Here are the best – and worst – performing IPOs of FY22

Picture: Getty Images

- Only 44 out of the 198 IPOs this financial year are trading above their listing price

- 8 fresh listees for FY22 were trading up 100% since they hit the bourse

- A whopping 149 IPOs are trading down between 3%-92%

A massive 198 new stocks hit the ASX in FY22 – and it’s no surprise the top performers were in the materials or mining sector.

Only 44 IPOs are trading above their listing price and 37 are those are mining.

But to be fair, they also make up a solid portion (84 to be exact) of the 149 stocks trading down 3-92% since listing.

Here’s how all the FY22 IPOs are tracking:

| Code | Company | Listing Price | Price Today | Percentage Change | Sector |

|---|---|---|---|---|---|

| NC1 | Nicoresourceslimited | 0.2 | 0.775 | 288% | Materials |

| AR1 | Australresources | 0.2 | 0.625 | 213% | Materials |

| KNI | Kunikolimited | 0.2 | 0.57 | 185% | Materials |

| GT1 | Greentechnology | 0.25 | 0.58 | 132% | Materials |

| PGO | Pacgold | 0.25 | 0.58 | 132% | Materials |

| SXG | Southern Cross Gold | 0.2 | 0.445 | 123% | Materials |

| NIM | Nimyresourceslimited | 0.2 | 0.43 | 115% | Materials |

| CPM | Coopermetalslimited | 0.2 | 0.41 | 105% | Materials |

| CLG | Close Loop | 0.2 | 0.39 | 95% | Commercial & Professional Services |

| CHR | Charger Metals | 0.2 | 0.37 | 85% | Materials |

| BRX | Belararoxlimited | 0.2 | 0.345 | 73% | Materials |

| IND | Industrialminerals | 0.2 | 0.325 | 63% | Materials |

| MMA | Maronanmetalslimited | 0.2 | 0.325 | 63% | Materials |

| CNR | Cannon Resources | 0.2 | 0.32 | 60% | Materials |

| RRR | Revolverresources | 0.2 | 0.31 | 55% | Materials |

| EV1 | Evolutionenergy | 0.2 | 0.305 | 53% | Materials |

| FEG | Far East Gold | 0.2 | 0.305 | 53% | Materials |

| LPM | Lithium Plus | 0.25 | 0.38 | 52% | Materials |

| AQN | Aquirianlimited | 0.2 | 0.3 | 50% | Commercial & Professional Services |

| FRE | Firebrickpharma | 0.2 | 0.3 | 50% | Pharmaceuticals, Biotechnology & Life Sciences |

