ASX Small Caps Lunch Wrap: Is this the weaponised AI we’re supposed to be scared of?

"...and by tweaking this bit of code here, I can make it look like it's her anus that's singing." Pic via Getty Images.

Local markets have fallen again, because US Fed boss Jerome Powell wandered into the TV studios at 60 Minutes and said things into a microphone.

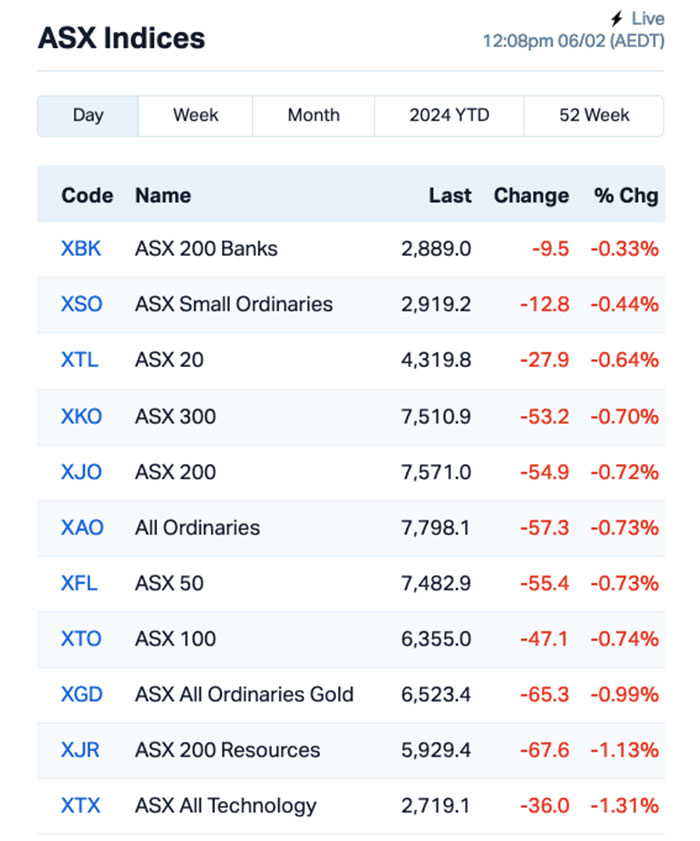

That pushed US markets lower, so the ASX 200 benchmark has slavishly followed suit, losing around -0.7% this morning as even the best of the market’s sectors struggle to make any headway.

I’ll get into more detail on that shortly, but first, there’s news that has sent chills down the spine of every IT security department in the world, after a Hong Kong-based finance worker was tricked into transferring $200 million Hong Kong dollars (more than AUD$39 million) by fraudsters posing as colleagues on a video call, including his company’s chief financial officer.

According to CNN reports, the man received an email that he thought looked a bit suspicious, inviting him to a video conference call to discuss “a secret transaction to be carried out”.

But when the worker signed in to the conference call, the rest of the team he was expecting to see were there – including the firm’s UK-based CFO, who looked and sounded just like he was meant to… so, he transferred the funds and only later, when the company came looking for the missing millions, did the penny drop that he’d been duped.

Hong Kong police say that it’s the latest in a string of crimes where the bad guys are using Deepfake technology to impersonate corporate identities to steal money, instead of what it’s meant to be used for, which is – I’m told – flooding the internet with Taylor Swift porn.

Tay-tay has been the object of a sustained campaign to use the technology to create some – I’m told – very convincing sexual images of the singer, which turned both the X and Telegram platforms into a blizzard of Swifty porn in recent days.

Such was the extent of the number of images – I’m told – they have been viewed tens of millions of times, prompting calls from US politicians for the tech to be banned, while others demanded to know precisely which X and Telegram accounts were pushing the imagery, so that they would know which accounts not to look at, because… you know… that’d be wrong, and the internet is such a big place and there are so many accounts and, well… you can’t be too careful.

Yvette D Clarke, a Democratic congresswoman for New York, has taken to social media to call out the monsters responsible for defiling America’s Grammy-winning sweetheart, saying “What’s happened to Taylor Swift is nothing new. For yrs, women have been targets of deepfakes [without] their consent. And [with] advancements in AI, creating deepfakes is easier & cheaper”.

