ASX Small Caps Lunch Wrap: Who’s getting stroppy about their $100k rust buckets this week?

Thanks Elon, I hate it. Pic via Getty Images.

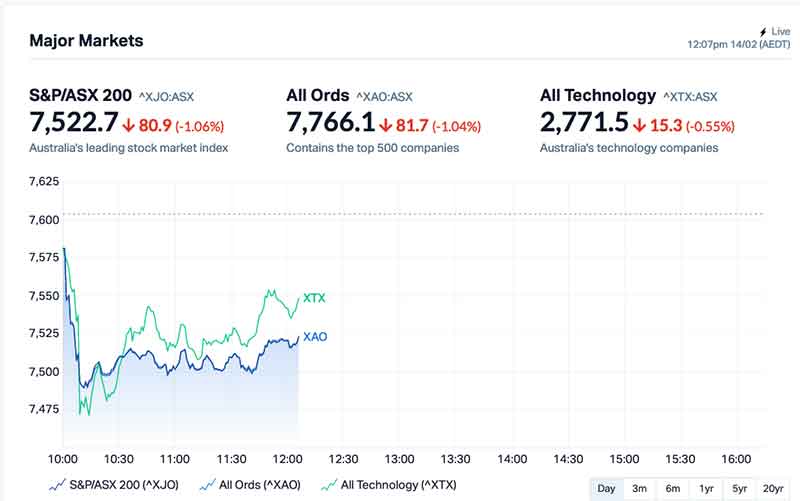

The ASX has turned a lovely, bright rose red for Valentine’s Day, after the benchmark sank 1.5% at open, thanks to US CPI data coming in a smidgen worse than expected, and Wall Street reacting like someone took a dump on the doorstep.

Things improved slightly between open and the lunch bell ringing, but it’s been hard yakka for the benchmark – even getting to -1.05% hasn’t been helped by a tranche of poor news that has sent a number of stocks tumbling this morning as well.

I’ll get into the details shortly, but first, there’s news from the world of Tesla, where the much-vaunted CyberTruck has been hit with yet another round of terrible press, as a number of early adopters have reported that their shiny new toy is starting to rust.

For some unfathomable reason, Tesla – in its infinite wisdom – shipped its all-singing, slightly-dancing eyesore as a bare metal vehicle, the stainless steel exterior unsullied by even the faintest whiff of a clear-coat, unless the buyer was canny enough to fork out anywhere between US$5,000-$6,000 for an optional satin finish clear coat that would stop their new beast from developing freckles like a cyborg Morgan Freeman.

It turns out that there’s instructions for care, buried deep in the owner’s manual, that instructs Cybertruck owners to wash their vehicles nearly every single time they drive them – and not just a quick hose-down, either.

The instructions are very clear that owners must “immediately remove corrosive substances (such as grease, oil, bird droppings, tree resin, dead insects, tar spots, road salt, industrial fallout, etc.)” – or run the risk of spot rust covering the exterior of their new toy.

It’s not 100% surprising that there’s a pricey option to protect the vehicle on offer – this is Tesla we’re talking about, a company quite famous for paywalling optional extras like going fast, or self-driving – but what’s baffling is that the decision was made somewhere in the design and production process to launch the vehicle without a clear coat to stop the problem from happening in the first place.

Yes, the choice not to clear-coat the Cybertruck at the factory level is a production line money-saver, but at what cost?

Surely the probability of endless negative press stemming from having the company name tied to a rapidly rusting fleet of weird-looking utes with close to zero resale value was a foreseeable outcome.

Still, there’s an argument there for “buyer beware” – and you’d be hard-pressed to do anything but laugh at anyone dumb enough for fork out US$79,990 for a lumbering eyesore without ticking the “I’d like it not to rust to pieces in my driveway, thankyouverymuch” option.

To think, the bullet-proof unstoppable off-roader of the future is set to come undone because of a few stray dollops of bird poo…

TO MARKETS

Local markets have taken a hit this morning, and it’s all Wall Street’s fault – except for the bits that aren’t, of which there are quite a few.

I’ll deal with the US news shortly, but the headline grabber today is some terrible news out of Turkey, where ASX-listed SSR Mining has had to suspend operations at its Çöpler gold mine, following a catastrophic slip on the heap leach pad.

Currently, the news from the site is very grim indeed, with at least nine miners listed as missing. The search for the missing workers is being hampered by the cyanide-laced tailings thought to have caused the landslide.

