ASX Defence Stocks Part 1: Who’s fighting who, and who’s out at sea?

News

In Part I of this look at ASX-listed defence stocks, Christian Edwards takes a long, stoic look out to sea to see what he can see when it comes to naval applications of solid Aussie tech.

“There is no more important and consequential task for Government than protecting the security,

interests and livelihoods of its people.”

Thus begins the Albanese Government’s independent Defence Strategic Review (DSR, released to the public in May) a 100-ish page assessment of the question; does Australia have the necessary ‘capability, posture and preparedness to best defend the country and its interests in the strategic environment we now face.’

China, India and Japan are leading a surge in military spending in the Asian region with geopolitical tensions pushing the rest of us – South Korea, Australia and Taiwan, in particular, to follow suit.

On Monday, local aerospace specialist Electro Optic Systems (ASX:EOS) secured its latest new supply contract (valued at circa $28mn) as part of the deployment of its R600 Remote Weapon System (RWS) to a customer in South East Asia.

EOS is largely focused in space defence, but its defence systems – which include laser physics, advanced optics, precision control systems, space domain sensors and communications technologies – also feature remote operated combat vehicles bristling with systems like the R600. I have heaps on that below, so keep reading, my pretties.

(Ed’s note – if you’re pretty enough to keep reading, get comfy… there’s a lot of ground to cover)

According to Titomic (ASX:TTT) head of sales and marketing Dominic Parsonson, while no one wants a bucket of war, the present geopolitical unrest is ramping up and that on both a macro and micro level, represents an important shift for many Australian SMEs.

“Now, as our Government looks to be self-reliant by securing supply chains and onshoring capability yet at the same time ensuring a collaborative approach to development, we have a golden chance to enter the global arena,” he says.

Among major global companies in the defence market are Raytheon Technologies Corporation, The Boeing Company, Lockheed Martin Corporation (see below), Northrop Grumman Corporation, BAE Systems, Airbus Group SE and Thales Group.

And to that end, Parsonson says there’s ASX companies steeping up for the defence sector, leading to global partnerships with some of the big players.

“These are companies delivering competitiveness based on a unique capability, rather than attempting to compete on volume or in commodity areas,” he told Stockhead last month.

“A number of the large primes, for example, BAE Systems and Boeing to name a few, also have very active Australian industry content programs where they are actively working with SMEs to uplift their capabilities and introduce them into their broader supply chains.”

Parsonson says Australian Government backed Team Defence Australia (TDA) is also helping companies grow globally in the sector.

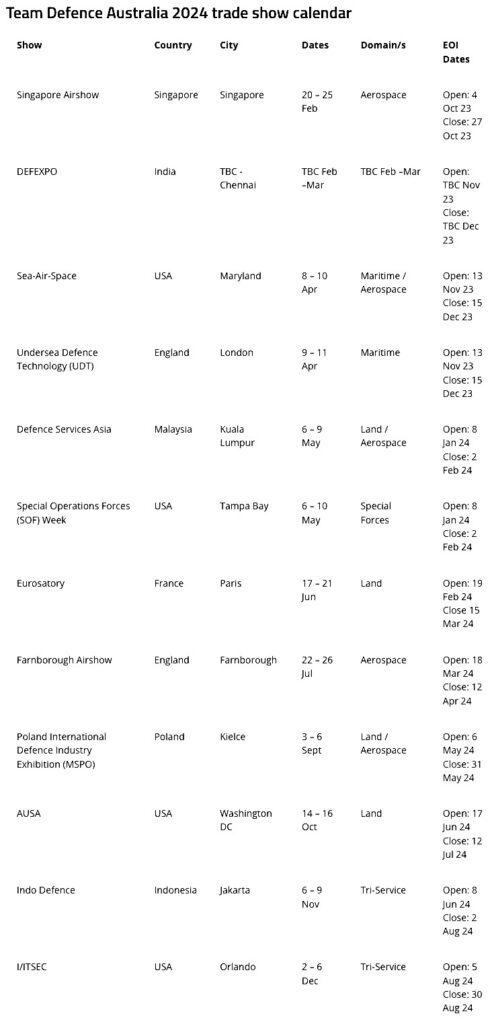

Their events are worth keeping track of:

Needless to say, the US retains by far the largest global military with spending of US$812 billion last year — almost three times that of China’s circa US$283bn.

The American’s commitment of 3.45% of GDP is one of the largest in the advanced world, exceeded only by Israel (4.5%) and by both Russia (4.06%) and Ukraine (33.5%).

Japan, meanwhile plans to splurge more than double on defence over the five years vs the last five as it steps to the variety of security challenges in the Indo-Pacific region, according to the country’s new defence whitepaper, released in July.

