You might be interested in

News

ASX Small Caps Lunch Wrap: Weak retail sales lift local market, choice Chinese data might even keep it there

News

Top 10 at 10: Silver hits and a big lithium rally

Mining

News

It’s always a lovely surprise when things that you think are going to be terrible turn out okay – like finding out that you’re going to be gassed unconscious before a colonoscopy, or thinking that a review of the ASX this week isn’t the bloodbath that you were expecting.

This week, the mood around the bourse has been pretty negative. Ructions from the US over rising bond yields and the catastrophically dim behaviour of America’s “leaders” pushing towards a government shutdown that they all claim to want to avoid has given Wall Street some collective heartburn, which local markets seem to absorb like secondhand smoke in a cigar bar.

So the fact that the ASX 200 benchmark is looking to end the week pretty much flat is certainly a happy one this afternoon.

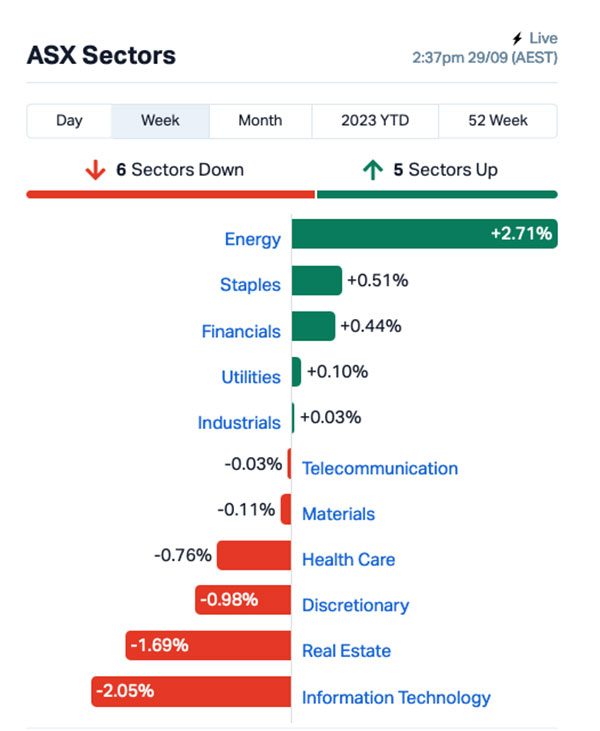

But that’s not to discount that certain market sectors have done really well – Energy is the clear standout, after uranium stocks went ballistic early in the week – while others have fallen dramatically.

Here’s the state of play:

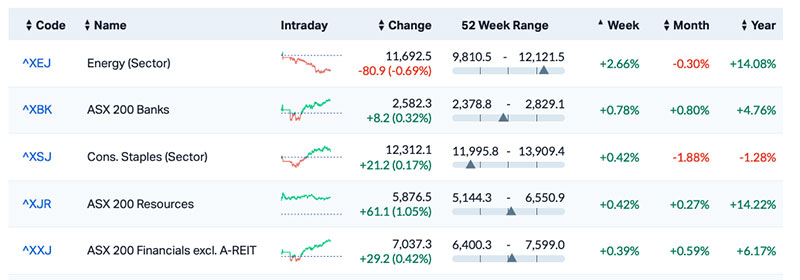

A more granular look via the official ASX indices tell the same story, while highlighting that the better of the gains were right where you’d expect to find them – up the big end of town, among the Banks and the Big Diggers.

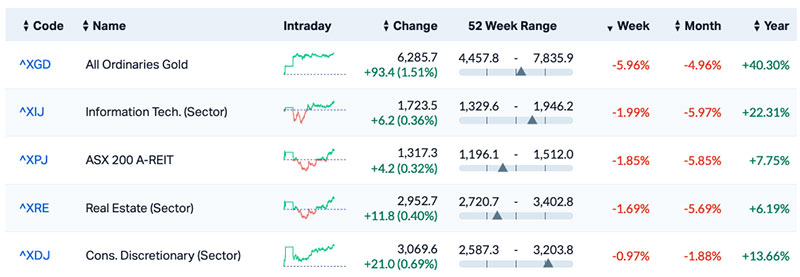

Except for gold. The ASX XGD All Ords Gold index fell shockingly this week, losing more than 6.0% – which is bad if that’s where your money’s been parked, but a positive sign in some respects, suggesting that risk appetite is returning to the market, despite how volatile things have been.

The best of the ASX indices look like this:

And the worst of them are about as joy-inducing as a dropped ice cream on a hot summer’s day.

