ASX Rebalance: Biotech Neuren enters S&P ASX 200, Harvey Norman booted and Liontown makes the top 100

News

News

The scent of blooming flowers, a gentle warming sun, maybe if you’re not so lucky the triggering of spring allergies – September has arrived.

The first month of spring also signals the ASX September rebalance of some key indices.

Responsibility for rebalancing falls on S&P Dow Jones Indices, part of credit rating agency S&P Global. Indexes rebalanced in the latest quarterly review included:

The September rebalance comes into effect before opening trade on Monday, September 18, 2023.

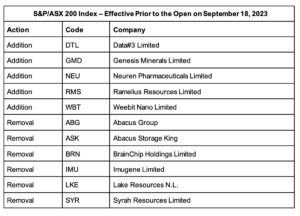

Of particular note are the S&P/ASX 200 and S&P/ASX 300 and are ones many fund managers or investors use as a cutoff for investments.

Entering the S&P/ASX 300 is a major milestone for a company, signifying they’ve made it to the big league.

READ: The great rebalancing act and how it can impact share prices

Let’s dive deep into the performance of additions and removals to the indexes this September.

Firstly, there were no change to the S&P ASX 20 and S&P ASX 50. However, consumer electronics, bedding, appliances and whitegoods retailer Harvey Norman Holdings (ASX:HVN) found itself booted out of the S&P ASX 100.

The HVN price has fallen 0.24% YTD with the retailer heavyweight last week announcing a near one-third decrease in its full-year FY23 earnings, prompting a reduction in its dividend.

NPAT was $539.5 million, a decrease of 33.5%. Earnings stood at $680.23 million, aligning closely with the market guidance provided in June, showing a decrease of 27.8%

A new addition to the S&P ASX 100 is Tim Goyder-chaired Liontown Resources (ASX:LTR), which has risen in value by 14,100% since it was trading at just 2c in early 2019 and is up more than 115% YTD.

The prospective lithium miner has been the target of takeover bids from Albemarle (NYSE:ALB) and announced on Monday that it had received a revised conditional and non-binding indicative proposal to acquire all of the ordinary shares outstanding for $3/per share valuing the company at $6.6 billion.

LTR appears ready to accept the latest offer saying the board has determined to grant Albemarle an opportunity to conduct a limited period of exclusive due diligence.

The prospective lithium miner plans to open its $895 million Kathleen Valley spodumene mine in WA’s Goldfields in mid-2024 and is up ~98% YTD.

2023 darling of the ASX biotech sector Neuren Pharmaceuticals (ASX:NEU) has been elevated to the S&P ASX 200 after rising more than 47% YTD after large pharma partner Acadia (Nasdaq:ACAD) announced in March that the US Food and Drug Administration (FDA) had approved trofinetide for the treatment of Rett syndrome.

Now dubbed DAYBUE, the drug is the first approved treatment for Rett syndrome with its official launch in the US by Acadia in April.

Acadia recently provided encouraging early insights into the US launch of DAYBUE, expecting net sales of US$21-23 million in Q2 2023 and US$45-55 million in Q3 2023.

Furthermore, NEU recently announced it had received the upfront payment of US$100 million that was earned following the recent expansion of its partnership with Acadia for trofinetide to a worldwide exclusive licence.

Petra Capital healthcare analyst Tanushree Jain told Stockhead it’s another key milestone for NEU and comes exactly one year after the company was added to the ASX 300.

“There are several important catalysts skewed to Q4 this year with further update and sales guidance from partner Acadia on Daybue expected in November, to be followed by proof-of-concept results for second drug NNZ-2591 (for Phelan-McDermid syndrome) which is commercially more attractive but not reflected in current price making it a free option,” Jain says.

“While we are watching for competitor Anavex’s results also in Q4 we do not view it as a material threat to change our investment view on the stock.”

Also added to the S&P ASX 200 were tech plays Weebit Nano (ASX:WBT) and Data#3 (ASX:DTL) as artificial intelligence (AI) fuels a resurgence in the the tech sector in 2023.

WBT, which specialises in semiconductor memory technology development, has seen its share price rise more than 20% YTD. Its Resistive RAM (ReRAM) technology caters to the demand for enhanced performance and reduced power consumption in various emerging electronic products, including Internet of Things (IoT) devices, smartphones, robotics, autonomous vehicles, 5G communications, and AI.

Brisbane-based IT services and solutions provided DTL reported a 22% increase in profits of $37 million for FY23 and revenue up 16.9% to $2.5 billion, with its share price up ~9% YTD.

CEO and managing director Laurence Baynham says revenue growth was three times greater than the wider IT sector as DTL continues to capture market share which is testament to its full lifecycle service offering, the strength of vendor relationships and track record in delivering large scale infrastructure and digital transformation projects.

“Meanwhile we are seeing new solutions emerging in artificial intelligence (AI) which is creating substantial opportunities across our customer solutions,” he says.