The paper projects the Japanese defence budget will grow to US$310bn between fiscal 2024 and fiscal 2028, compared with the US$122.5bn spent from 2019 and to fiscal 2023.

This includes US$35.6bn for standoff defence capabilities that Japan has just recently begun to acquire; a sector Japan had previously spent US$1.4m on since 2019.

The global defence market is, unsurprisingly, scary AF. The current market value of war? Not an easy thing to put a number on, considering the very nature of conflict – a term I’ve always considered apt – The fog of war from the German Nebel des Krieges, a phrase used to describe the ‘uncertainty in situational awareness experienced by participants during military operations.’

Consider Israel in Gaza right now as a typical example… knowing what is happening and making the right decisions within the field in real time is done entirely blindly.

It’s off topic, but if you’re investing in war, then this is a fine film to consider.

Anyhoo, according to this research, the world spent US$474.69bn in 2021 on war, the defence sector will clock US$687.84 million in 2026 at a CAGR of +7%.

The defence sector is then expected to grown at a CAGR of 4% from 2026 and reach US$838.03 billion in 2031. I just think these numbers are pot shots. But at least they provide context and ballpark.

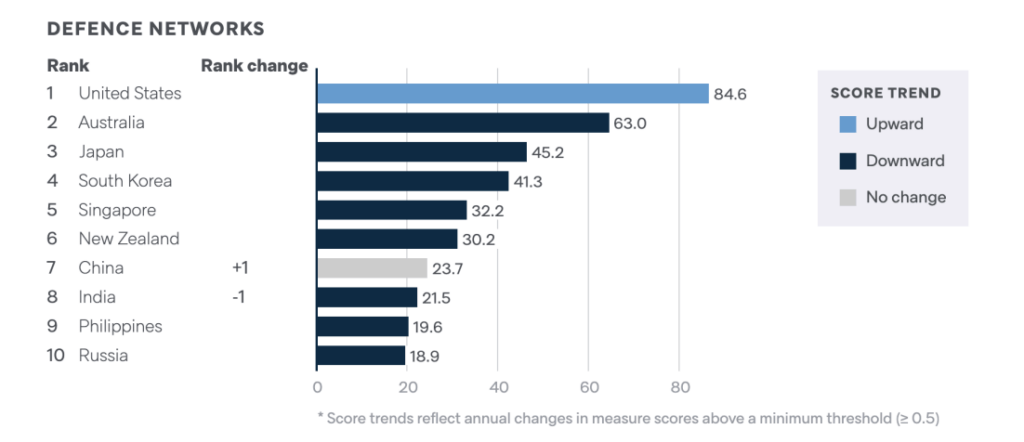

Lowy Institute Asia-Pacific Defence Network rankings 2023:

Defence partnerships that act as force multipliers of autonomous military capability; measured through assessments of alliances, regional defence diplomacy and arms transfers.

