ASX Small Caps Lunch Wrap: Whose hypernerd hobby cost them a cool US$2 million this week?

News

News

Local markets are down this morning, diving 0.2% when the bell rang as the knock-on from Friday’s not-very-splendid session on Wall Street hung around for the weekend, just so it could mug us all this morning.

By lunchtime, things had worsened somewhat, leaving the benchmark down 0.3%.

But before I get into the market’s meaty bits this morning, a news story from the Land of the Everlasting Nerds caught my eye over the weekend, stirring up some very deep memories and making me wonder whatever happened to a card collection that, once upon a time, I was proud of and ashamed of in roughly equal measures.

It may surprise some people to learn that, when I was a much younger man, I was heavily into role playing, but not the “let’s pretend you’re a naughty maid and I’m a creepy old magistrate” kind.

This was very much the “let’s all go and slay the dragon”, Dungeons and Dragons kind, though, the kind of role-playing that both fed my love of imagination and adventure, while at the same time basically making me 100% girl-proof from the eyebrows, down.

The lads I played were the usual ragtag bunch of eggheads, a walking advertisement for deodorant and zit cream. The poster children of the generation before people realised that it’s a profoundly bad idea to drop babies on their heads.

When we weren’t playing Dungeons and Dragons, a few of us were well into a card game called Magic: The Gathering, an early form of NFT-esque gambling that involved spending huge sums of money collecting hundreds and hundreds of packs of cards, in the vague hope that there would be something of value inside.

In the 10 or so years that I played that particular game, I never got lucky. I was the proud owner of several binders of carefully preserved cards that were, upon reflection, worth far less than I’d ever spent on them.

These days, those cards are worth small fortunes in some cases, with some cards so scarce they attract preposterous sums of money if they’re ever put up for sale. And recently, the publishers of the game spruiked the release of a one-off, featuring The One Ring made famous by Frodo and that lot in Lord of the Rings.

Magic: The Gathering fans, predictably, went berserk – and the global Wonka-like hunt for the rarest card ever began, with bounties up to US$1 million on offer to whoever was the lucky player to find it.

That honour went to a fella called Brook Trafton, a forklift driver/retail worker from deep within Middle America, who bought the card pack for $50, pulled The One Ring card and was lucky not to die of a heart attack.

Within days, Trafton was officially a millionaire, after a singer (I think… it’s hard to tell) called “Post Malone” bought the card for US$2 million.

Post (that’s what all the cool kids call him) at first seems like an unlikely candidate to drop that kind of money on a rare piece of cardboard, but upon reflection it very much makes sense, given his signature ‘look’ is a startling combination of “Human Magic: The Gathering card” and “I routinely make terrible life choices”.

This is normally the point of the story where I’d descend into a rant about people who have too much money, and how celebrities are all terrible with their money, but it’s hard to see past just how happy those two goofballs look, each for their own reasons of course.

I guess the lesson here is simple enough, though – next time you (and by ‘you’, I really mean ‘me’) get snarky about how NFTs were the modern day Tulip Bubble, there’s always going to be a market for silly things like this – as long as rich celebrities exist, anyway.

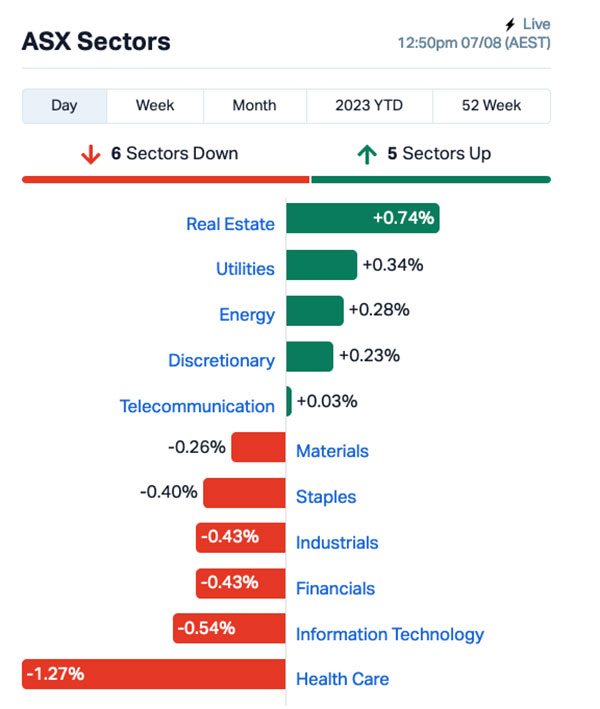

After a 0.2% drop at open, things looked like they were improving for local markets by 11:00am today. But as we trundle into the lunch break, the benchmark’s down to -0.3% thanks to Health Care, InfoTech and the hugely influential Financials sectors all taking a bit of a bath.