“This is an issue both sides of the aisle & even Swifties should be able to come together to solve,” she added, which probably could have been phrased a lot better, but it’s done now, so…

The flood of Swift porn prompted the X platform to step in, which it did – by redirecting every search for Taylor Swift to a blank page, effectively making the singer invisible even to fans who were searching Twitter for news of their favourite star.

The timing of the search ban – right around the same time that certain sections of the US political scene were losing their minds at the idea that Tay-tay might carry enough clout to sway the entire US election – is absolutely just a coincidence, right?

We are through the looking glass here, people… and it’s probably best that we step back from the brink of outright conspiracy madness, before the mob that runs the internet realises we’re onto them.

TO MARKETS

Local markets are down again this morning, losing ground for the second day running after yesterday’s -0.92% fall.

The reasons for today’s fall are, as always, complicated and varied – but the main motivator for this mornin’s bad news is that things didn’t go so great in the US overnight, and that’s because someone let Jerome Powell near a microphone again.

Honestly, when will people learn? It’s like clockwork – Powell has a thought, he says it into a microphone, people hear it and Wall Street falls.

So there’s that, plus our own local version of the J-Pow kneecappers, the Reserve Bank board, kicking off their meeting today to decide what to do with local interest rates – but pretty much everybody is expecting the RBA to keep things on autopilot for now and the rate to stay the course at 4.35%.

The announcement from the RBA isn’t due until 2.30pm, so everyone has ample time to brace for nothing at all to change.

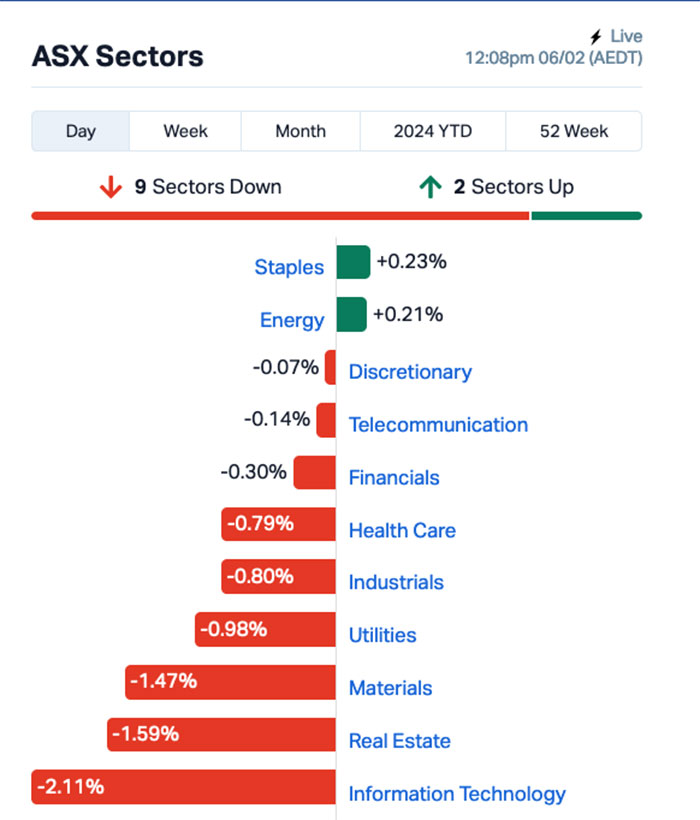

A look at the ASX sectors this morning shows that we’re two up and nine down for the moment, with the chart revealing that it’s InfoTech’s turn in the barrel today, shedding more than 2.0% in early trade.

The only two sectors doing anything remotely worth a damn are Consumer Staples and Energy stocks – but they’re both barely above zero and struggling to stay there, so I’m not holding out much hope for the rest of the day.

Up the top end of town, leather-clad lounge lothario Nick Scali (ASX:NCK) has spiked more than 16% this morning, after delivering a set of half-year results that on the surface are anything but the comfy recliner investors were seeking.

The furniture seller has reported a 20% decline in revenue on PCP, and a 29% fall in NPAT, which is unpleasant any way you slice it, but… somehow, the company has managed to wring a few extra dollars out of its consumer base, because the $43 million NPAT is $1 million over guidance issued in October, and the company will be paying the same 35c divvy it did last time.