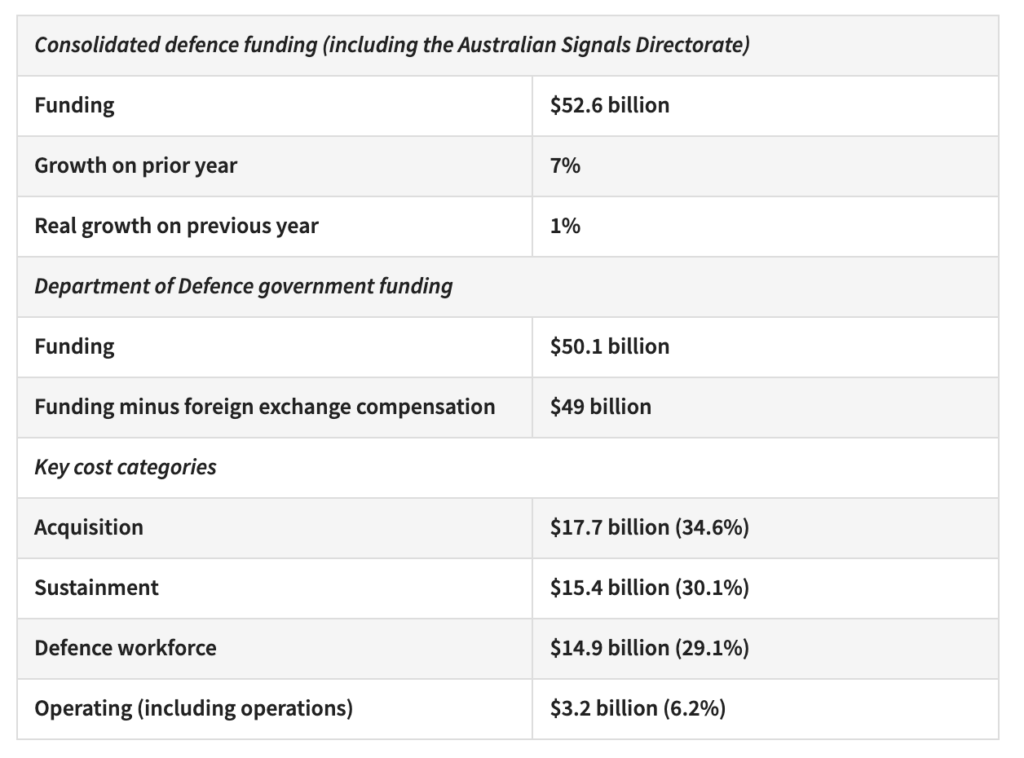

While the current core funding of our Defence budget, excluding the Australian Signals Directorate, is actually falling ($154bn in 2023–24 to $152.5bn 2025–26), the Australian Strategic Policy Institute says both the AUKUS nuclear submarine deal and the DSR conclusions highlight an approach in which ‘capability will drive budget conversations, not vice versa.’

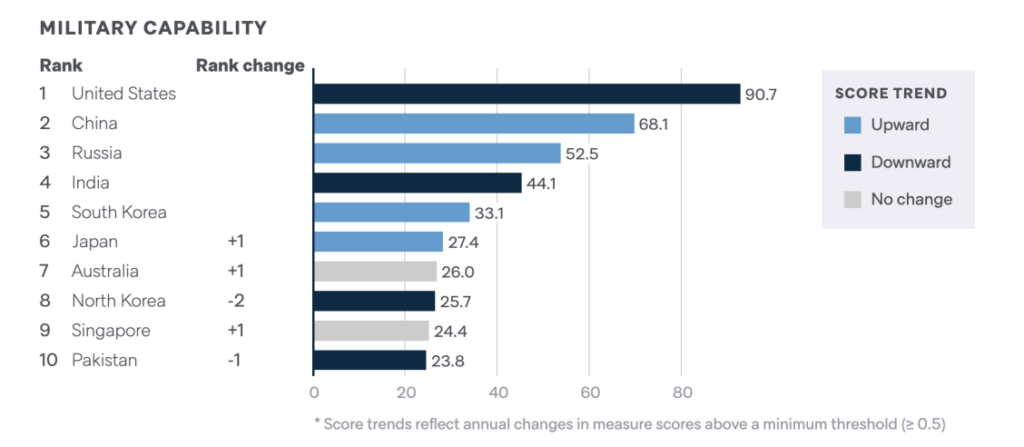

Lowy Institute Military Capability Asia-Pacific 2023:

Conventional military strength; measured in terms of defence spending, armed forces and organisation, weapons and platforms, signature capabilities and Asian military posture.

Australia’s defence funding for 2023-24 is now at 2.04% of GDP, up from the more traditional circa 1.5% and according to ANZ research military spending was forecast to reach 3.5% of GDP by the end of the decade.

Things, the DSR concludes, are getting that serious.

From 2027, the government will start lifting funding for defence from around 2.05% of GDP to more than 2.3%. The additional funding will lift Defence’s share of government spending from about 8.2% now, including both operational and capital spending, to about 9.7% by 2032–33.

Something along these lines, as per the DSR:

The Government’s immediate actions to reprioritise Defence’s capabilities in line with the Review’s recommendations include:

- Investing in conventionally-armed, nuclear-powered submarines through the AUKUS partnership

- Developing the ADF’s ability to precisely strike targets at longer range and manufacture munitions in Australia

- Improving the ADF’s ability to operate from Australia’s northern bases

- Lifting our capacity to rapidly translate disruptive new technologies into ADF capability, in close partnership with Australian industry

- Investing in the growth and retention of a highly-skilled Defence workforce

- Deepening our diplomatic and defence partnerships with key partners in the Indo-Pacific

In collaboration with the local defence industry, the Australian Government is extending its military support to Ukraine with an additional allocation of $20 million. This assistance includes a range of Australian-manufactured equipment designed to bolster Ukraine’s defense capabilities, such as demining tools, portable X-ray machines, a 3D metal printer, and anti-drone systems.

These cutting-edge items are produced by four forward-thinking Australian defense companies: DroneShield, Micro-X, Minelab, and SPEE3D. With this new allocation, Australia’s total support to Ukraine reaches approximately $910 million, encompassing the provision of Bushmaster-protected mobility vehicles, heavy artillery, essential ammunition, and contributions to the Ukraine Humanitarian Fund.

