ASX Small Caps Lunch Wrap: Who’s working hard to stop children from exploding this week?

News

News

After an incredibly brief blast of hope that saw the benchmark spike 0.1% into positive territory this morning, local markets suddenly remembered where they are, and sank like a stone to -0.16% within 30 minutes of opening this morning.

With the May ASX 200 futures contract pointing down by 0.4% at 8am this morning, the detonation wasn’t quite as bad as some were expecting when the bell rang – but there’s still plenty of time left today for the market to sag even more.

But first, and speaking of things that like to blow up, there’s some exciting news from the world of batteries, after a team of researchers at the Italian Institute of Technology (IIT) in Milan developed an edible battery.

This is, obviously, a massive blow to the nation’s red-hot lithium and battery metals scene, as the new batteries don’t contain anything that isn’t capable of being digested.

The reason digestion is an issue is because children are thicker than pigsh*t, especially when it comes to putting stuff in their mouths that has absolutely no business being there.

According to the researchers who have developed this edible battery, about 2,500 kids are hospitalised in the United States every year after eating the batteries that power their otherwise harmless toys.

Batteries which – as we all know – contain all manner of things that are generally considered to be “not food” and therefore “incredibly dangerous” for growing bodies.

But it’s not just the toxicity of what lurks inside your average dry-cell battery. There’s also a risk from the chemical reaction that takes place when batteries – even the little tiny ones – end up in someone’s stomach.

And that’s where the magic of “water electrolysis” can have a disastrous effect.

The end result is a) great material for a new Roald Dahl novel and b) the potential to turn Little Timmy’s tummy into a walking bomb, capable of taking out a few city blocks if the gas gets ignited.

For a reminder of what happens when large quantities of hydrogen ignite, here is footage of one of the most horrendous disasters of all time:

See ground footage of the Hindenburg disaster, 80 years after the fatal flight. https://t.co/VQFKgPYlMK pic.twitter.com/xzCy7HEHus

— Getty Images (@GettyImages) May 6, 2017

Anyhow – according to the research team, the main components of their edible battery include:

For those wondering how gold is considered “edible”, it’s the same stuff that International Bozo Salt Bae uses to make other idiots pay thousands of dollars for a “gold-plated”, poorly-cooked steak.

My world 🔪 Benim Dünyam #saltbae #salt#saltlife pic.twitter.com/ra6ORw6MuY

— @nusr_et#Saltbae (@nusr_et) May 30, 2018

How great is science?

Right, I’ve got to go and see some people about a dog, so I’m passing the baton to my degenerate crypto “investing” colleague Bob Radman to fill in the rest.

I know you’ll be fascinated to learn that the new meme coin “LADYS” is up by a gazillion per cent this morning, Gregor. Elon Musk is up to his old crypto-pumping tricks again.

But moving on to more pertinent matters that make (a fraction) more sense than anything related to the crypto gambling den… the ASX is indeed dipping – as predicted further above and as our resident markets soothsayer Eddy Sunarto gleaned when he examined the entrails of some roadkill on the way into the office this morning.

After that brief frisson Gregor was talking about, the ASX 200 has erectile dysfunctioned by -0.30% at the time of writing.

But why, when, for instance the influential US stock markets appear to have received a tiny amount of relief with a cooler-than-expected inflation report via the latest Consumer Price Index?

There have been mixed reactions on Wall Street to that so far. And, as the dust settles on our Federal budget here, there are certainly mixed feelings about that, too, which might well be seeing investors tread carefully this week.

Middle Australia faces an economic penalty from Labor’s big-spending second budget, with analysts warning that mortgage holders are likely to be hit with higher interest rates despite government assurances. https://t.co/BoSnREv6hF

