You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

News

News

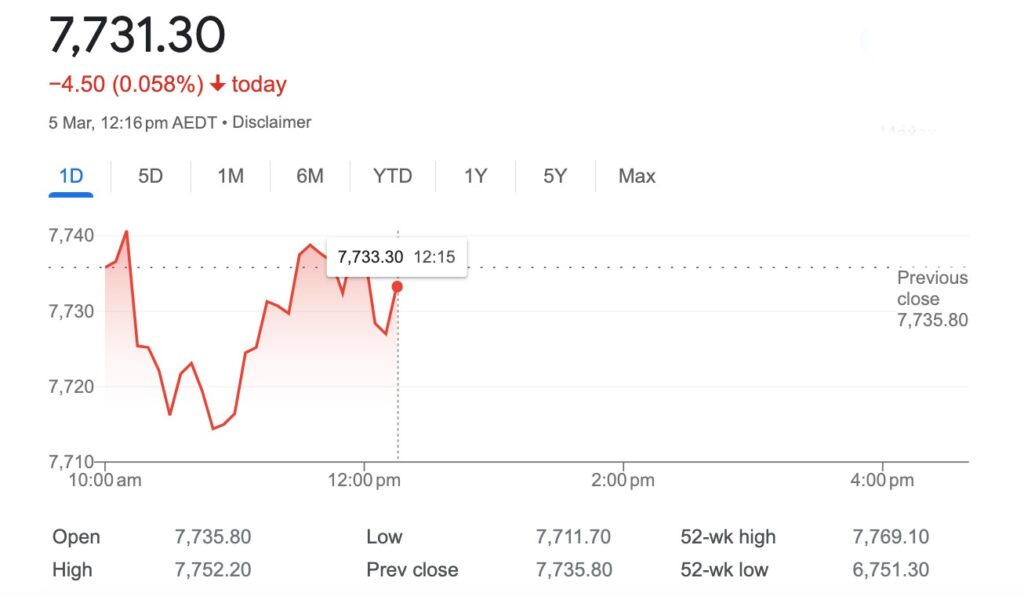

Australian markets are wobbling ahead of the latest GDP read on Wednesday which pretty much everyone now reckons will likely show a fourth straight quarter of negative economic growth.

At 12.15pm on Tuesday March 5, the benchmark ASX200 (XJO) was 5 points or 0.058% lower at 7,731.3.

The numbers speak for themselves on Tuesday.

So why not start with some digits interesting enough for me to call Stockhead’s own Rob Badman, the baddest human in this story.

Bitcoin is on an absolutely vertical rise these days, its rapid ascent to fresh and freaky new riches is something Rob told me to “not worry about”, “if it gets serious, I’ll tell you,” “I’ll handle crypto” “Get out of my lane, grandma!” and “hey Christian, maybe you should focus more on work, than setting my daily agenda.” Also, but unrelated: “pass the spam, or you’ll find out who I am!”

Now that BTC’s getting close to snapping its all-time high, I just thought I’d remind him – and myself – of that moment about four or five months ago… right about when the emotional and rational tide was turning.

Also he’s ruined The A-Team for all of us. And he owes me a beer. And he could work on his people skills.

But back to work, the big name cryptocurrency overnight added another 8% climb to clock US$67,310, (well above its US$44k valuation at the start of the year), and less than US$2,000 away from whipping its November 2021 record high of around US$69,000. (There is an excellent chance it is now at least obliged to go to US$69,420.)

Local shares were subdued for the opening hour of the day before some lovely choppy trade blew in from the south.

The spanner in the clam is cunning work from my old mates at Agence France Presse who got their hands on an official copy of the key Chinese government work report which says Beijing is setting a a 5% GDP target when the National People’s Congress goes ahead later today.

The figure is low-balling.

But does that mean good or bad news for Australian miners?

For the most part trade here in Sydney tracked some tepid trade on global equity markets overnight as investors dog paddle ahead of economic data and central bank signals later this week.

