ASX Small Caps and IPO Weekly Wrap: Gold and medicine are the best medicine

Via Getty

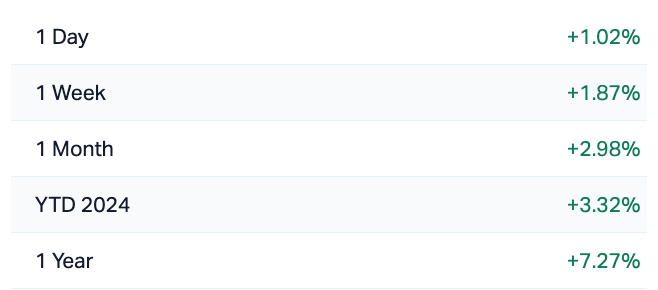

- The ASX200 benchmark index has ended a positive week on a positive note

- Financials ands IT, best-performing sectors

- Koonenberry Gold is small cap of the week!

Local markets found something to live for this week with the Q4 23 national accounts revealing Australia’s GDP increased by just 0.2%qoq and 1.5%yoy.

That was not awful.

And with China declaring an also not awful (albeit fanciful) 2024 GDP growth target of ‘around 5%’ with a touch of investment stimulus.

Then global equity were set for the Christine Legardians at the ECB to keep interest rates on hold – which they did – allowing other markets to go price in rate cuts across the EU and the US within months.

But first, this is how the ASX200 (XJO) index looked at 2.30pm on Friday March 8:

So earlier this week, the proof that Australia’s economy expanded less than expected in the fourth quarter, supporting bets that the Reserve Bank of Australia could start cutting rates this year.

GDP growth came in at just 0.2% in the quarter, in line with our call and the market consensus.

In annual terms, GDP grew at just 1.5%. This is well below population growth and confirms another quarter of per‑capita GDP contraction (‑0.3%).

Indeed, per person GDP contracted in every quarter of 2023 and is 1.0% lower than a year ago.

With that in mind it was little surprise the ASX200 was up by 0.9% to smash its way through the 7,800 mark on Friday at lunch.

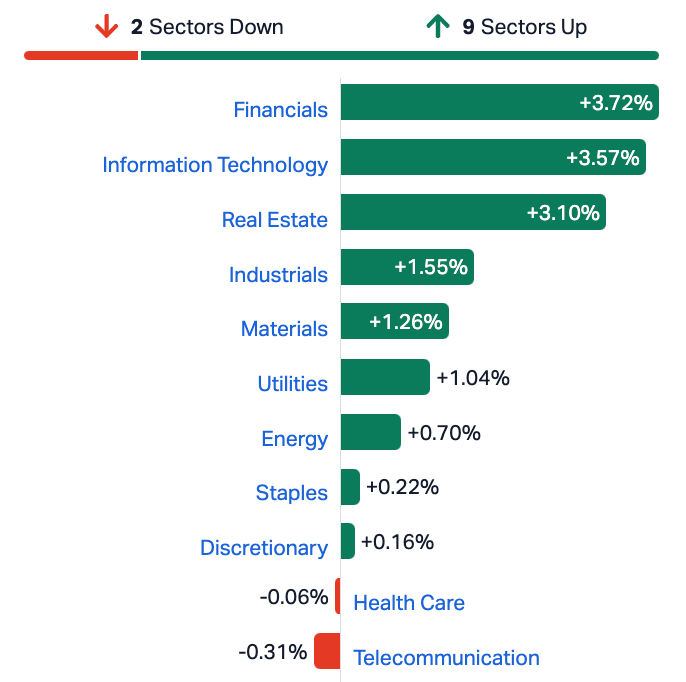

Nine of the ASX’s 11 sectors finished higher this week, with the interest-rate-sensitive sectors surging.

Needless to say it’s been a week for ASX Tech.

The ASX Sectors this week

Local record highs tracked the latest tech-led rally on Wall St this week as all that enthusiasm over artificial intelligence just catalysed on expectations the ever dovish smoke signals out of central banks led global markets higher.

At home, the numbers team at Commonwealth Bank (ASX:CBA) reiterated its forecast of 75 basis points in total rate reductions this year after the weak GDP data.

Stock of the week…

Gold hovered all-time highs near US$2,160 an ounce on Friday and was set to advance more than 3% this week as the USD and American Treasury yields fell on the juicier expectations that the Fed’s going to get well pivoting this year.