However, being removed from the S&P ASX 200 is another tech and AI play BrainChip Holdings (ASX:BRN).

BRN is involved in neuromorphic computing, which is a type of AI that simulates the functionality of the human neuron and is working on commercialisation of its Akida chip. With a market cap of $772 million, BRN is down more than 58% YTD.

On the resources side, gold miners surge with Raleigh Finlayson’s Genesis Minerals (ASX:GMD)and Ramelius Resources (ASX:RMS) new additions to the S&P ASX 200.

The GMD share price is up 35% YTD with the company buying the underperforming St Barbara (ASX:SBM)

Gwalia gold mine to revive.

RMS’s share price has lifted more than 43% YTD with the gold miner recently announcing it will pay out a 2 cents/share fully franked dividend, double last year’s final return.

The dividend lift came on the back of solid FY23 results including production of 240,996oz of gold at an AISC of $1895/oz, a 5% lift in revenue to $631.3m, 23% rise in EBITDA to $256.7m and 396% lift in statutory net profit to $61.6m.

RMS delivered underlying NPAT of $75.3 million in FY23, up 3% on FY22, with underlying EBITDA down 6% to $276.3m and cash and bullion on hand up 57% to $272.2m.

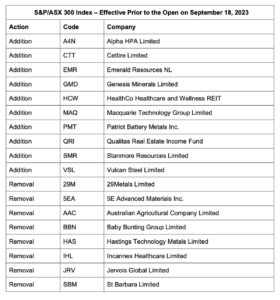

Online luxury fashion retail platform Cettire (ASX:CTT) is a new addition to the S&P ASX 300 with its share price up ~130% YTD.

CTT reported a strong FY23, including sales revenue up 98% on pcp to $416.2 million, while Adjusted EBITDA was $29.3 million, up from a loss of $21.5 million in the pcp.

“FY23 has been another year of tremendous growth and transformation for Cettire,” says CEO and founder, Dean Mintz.

“Through strong execution against our strategy to maximise profitable revenue growth, Cettire grew rapidly whilst also delivering significant profitability and cash generation.”

However, maternity and baby retailer Baby Bunting (ASX:BBN) has been removed from the S&P ASX 300 with its share price down ~19%.

BBN recorded total FY23 sales of $515.8 million, up 1.7% on the pcp with statutory NPAT of $9.9 million, down 49.5% vs pcp and cutting its dividend.

The company says while its business is less discretionary, customers are still not immune to cost-of-living pressures and as a result, it experienced sales decline towards the end of the year as consumer spending slowed.

New addition to the S&P ASX 300, high purity alumina (HPA) stock Alpha HPA (ASX:A4N), has quietly gained 85% in 2023 and is now worth more than $1 billion.

A4N is focused on delivering its HPA First Project in Gladstone, Queensland, which seeks to commercialise its proprietary aluminium purification and refining technology with the company awarded a $15.5m grant under the Federal Government’s Critical Minerals Development Program.

Red hot lithium stock Patriot Battery Minerals (ASX:PMT) is also into the S&P ASX 300 after stellar gains this year. PMT released a monster maiden resource at its Corvette lithium project in Canada of 109.2Mt @ 1.42% Li2O in July.

In August it inked a strategic investment deal and Memorandum of Understanding with Albemarle Corporation.

4D Medical (ASX:4DX), Macquarie Technology Group (ASX:MAQ) and OFX Group (ASX:OFX) are new additions to the S&P ASX All Technology Index, while CogState (ASX:CGS) has been booted.

4DX owns the XV Technology, a platform that’s rapidly setting the scene for a step-change in respiratory imaging, disrupting methods that in some cases have been in use for more than a century. The company has seen its share price up more than 53% YTD.

MAQ (MAQ, formerly Macquarie Telecom Group) provides cloud computing, telecommunication, cybersecurity and data centre services to government and corporate clients. Its share price is up ~14% YTD.

Formerly OzForex Group OFX provides online international payment services for consumer and business clients and foreign exchange services.

The company recently announced FY23 turnover of $39.1 billion driving net operating income of $214.1 million, and underlying EBITDA of $62.4 million.

“These metrics represent the biggest NOI we have ever produced, up 45.6% on prior corresponding period, and the biggest underlying EBITDA we have ever produced, up 40.3% vs prior corresponding period, whilst generating the strongest net available cash of $67.4m we have ever had,” CEO Skander Malcolm says.

However, finding itself removed from the S&P All Technology index is CGS, which is down more than 21% YTD. CGS is involved in the validation and commercialisation of digital brain health assessments, as well as provision of quality assurance services in clinical trials.

The company recently reported its FY23 results including revenue of $40.5 million, down 10% on PCP but within guidance of $39 million to $41 million.

CGS says it was impacted by trial delays and low second half new contract sales.

“With a growing addressable market, a well-validated offering, strong commercial partnerships with the relevant drug developers, and a strong balance sheet, Cogstate is well positioned to return to growth quickly,” CGS says.