Here are the best performing ASX small cap stocks from 18-22 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| BIT | Biotron Limited | 0.071 | 115% | $45,999,190 |

| ERG | Eneco Refresh Ltd | 0.023 | 64% | $6,264,242 |

| LPI | Lithium Pwr Int Ltd | 0.36 | 60% | $220,233,146 |

| BGE | Bridgesaaslimited | 0.036 | 55% | $1,419,696 |

| 8IH | 8I Holdings Ltd | 0.029 | 45% | $10,363,324 |

| CXU | Cauldron Energy Ltd | 0.013 | 44% | $11,418,824 |

| MTC | Metalstech Ltd | 0.215 | 43% | $40,549,987 |

| HAR | Harangaresources | 0.24 | 41% | $11,179,084 |

| RML | Resolution Minerals | 0.007 | 40% | $8,801,043 |

| CBR | Carbon Revolution | 0.16 | 39% | $29,701,351 |

| FL1 | First Lithium Ltd | 0.25 | 39% | $18,563,692 |

| 1AE | Auroraenergymetals | 0.145 | 38% | $23,085,005 |

| PIL | Peppermint Inv Ltd | 0.011 | 38% | $24,454,282 |

| 1AG | Alterra Limited | 0.008 | 33% | $5,572,420 |

| ADR | Adherium Ltd | 0.004 | 33% | $19,997,633 |

| AVW | Avira Resources Ltd | 0.002 | 33% | $4,267,580 |

| EEL | Enrg Elements Ltd | 0.008 | 33% | $7,069,755 |

| INP | Incentiapay Ltd | 0.008 | 33% | $10,120,509 |

| MTH | Mithril Resources | 0.002 | 33% | $6,737,609 |

| NET | Netlinkz Limited | 0.008 | 33% | $28,244,227 |

| RDS | Redstone Resources | 0.008 | 33% | $6,971,028 |

| RGS | Regeneus Ltd | 0.008 | 33% | $2,145,058 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| SW1 | Swift Networks Group | 0.02 | 33% | $9,933,815 |

| PEN | Peninsula Energy Ltd | 0.145 | 32% | $157,224,773 |

| OLI | Oliver'S Real Food | 0.025 | 32% | $10,577,566 |

| GLA | Gladiator Resources | 0.022 | 29% | $11,225,140 |

| BTH | Bigtincan Hldgs Ltd | 0.38 | 29% | $233,792,440 |

| 1TT | Thrive Tribe Tech | 0.027 | 29% | $8,008,781 |

| FRX | Flexiroam Limited | 0.036 | 29% | $23,910,901 |

| KNO | Knosys Limited | 0.041 | 28% | $8,861,687 |

| AN1 | Anagenics Limited | 0.023 | 28% | $7,312,399 |

| AJL | AJ Lucas Group | 0.014 | 27% | $20,635,944 |

| DYL | Deep Yellow Limited | 1.3525 | 25% | $978,320,434 |

| FLC | Fluence Corporation | 0.175 | 25% | $107,341,416 |

| CTN | Catalina Resources | 0.005 | 25% | $6,192,434 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | $1,787,583 |

| E33 | East 33 Limited. | 0.03 | 25% | $15,053,572 |

| GTG | Genetic Technologies | 0.0025 | 25% | $28,854,145 |

| GTH | Gathid Ltd | 0.025 | 25% | $6,058,612 |

| ROO | Roots Sustainable | 0.005 | 25% | $693,611 |

| T92 | Terrauraniumlimited | 0.15 | 25% | $6,450,645 |

| VAR | Variscan Mines Ltd | 0.015 | 25% | $4,992,606 |

| XF1 | Xref Limited | 0.2 | 25% | $37,700,699 |

| QPM | Queensland Pacific | 0.067 | 24% | $123,065,000 |

| A8G | Australasian Metals | 0.185 | 23% | $9,642,291 |

| JGH | Jade Gas Holdings | 0.037 | 23% | $37,229,555 |

| STK | Strickland Metals | 0.064 | 23% | $97,614,701 |

| IND | Industrialminerals | 0.49 | 23% | $30,580,500 |

| LV1 | Live Verdure Ltd | 0.33 | 22% | $33,086,922 |

There is an enormous amount of buzz around local health tech Biotron (ASX:BIT), putting it at the tippy top of the winners list for the week, after a happy letter from management to shareholders about how things are progressing for its clinical trials.