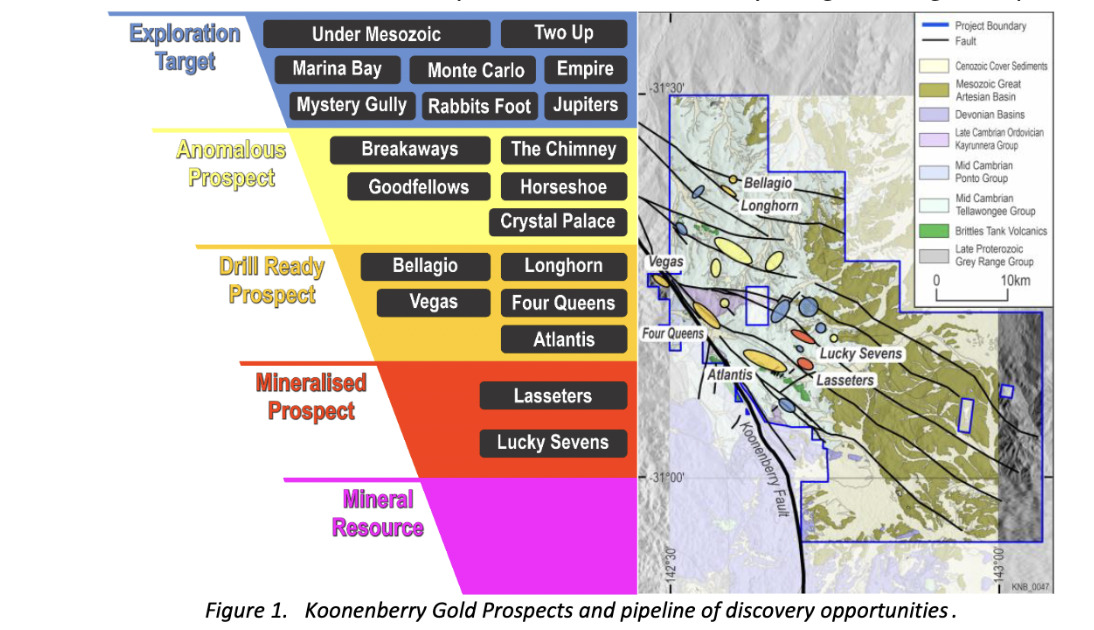

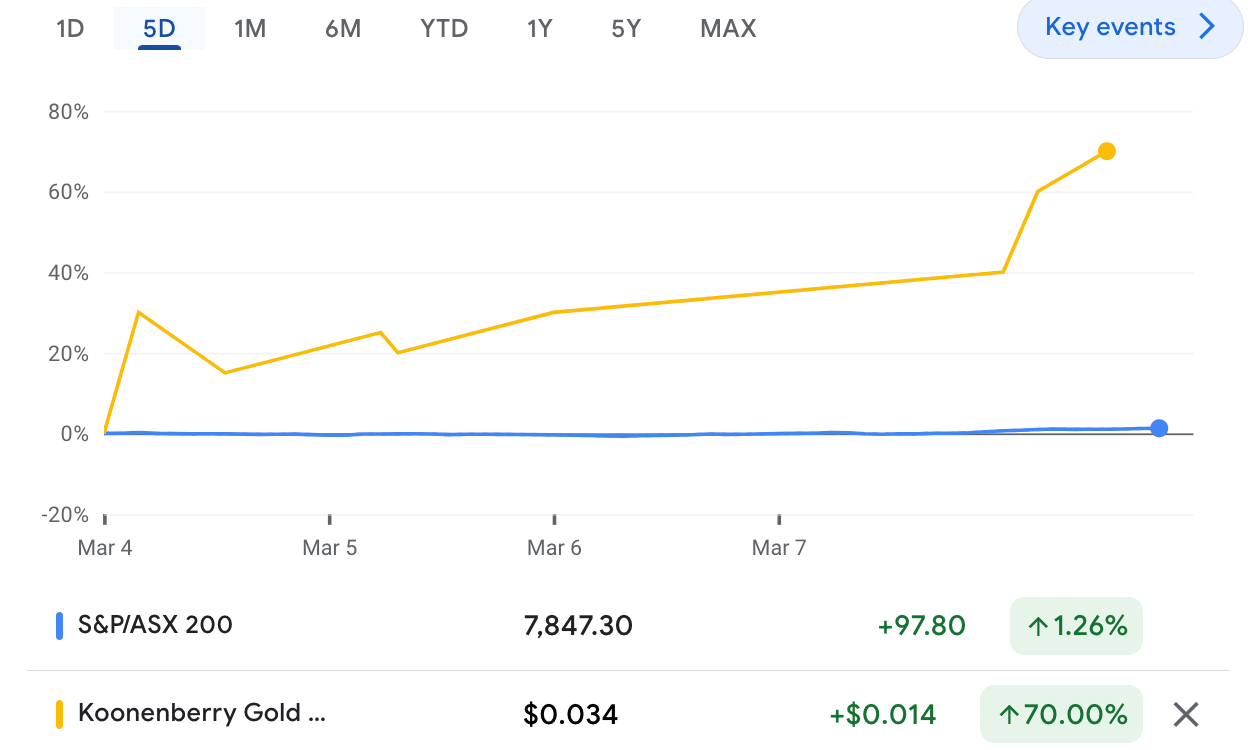

Into this heady atmosphere strode the junior gold explorer Koonenberry Gold (ASX:KNB) this week. KNB burst into life on Monday and has run happily up the bourse after after announcing a Placement and fully underwritten Entitlement Offer to raise $2.35 million (before costs).

This cash injection comes from a group of sophisticated investors and company directors, led by major small caps mining investor Lion Selection Group in the cornerstone position.

Funds raised will reportedly be used to advance exploration of KNB’s flagship gold and copper targets – the Bellagio and Atlantis projects – including high impact drilling programs.

The Bellagio prospect in northwestern NSW has pulled up high-grade gold rock chips to 39.4g/t Au with widespread bedrock gold mineralisation open in all directions and along +20km of the Royal Oak Fault.

The never-before-drill-tested Atlantis prospect, also in NSW, meanwhile boasts 15% Cu, 0.84g/t Au in rock chips and a 6.5km long soil anomaly.

This was Koonenberry Gold vs the ASX this week:

And that, lads and ladies, is why small caps are best.

So… who won the week? Let’s find out together…

ASX SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| KNB | Koonenberry Gold | 0.034 | 127% | $3,113,476 |