Meanwhile, department store behemoth Myer (ASX:MYR) has revealed that its sales have retreated from record levels it hit in previous years, with total sales for 1H24 expected to be down 3.0% on 1H23 to $1,829.1 million.

From that total, some 21.3% of total sales are coming from the group’s online arm, a 2.0% increase year-on-year, bringing $390 million into the cash drawer without the need to pay any rent.

NOT THE ASX

I’ve already touched on why the US market was terrible, but in slightly more detail, here’s why: Jerome Powell went on 60 Minutes to spray cold water on any talk of rate cuts in the first three months of 2024, and that – naturally – gave Wall Street an attack of the sads.

Overnight, the S&P 500 fell by -0.32%. The blue chips Dow Jones index was down by -0.71%, and the tech-heavy Nasdaq slipped by -0.2% – not quite the usual J-Pow disaster, but that’s likely because he’s not telling anyone anything new… just repeating the same market-weakening mantra we’ve been hearing for quite some time already.

In US stock news, burger giant McDonald’s fell -3.75% as Q4 revenue missed estimates, largely due to the strength of boycotts in crucial overseas markets, over beliefs that the company is a little too closely aligned with Israeli interests.

The Maccas division that is suffering is the one that includes India, China and the Middle East, and it’s not the only big Western target of a sustained campaign to boycott the company, with coffee chain Starbucks also losing significant ground in the Middle Eastern market.

Tesla fell -3.7% to a nine-month low, after the company had a very rough few days. For starters, the company has been forced to recall more than 2 million cars in the US because apparently some of the warning lights on the dashboard are “too small”.

And Tesla CEO Elon Musk was the subject of reports in the Wall Street Journal that those around him have been suggesting he might need to do a stint in rehab, over concerns that his alleged drug-taking is getting out of hand.

Plus there’s the whole thing about Musk’s pay packet, and his move to shift the company’s nominal base of operations from Delaware to the more evil-billioniare-friendly state of Texas.

That’s because one guy – a former thrash metal drummer from Pennsylvania called Richard Tornetta, who owned just nine shares in the company – filed a lawsuit in 2018 over how much Tesla was paying Musk.

Every time I think things are as weird as they’re gonna get, I am pleasantly surprised by the little details like that, as the story takes yet another step on its descent into outright farce.

In Asian markets, things aren’t quite as weird – which is saying a lot, because… Japan.

The Nikkei is down 0.70% this morning, while in Shanghai markets are 0.80% lower and Hong Kong’s Hang Seng is up 0.20% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 06 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Company Price % Volume MARKET CAP JAN Janison Edu Group 0.39 53% 1,306,355 $65,178,741 ACS Accent Resources NL 0.01 43% 1 $3,311,891 MKG Mako Gold 0.031 29% 42,256,274 $15,897,826 ERL Empire Resources 0.005 25% 2,410,000 $4,451,740 PNX PNX Metals Limited 0.005 25% 14,079,301 $21,522,499 KNB Koonenberrygold 0.037 23% 70,001 $3,592,473 YOJDA Yojee Limited 0.033 22% 26,667 $4,581,978 NRZ Neurizer Ltd 0.0085 21% 7,945,741 $9,864,370 QXR Qx Resources Limited 0.017 21% 1,294,374 $15,541,090 CCZ Castillo Copper Ltd 0.006 20% 3,500 $6,497,527 LML Lincoln Minerals 0.006 20% 222,222 $8,520,226 PVL Powerhouse Ven Ltd 0.044 19% 20,001 $4,467,498 XST Xstate Resources 0.019 19% 372,668 $5,144,306 NCK Nick Scali Limited 14.15 18% 868,247 $972,810,000 AL8 Alderan Resource Ltd 0.0035 17% 4,000,000 $3,320,584 RGS Regeneus Ltd 0.007 17% 249,192 $1,838,621 TOY Toys R Us 0.007 17% 362,551 $5,894,781 VAL Valor Resources Ltd 0.0035 17% 541,429 $12,520,004 DEL Delorean Corporation 0.06 15% 447,764 $11,217,488 DXNDA DXN Limited 0.015 15% 66,670 $2,403,561 A8G Australasian Metals 0.115 15% 2,787 $5,212,049 XRG Xreality Group Ltd 0.039 15% 679,690 $18,670,737 BCT Bluechiip Limited 0.008 14% 2,199,787 $5,567,617 ENV Enova Mining Limited 0.025 14% 29,080,361 $14,100,445 EWC Energy World Corpor. 0.017 13% 3,751 $46,183,819