On the upside, though, Real Estate’s banking a solid set of figures this morning, up 0.74% so far.

Plus, we’re seeing a surge from the goldies, with the XGD All Ords Gold index up 0.3% for the morning, while our bread and butter – the XSO Small Ordinaries – is outpacing the market handsomely as well, up 0.18%.

There’s not a lot to crow about up the top end of town, but it’s bad news for Block Inc (ASX:SQ2), with the dual-lister starring in a three-hour, back-alley beating this morning that’s seen it plummet more than 10%, following the 19% beating it took in the US.

Block delivered a quarterly to Wall Street on Friday that showed that the company’s US$5.5b in revenue had come in 8.5% ahead of expectations, but that’s pretty much where the good news ends.

Statutory earnings came in around 5.0% below consensus predictions at US$0.20 per share, sending investors scattering both in the US and locally this morning.

Wall Street ended the week on a low note on Friday, leaving the S&P down 0.53$, the Dow lower by 0.43% and the Nasdaq pointing 0.36% lower as well.

Apple fell 5% as its market cap slipped below US$3 trillion after posting a 1% decline in quarterly sales, and also played a part in Paypal’s 2% fall concerns over the latter’s margins and competition from Apple Pay.

Amazon, however, popped nicely again – up 8% after delivering strong profit for the quarter on e-commerce and cloud sales.

Earlybird Eddy Sunarto’s been over some data from Refinitiv, and reports that of the 392 companies in the S&P 500 that have reported quarterly earnings, almost 80% have beatean analysts’ estimate.

Meanwhile, traders assessed non-farm payrolls data, which increased by 187,000 jobs last month.

“The Fed has likely ended its most aggressive tightening campaign in generations, with a reasonable path to a soft landing,” said Candice Tse of Goldman Sachs.

Bond yields fell after the jobs report – suggesting bets on lower rates – with the 10-year Treasuries yield declining 13bp to 4.05%.

In commodities, gold rose modestly by 0.15% to US$1,944.99 an ounce, and crude prices climbed by 0.5%, with WTI now trading at US$83.21 a barrel, as Saudi increased prices for most of its crude to Asia for September deliveries.

Iron ore 62% fe rose almost +1% to $US105.18/tonne, still perilously close to the US$100/tonne low water mark, thanks to ongoing slump in demand from China.

Alarmingly, global rice prices are heading for 12-year highs, after India slapped an export ban on non-Basmati rice in a bid to curb domestic supply issues.

India currently accounts for more than 40% of the world’s rice export market, and the export ban will place enormous pressure on basic food security for millions of people around the world, who rely on rice as a staple.

In Japan, the Nikkei is flattish at just -0.07%, as the nation grapples with a graffiti attack on one of its most iconic national treasures, the Nigatsudo prayer hall complex at Todaiji Temple, in Nara Prefecture, south-central Honshu.

Japan is not just appalled that the temple – constructed during the Kamakura period of Japanese history between 1185 and 1333 – has been defaced, but also at how laughably bad the vandal’s artistic skills appear to be.

It’s a picture of a cat – or, as it’s more accurately being described by local media – a “cat-like shape”, scrawled on a temple door at a height suggesting that it was done by an adult, or three small children in a trench coat.

Either way, it’s a terrible eyesore, as this incredible footage of a man pointing angrily clearly shows.

Meanwhile in China, Shanghai markets are down 0.64% this morning, while in Hong Kong the Hang Seng is flat.

In crypto news, BTC is up 0.3% over the past 24 hours to $29,125, ETH is up 0.23% to US$1,839 and XRP has fallen 1.27% to US$0.623.

Here are the best performing ASX small cap stocks for 07 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LIT Lithium Australia 0.051 55% 44,628,697 $40,299,325 EDE Eden Inv Ltd 0.004 33% 349,989 $8,990,833 MTH Mithril Resources 0.002 33% 500,052 $5,053,207 BDX BCAL Diagnostics 0.14 33% 1,035,457 $22,201,597 G1A Galena Mining 0.115 26% 6,388,224 $68,483,751 GES Genesis Resources 0.005 25% 7,500 $3,131,365 TSN The Sustainable Nutrition Group 0.01 25% 18,087 $1,126,103 RML Resolution Minerals 0.006 20% 1,012,451 $6,286,459 SGC Sacgasco Ltd 0.006 20% 376,400 $3,867,914 MEM Memphasys Ltd 0.016 19% 5,836,339 $12,953,525 TIG Tigers Realm Coal 0.007 17% 220,801 $78,400,214 BBT Bluebet Holdings Ltd 0.29 16% 191,764 $50,065,315 KNB Koonen Berrygold 0.051 16% 95,000 $3,333,284 HXL Hexima 0.022 16% 123,147 $3,173,753 VAR Variscan Mines Ltd 0.015 15% 417,000 $4,394,047 VMM Viridis Mining 0.69 15% 945,894 $18,725,399 RNO Rhinomed Ltd 0.07 15% 100,202 $17,428,901 ARV Artemis Resources 0.0195 15% 2,896,936 $26,688,612 NRX Noronex Limited 0.016 14% 81,500 $4,412,678 SIS Simble Solutions 0.008 14% 661,000 $4,220,655 CPV Clearvue Technologie 0.34 13% 1,009,378 $65,151,527 SCT Scout Security Ltd 0.017 13% 50,000 $3,460,020 ERW Errawarra Resources 0.13 13% 305,437 $6,957,960 ORR Orecorp Ltd 0.49 13% 1,825,923 $173,563,938 N1H N1 Holdings Ltd 0.18 13% 1,000 $14,088,892

