ASX Small Caps Lunch Wrap: Who else reckons yoga is absolute murder today?

News

News

For about 10 minutes this morning, things on the ASX were looking pretty good – the benchmark was up 0.06% in pretty short order, and there were a few interesting looking early risers that looked like they might have had the legs to carry things forward, at least until morning tea.

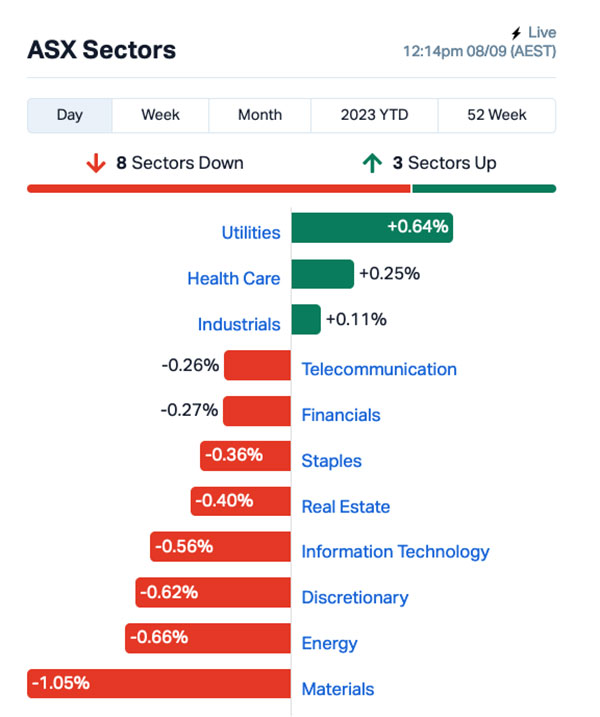

But then, just as quickly, things became less pleasant, and as the morning turns to lunchtime, the benchmark is down about 0.5% with only Utilities and Health Care on the right side of zero for the day.

I’ll have more on that in a moment, because first – as always – I have news.

This time, it’s coming all the way from Ol’ Blighty, where a couple of well-meaning dog walkers were shocked when they accidentally stumbled upon a bizarre ceremony taking place inside the North Sea Observatory in Chapel St Leonards, Lincolnshire.

The couple were wandering past the venue and, being the good and responsible local citizens they are, figured they had the right to go peering in through the windows – where they got the shock of their boring little lives.

Inside, they saw a room, dimly lit by a scattering of candles on the floor, and a woman wearing robes while pacing slowly around the room, gently beating a ceremonial drum as she strolled among seven motionless bodies.

Like every completely normal and rational person on the planet, they immediately came to the conclusion that they were witnessing a “ritual mass murder”, and called the cops.

Lincolnshire police dispatched five squad cars to the scene, expecting the scene to be an absolute gore-fest with a lone female maniac in the middle of the whole, sorry mess.

What they found was even worse – a Yoga class.

The yoga teacher, 22-year-old Millie Laws, explained to local media that the couple happened to be looking into the room during the Shavasana stage of the lesson, which is the bit where everybody lies on the floor to thank a few multi-armed deities that their 45-minute ordeal was now over.

“They’re [students] laying down with blankets over them, their eyes are closed. It’s very dark in there. I just had candles and little tea lights lit the whole room, and I was just walking around playing my drum. I had a nice floaty top on with large bell sleeves,” Ms Laws told the BBC.

Ms Laws only moved into the small seaside community about three months ago, and will no doubt be hounded out of town in very short order by irate locals, “because she’s a witch”.

And speaking of witchcraft, it’s time to take a look at how the markets are doing today.

They are not doing well. As noted earlier, the first 10 minutes this morning looked excellent, right up to the moment that it stopped looking excellent and became a disappointment.

The benchmark is hovering between -0.4% and -0.5%, despite a mid-morning but short-lived rally that fizzled out in pretty short order.

Utilities is the best performing sector, and at lunchtime it’s out in front of Health Care and Industrials as the only sectors making gains so far today.

As you can see, the rest aren’t faring too well, with the Materials sector off by more than 1.0% and the rest on soft, soggy ground.

Up the top end of town, Westgold Resources (ASX:WGX) is the biggest name on the winner’s list today, up 6.2% on no particular news.

Losing ground this morning is Audinate Group (ASX:AD8), down more than 9.0% on news that it has raised A$50 million through an Institutional Placement supported by existing institutional shareholders and new institutional investors.

And Qantas (ASX:QAN) is down another 1.7% today, as the company doggedly pushes forward with its plan to sink its stock price to half mast, as it mourns the early departure of CEO Alan Joyce.

Wall Street’s news was dominated overnight by China’s decision to ban iPhones (and other foreign-branded mobile devices) from use by government officials, after the orders were distributed to staff during the week.

It’s a curious decision from China – one which is reportedly based on China’s push to become less reliant on US-owned technology – especially for the countless thousands of workers in Foxconn’s massive manufacturing communities, where the phones are being confiscated almost as quickly as the kids can put them together.

Apple stock has fallen about 5% this week.

In broader terms, Wall Street delivered mixed results, leaving the S&P 500 down by -0.32%, the blue chips Dow Jones up by +0.17%, while the tech-heavy Nasdaq slumped -0.89%.

Earlybird Eddy reports that the China/Apple ructions also sent microchip stocks, including Nvidia, Skyworks, Qualcomm and Qorvo, falling after the news broke out.

The rot also spread across the Atlantic to European markets, where Apple supplier STMicroelectronics slumped 4%, along with other semiconductor chips including BE Semiconductor, Nordic Semiconductor and ASM.

In economic news, US bond yields fell after US jobless claims hit the lowest level since February and productivity was revised downwards.