— The Australian (@australian) May 10, 2023

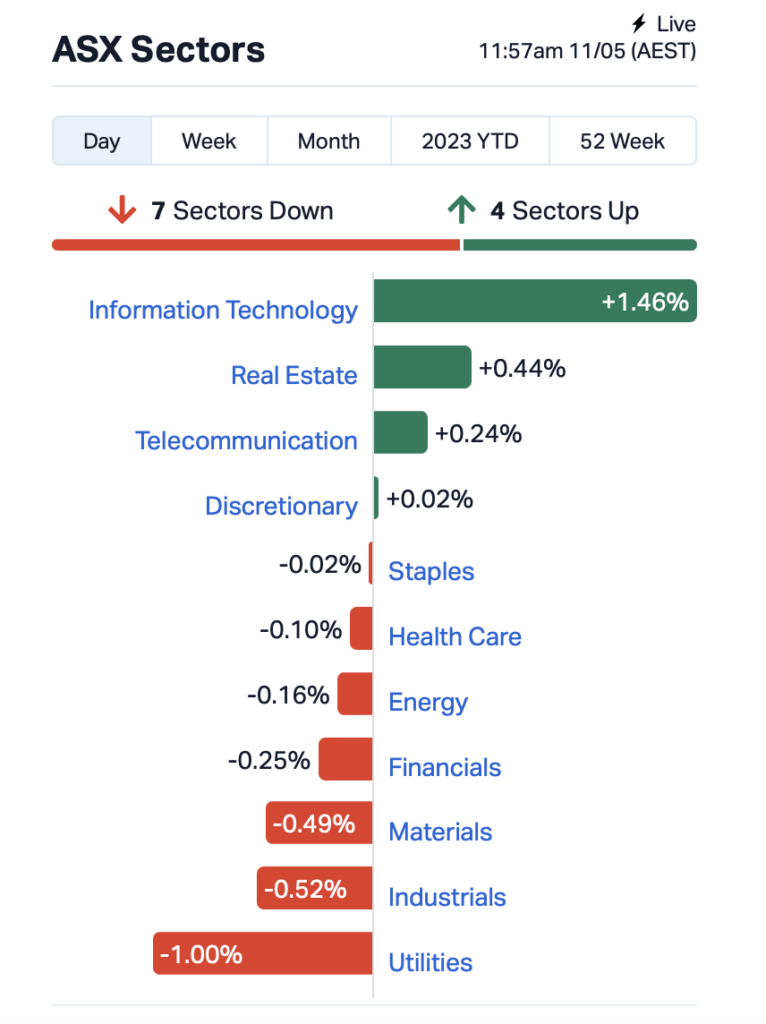

Let’s quickly dig into the sector-specific happenings this morning…

Utilities, Industrials and Materials are leading the laggards, while IT, Real Estate and Telcos are keeping heads above water well enough today.

In Large-ish cap news, the quite massive story is that shares in the global lithium mining company Allkem (ASX:AKE) have been rocketing (+15.5% at present) after it announced an agreement to merge with US lithium titan Livent Corp, which sports the ticker (NYSE: LTHM).

What else is happening in unicorn territory? Graincorp (ASX:GNC) is having a good one, too, up about 8% on some decent 1H23 earnings figures.

The CPI data and softening inflation ought to be pumping markets, one might assume. But that’s not exactly the case at the moment, with mixed feelings emanating from major US indices (S&P closing in the green, Dow and Nasdaq in the red).

As Eddy “Market Highlights” Sunarto notes, New York Fed Reserve President John Williams said this week that it was too soon to say whether the Fed is done raising interest rates.

“We haven’t said we are done raising rates. If additional policy firming is appropriate, we’ll do that,” he said.

And as for a looming recession that’s keeping investors fearful… haven’t we already been technically (if not “officially”) navigating one for the past several months to year? We’ve seen corrections on risk assets, major companies correcting 25-40%, the US dollar climb and rate hikes a-go-go.

The US debt ceiling (upper limit on how much a government can borrow) issue is a factor for investors, too, notes Eddy. We might know slightly more about what the US government intends to do about that by Friday (or Saturday here in Oz).

Treasury Secretary Janet Yellen on the weekend said that failing to raise the debt ceiling will cause a “steep economic downturn” in the US.

The empire of debt has no choice but extend the debt ceiling or everything collapses.

The pretense of sound & responsible budgets is just that, a pretense.

Reality is none of it can be sustained with current rates as ever more debt is required.

Jay knows it. Janet knows it.— Sven Henrich (@NorthmanTrader) May 9, 2023

How much is the US currently in debt? Ah it’s only US$31.7 trillion or so and counting.

Meanwhile, over in the far-off land of magical internet money (that’d be crypto), Bitcoin had a little pump on the CPI news, then a little dump, and now it’s about right back to where it was all sitting this time yesterday.

Yes, there’s more nuance to it than that, and other things are afoot, including something called Milady Meme Coin, which none other than Elon Musk has managed to send into the stratosphere faster than one of his rockets.

You can find out more about that craziness over at Mooners and Shakers.