| SLZ | Sultan Resources Ltd | 0.028 | 115% | $3,852,941 |

| WWG | Wiseway Group | 0.1 | 113% | $16,562,093 |

| IMC | Immuron Limited | 0.145 | 101% | $28,474,793 |

| DCX | Discovex Resources | 0.002 | 100% | $6,605,136 |

| M4M | Macro Metals Limited | 0.006 | 100% | $16,872,467 |

| ABE | Australian Bond Exchange | 0.04 | 90% | $4,281,388 |

| EMD | Emyria Limited | 0.074 | 76% | $23,097,652 |

| OLL | Openlearning | 0.026 | 73% | $4,553,774 |

| SCN | Scorpion Minerals | 0.031 | 72% | $12,693,142 |

| MMM | Marley Spoon Se | 0.055 | 67% | $6,474,842 |

| NVQ | Noviqtech Limited | 0.005 | 67% | $6,547,226 |

| PRX | Prodigy Gold NL | 0.005 | 67% | $7,004,431 |

| NME | Nex Metals Explorat | 0.021 | 62% | $7,403,183 |

| AOA | Ausmon Resorces | 0.003 | 50% | $3,176,998 |

| ARV | Artemis Resources | 0.021 | 50% | $30,441,531 |

| CNJ | Conico Ltd | 0.003 | 50% | $4,710,285 |

| LRL | Labyrinth Resources | 0.006 | 50% | $7,125,262 |

| QEM | QEM Limited | 0.195 | 50% | $27,628,987 |

| QUE | Queste Communication | 0.066 | 50% | $1,786,774 |

| SXG | Southern Cross Gold | 1.7925 | 49% | $153,544,837 |

| AWJ | Auric Mining | 0.175 | 46% | $22,900,428 |

| OSX | Osteopore Limited | 0.66 | 45% | $6,765,291 |

| RAC | Race Oncology Ltd | 1.22 | 44% | $167,416,806 |

| HXG | Hexagon Energy | 0.017 | 42% | $6,667,907 |

| VMS | Venture Minerals | 0.024 | 41% | $53,200,313 |

| FTL | Firetail Resources | 0.058 | 38% | $8,636,522 |

| WA8 | Warriedar Resources | 0.04 | 38% | $21,849,814 |

| BGT | Bio-Gene Technology | 0.056 | 37% | $10,068,079 |

| GML | Gateway Mining | 0.03 | 36% | $10,363,783 |

| GNX | Genex Power Ltd | 0.245 | 36% | $339,368,399 |

| MAG | Magmatic Resrce Ltd | 0.068 | 36% | $13,756,176 |

| APX | Appen Limited | 0.765 | 35% | $164,431,403 |

| AQI | Alicanto Min Ltd | 0.035 | 35% | $18,460,104 |

| AUH | Austchina Holdings | 0.004 | 33% | $8,311,535 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | $12,677,188 |

| BTR | Brightstar Resources | 0.016 | 33% | $37,926,062 |

| H2G | Greenhy2 Limited | 0.008 | 33% | $3,350,047 |

| MRD | Mount Ridley Mines | 0.002 | 33% | $15,569,766 |

| OEC | Orbital Corp Limited | 0.16 | 33% | $18,225,842 |

| PKO | Peako Limited | 0.004 | 33% | $2,108,339 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TOU | Tlou Energy Ltd | 0.04 | 33% | $43,061,469 |

| TTM | Titan Minerals | 0.029 | 32% | $49,179,542 |

| ICL | Iceni Gold | 0.025 | 32% | $7,643,393 |

| 1TT | Thrive Tribe Tech | 0.021 | 31% | $5,932,430 |

| RNT | Rent.Com.Au Limited | 0.034 | 31% | $22,037,735 |

| BC8 | Black Cat Syndicate | 0.255 | 31% | $73,435,591 |

| WWI | West Wits Mining Ltd | 0.017 | 31% | $41,316,658 |

| PGC | Paragon Care Limited | 0.2675 | 30% | $180,324,408 |

As mentioned, our mates at Koonenberry, but the other eye-opening performances this week were all biopharma, medtech small caps.

On Tuesday it was Immuron (ASX:IMC) when topline results confirmed how good its headline travel medicine Travelan seems to also be in stopping diarrhoea and generally feeling crap.

IMC have caught the eye of the US D.O.D which needs some good travel meds because it seems all their guys get sick on the way to war, and even worse, stay sick whewn they get there.

I’m sure its not an aversion to bullets or getting shot at. It’s just sea sickness.

ASX SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| 1AG | Alterra Limited | 0.004 | -43% | $3,482,763 |

| ACS | Accent Resources NL | 0.006 | -40% | $4,731,273 |

| HHR | Hartshead Resources | 0.0075 | -38% | $28,086,821 |

| MSG | MCS Services | 0.005 | -38% | $990,498 |

| RFA | Rare Foods Australia | 0.029 | -36% | $6,148,480 |

| INP | Incentia Pay Ltd | 0.004 | -33% | $6,219,650 |

| RBR | RBR Group Ltd | 0.002 | -33% | $4,855,214 |

| ESK | Etherstack PLC | 0.2 | -29% | $29,037,140 |

| TNY | Tinybeans Group Ltd | 0.09 | -28% | $8,438,734 |

| X2M | X2M Connect Limited | 0.038 | -27% | $9,587,852 |

| WEC | White Energy Company | 0.035 | -26% | $3,963,237 |

| 1MC | Morella Corporation | 0.003 | -25% | $18,536,398 |

| EXL | Elixinol Wellness | 0.006 | -25% | $5,062,973 |

| LNR | Lanthanein Resources | 0.003 | -25% | $6,492,181 |

| RMI | Resource Mining Corp | 0.015 | -25% | $8,885,217 |

| TKL | Traka Resources | 0.0015 | -25% | $2,625,988 |

| TTI | Traffic Technologies | 0.006 | -25% | $4,546,021 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| DBO | Diabloresources | 0.022 | -24% | $2,267,571 |