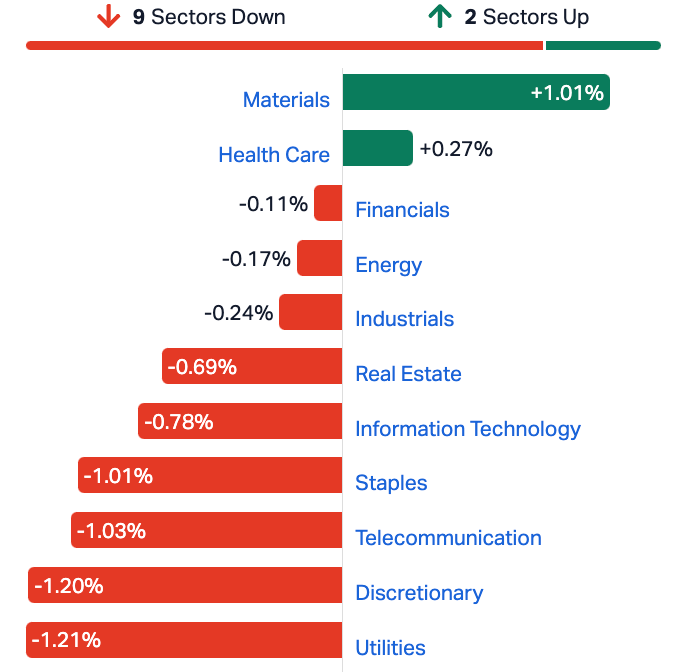

The Healthcare Sector is ahead after the federal government confirmed insurance premiums will rise from April. materials are also ahead, although lithium stocks aren’t part of that push. Pilbara Minerals (ASX:PLS) is making me seasick. Down 5.5%.

Gold stocks are bold, like the price, and the iron ore biggies are ahead.

BHP (ASX:BHP) gained 1.1% by lunch and that’s helped offset some losses. Fortescue (ASX:FMG) added 2.7% and Rio Tinto (ASX:RIO) gained 2.1 per cent.

EU shares hit another record high, but then gave away a fair few of those gains.

Wall Street’s main indices struggled to gain traction as many Mega Tech stocks wilted under rising treasury yields.

Nvidia did not, if you were wondering.

Apple fell after European regulators fined the company US$2bn for preventing Spotify and other music streaming services from informing users of payment options outside of its App Store.

Coles Group (ASX:COL) is paying 36 cents fully franked

Endeavour Group (ASX:EDV) is paying 14.3 cents fully franked

Embark Education Group (ASX:EVO) is paying 1.5 cents fully franked

Heartland Group (ASX:HGH) is paying 3.764 cents unfranked

Iluka Resources (ASX:ILU) is paying 4 cents fully franked

Kina Securities (ASX:KSL) is paying 5.1 cents unfranked

Lynch Group (ASX:LGL) is paying 4 cents fully franked

Lovisa Holdings (ASX:LOV) is paying 50 cents 30 per cent franked

Orora (ASX:ORA) is paying 5 cents unfranked

Origin Energy (ASX:ORG) is paying 27.5 cents fully franked

Pengana Capital Group (ASX:PCG) is paying 1 cent fully franked

Qualitas (ASX:QAL) is paying 1.1285 cents unfranked

Qube Logistics (ASX:QUB) is paying 4 cents fully franked

Sequoia Financial Group (ASX:SEQ) is paying 2 cents fully franked

SG Fleet (ASX:SGF) is paying 9.6 cents fully franked

Veem (ASX:VEE) is paying 0.77 cents unfranked

Worley (ASX:WOR) is paying 25 cents unfranked

WOTSO Property (ASX:WOT) is paying 1 cent unfranked

You probably already know that everyone’s favourite renegade Republican entrepreneur billionaire technologist Mr Elon Musk is suing the pants off OpenAI, alleging the ChatGPT maker is “putting profit before humanity.”

Now the billionaire – who lost his top spot on the Forbes Richest list overnight – is facing a US$130m lawsuit from a handful of former Twitter execs led by ex-CEO Parag Agrawal and former CFO Ned Segal who allege Elon was both really, unfairly mean and also failed to pay them about half a billion US dollarbucks in unpaid severance, after Elon bought the social network and fired all the losers.

Elon probably fired these guys after getting the cheque for $44bn in 2022. At the time, Elon said he didn’t have to pay severance because they all got fired.

The suit follows a diff legal complaint filed last year by the rest of the Twitter ex-employees – those guys are also seeking half a billion US dollarbucks in unpaid severance.

Meanwhile, the same lawyers who had Elon’s US$56bn Tesla pay package nixed in a Delaware court are reportedly asking to have their legal fees paid via US$6bn of Tesla stock.