Back in Oz, and the market’s not having a pleasant day at all, with the exception of a few holdouts including large cap IDP Education, which has delivered a strong 12% jump this morning, on news of record revenue of $579 million, up 15 per cent on H1 FY23, driven by a surge in student placement revenue growth of 44 per cent.

But the benchmark has been struggling to retake the ground it lost at open, hampered by a poor performance almost across the board.

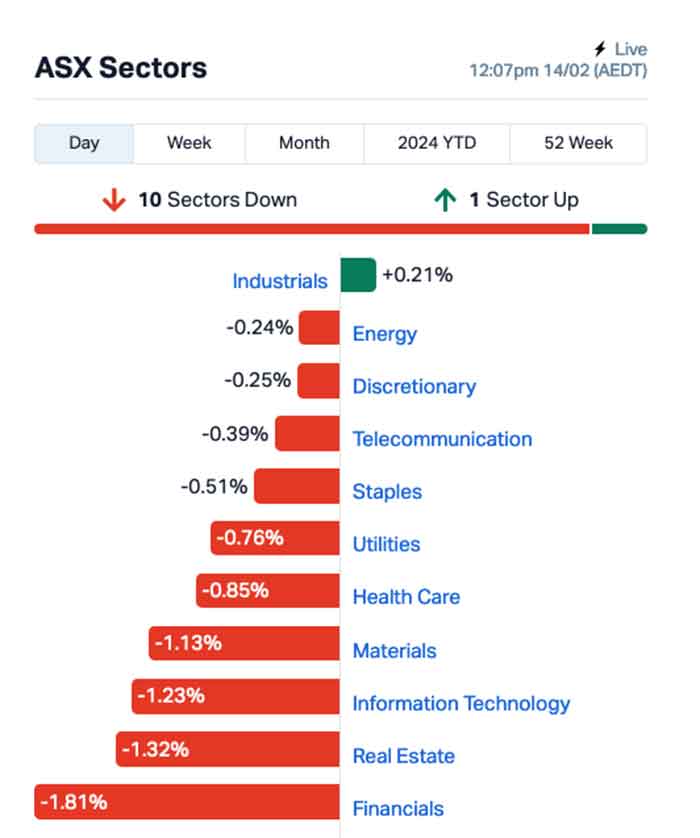

The lone hold-out in prosperity this morning is the Industrials sector, which has managed to poke its head above the parapets to take a 0.2% win in the face of solid sell-offs – and almost all of that success is down to a single large cap.

Downer Edi – which is nebulously described as ”a leading provider of integrated services in Australia and New Zealand” – has punched out a massive 12.4% jump this morning, taking its market cap well over the $3 billion mark for the first time since December 2022.

The jump has come off the back of a half-year report showing that while revenue has dipped 2.2% on PCP, the company has managed to lift profits by 3.8% (NPATA), which in turn has led to Downer getting set to drop a juicy 6.0c divvy for the period.

The rest of the sectors are, as you can see, doing poorly.