| AYA | Artryalimited | 0.28 | -23% | $23,594,698 |

| HT8 | Harris Technology Gl | 0.01 | -23% | $2,991,355 |

| SSH | Ssh Group | 0.1 | -23% | $6,589,985 |

| VRC | Volt Resources Ltd | 0.005 | -23% | $24,780,640 |

| EMS | Eastern Metals | 0.027 | -23% | $2,307,935 |

| PTL | Prestal Holdings Ltd | 0.34 | -23% | $58,808,527 |

| TGN | Tungsten Min NL | 0.058 | -23% | $45,612,028 |

| ASP | Aspermont Limited | 0.007 | -22% | $17,189,443 |

| TG6 | TG Metals | 0.21 | -22% | $12,439,818 |

| XPN | Xpon Technologies | 0.021 | -22% | $6,982,988 |

| XST | Xstate Resources | 0.018 | -22% | $5,465,826 |

| PXX | Polarx Limited | 0.011 | -21% | $18,035,785 |

| IMI | Infinity Mining | 0.071 | -21% | $8,668,997 |

| ICR | Intelicare Holdings | 0.015 | -21% | $3,522,367 |

| SRJ | SRJ Technologies | 0.079 | -21% | $11,943,355 |

| JPR | Jupiter Energy | 0.019 | -21% | $24,199,392 |

| 5EA | 5Eadvanced | 0.23 | -21% | $73,595,248 |

| AGH | Althea Group | 0.028 | -20% | $10,693,187 |

| ASQ | Australian Silica | 0.04 | -20% | $11,838,136 |

| CR9 | Corellares | 0.02 | -20% | $10,231,999 |

| CTN | Catalina Resources | 0.004 | -20% | $4,953,948 |

| EOF | Ecofibre Limited | 0.08 | -20% | $32,204,282 |

| TMX | Terrain Minerals | 0.004 | -20% | $5,726,683 |

| PAA | PharmAust Limited | 0.28 | -20% | $109,364,760 |

| EUR | European Lithium Ltd | 0.069 | -20% | $96,202,503 |

| PLG | Pearl Gull Iron | 0.025 | -19% | $5,113,545 |

| SEG | Sports Entertainment Group | 0.19 | -19% | $50,302,194 |

| DAL | Dalaroo Metals | 0.017 | -19% | $1,324,000 |

| ICU | Investor Centre Ltd | 0.017 | -19% | $6,367,159 |

| MRZ | Mont Royal Resources | 0.064 | -19% | $5,441,907 |

| PV1 | Provaris Energy Ltd | 0.03 | -19% | $17,938,141 |

HOW THE WEEK SHOOK OUT

Monday 4 March, 2024

Koonenberry Gold (ASX:KNB) wowed with the news of its capital raise. ‘Nuff said.

The cybersecurity stock WhiteHawk (ASX:WHK) jumped 60% on Monday and several hundred per cent last week, on the back of its AI strategy announcement last week.

Queensland renewable energy company Genex Power (ASX:GNX) announced it had received an indicative bid proposal from Japan’s Electric Power Development, J-Power, valuing its equity at ~$380m or 27.5c a share.

Calix (ASX:CXL) soared after announcing that the Leilac-2 (Low Emissions Intensity Lime And Cement) project will be hosted at Heidelberg Materials’ (FWB: HEI) cement plant in Ennigerloh, Germany. The selection of Ennigerloh as the project’s host plant is the result of a thorough site assessment process that followed Heidelberg Materials’ decision to end clinker production in Hanover.

FireFly Metals (ASX:FFM) announced more wide high-grade copper-gold intersections from its drilling program at the Green Bay project in Canada. Results include: 18.0m at 3.3% CuEq within a broader copper zone of 41.1m at 2.3% CuEq, and 18.8m at 3.5% CuEq within a broader copper zone of 47.1m at 2.4% CuEq.

Tuesday 5 March, 2024

Alara Resources (ASX:AUQ) completed the commissioning and the commencement of concentrate production at its Wash-hi – Majaza Mine and copper concentrate plant in Oman.

AUQ says production will ramp up to full capacity over the next two to three months.

The sale of the first shipment – approximately 1000 dry metric tons of copper concentrate – to Trafigura is expected in April 2024.

Dynamic Metals (ASX:DYM) entered a lucrative farm-in and joint venture agreement with Mineral Resources (ASX:MIN) over the lithium rights to its Widgiemooltha project in the WA Goldfields. The Chris Ellison-company is eligible to earn up to 80% of the tenements via a total exploration spend of $20 million, through to a decision to mine.