Forbes is saying attorneys for the Tesla investor who challenged Musk’s executive-compensation award – the largest ever given to a corporate titan – filed the request Friday in the same Delaware court.

Finally, Tesla dropped more than 7% after announcing new price discounts and incentives late last week.

Tesla has shipped 60,365 vehicles from its China factory in February, according to preliminary Chinese industry data, the lowest such figure since December 2022 and down almost 16% month-on-month.

That’s what cost Elon his richest dude tag.

That’ll do for now.

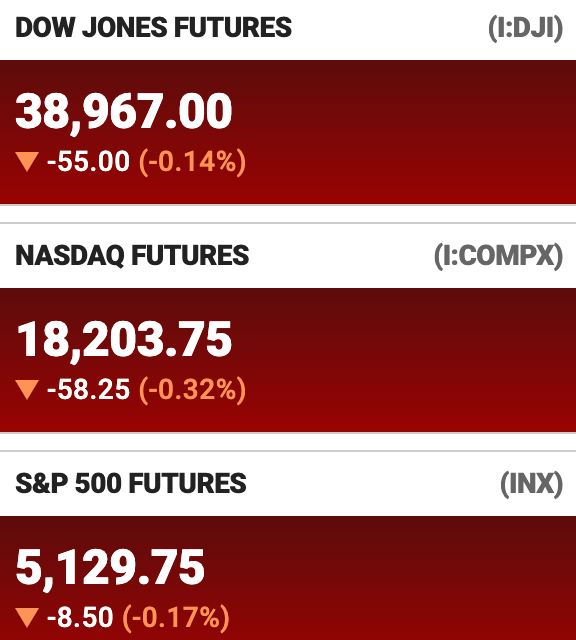

Wall Street made a bit of a tactical retreat overnight although Wall Street still seems to be enthusiastic about Monday’s session. The AI festival apparently remains in full swing.

The S&P 500 shed 0.12% to 5,130.95, while the Nasdaq Composite slipped 0.41% to 16,207.51. The Dow Jones Industrial Average lost 97.55 points, or 0.25%, to finish at 38,989.3.

The depth of pain was offset to an extent by more sugar for the AI darling Nvidia. Super Micro Computer soared 18% after S&P Dow Jones Indices announced it would join the S&P 500 later this month.

Actually, a fair few of the BTC-focused stocks, including Coinbase, also rose in anticipation as the cryptocurrency nears its 2021 all-time high.

But on the side of the Mega Tech ledger, Apple fell 2.5% after getting hit with an EU antitrust fine of about US$2bn.

The iPhone maker was accused of ruining competition for other music streaming rivals.

Outside of the punchy tech players Ford added more than 2% on the back of strong sales.

Eh. The big US retailer Macy’s soared more than 13.5% after twin raiders Arkhouse Management and Brigade Capital Management increased their buyout offer by a stonking 33%.

Meanwhile, the airlines JetBlue rose more than 4%, while Spirit Airlines crashed more than 10% after killing plans to merge overnight, weeks after losing a federal antitrust lawsuit that jeopardised the $3.8-billion deal.

Among the US sectors, Utilities was the best and Comms Services was the worst.

We’re listening this week for hints about the future trajectory of US rates with a fair bit of Fedspeak and testimony from US Federal Chair J. Powell to the House of Reps on Wednesday and the US Senate on Thursday.

The ADP Employment Survey and January job openings data will be released on Wednesday, providing further insight into the labour market.

Manufacturing and non-farm payrolls data for February are due Friday

US Earnings will not end…

Tuesday

Target (TGT), NIO (NIO), Ross Stores (ROST), Nordstrom (JWN), CrowdStrike (CRWD), and Box (BOX).

Wednesday

JD.com (JD), Campbell Soup (CPB), Foot Locker (FL), Abercrombie & Fitch (ANF), and Victoria’s Secret (VSCO).