As of this arvo, it’s jumped 115% – but not after catching the eye of the ASX market watchers, and earning BIT a speeding ticket early on Friday morning.

Biotron’s response was pretty clear… they’ve got no reason to explain away why everyone piled on so aggressively on Friday, but it is what it is, and I doubt BIT’s shareholders are complaining too much.

Eneco Refresh (ASX:ERG), supplier of those huge water bottles we all love to gather around to gossip, also put in a winning show this week, closing around 65% higher after releasing its annual report to shareholders.

The company dropped a preview report in late August, which sent the company’s trading price on a bit of a see-saw run – but today’s report has been taken quite positively by the market.

The company ended up with an 11% increase in revenue this financial year, and also sold off its Darwin factory on 9 June 2023 for $4.5 million, before selling its entire Darwin operation on 15 August 2023 for $400,000.

Lithium Power International (ASX:LPI) came through the week on a highly positive note as well, continuing its rapid rise that kicked off on 21 September to end this current week up 60%.

Two reasons behind that are a massive new surge of interest in lithium players this week, followed by confirmation of media reports that the company is in early talks with Chile’s state miner about a potential transaction.

It’s still very early stages, though, according to the company – but the hint that there’s potentially something in the works for LPI was enough to jazz things up considerably.

Here are the best performing ASX small cap stocks from 18-22 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MSI | Multistack Internat. | 0.003 | -40% | $408,912 |

| AW1 | Americanwestmetals | 0.14 | -39% | $49,980,073 |

| FGL | Frugl Group Limited | 0.011 | -39% | $11,472,744 |

| CHR | Charger Metals | 0.12 | -37% | $6,832,580 |

| VPR | Volt Power Group | 0.001 | -33% | $16,074,312 |

| BOT | Botanix Pharma Ltd | 0.125 | -32% | $170,543,618 |

| VN8 | Vonex Limited. | 0.013 | -32% | $5,427,429 |

| JNO | Juno | 0.075 | -31% | $11,530,930 |

| IGN | Ignite Ltd | 0.052 | -31% | $4,658,273 |

| TPC | TPC Consolidated Ltd | 5.26 | -30% | $59,549,999 |

| MKG | Mako Gold | 0.014 | -30% | $8,064,115 |

| OZM | Ozaurum Resources | 0.1 | -29% | $17,462,500 |

| RNO | Rhinomed Ltd | 0.036 | -28% | $10,285,909 |

| DTM | Dart Mining NL | 0.021 | -28% | $3,287,232 |

| CDR | Codrus Minerals Ltd | 0.067 | -27% | $4,774,770 |

| ACM | Aus Critical Mineral | 0.26 | -27% | $7,581,469 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | $8,737,021 |

| BEX | Bikeexchange Ltd | 0.006 | -25% | $8,595,779 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | $2,669,460 |

| DES | Desoto Resources | 0.12 | -25% | $8,090,078 |

| KEY | KEY Petroleum | 0.0015 | -25% | $2,951,892 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | $15,569,766 |

| MTB | Mount Burgess Mining | 0.003 | -25% | $4,062,587 |

| OAR | OAR Resources Ltd | 0.0045 | -25% | $13,065,679 |

| S3N | Sensore Ltd | 0.21 | -25% | $8,188,479 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | $18,306,384 |

| TYM | Tymlez Group | 0.003 | -25% | $3,714,586 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| CAZ | Cazaly Resources | 0.031 | -24% | $13,430,102 |