Fin Resources (ASX:FIN) was buoyed by a review of work carried out historically on its Ross project in Quebec which identified highly anomalous uranium in soil sampling, including up to 1,486ppm U3O8 associated with low thorium.

Noble Helium (ASX:NHE) says its plans to monetise the helium potential of its North Rukwa project in Tanzania have received a major boost after further detailed analysis and integration of well data indicates the probable free gas cap at Mbelele to be six times larger than originally mapped.

Telix Pharma (ASX:TLX) rose 2% after proposing to acquire Canada-based diagnostic imaging isotope specialist ARTMS for $US42.5M worth of TLX shares upfront, and a further $US15m in earnouts.

And Nova Eye Medical (ASX:EYE) has reported a record sales month for February with US$0.99 million (A$1.52 million) in the bank following improved uptake of its iTrack Advance glaucoma surgical devices.

Wednesday 6 March February, 2024

Atomo Diagnostics (ASX:AT1) rocketed by as much as 90% after announcing that it has secured a significant order for its HIV Self-Tests.

Atomo said it secured purchase orders from US-based Viatris Healthcare for approximately $970k worth of HIV Self-Tests, manufactured by Atomo under the Mylan brand, for supply to a number of Low- and Middle-Income Countries (LMICs).

AdAlta (ASX:1AD) announced key results from its Phase 1 extension study of lead asset AD-214, a drug for fibrotic diseases.

AdAlta says the results have positively answered key partnering discussion questions to support progressing AD-214 to Phase II clinical studies in Idiopathic Pulmonary Fibrosis (IPF).

Metalicity (ASX:MCT) says drilling approvals at its 80% owned Yundamindra Gold Project (20% owned by JV partner Nex Metals Exploration (ASX:NME) have been lodged for the first drilling program in over a decade. MCT says following favourable Wardens Court decisions regarding the Yundamindra tenements, the company has been undertaking extensive internal and external review of all historical data and activities at the highly prospective gold project.

Thursday March, 2024

Immuron (ASX:IMC) jumped 80% after announcing interim topline results confirming the efficacy of Travelan in preventing diarrhoea following a bout of enterotoxigenic Escherichia coli (ETEC). The study on 60 patients show that a single daily dose of Travelan is 36.4% effective in the prevention of moderate to severe diarrhoea induced by ETEC, when compared to the placebo group in the study. Around 66.7% protective efficacy against ETEC-induced severe diarrhoea was also observed in the patients taking Travelan, compared to the placebo group (secondary endpoint).

Heavy Minerals (ASX:HVY) has signed a non-binding Memorandum of Understanding with ABSS for the future sales of a minimum of 15,000 tonnes per annum of garnet to be produced at its Port Gregory Project for an initial three-year period. This offtake will account for approximately 10% of the Company’s annual future garnet production at its Port Gregory Project and will be sold into the Australian and New Zealand sand blasting and water jet cutting markets by ABSS.

Widgie Nickel (ASX:WIN) says its Mt Edwards project has benefited from the Federal Government’s call to put nickel on the critical list, as that has propelled the project into feasible, standalone territory. Widgie says a fresh scoping study shows that it’s good for an 800ktpa standalone nickel concentrator producing 103,000tpa @ 10.1% Ni concentrate for 10,380 tonnes of contained nickel per year.

Friday 01 March, 2024

Magmatic Resources (ASX:MAG) says a farm-in and Joint Venture Agreement has been executed with Fortescue (ASX:FMG) at the Myall Project. Fortescue will spend up to $14m over six years to earn up to 75% joint venture interest in the project. Fortescue will also subscribe for 75,946,151 shares in MAG shares at a price of $0.04884 per share to hold a 19.9% stake in the company.

OpenLearning (ASX:OLL) says it’s signed a three-year platform SaaS and content licence deal with the Asia Pacific International College. OLL says the minimum value is $1.07 million. APIC is a higher education institution with campuses in Sydney, Melbourne and Brisbane that offers undergraduate and postgraduate degree courses to over 4,000 students per year.

Imricor Medical Systems (ASX:IMR) says the Ethics Committee at Lausanne University Hospital (CHUV) has approved its VISABL-AFL clinical trial. This is the first of two approvals required for CHUV to join the trial. The final approval required is from Swissmedic, the competent authority in Switzerland. VISABL-AFL is the global trial to support US FDA approval of Imricor’s products.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.