ASX Small Caps Lunch Wrap: Which marketing genius nearly sank Red Lobster last quarter?

News

News

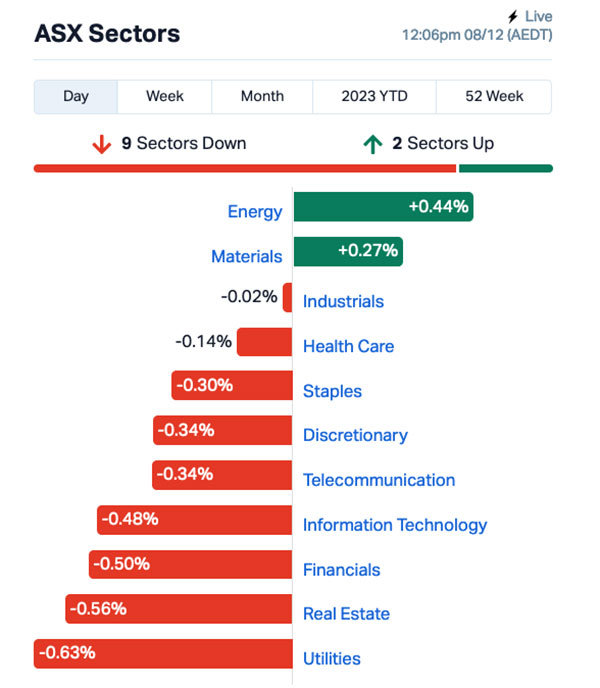

Local markets are down this morning, which is entirely understandable because this morning is basically a mirror image of Wednesday morning’s performance – most sectors have dipped into the red, but Energy’s taking a semi-serious tilt at recovering some of its losses for the week.

The end result is a benchmark hovering around the -0.3% mark as we roll towards lunch, trying all the while to make sense of volatile commodities markets.

Before I get too far into that, though, there’s a quick cautionary tale from the United States this morning, where someone from the Red Lobster restaurant chain’s marketing department is no doubt quietly seeking new employment opportunities.

Red Lobster, in case you don’t know, is a decades-old Casual Family Dining chain, which launched in Florida in 1968 and has been supplying the United States with suspiciously inexpensive shellfish ever since.

However, it’s a difficult market to thrive in, and competition to get bums on seats is fierce – and with the relentless pressure to achieve maximum growth at all times weighing heavily on the shoulders of management, Red Lobster had a problem.

The number of patrons it was attracting had, like the Florida swamps the company emerged from, stagnated – and things were getting desperate.

Enter the Red Lobster marketing team geniuses, led by industry heavyweight Patty Trevino, who led her team into the boardroom to pitch a very bold move for the company.

Mondays have been a big day at Red Lobster for years, as it was the one day of the week to play host to the chain’s most enduringly popular promotion – All You Can Eat Shrimp.

It’s been a marketing staple that has driven customer engagement on an otherwise dead night for restaurants in the US and, seeing the success there, the marketing team jumped to an obvious conclusion.

If it’s working well on Mondays, why not make it every night? After all, giving the famously gluttonous American dining public the opportunity to make absolute slobbering pigs of themselves every night of the week with a bottomless food offer couldn’t possibly backfire.

Spoiler alert: it backfired in a very big way.

The promotion did result in a 4.0% rise in overall consumer traffic, which is arguably a win in such a tightly competitive market.

The $11 million hole it blew Red Lobster’s results for Q3 this year, however, is about as far from a win as you could get.

It’s a tale of woe that even the dimmest of business minds could have seen coming, but its even more embarrassing for Red Lobster because it’s not the first time this has happened.

20 years ago, the company launched an all-you-can-eat snow crab leg offer, which ended up as a $3 million black hole in the books.

Things are a little weird today, with local investors ignoring what seemed like a pretty good lead-in from Wall Street overnight, engaging instead in a broad sell-off that’s seen the benchmark dribble to a -0.2% dip before lunch.

Early in the day, the market was looking like a direct inverse of Wednesday’s effort – Energy stocks were really the only ones doing well, while the rest of the sectors struggled to make any sort of forward movement.