| WBEDC | Whitebark Energy | 0.038 | -24% | $7,339,661 |

| HAW | Hawthorn Resources | 0.092 | -23% | $33,501,561 |

| GLL | Galilee Energy Ltd | 0.05 | -23% | $17,603,950 |

| HTG | Harvest Tech Grp Ltd | 0.027 | -23% | $18,086,000 |

| MZZ | Matador Mining Ltd | 0.044 | -23% | $15,771,702 |

| BMR | Ballymore Resources | 0.085 | -23% | $16,081,699 |

| NYM | Narryermetalslimited | 0.12 | -23% | $5,649,000 |

| EMT | Emetals Limited | 0.007 | -22% | $5,950,000 |

| IBG | Ironbark Zinc Ltd | 0.007 | -22% | $10,267,490 |

| L1M | Lightning Minerals | 0.105 | -22% | $5,307,957 |

| SP8 | Streamplay Studio | 0.007 | -22% | $7,966,866 |

| ARN | Aldoro Resources | 0.086 | -22% | $11,577,642 |

| ANX | Anax Metals Ltd | 0.036 | -22% | $15,906,445 |

| RRR | Revolverresources | 0.094 | -22% | $11,634,910 |

| TRE | Toubaniresourcesinc | 0.098 | -22% | $12,340,529 |

| ICR | Intelicare Holdings | 0.011 | -21% | $2,506,985 |

| MRC | Mineral Commodities | 0.033 | -21% | $22,818,046 |

| BTE | Botalaenergyltd | 0.095 | -21% | $5,331,667 |

| BBX | BBX Minerals Ltd | 0.027 | -21% | $13,978,834 |

| BPP | Babylon Pump & Power | 0.004 | -20% | $12,310,385 |

| HLX | Helix Resources | 0.004 | -20% | $9,292,583 |

Monday September 25, 2023 – ASX down 0.06% at the bell, up 0.1% at settlement

Firstly, Cauldron Energy (ASX:CXU) was one of the many smaller stocks which climbed nicely on Monday despite offering nothing in the way of a market moving update.

However, CXU is part of the upwardly mobile family of ASX uranium players Aurora Energy Metals (ASX:1AE), Elevate Uranium (ASX:EL8), and Alligator Energy (ASX:AGE) as chatter about a nuclear-powered future builds in intensity.

Global investors are all over ASX uranium shares as the spot price clocks more than decade highs, with expectations that the bull run is just starting.

SaaS firm Bridge SaaS (ASX:BGE) said goodbye to interim CEO Anna-Marie Stella, with the news non-executive director and tech guru Leanne Graham will assume the role of interim boss.

Algorae Pharmaceuticals (ASX:1AI) jumped on no news. The company (formerly Living Cell Technologies (ASX:LCT)) recently announced that it’s signed an MoU with UNSW to develop an AI platform to assist with drug development.

QX Resources (ASX:QXR) also rose, living on last week’s news that the company’s 39%-owned company Bayrock has expanded the Vuostok nickel-copper project area in northern Sweden by 33%.

Tuesday September 26, 2023 – ASX down almost -0.6%

In a very welcome letter to shareholders on Tuesday, Michelle Miller CEO and MD of the Aussie pharmaceutical aspirant, Biotron (ASX:BIT) revealed a fair bit of excitement about the near-term outlook as it completes the final stage of three Phase 2 clinical trials for HIV‐1 and COVID‐19.

Meanwhile, top of the pops on Tuesday was NickelSearch (ASX:NIS) following lithium-related exploration results at its Carlingup nickel sulphide project near Ravensthorpe in WA.

NIS says it’s ID’d spodumene in pegmatites at Carlingup in collaboration with geologists from neighbouring big miner Allkem (ASX:AKE) .

As Stockhead’s legendary roving (mostly around his own home) reporter Rob Badman wrote, AKE is a $7.44bn lithium exploring star and NIS has set up its Carlingup shop with a nearology narrative just 10km from Allkem’s Mt Cattlin lithium mine – which hosts an estimated 12.8Mt high-grade resource.

Aurora Energy Metals (ASX:1AE) was surging again after strong gains on Monday, and at this stage of the week, it was up 71%.

Finally, Avenira (ASX:AEV) was up over 20% after executing a License and Technology Transfer Agreement and a Subscription Agreement with its Taiwanese tech partner Aleees (or Advanced Lithium Electrochemistry).

The two deals provide Avenira access and the right to use Aleees’ intellectual property for the manufacture and global distribution of Lithium Ferro Phosphate (LFP) cathode active material.

The new tie-ups follow the signing of a non-binding MOU with Aleees in September last year to work towards the development of a Lithium Iron Phosphate (LFP) battery cathode manufacturing plant in Darwin using Avenira’s flagship Wonarah Phosphate Project.

Wednesday September 27, 2023 – ASX down -0.3% at close, -0.1% after settlement

Uranium junior Haranga Resources (ASX:HAR), secured firm commitments for $2.86m, then climbed throughout the day to sit comfortably atop the small cap ladder at with a gain of 63% late in afternoon trade.

Philippines-focused Aussie fintech Peppermint Innovation (ASX:PIL) jumped about 50% after sharing the long-awaited and terribly welcome news that its subsidiary, Peppermint Bizmoto Inc has secured 2x “vitally important certifications” from the Central Bank of the Philippines, Bangko Sentral ng Pilipinas.

Shares in Mighty Kingdom (ASX:MKL) jumped in late arvo trade, after the gaming stock revealed that exactly 52,496,666 fully paid ordinary shares will be released from escrow on 2 October 2023, as per its prospectus.