In Japan, the Nikkei is down 0.92% this morning, despite the nation taking not one, but two giant leaps for mankind yesterday with the launch of a duo of exciting space missions.

The first was the X-Ray Imaging and Spectroscopy Mission (XRISM), and the second – and arguably for more interesting – was the ultra-Japanese sounding Smart Lander for Investigating Moon (SLIM) mission.

The race to the moon is very much underway again at the moment, and Japan’s SLIM is an attempt to prove that it’s been able to develop a lightweight, highly manoeuvrable craft to deliver probes and questionable Pokemon pornography to the lunar surface.

Japan is no doubt hoping for the best in terms of success, with the goal of getting its lunar rover on board after India put its own lander on the moon, made it hop around a couple of times and then put it to sleep, and Russia didn’t.

In China, Shanghai markets are down 0.45% in early trade, and Hong Kong markets are closed today for Yet Another Holiday.

Here are the best performing ASX small cap stocks for 08 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CRB Carbine Resources 0.01 43% 296,148 $3,862,164 OLI Oliver'S Real Food 0.023 35% 487,781 $7,492,443 ASW Advanced Share Ltd 0.165 32% 281,377 $24,175,972 APC Aust Potash Ltd 0.005 25% 100,000 $4,154,758 TZL TZ Limited 0.021 24% 36,648 $4,364,888 ERW Errawarra Resources 0.215 23% 1,778,079 $10,588,200 WCN White Cliff Min Ltd 0.0085 21% 2,650,936 $8,799,130 EXT Excite Technology 0.006 20% 550,000 $5,796,209 SUH Southern Hemisphere Mining 0.025 19% 1,695,734 $11,063,933 QML Qmines Limited 0.11 18% 759,559 $19,178,043 PRM Prominence Energy 0.021 17% 100,000 $2,182,156 ECT Env Clean Tech Ltd. 0.007 17% 32,778,601 $17,085,331 NAE New Age Exploration 0.007 17% 35,062,262 $8,615,393 SI6 SI6 Metals Limited 0.007 17% 38,092,978 $11,963,157 TOR Torque Met 0.39 16% 2,616,667 $32,507,408 WYX Western Yilgarn NL 0.15 15% 127,054 $6,455,476 MEM Memphasys Ltd 0.015 15% 3,385,156 $12,473,765 ZEU Zeus Resources Ltd 0.015 15% 604,460 $5,970,653 CTN Catalina Resources 0.004 14% 1,400,000 $4,334,704 EXL Elixinol Wellness 0.008 14% 931,805 $4,385,379 RMX Red Mount Min Ltd 0.004 14% 259,291 $8,835,229 SPX Spenda Limited 0.008 14% 1,052,506 $25,699,955 SPD Southern Palladium 0.38 13% 53,233 $14,431,240 BFC Beston Global Ltd 0.009 13% 551,261 $15,976,375 GTR GTI Energy Ltd 0.009 13% 17,251,557 $15,582,033

Nominally at the top of the charts this morning is Oliver’s Real Food (ASX:OLI), which has wandered somewhat zombie-like to a 35.3% rise on zero news.

Advanced Share Registry (ASX:ASW) is next on the list, up 32% this morning after revealing that it’s entered into a scheme of arrangement, under which Automic Enterprise will buy 100% of the company, at $0.165 per share.

ASW closed at $0.125 yesterday, and is sitting right on top of Automic’s target price at lunchtime today.

Southern Hemisphere Mining (ASX:SUH) is up 23.8% this morning, with Wednesday’s announcement that a shortfall from the Company’s recent entitlement offer has been filled providing enough of a tailwind to keep it moving today.

Here are the most-worst performing ASX small cap stocks for 08 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AMA AMA Group Limited 0.063 -40% 48,930,865 113,444,983 M3M M3 Mining 0.08 -38% 1,604,849 6,046,729 MXC MGC Pharmaceuticals 0.002 -33% 690,692 13,283,905 AD1 AD1 Holdings Limited 0.006 -25% 501,226 6,580,551 EDE Eden Inv Ltd 0.003 -25% 58,348,672 11,987,881 88E 88 Energy Ltd 0.007 -13% 71,517,798 165,287,509 BSE Base Res Limited 0.185 -18% 474,008 265,052,666 LML Lincoln Minerals 0.005 -17% 64,338 8,524,271 TKL Traka Resources 0.005 -17% 7,706,900 5,227,976 YRL Yandal Resources 0.047 -15% 55,443 8,679,169 CHK Cohiba Min Ltd 0.003 -14% 580,677 7,746,355 MOB Mobilicom Ltd 0.0065 -13% 2,254,353 9,950,075 AUE Aurum Resources 0.105 -13% 35,359 3,000,000 IMI Infinity Mining 0.15 -12% 167,192 13,200,735 AJQ Armour Energy Ltd 0.12 -11% 24,517 13,921,215 CCZ Castillo Copper Ltd 0.008 -11% 28,438 11,695,548 CXU Cauldron Energy Ltd 0.008 -11% 9,794,042 8,564,118 NET Netlinkz Limited 0.008 -11% 620,551 31,774,755 GHY Gold Hydrogen 0.245 -11% 190,658 15,653,831 NKL Nickelxltd 0.067 -11% 15,384 6,482,646 PGC Paragon Care Limited 0.17 -11% 1,387,090 125,275,727 ADX ADX Energy Ltd 0.009 -10% 1,395,500 36,213,675 ALM Alma Metals Ltd 0.009 -10% 221,428 11,140,008 JXT Jaxstaltd 0.048 -9% 66,878 22,724,278 MMM Marley Spoon SE 0.068 -9% 1,523,015 29,501,980