% higher, and this in the face of sticky high inflation and the booming population growth.

The ABS noted that the trend annual growth rate of 1.3% is the lowest in the history of the series, dating back to 1982, around the time John carpenter’s The Thing was released to no great acclaim.

“The weak retail result is in line with our internal data from the August CommBank Household Spending Insights (HSI) release, which also contained a +0.2% monthly outcome for retail spending,” says CBA’s Harry Ottley.

“On an annual change basis, the CommBank HSI Retail index is sitting at just +0.9%. Both our internal data and the official ABS measures suggest momentum in retail spending is sluggish.”

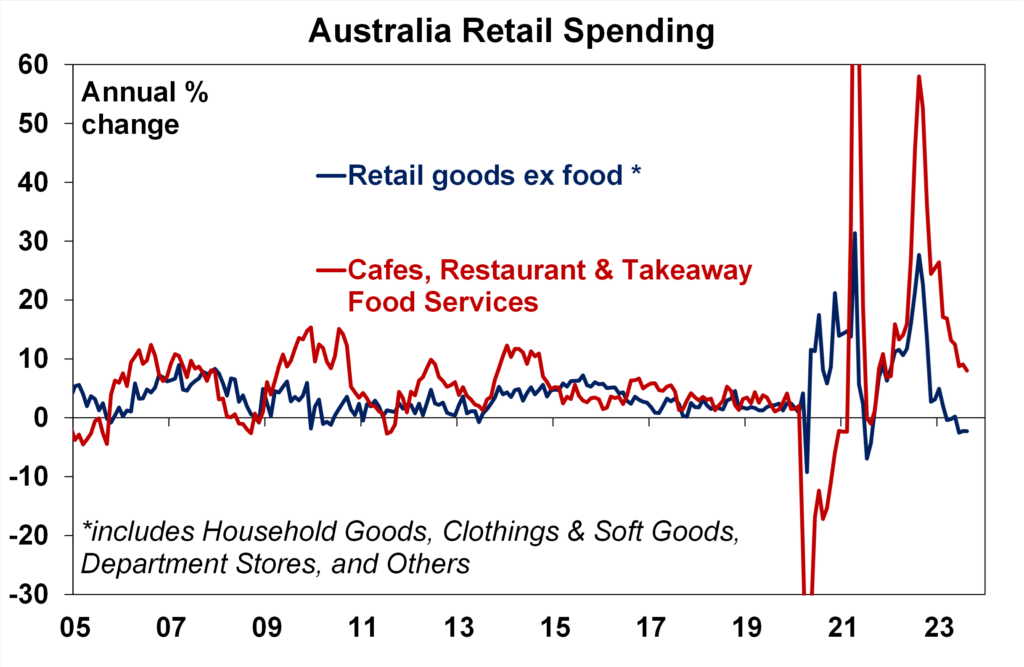

Harry also notes that the ‘resilience of retail spending by industry remains divergent.’

“The Women’s FIFA World Cup again provided a boost to spending on eating out, which was 0.7% higher in the month. On an annual change basis, spending on café’s, restaurants and takeaway remains a clear standout (+8.0%) as consumers prioritise services and experiences for their discretionary spend. Prices continue to rise briskly for restaurant and takeaway meals, which would also be contributing to the strong nominal spend.”

AMP Capital’s chief economist Dr Shane Oliver says the 0.2% Australian nominal retail sales rose by in August, came in ‘as expected by us’ and slightly lower than market consensus of +0.3%.

But Dr Shane also reminds that annual inflation is still rather toppy.

“This means retail sales volumes are likely continuing to fall despite rapid population growth. On our estimates, real retail sales are running down 2% on a year ago.

In August:

The ABS puts the pickups to a) warmer weather, b) Afterpay Day promotions (which might not be reflected in seasonal adjustments), c) the boosted demand for fan gear AND takeaway food – thanks to the cracking 2023 FIFA Women’s World Cup.