| IG6 | Internationalgraphit | 0.2 | 0.3 | 50% | Materials |

| LYN | Lycaonresources | 0.2 | 0.3 | 50% | Materials |

| GRE | Greentechmetals | 0.2 | 0.28 | 40% | Materials |

| ITM | Itech Minerals Ltd | 0.2 | 0.28 | 40% | Materials |

| ATA | Atturralimited | 0.5 | 0.7 | 40% | Materials |

| IPG | Ipd Group | 1.2 | 1.655 | 38% | Capital Goods |

| SPD | Southernpalladium | 0.5 | 0.65 | 30% | Materials |

| AR3 | Austrare | 0.3 | 0.375 | 25% | Materials |

| AS2 | Askarimetalslimited | 0.2 | 0.25 | 25% | Materials |

| MPG | Manypeaksgoldlimited | 0.2 | 0.25 | 25% | Materials |

| VMM | Viridismining | 0.2 | 0.25 | 25% | Materials |

| IR1 | Irismetals | 0.2 | 0.245 | 23% | Materials |

| LRV | Larvottoresources | 0.2 | 0.245 | 23% | Materials |

| WIN | Widgienickellimited | 0.2 | 0.245 | 23% | Materials |

| BVR | Bellavistaresources | 0.2 | 0.23 | 15% | Materials |

| 1AE | Auroraenergymetals | 0.2 | 0.225 | 13% | Materials |

| VSL | Vulcan Steel | 7.1 | 7.92 | 12% | Materials |

| FTL | Firetail Resources | 0.25 | 0.275 | 10% | Materials |

| RWL | Rubicon Water | 1 | 1.1 | 10% | Technology Hardware & Equipment |

| CPO | Culpeominerals | 0.2 | 0.215 | 7% | Materials |

| REC | Rechargemetals | 0.2 | 0.21 | 5% | Materials |

| NOL | Nobleoak Life Ltd | 1.95 | 2.04 | 5% | Insurance |

| PR1 | Pureresourceslimited | 0.2 | 0.205 | 2% | Materials |

| TEE | Topendenergylimited | 0.2 | 0.205 | 2% | Energy |

| MMG | Monger Gold Ltd | 0.2 | 0.2 | 0% | Materials |

| NNL | Nordicnickellimited | 0.25 | 0.25 | 0% | Materials |

| OSM | Osmondresources | 0.2 | 0.2 | 0% | Materials |

| SLH | Silk Logistics | 2 | 2 | 0% | Transportation |

| TLC | The Lottery Corp | 4.6 | 4.58 | 0% | Consumer Services |

| CVR | Cavalierresources | 0.2 | 0.195 | -3% | Materials |

| SSH | Sshgroupltd | 0.2 | 0.195 | -3% | Commercial & Professional Services |

| WR1 | Winsome Resources | 0.2 | 0.195 | -3% | Materials |

| SHA | Shape Aust Corp Ltd | 1.96 | 1.89 | -4% | Capital Goods |

| CDO | CDO Opportunity Fund | 2.52 | 2.42 | -4% | Diversified Financials |

| 29M | 29Metalslimited | 2 | 1.92 | -4% | Materials |

| NXG | Nexgenenergycanada | 5.6 | 5.32 | -5% | Materials |

| AII | Almontyindustriesinc | 1 | 0.95 | -5% | Materials |

| LRD | Lordresourceslimited | 0.2 | 0.19 | -5% | Materials |

| MM1 | Midasmineralsltd | 0.2 | 0.19 | -5% | Materials |

| SLB | Stelarmetalslimited | 0.2 | 0.19 | -5% | Materials |

| BST | Best & Less | 2.16 | 2.03 | -6% | Retaiing |

| BMM | Balkanminingandmin | 0.2 | 0.185 | -8% | Materials |

| CSF | Catalanoseafoodltd | 0.2 | 0.185 | -8% | Food, Beverage & Tobaco |

| OPN | Oppenneg | 0.2 | 0.185 | -8% | Commercial & Professional Services |

| ALV | Alvomin | 0.25 | 0.225 | -10% | Materials |

| CMO | Cosmometalslimited | 0.2 | 0.18 | -10% | Materials |

| HAR | Harangaresources | 0.2 | 0.18 | -10% | Materials |

| HVY | Heavymineralslimited | 0.2 | 0.18 | -10% | Materials |

| PNT | Panthermetalsltd | 0.2 | 0.18 | -10% | Materials |

| WTN | Winton Land | 3.89 | 3.45 | -11% | Real Estate |

| VNT | Ventiaservicesgroup | 2.75 | 2.43 | -12% | Capital Goods |

| AVD | Avada Group Limited | 1 | 0.88 | -12% | Commercial & Professional Services |

| DRM | Demetallicalimited | 0.25 | 0.22 | -12% | Materials |

| PBL | Parabellumresources | 0.2 | 0.175 | -13% | Materials |

| UVA | Uvrelimited | 0.2 | 0.175 | -13% | Materials |

| USQ | Us Student Housing R | 1.38 | 1.2 | -13% | Real Estate |

| Z2U | Zoom2Utechnologies | 0.2 | 0.17 | -15% | Software & Services |

| 5EA | 5Eadvanced | 2.78 | 2.35 | -15% | Materials |

| BMR | Ballymore Resources | 0.2 | 0.165 | -18% | Materials |

| LDR | Lode Resources | 0.2 | 0.165 | -18% | Materials |

| NHE | Nobleheliumlimited | 0.2 | 0.165 | -18% | Energy |

| REM | Remsensetechnologies | 0.2 | 0.165 | -18% | Capital Goods |

| SNX | Sierra Nevada Gold | 0.5 | 0.41 | -18% | Materials |

| REP | REP Essential Prop | 1 | 0.8 | -20% | Real Estate |

| AW1 | Americanwestmetals | 0.2 | 0.16 | -20% | Materials |

| EQN | Equinoxresources | 0.2 | 0.16 | -20% | Materials |

| SLS | Solsticeminerals | 0.2 | 0.16 | -20% | Materials |

| SDR | Siteminder | 5.06 | 3.93 | -22% | Software & Services |

| CMX | Chemxmaterials | 0.2 | 0.155 | -23% | Materials |

| OD6 | Od6Metalsltd | 0.2 | 0.155 | -23% | Materials |

| SRR | Saramaresourcesltd | 0.2 | 0.155 | -23% | Materials |

| PXA | Pexagroup | 17.13 | 13.17 | -23% | Real Estate |

| NPR | Newmark Property | 1.9 | 1.44 | -24% | Real Estate |

| KLI | Killiresources | 0.2 | 0.15 | -25% | Materials |

| KNG | Kingsland Minerals | 0.2 | 0.15 | -25% | Materials |

| LYK | Lykosmetalslimited | 0.2 | 0.15 | -25% | Materials |

| TMB | Tambourahmetals | 0.2 | 0.15 | -25% | Materials |

| HCW | Hlthcohcwellnsreit | 2 | 1.495 | -25% | Real Estate |

| APM | APM Human Services | 3.55 | 2.64 | -26% | Commercial & Professional Services |