Janison Education Group (ASX:JAN) was topping the winners list on Tuesday morning, posting a 43% gain on news that the company has inked a deal with the New South Wales Department of Education to deliver the state’s selective education placement tests as computer-based tests via Janison’s digital assessment platform.

The deal, which also includes Cambridge University Press & Assessment, is reportedly worth up to $45 million over the initial five-year term – provided all stages are approved – with an option for the department to extend for a further five-year term.

Mako Gold’s (ASX:MKG) position as market darling looks set to continue again today, with the company landing another 25% jump this morning on the back of a string of happy announcements that kicked off at the end of January with the company’s quarterly.

Since then, Mako has revealed positive rock chip sampling results that suggest a “very high grade” find at Tchaga North, on the company’s 90% owned flagship Napié Project in Côte d’Ivoire.

Since 30 January, Mako has improved from a close of $0.011 to be at $0.032 per share at lunchtime today, and up 220% for the year so far.

And another junior goldie, Koonenberry Gold (ASX:KNB), is up 23% this morning, improving on the previous session’s gains when it announced that Phase 2 drilling at the company’s Bellagio prospect has defined widespread gold mineralisation >1g/t Au over >125m area, with the target remaining open down dip and plunge.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 06 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Company Price % Volume MARKET CAP YPB YPB Group Ltd 0.0015 -25% 1,290,990 $1,580,923 AZY Antipa Minerals Ltd 0.012 -20% 11,617,678 $62,022,119 AHK Ark Mines Limited 0.12 -20% 18,235 $8,316,962 EG1 Evergreenlithium 0.1 -20% 20,000 $7,028,750 88E 88 Energy Ltd 0.004 -20% 11,338,062 $123,627,103 CTO Citigold Corp Ltd 0.004 -20% 10,000 $15,000,000 RMX Red Mount Min Ltd 0.002 -20% 895,074 $6,683,940 TMK TMK Energy Limited 0.004 -20% 369,717 $30,612,897 AMM Armada Metals 0.024 -17% 90,000 $6,032,000 BVR Bellavistaresources 0.1 -17% 135,728 $5,953,317 AYT Austin Metals Ltd 0.005 -17% 494,235 $7,711,148 GCM Green Critical Min 0.005 -17% 1,808,357 $6,819,510 GT1 Greentechnology 0.1125 -17% 1,440,361 $42,829,033 IEC Intra Energy Corp 0.0025 -17% 7,117,258 $4,982,345 MSG Mcs Services Limited 0.01 -17% 70,728 $2,377,196 NRX Noronex Limited 0.01 -17% 400,000 $4,539,621 SIT Site Group Int Ltd 0.0025 -17% 74,676 $7,807,471 ODY Odyssey Gold Ltd 0.021 -16% 102,691 $22,471,778 SCN Scorpion Minerals 0.021 -16% 568,181 $10,236,405 GTE Great Western Exp. 0.037 -16% 1,017,875 $15,312,467 BOC Bougainville Copper 0.6 -14% 243,391 $280,743,750 RDM Red Metal Limited 0.15 -14% 2,387,873 $52,206,584 ROC Rocketboots 0.09 -14% 253 $3,416,543 MTL Mantle Minerals Ltd 0.003 -14% 129,411 $21,691,060 WAF West African Res Ltd 0.8075 -14% 6,477,707 $964,757,792

ICYMI – AM Edition

LTR Pharma (ASX:LTP) has revealed that it has successfully completed a pivotal stability and quality control milestones for its erectile dysfunction nasal spray product Spontan, ahead of an upcoming bioequivalence clinical study.

And Koba Resources (ASX:KOB) has announced that it has appointed experienced geologist, Mark Couzens, as “Exploration Manager – Uranium”, to lead the Company’s exploration activities at its recently acquired Yarramba Uranium Project in South Australia.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.