Those companies that were moving – for better or worse – were largely doing so without the benefit of market announcements or headline news to explain why they were moving the way they were.

The answer, it seems, lies in where things are at on the various commodity markets – specifically, some large and unexpected swings have driven investor sentiment today.

Coal, for example, is surging today – up 5.9% this morning, bringing its climb for the week to 12.5%, and more than +21.4% for the month.

That’s helped the likes of Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC) add to their bottom lines this morning, up 1.65% and 2.05% respectively.

The other big news moving the energy market today is confirmation of media speculation regarding talks between Santos (ASX:STO) and Woodside Energy Group (ASX:WDS) about a potential merger.

Statements after hours last night from both companies essentially said that yes, they’ve been chatting, but it’s still very early stages, so everyone should probably calm themselves down a little.

The market’s sense of who the winner would be in the scenario of the pair merging is pretty stark, though. Santos has leapt 6.5% this morning. Woodside is down 1.5%.

And the other other energy stock news this morning is 92 Energy’s bombshell, outlining that the company has signed on for a takeover by Canadian Stock Exchange listed ATHA Energy, which is on a bit of a spending spree at the moment

I’ll explain the details behind it all a little later on, but before I do, there’s the international market news to talk about.

It was a pleasant enough evening on Wall Street overnight, which left the S&P 500 up by +0.8%, the blue chips Dow Jones index up by +0.17%, and the tech-heavy Nasdaq surging by +1.37%.

It’s a highly positive result for New York’s Finest, considering that investors on that side of the Pacific were grappling with weak jobs data, following a moderate bump in the number of Americans filing new claims for unemployment benefits.

Much like the RBA’s desire to see unemployment rise in Australia, it’s being seen as a good sign for the US economy at a broad level, indicating (some say) that the Fed’s aggressive interest rate plays have started paying dividends, and that the US economy is headed for a softer landing than predicted.

To stock news, a rally among the megacaps sparked speculation the artificial intelligence (AI) boom will continue fueling market gains, Earlybird Eddy Sunarto reports.

Alphabet shares surged more than 5% following the rollout of Gemini, its new AI tool. Google executives said Gemini could outperform ChatGPT in some areas.

Tesla rose 1.43% despite rumours that its Dojo supercomputer project lead, Ganesh Venkataramanan, has left the company.

His departure is seen as a setback to the automaker’s self-driving technology efforts, which are currently under yet another cloud thanks to whistleblower Lukasz Krupski’s assertions that the company’s autopilot program was far from ready at the time it was launched on public roads.

JetBlue Airways was one of the best stocks overnight, up 15% after narrowing its loss forecast thanks to recent strong travel demand, and meme stock Gamestop also rose 10% despite a revenue miss in Q3.

In Asian markets, Japan’s Nikkei is down 1.5% this morning, despite news that the nation’s third-most infamous export (behind dead whales and terrible pilots) Godzilla is shaping up to knock Christopher Nolan’s Oppenheimer off the top spot for Biggest and Bestest Movie in 2023.

In China, Shanghai markets are flat again, while in Hong Kong the Hang Seng is up 0.33% in early trade.

Here are the best performing ASX small cap stocks for 8 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SIH Sihayo Gold Limited 0.002 100% 400,000 $12,204,256 YPB YPB Group Ltd 0.002 100% 3,624,148 $790,461 BP8 Bph Global Ltd 0.002 33% 800 $2,423,345 FAU First Au Ltd 0.004 33% 4,239,757 $4,985,980 MCT Metalicity Limited 0.002 33% 1,005,000 $6,376,629 SRI Sipa Resources Ltd 0.032 28% 511,770 $5,703,953 92E 92Energy 0.465 27% 3,071,140 $38,826,912 MPK Many Peaks Minerals 0.19 27% 16,705 $5,456,172 M2R Miramar 0.025 25% 120,729 $2,977,391 NYR Nyrada Inc. 0.025 25% 35,000 $3,120,174 IXC Invex Therapeutics 0.078 22% 690,409 $4,787,300 HYT Hyterra Ltd 0.028 22% 795,000 $12,937,470 ICG Inca Minerals Ltd 0.012 20% 64,500 $5,844,355 LPM Lithium Plus 0.455 20% 105,727 $32,675,516 OSL Oncosil Medical 0.0095 19% 1,439,847 $15,796,329 RVT Richmond Vanadium 0.365 18% 20,001 $26,724,420 LRS Latin Resources Ltd 0.2175 18% 10,453,521 $512,913,647 HCT Holista CollTech Ltd 0.014 17% 201,333 $3,345,601 VAL Valor Resources Ltd 0.0035 17% 250,000 $11,620,004 MOM Moab Minerals Ltd 0.008 14% 668,204 $4,983,744 PXX Polarx Limited 0.008 14% 834,037 $11,477,317 AUG Augustus Minerals 0.12 14% 21,432 $8,822,100 MYE Metarock Group Ltd 0.12 14% 3,378 $32,137,002 DAL Dalaroo Metals 0.025 14% 220,685 $1,795,200 APX Appen Limited 0.71 14% 3,058,622 $112,448,664