ASX defence stocks best positioned for the frontline:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Sub-sector |

|---|---|---|

| AJX | ALEXIUM INTERNATIONAL GROUP | MILITARY EQUIPMENT |

| ASB | AUSTRAL | SHIPBUILDING |

| BCT | BLUECHIIP LTD | MILITARY EQUIPMENT |

| BIS | BISALLOY STEEL GROUP LTD | MILITARY EQUIPMENT |

| BRN | BRAINCHIP HOLDINGS LTD | MILITARY EQUIPMENT |

| CDA | CODAN LTD | MILITARY EQUIPMENT |

| DRO | DRONESHIELD LTD | DRONES |

| ELS | ELSIGHT LTD | DRONES |

| EOS | ELECTRO OPTIC SYSTEMS | SATELLITES/SPACE |

| MOB | MOBILICOM LTD/AUSTRALIA | MILITARY EQUIPMENT |

| OEC | ORBITAL CORP LTD | DRONES |

| QHL | QUICKSTEP HOLDINGS LTD | MILITARY EQUIPMENT |

| TTT | TITOMIC LTD | MILITARY EQUIPMENT |

| UUV | UUV AQUABOTIX LTD | MILITARY EQUIPMENT |

| 3DA | AMAERO INTERNATIONAL | MILITARY EQUIPMENT |

| AL3 | AML3D | MILITARY EQUIPMENT |

| XTE | XTEK LTD | DRONES/MILITARY EQUIPMENT |

Australia has a long coastline to defend and its navy has to patrol three large oceans. Among the most established ASX companies operating in the defence sector is shipbuilding company Austal (ASX:ASB).

Two weeks ago, Fairfax reported that ASB was in discussions with 2x US-based private equity firms interested in a buyout of the ASX-listed shipbuilder – Cerberus Capital Management and JF Lehman & Company.

JPMorgan has apparently been working with Austal since June and unsurprisingly there’s plenty of interest as ASB has a history of consistently lucrative contacts with the US Navy but faces operational challenges at a time of opportunity.

In August, Austal’s head of US operations – *ahem* – jumped ship, after ASB delivered a massive full year deficit, profits down to $13.8 million from the previous year’s $79.6 million.

The business is one of the ASX’s more established defence stocks. It operates five shipyards across the region in strategically advantageous locations including Australia, China, Philippines, the United States and Vietnam.

ADB’s mantra has been to become the Indo Pacific’s leading naval defence prime contractor and in its FY23 results reported growing industrial and sovereign capability in Australia and the US, with several new projects won and existing contracts further developed.

Worldwide, the company was awarded contracts for 11 new ships, while a total of nine ships were delivered by its shipyards.

The USS Canberra (LCS 30) was commissioned in Sydney in July 2023. Originally designed by Austal (Australia) but built by Austal (USA), the USS Canberra is the first US Navy ship to be commissioned outside of the US.

ASB says one of its key innovations in recent times has been its DeepMorpher artificial intelligence tool that is helping to optimise hull forms, quickly and efficiently.

EOS Secures New R600 Remote Weapon System Contract

And this week – in fact late on Monday, Electro Optic Systems (ASX:EOS) revealed it has secured a new contract valued at circa $28 million to supply R600 Remote Weapon System (RWS) unit spares to a customer in South East Asia.

This is it:

The R600, renowned for its dual weapon configuration, offers operational flexibility and a range of weapon options to suit diverse mission requirements.

Originally developed for a South East Asian customer, the R600 RWS has been subject to continuous innovation and development.

Deliveries under the contract are scheduled to commence in late 2024 and continue into 2025 and 2026.

This sale aligns with EOS’ strategic initiatives to broaden its product and customer base, as well as its manufacturing capabilities. The products under this contract will primarily be manufactured in EOS facilities in the United States.

Dr Andreas Schwer, CEO for EOS, said, “EOS is proud of this achievement, which not only strengthens its presence in the South East Asian defence sector but also reinforces its position as a leading innovator in the global defence industry.”

EOS says the R600 remote weapon system (RWS) integrates advanced surveillance capabilities with rapid engagement features, delivering exceptional performance and versatility on the battlefield.

- The R600 offers a flexible dual weapon configuration, enabling operators to choose from a range of firepower options that best suit their mission requirements. These options include combinations of 7.62mm, 12.7mm, 40mm automatic grenade launcher (AGL).”

- To enhance lethality, the R600 Missile Carrier (R600MC) combines medium-calibre firepower with multiple anti-tank or anti-air missiles.

- Weighing less than 725kg (1,600lb), this system empowers manoeuvre units to effectively address any threat on the modern battlefield.

- Commanders can configure the missile pods to neutralise the most dangerous targets, while the standard medium-calibre main armament and 7.62 coaxial machine gun provide vehicle commanders with effective self-defence firepower.

- The RWS features EOS’ advanced pointing and tracking technology, significantly enhancing first-round hit probability.

- “This sophisticated ballistic solution accounts for a comprehensive range of variables including weapons, ammunition, range, atmospheric environment, vehicle attitude, and target motion.”

Up next in Part 2: We look to the skies to get a bead on the ASX-listers with defence tech that’s flying high.