“Retail sales are actually pretty soft though given the boost from warmer than normal weather, the boost from the Women’s World Cup, the Afterpay Day promotions, the fastest population growth since the 1950s and still high inflation,” says Dr Oliver

“The 0.2% rise in August followed a 0.5% rise in July but a 0.8% fall in June and since October/November last year retail sales have basically been flat. September quarter real retail sales are on track for their fourth quarterly fall in a row highlighting the pressure on households from interest rate hikes and cost of living pressures.”

With population growth running around 2.5%, he adds, retail sales per person are actually down 1%yoy and real retail sales per person are down around 4.5%yoy.

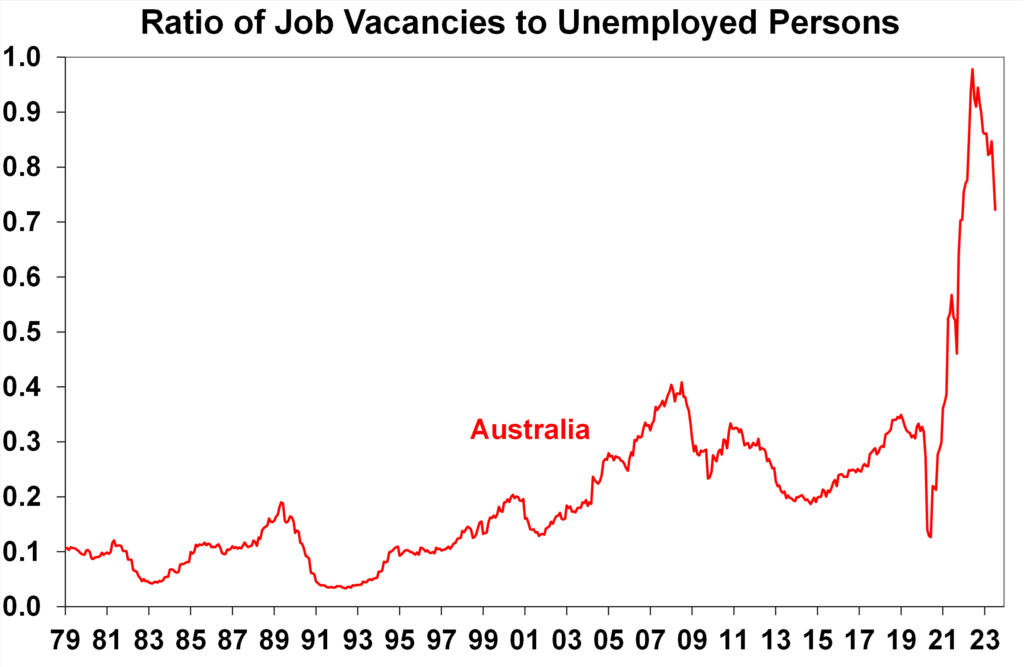

Job vacancies are also falling sharply, the ABS data shows, as rate hikes increase downward pressure on the economy.

Job openings registered the fifth straight quarterly decline – falling by 8.9% over the three months to August, leaving them full 18% below that impressive May 2022 high.

This has taken the ratio of job vacancies per unemployed person from a high of 1 in July last year to now 0.7, according to AMP Capital.

The level of job vacancies are still high, Dr Oliver notes, indicating a still tight labour market, but one which is ‘falling rapidly’ suggesting a hot market, cooling.

“Leading labour market indicators, including job vacancies and job ads and the ratio of job vacancies to unemployment are now all deteriorating, pointing to a further cooling in the jobs market ahead. This in turn should start to take pressure of wages growth next year, albeit the risks are on the upside in the near term,” Dr Oliver suggests.

“The CPI data confirms ongoing weakness in consumer spending and a still tight but cooling labour market, and we see it as boosting the case for the RBA to leave rates on hold next week which we think they will do,” Dr Oliver says.

Signs of rising wages growth in enterprise bargaining agreements and still high inflation mean that the risk of another rate hike is high, Dr Oliver adds.

“Though (at around 40% in our view) but if this were to occur it probably won’t come until November or December after the next round of ABS inflation and wages data and revisions to RBA forecasts.

“But given falling real retail sales and the softening jobs market it’s a tough one for the RBA and we continue to see the RBA cutting rates next year starting around June as the economy weakens with a very high risk of recession.”