Top of the Small Caps ladder this morning is Lithium Australia (ASX:LIT), which has popped a 64% jump this morning on news that the company has signed a landmark agreement with industry giant Mineral Resources (ASX:MIN), related to LIT’s “disruptive lithium extraction technology” called LieNA.

The agreement is simple enough: Lithium Australia is bringing its LieNA technology to the table, which is shaping up as a game-changer for lithium production offering up to 50% improvements to extraction yields over existing tech.

In return, MinRes is opening its hefty-sized chequebook to solely fund the development and operation of a pilot plant up to the total budgeted cost of $4.5 million and provide raw materials for the pilot plant at no cost.

A 50:50 joint venture to own and commercialise the LieNA technology through a licensing model is also potentially on the table.

Second-best this morning is Bcal Diagnostics (ASX:BDX), continuing its run of gains in the wake of last week’s news of breakthrough results from a clinical study, giving the company a solid footing towards commercialisation of its much-needed breast cancer screening tech.

And in third place, it’s Galena Mining (ASX:G1A) on news of a JORC-compliant Mineral Resource Estimate update from the company’s Abra Base Metals Mine.

It’s the first MRE annual update including all underground diamond drilling up to 5 May 2023, and all underground geological mapping, and mining and processing up to 30 June 2023.

The company reports that the updated MRE of 33.4Mt at 7.1% Pb and 17g/t Ag (5% Pb cut-off grade) – including 0.3Mt at 7.3% Pb and 32g/t Ag measured, 16.2Mt at 7.3% Pb and 19g/t Ag indicated and 16.9Mt at 6.9% Pb and 15g/t Ag inferred – shows “no material difference” from the previous MRE in April 2021, supporting Abra’s long-term lead-silver mining plans.

Here are the most-worst performing ASX small cap stocks for 07 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 294,081 $11,649,361 CLE Cyclone Metals 0.001 -50% 2,161,227 $20,529,010 DXN DXN Limited 0.001 -50% 204,082 $3,442,630 TD1 Tali Digital Limited 0.001 -33% 4,581 $4,942,733 MCT Metalicity Limited 0.0015 -25% 50 $7,472,172 CLA Celsius Resource Ltd 0.018 -18% 30,177,243 $49,293,637 MXO Motio Ltd 0.037 -21% 98,543 $12,287,429 BPP Babylon Pump & Power 0.004 -20% 175,000 $12,288,857 LSR Lodestar Minerals 0.008 -20% 16,766,027 $18,433,973 ROO Roots Sustainable 0.004 -20% 3,333 $693,611 THR Thor Energy PLC 0.004 -20% 3,415,502 $7,296,457 CMX Chemx mMaterials 0.095 -17% 153,169 $5,826,029 AJX Alexium Int Group 0.015 -17% 6,511 $11,725,016 HFY Hubify Ltd 0.025 -17% 83,093 $14,884,089 BNO Bionomics Limited 0.01 -17% 2,151,185 $17,624,825 CT1 Constellation Tech 0.0025 -17% 600,994 $4,413,601 MRQ MRG Metals Limited 0.0025 -17% 4,808,178 $5,957,756 NAE New Age Exploration 0.005 -17% 1,295,691 $8,615,393 SP3 Spectur 0.021 -16% 4,844 $5,644,622 ADY Admiralty Resources 0.006 -14% 4,000 $9,125,054 ELE Elmore Ltd 0.006 -14% 4,393,820 $9,795,687 IVX Invion Ltd 0.006 -14% 7,392 $44,951,425 YPB YPB Group Ltd 0.003 -14% 200,179 $2,602,115 BUR Burley Minerals 0.125 -14% 1,275,241 $14,688,030 PFT Pure Foods Tas Ltd 0.095 -14% 150,247 $12,071,391