There’s a lot of microcap movement this morning, with a number of the ASX’s smaller companies posting some healthy percentage gains before lunch – most of them without any news or announcements to pin that on.

92 Energy (ASX:92E) is moving well this morning, and it definitely has news for investors, as it’s now part of a three-way takeover deal with Canadian-listed resources company ATHA.

ATHA has inked a deal with 92 Energy to snap up 100% of the company, at a whopping 78% premium to the local explorer’s closing price of recent times – shareholders are set to pocket 0.5834 ATHA shares for every 92E share held, giving an implied value of around $0.65 a pop.

It’s not the only shopping that the Canadian firm has been doing, though – it’s also buying up all of the issued and outstanding shares of Latitude Uranium, by way of a Canadian court-approved plan of arrangement.

Holista CollTech (ASX:HCT) is up this morning as well, following news that the judge overseeing the Federal Court stoush between the company and the Australian Securities and Investments Commission pulled the pin on proceedings a day earlier than expected. No decision has been announced.

First Au (ASX:FAU) is moving in the right direction, off the back of a fancy-lookin’ investor presentation that the company released yesterday.

Here are the least-best performing ASX small cap stocks for 8 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EMU EMU NL 0.001 -50% 4,250,076 $3,335,043 NZS New Zealand Coastal 0.001 -50% 256,695 $3,334,020 AVM Advance Metals Ltd 0.002 -33% 400,000 $2,377,897 GTG Genetic Technologies 0.002 -33% 393,407 $34,624,974 T3DDB 333D Limited 0.004 -33% 2 $637,863 XPN Xpon Technologies 0.022 -31% 46,000 $5,072,881 RIL Redivium Limited 0.005 -29% 40,000 $19,115,984 ME1 Melodiol Global Health 0.0015 -25% 1,359,880 $9,225,840 CL8 Carly Holdings Ltd 0.013 -24% 742,972 $4,562,297 BCK Brockman Mining Ltd 0.023 -21% 286,576 $269,126,732 HLX Helix Resources 0.004 -20% 3,318,281 $11,615,729 LSR Lodestar Minerals 0.004 -20% 1,120,000 $10,116,987 MRQ MRG Metals Limited 0.002 -20% 275,000 $5,514,797 NIM Nimy Resources 0.18 -18% 676,735 $30,054,838 EL8 Elevate Uranium Ltd 0.425 -17% 1,662,538 $146,588,084 HMD Heramed Limited 0.029 -17% 385,167 $9,782,997 SFG Seafarms Group Ltd 0.005 -17% 11,588 $29,019,595 TAS Tasman Resources Ltd 0.005 -17% 40,000 $4,276,016 AHK Ark Mines Limited 0.205 -16% 37,249 $11,060,466 NRX Noronex Limited 0.011 -15% 140,250 $4,917,923 GNM Great Northern 0.017 -15% 201,334 $3,092,582 MZZ Matador Mining Ltd 0.053 -15% 373,835 $24,444,699 AHN Athena Resources 0.003 -14% 111,111 $3,746,636 AQX Alice Queen Ltd 0.006 -14% 3,382,663 $1,018,444 FHS Freehill Mining Ltd 0.003 -14% 340,000 $9,974,421