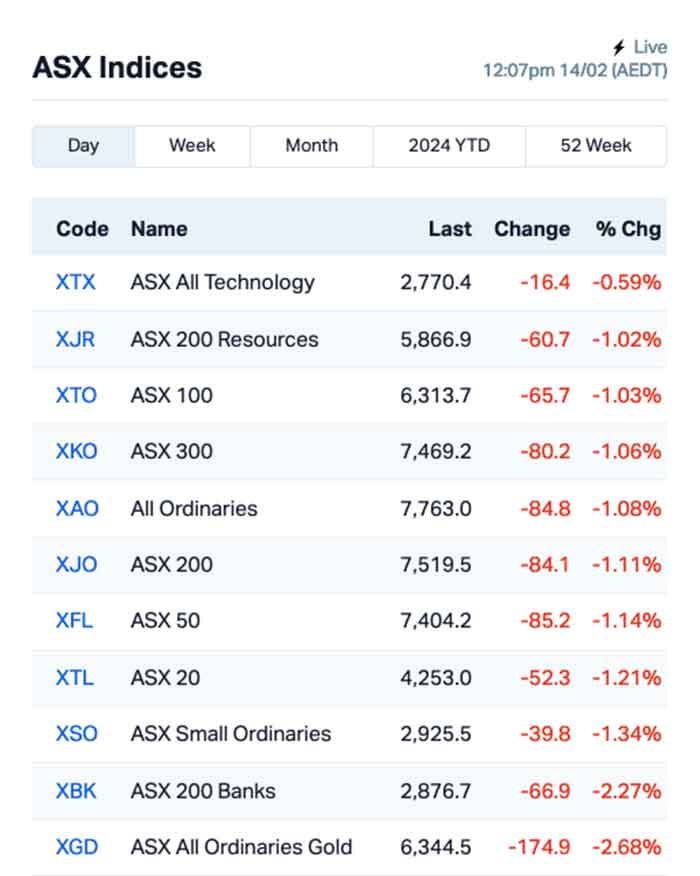

There’s been a sudden burst of interest in a number of junior goldies this morning, namely First Au and minnow Alice Queen, neither of which have news to add to the pile today – but that’s not been enough to lift the XGD All Ords Gold index out of the mire.

It’s down 2.7% this morning, along with just about every other significant index as well.

The root cause of that was last night’s performance on Wall Street, which looked a little bit like this…

NOT THE ASX

A blip on the US CPI data caused minor mayhem for US investors, with the US CPI print coming in at 3.1%, the highest reading in eight months, which is pretty much the final nail in the coffin for any hopes of a near-term rate cut by the US Fed.

“The Fed will view this as another reason to wait until May or June, but the direction of trend is still lower,” said Charles Schwab’s chief fixed-income strategist, Kathy Jones, agreeing with me because I’m smart.

It wasn’t a huge miss by any standards, but it was enough to spark a pretty major sell-off that left the S&P 500 down by -1.44%, the Dow Jones index lower by -1.39%, and the tech-heavy Nasdaq sinking by -1.86%.

In US stock news, Shopify Inc plunged by -13% after Q4 sales and profit only narrowly beat estimates.

Pharma company Biogen fell -7% after Q4 revenue missed analysts’ expectations on declining multiple sclerosis drugs sales.

Boeing Co. fell -2% after announcing plans to build the 737 Max aircraft at a slower pace during H1 amid quality issues.

In Asia, Chinese markets are still closed, as New Year celebrations drag on (geddit?), while in Japan the Nikkei is down 0.6% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 14 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap FAU First Au Ltd 0.004 60% 9,435,077 $4,154,983 LNU Linius Tech Limited 0.003 50% 92,222 $9,878,481 NVQ Noviqtech Limited 0.003 50% 340,519 $2,618,891 AQX Alice Queen Ltd 0.007 40% 12,962,455 $3,454,921 NRZ Neurizer Ltd 0.007 40% 3,282,188 $7,069,554 PRX Prodigy Gold NL 0.005 25% 7,250,064 $7,004,431 CHK Cohiba Minerals 0.003 20% 1,000,000 $6,325,575 TIG Tigers Realm Coal 0.006 20% 5,368,300 $65,333,512 RXL Rox Resources 0.19 19% 625,000 $59,096,682 BMO Bastion Minerals 0.013 18% 15,746,292 $3,425,885 ODE Odessa Minerals Ltd 0.007 17% 1,166,666 $6,259,695 RGS Regeneus Ltd 0.007 17% 20,000 $1,838,621 ATS Australis Oil & Gas 0.015 15% 3,506 $16,599,252 DOW Downer EDI Limited 4.945 15% 4,335,079 $2,894,482,556 HMX Hammer Metals Ltd 0.055 15% 4,215,776 $42,547,553 KGL KGL Resources Ltd 0.125 14% 19,449 $62,402,105 RSH Respiri Limited 0.025 14% 632,749 $23,317,116 KIN KIN Min NL 0.07 13% 4,983,383 $73,045,334 88E 88 Energy Ltd 0.0045 13% 2,829,078 $98,901,682 OSL Oncosil Medical 0.009 13% 452,404 $15,796,329 VML Vital Metals Limited 0.0045 13% 1,243 $23,580,268 WML Woomera Mining Ltd 0.0045 13% 1,288,024 $4,872,556 IEL IDP Education Ltd 22.635 12% 1,857,142 $5,633,524,911 BRN Brainchip Ltd 0.285 12% 19,896,412 $460,482,745 MGU Magnum Mining & Exp 0.019 12% 3,701,274 $13,759,144

There was a fair bit of movement among a number of junior miners and explorers on Wednesday morning, including market leader First Au, which posted a 60% jump for the morning.