Thursday

Costco (COST), Broadcom (AVGO), Gap (GPS), Marvell Technology (MRVL), and DocuSign (DOCU)

Friday

Genesco (GCO) and America’s Car-Mart (CRMT)

US Futures are thusly on Tuesday at lunch in Sydney:

Here are the best performing ASX small cap stocks for 5 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap JAV Javelin Minerals Ltd 0.20 100.00 256,000 $2,176,231 PRX Prodigy Gold NL 0.50 66.67 2,100,077 $5,253,323 AUQ Alara Resources Ltd 5.70 54.05 6,037,324 $26,569,239 PGC Paragon Care Limited 28.00 36.59 6,058,467 $136,912,977 DYM Dynamicmetalslimited 21.50 34.38 8,290,905 $5,760,000 AUH Austchina Holdings 0.40 33.33 9,634,087 $6,233,651 AUK Aumake Limited 0.40 33.33 1,733,238 $5,743,220 TRE Toubani Res Ltd 14.00 33.33 118,995 $14,055,895 WWI West Wits Mining Ltd 1.70 30.77 9,775,177 $31,595,091 AL8 Alderan Resource Ltd 0.50 25.00 6,340,936 $4,427,445 EDE Eden Inv Ltd 0.25 25.00 1,000,000 $7,356,542 PUA Peak Minerals Ltd 0.25 25.00 200,000 $2,082,753 FIN FIN Resources Ltd 1.80 20.00 643,136 $9,739,031 FTC Fintech Chain Ltd 2.40 20.00 80,734 $13,015,392 GCM Green Critical Min 0.60 20.00 526,170 $5,682,925 CYL Catalyst Metals 58.50 17.00 679,494 $110,078,772 TOU Tlou Energy Ltd 3.50 16.67 35,730 $32,296,102 AVE Avecho Biotech Ltd 0.35 16.67 17,125 $9,507,891 LPD Lepidico Ltd 0.70 16.67 74,667 $45,829,848 MHC Manhattan Corp Ltd 0.35 16.67 366,550 $8,810,939 TAR Taruga Minerals 0.70 16.67 449,969 $4,236,161 ARD Argent Minerals 1.10 15.79 2,711,555 $12,271,711 CL8 Carly Holdings Ltd 2.20 15.79 55,347 $5,099,037 SGA Sarytogan 22.00 15.79 1,009,549 $14,620,483 IOD Iodm Limited 26.50 15.22 264,892 $137,233,923

Alara Resources (ASX:AUQ) has completed the commissioning and the commencement of concentrate production at its Wash-hi – Majaza Mine and copper concentrate plant in Oman.

AUQ says production will ramp up to full capacity over the next two to three months.

The sale of the first shipment – approximately 1000 dry metric tons of copper concentrate – to Trafigura is expected in April 2024.

The Al Wash-hi – Majaza Mine is owned and operated by Alara’s 51% joint venture company, Al Hadeetha.

Alara MD Atmavireshwar Sthapak says the company is now on its “journey to become a mid-tier mining production company”.

“(This) involves a shift of focus to developing existing exploration projects and new acquisitions.”