The release is welcome news for the Aussie gaming minnow, which hired lawyers last week to chase down their own ex-CEO for circa $2.1 million, and which it says are owed by the gaming company’s largest shareholder Gamestar Studios founded by ex MKL CEO Shane Yeend.

Flynn Gold (ASX:FG1) commenced drilling at Tasmania’s Warrentinna project testing a high grade, near-surface gold target zone identified by historical drill results that include a thumping 5.0m @ 28.93g/t Au from 36.0m, including 1.0m @ 103.25g/t Au from 37.0m.

Recent market leader OzAurum Resources (ASX:OZM) gained another double digit increase on an amended announcement that the company has completed its due diligence on the Linopolis Jaime hard rock lithium project acquisition in the state of Minas Gerais, Brazil.

Thursday September 28, 2023 – ASX down 0.08%

Pioneer Lithium (ASX:PLN) topped the charts with a belter of a debut, going live on the market after a heavily oversubscribed $5 million IPO, thanks to the company’s “multi-asset portfolio of strategically located lithium projects in Ontario and Quebec, Canada”.

Mali spod hunter First Lithium (ASX:FL1) – formerly known as (Ookami) jumped back to work on the ASX after a long and lonely suspension. FL1 stock clocked in at over +41% by lunch in a warm welcome back, to finish the day up more than 47%.

You should read Reub’s and Josh’s work on this one – it’s complicated, and they’re far better at explaining it than I am.

MetalsTech (ASX:MTC) finished up 26.5% because “lithium”, which seemed to be the hard driver for Small Caps yesterday.

MTC recently announced that it bought a hard rock lithium project in… you guessed it… James Bay, and this morning announced that “highly respected lithium industry executive” Robert Sills has been added to the board as a non-executive technical director.

The other big winner was Lithium Power International (ASX:LPI), which climbed 34.6% after confirming that recent media speculation regarding discussions between Chile’s national miner and LPI about a potential transaction were, indeed, true.

Friday 22 September – ASX up around 0.35%

Biotron (ASX:BIT) added more than 40% on Friday, moving very rapidly on no fresh news (since Tuesday, when it shot up earlier in the week), catching the eye of the ASX Highway Patrol, who issued it a speeding ticket this morning to ask why BIT’s price has launched from a low of $0.032 to a high of $0.07 by 11am.

Biotron responded with a very curt “No idea, sorry” – and that was the end of that discussion.

CZR Resources (ASX:CZR) was leading the way at lunchtime, up 31.8% early before closing around +27% on news that the Pilbara Ports Authority (PPA) has reviewed the Port of Ashburton Consortium Joint Venture (PAC JV) Project Definition Document for the iron ore export facility and provided conditional support subject to EPA, Main Roads WA and Shire of Ashburton approvals.

Following its review, the PPA has agreed for the PAC JV to submit a Development Application for the POA Export Facility – consent that the company says “represents a significant development for the project”.

Forbidden Foods (ASX:FFF) climbed nicely through 21% this morning to close around the same price later in the day after releasing its annual report to shareholders after hours last night.

It’s really long, so I only managed to grab time to skim it, but from what I can see, FFF has spent the year repositioning itself in response to a variable market for its product, reducing costs and making healthier offerings.

However, revenue is down Yoy, $3,733,271 for FY23 against $6,581,489 for FY22 – but the company seems pretty upbeat about what the coming year will hold, and so do investors.

Yes, there was!

Listing: 28 September, 2023

IPO: $5.0m at $0.20 per share (heavily oversubscribed)

A couple of weeks after Canadian lithium play James Bay Minerals (ASX:JBY) broke the IPO drought and scored big time, Pioneer Lithium made its own solid debut, hitting the ground running at launch and ending the week up 90%, around $0.38 a pop.

It’s hardly surprising, given that the company’s portfolio covers three highly prospective battery/critical minerals projects in Northern Ontario and in James Bay, Quebec – all of which have access to the fast-growing North American battery raw material market.

The plans is to kick off exploration at its Root Lake lithium project in Ontario, which sits directly between Green Technology Metals’ (ASX:GT1) Root Bay and Morrison/McCombe lithium deposits, and the company’s LaGrande project in the world class James Bay region.

Chariot Corporation (CC9) – Due to list on October 2, $15.5 million at $0.45.

CGN Resources (CGN) – Due to list on October 12, $10 million at $0.20.

Far Northern Resources (FNR) – Due to list on October 13, $6 million at $0.20.