Here are the best performing ASX small cap stocks for May 11 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ADS Adslot Ltd. 0.006 50% 36,930 $8,817,394 ILA Island Pharma 0.12 46% 150,625 $6,664,014 FTC Fintech Chain Ltd 0.015 36% 18,705 $7,158,465 BAT Battery Minerals Ltd 0.004 33% 3,139,863 $10,070,827 PRS Prospech Limited 0.042 27% 33,388,234 $7,203,166 BGT Bio-Gene Technology 0.13 24% 21,100 $18,588,498 CYQ Cycliq Group Ltd 0.006 20% 774,999 $1,737,583 BMO Bastion Minerals 0.025 19% 5,440,105 $3,347,643 PNN Power Minerals Ltd 0.41 17% 178,520 $25,316,999 HOR Horseshoe Metals Ltd 0.021 17% 469,123 $11,501,166 CPT Cipherpoint Limited 0.007 17% 29,638,755 $6,955,450 OAR OAR Resources Ltd 0.0035 17% 72,512 $7,233,114 AKE Allkem Limited 14.895 15% 8,232,067 $8,232,165,890 ZEU Zeus Resources Ltd 0.023 15% 2,998,617 $8,766,000 BRK Brookside Energy Ltd 0.016 14% 20,491,859 $70,203,639 ODE Odessa Minerals Ltd 0.008 14% 350,512 $5,187,418 JGH Jade Gas Holdings 0.057 14% 401,471 $50,270,210 LEL Lithenergy 0.83 14% 588,173 $43,909,500 GLN Galan Lithium Ltd 1.17 14% 1,835,525 $316,122,867 DNA Donaco International 0.044 13% 160,000 $48,180,186 OLL Openlearning 0.044 13% 25,000 $10,446,894 NIM Nimy Resources 0.22 13% 230,917 $13,234,416 LKE Lake Resources 0.575 13% 13,514,169 $725,446,801 IND Industrial Minerals 0.45 13% 106,008 $11,940,000 RTH Ras Technology Holdings 0.495 13% 47,039 $20,001,777

A couple of standouts:

• Prospech (ASX:PRS): +27% on news that an inspection of the “historic” drill core site at the Korsnäs Project in Finland has identified zones of potentially Rare Earth Element (‘REE’) mineralised carbonatite.

• Cipherpoint (ASX:CPT): +17% on news that the cybersecurity services firm’s subsidiary Excite IT has signed a managed services agreeement with the Lendlease Retirement Living business, worth $4.1 million.

Here are the most-worst performing ASX small cap stocks for May 11 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap APC Aust Potash Ltd 0.012 -33% 15,233,638 $18,696,201 AXP AXP Energy Ltd 0.002 -33% 51,344 $17,474,042 AHN Athena Resources 0.003 -25% 3,828,797 $4,281,870 MRD Mount Ridley Mines 0.003 -25% 151,434,313 $31,139,531 MXC Mgc Pharmaceuticals 0.007 -22% 1,388,270 $30,147,237 AHF Aust Dairy Limited 0.02 -20% 4,888,542 $14,712,889 DAF Discovery Alaska Ltd 0.043 -19% 148,025 $12,414,439 CMO Cosmo Metals 0.1 -17% 95,764 $3,061,200 IMI Infinity Mining 0.1425 -16% 70,553 $13,001,314 MDX Mindax Limited 0.105 -16% 1,136,508 $255,694,848 BYH Bryah Resources Ltd 0.016 -16% 131,602 $5,343,816 ENV Enova Mining Limited 0.011 -15% 40,000 $5,082,081 KNM Kneomedia Limited 0.006 -14% 823,700 $10,533,497 NTM Nt Minerals Limited 0.007 -13% 12,340 $6,405,591 PVS Pivotal Systems 0.007 -13% 200,000 $4,026,834 RLG Roolife Group Ltd 0.007 -13% 289,357 $5,756,465 LLO Lion One Metals Ltd 1 -12% 16,689 $13,817,894 S3N Sensore Ltd 0.265 -12% 5,000 $7,831,120 LVH Livehire Limited 0.07 -11% 212,172 $26,907,476 NOL Nobleoak Life Ltd 1.6 -11% 17,800 $154,727,428 RML Resolution Minerals 0.004 -11% 70,000 $5,642,063 TYM Tymlez Group 0.008 -11% 2,487,621 $9,829,758 YOJ Yojee Limited 0.016 -11% 2,258,656 $20,402,323 ATP Atlas Pearls Ltd 0.033 -11% 30,140 $15,831,255 AGR Aguia Res Ltd 0.035 -10% 428,986 $16,920,316