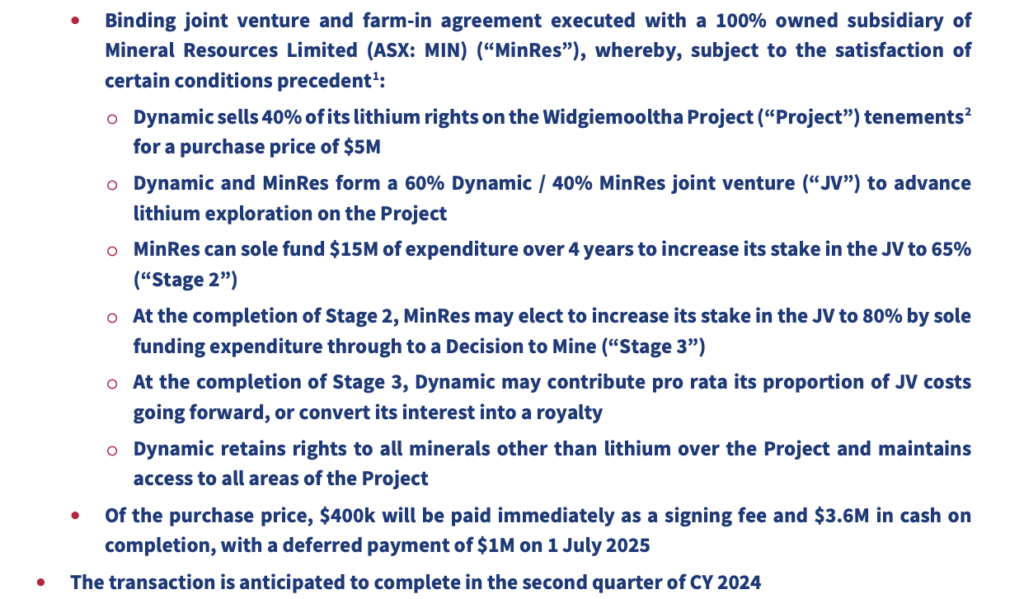

Dynamic Metals (ASX:DYM) has entered into a binding term sheet for a farm-in and joint venture with a wholly-owned subsidiary of Mineral Resources (ASX:MIN) under which DYM, (*eh, subject to the satisfaction of certain conditions), will sell 40% of all lithium mineral rights held by Dynamic on the Widgiemooltha tenement package for $5mn cash consideration to MIN.

Here’s the juicy:

Fin Resources (ASX:FIN) says a review of recent and historical work across the Ross Project has identified potential U-Th-REE bearing pegmatites, with Director Jason Bontempo calling the find “a very exciting time for FIN.”

Historical sampling completed in 2007 on FIN’s Ross Project identified highly anomalous Uranium in soil sampling up to 1,486 ppm U308 associated with low Thorium.

But the new analysis “identified a significant number of potential Uranium occurrences across the Ross Project.”

FIN are planning to complete a high resolution airborne magnetic and radiometric surveys across the Ross and Cancet West Projects during the Spring/Summer 2024 field season.

Here are the most-worst performing ASX small cap stocks for 5 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MSG Mcs Services Limited 0.50 -44.44 3,477,800 $1,782,897 HMD Heramed Limited 1.20 -40.00 27,923 $7,064,996 1MC Morella Corporation 0.30 -25.00 723,890 $24,715,198 AHN Athena Resources 0.30 -25.00 1,703,597 $4,281,870 EXT Excite Technology 0.60 -25.00 917,195 $10,633,934 IS3 I Synergy Group Ltd 0.60 -25.00 1,132,723 $2,432,643 OPN Oppenneg 0.60 -25.00 928,750 $9,033,437 X2M X2M Connect Limited 4.10 -21.15 259,018 $13,120,219 JPR Jupiter Energy 1.90 -20.83 90,830 $30,567,653 CTO Citigold Corp Ltd 0.40 -20.00 3,334,000 $15,000,000 LRL Labyrinth Resources 0.40 -20.00 178,526 $5,937,719 NAE New Age Exploration 0.40 -20.00 135,856 $8,969,495 ROG Red Sky Energy. 0.40 -20.00 530,375 $27,111,136 SI6 SI6 Metals Limited 0.40 -20.00 7,414,996 $9,969,297 TMK TMK Energy Limited 0.40 -20.00 31,664 $30,612,897 AQI Alicanto Min Ltd 2.90 -19.44 1,215,916 $22,152,125 STM Sunstone Metals Ltd 1.05 -19.23 18,251,476 $45,508,470 VKA Viking Mines Ltd 0.90 -18.18 5,542,883 $11,277,843 CBY Canterbury Resources 2.70 -18.18 79,497 $5,667,450 HAL Halo Technologies 11.50 -17.86 23,150 $18,129,330 ABE Ausbondexchange 1.50 -16.67 168,108 $2,028,026 EWC Energy World Corpor. 1.50 -16.67 4,720,835 $55,420,582 HT8 Harris Technology Gl 1.00 -16.67 876,234 $3,589,626 JTL Jayex Technology Ltd 0.50 -16.67 1,489,300 $1,687,671 OAR OAR Resources Ltd 0.25 -16.67 330,259 $7,959,933

QEM (ASX:QEM) has announced a slight update to the resource uneveiled yesterday for its Julia Creek project in North Queensland, now including a maiden 1C oil shale resource of 6.3 million barrels (MMbbls).

This is on top of the 28% increase to the indicated vanadium resource to 461Mt (2,406Mt remains in the inferred category) and 32% uplift in the 2C oil shale estimate to 94 MMbbls.

Utilising a 90% recovery factor, a 3C oil shale resource of 654 MMbbls.

At Stockhead, we tell it like it is. While Dynamic Metals, Fin Resources and QEM are Stockhead advertisers, they did not sponsor this article.