Blue Star Helium (ASX:BNL) got off to a good start early in the day, after the company revealed results from initial testing and evaluation at Bolling #4 SESW well, which resulted in gas to surface flow of >4% helium under vacuum with flow up to 268.4 mscf/d. The company has engineers evaluating well production potential.

Rox Resources (ASX:RXL) had good news, revealing that it has recently completed geophysical Gradient Array Induced Polarisation (GAIP) surveys at its Mt Fisher and Mt Eureka gold projects in Western Australia, identifying numerous high-priority, walk-up drill targets in the process.

The new targets add to a previous result from its 100% owned Mt Fisher project, which the company reported as 9m @ 34.34g/t Au, with work continuing on both that project and the 51% (with an avenue for earn-in up to 75%) owned Mt Eureka site.

Bastion Minerals (ASX:BMO) was also making news on Wednesday morning, announcing that 53 samples from old mine workings have confirmed that the strategic 115km2 Gyttorp land holding in Southern Sweden is highly prospective for high-grade REE, with laboratory results to 6.8% (68,078 ppm) total REE + yttrium and elevated results throughout the property.

The company says that other high-grade Total REE+Y samples that exceeded 1.0% (10,000 ppm) include: 3.09%, 2.85%, 2.46%, 2.09%, 1.52%, 1.49%, 1.45%, 1.29% and 1.1%.

Hammer Metals (ASX:HMX) announced that its JV partner, Sumitomo Metal Mining Oceania, has reached a $6 million (60% interest) earn-in milestone and has elected to continue to fund the JV, with drilling of the Shadow South IOCG target scheduled to commence in early March.

As such, Hammer has elected to dilute its position in the MIEJV in accordance with the JV agreement, noting that it can elect to contribute to the Joint Venture in the future to maintain its interest at that point in time.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 14 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SSR SSR Mining Inc. 7.49 -50% 190,249 $82,519,141 EDE Eden Inv Ltd 0.0015 -25% 783,682 $7,356,542 GTE Great Western Exploration 0.03 -25% 1,186,294 $13,920,425 TOT 360 Capital REIT 0.41 -25% 947,370 $79,696,680 BNZ Benzmining 0.13 -24% 153,564 $18,922,016 TGM Theta Gold Mines Ltd 0.11 -21% 139 $99,615,577 EXL Elixinol Wellness 0.008 -20% 2,742,089 $6,328,716 ROG Red Sky Energy. 0.004 -20% 17,893,010 $27,111,136 RR1 Reach Resources Ltd 0.002 -20% 301,777 $8,025,743 EYE Nova EYE Medical Ltd 0.2175 -19% 1,026,123 $51,047,435 CLU Cluey Ltd 0.065 -19% 12,923 $16,129,085 NIS Nickelsearch 0.033 -18% 1,818,537 $8,541,698 MTL Mantle Minerals Ltd 0.0025 -17% 20,647,045 $18,592,338 AUA Audeara 0.031 -16% 46,271 $5,350,486 HVY Heavy Minerals 0.083 -15% 30,432 $5,647,109 ASR Asra Minerals Ltd 0.006 -14% 350,000 $11,455,470 LPD Lepidico Ltd 0.006 -14% 10,000 $53,468,156 AGC AGC Ltd 0.073 -14% 200,203 $18,777,778 SHG Singular Health 0.13 -13% 1,991,103 $23,514,722 ICL Iceni Gold 0.034 -13% 366,773 $9,615,881 1TT Thrive Tribe Tech 0.014 -13% 104,506 $4,745,944 BMG BMG Resources Ltd 0.014 -13% 752,527 $10,140,755 KPO Kalina Power Limited 0.007 -13% 200,000 $17,681,024 LHM Land Homes Grp Ltd 0.007 -13% 23,146 $8,395,114 POD Podium Minerals 0.028 -13% 346,556 $14,551,897

ICYMI – AM Edition

Latin Resources (ASX:LRS) has announced the appointment of Peter Oliver as executive director and chairman of the Development Committee, effective immediately to proactively accelerate the Salina’s Lithium Project into production.

Mako Gold (ASX:MKG) has revealed that its planned SPP to raise $500,000 has attracted a lot more interest than anticipated. In light of the company received applications in excess of $3.7 million, it has decided to increase the SPP Offer to $2,000,000.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.