| TG6 | Tgmetalslimited | 0.2 | 0.145 | -28% | Materials |

| WA1 | Wa1Resourcesltd | 0.2 | 0.145 | -28% | Materials |

| IMI | Infinitymining | 0.2 | 0.14 | -30% | Materials |

| KOB | Kobaresourceslimited | 0.2 | 0.14 | -30% | Materials |

| LGM | Legacy Minerals | 0.2 | 0.14 | -30% | Materials |

| NFL | Norfolkmetalslimited | 0.2 | 0.14 | -30% | Materials |

| PFE | Panteraminerals | 0.2 | 0.14 | -30% | Materials |

| LLL | Leolithiumlimited | 0.7 | 0.485 | -31% | Materials |

| E79 | E79Goldmineslimited | 0.2 | 0.135 | -33% | Materials |

| QAL | Qualitaslimited | 2.5 | 1.68 | -33% | Real Estate |

| WMG | Western Mines | 0.2 | 0.1325 | -34% | Materials |

| C1X | Cosmosexploration | 0.2 | 0.13 | -35% | Materials |

| EMS | Eastern Metals | 0.2 | 0.13 | -35% | Materials |

| OM1 | Omnia Metals Group | 0.2 | 0.13 | -35% | Materials |

| XPN | Xpon Technologies | 0.2 | 0.13 | -35% | Software & Services |

| GQG | GQG Partners | 2.2 | 1.41 | -36% | Diversified Financials |

| G50 | Gold50Limited | 0.25 | 0.16 | -36% | Materials |

| AUE | Aurumresources | 0.2 | 0.125 | -38% | Materials |

| MAP | Microbalifesciences | 0.45 | 0.275 | -39% | Health Care Equipment & Services |

| JDO | Judo Cap Holdings | 2.1 | 1.265 | -40% | Banks |

| ALO | Alloggio Group | 0.2 | 0.12 | -40% | Consumer Services |

| FRS | Forrestaniaresources | 0.2 | 0.12 | -40% | Materials |

| M3M | M3Mininglimited | 0.2 | 0.12 | -40% | Materials |

| MMC | Mitremining | 0.2 | 0.12 | -40% | Materials |

| MTM | Mtmongerresources | 0.2 | 0.12 | -40% | Materials |

| PIM | Pinnacleminerals | 0.2 | 0.12 | -40% | Materials |

| RBX | Resource B | 0.2 | 0.12 | -40% | Materials |

| RON | Roninresourcesltd | 0.2 | 0.12 | -40% | Materials |

| FXG | Felix Gold Limited | 0.2 | 0.115 | -43% | Materials |

| NIS | Nickelsearch | 0.2 | 0.115 | -43% | Materials |

| NYM | Narryermetalslimited | 0.2 | 0.115 | -43% | Materials |

| RB6 | Rubixresources | 0.2 | 0.115 | -43% | Materials |

| VTX | Vertexmin | 0.2 | 0.115 | -43% | Materials |

| WC1 | Westcobarmetals | 0.2 | 0.115 | -43% | Materials |

| C79 | Chrysoscorpltd | 6.5 | 3.7 | -43% | Commercial & Professional Services |

| LIS | Lisenergylimited | 0.85 | 0.48 | -44% | Capital Goods |

| CUS | Coppersearchlimited | 0.35 | 0.195 | -44% | Materials |

| C29 | C29Metalslimited | 0.2 | 0.11 | -45% | Materials |

| RLF | Rlfagtechltd | 0.2 | 0.11 | -45% | Materials |

| TBN | Tamboran | 0.4 | 0.22 | -45% | Energy |

| SQ2 | Block | 180 | 98.5 | -45% | Software & Services |

| 1VG | Victory Goldfields | 0.2 | 0.105 | -48% | Materials |

| AE1 | Aerison | 0.2 | 0.105 | -48% | Capital Goods |

| BTN | Butn Limited | 0.2 | 0.105 | -48% | Diversified Financials |

| HMG | Hamelingoldlimited | 0.2 | 0.105 | -48% | Materials |

| MI6 | Minerals260Limited | 0.5 | 0.26 | -48% | Materials |

| PEB | Pacific Edge | 1.2 | 0.62 | -48% | Pharmaceuticals, Biotechnology & Life Sciences |

| DUN | Dundasminerals | 0.2 | 0.1 | -50% | Materials |

| KAL | Kalgoorliegoldmining | 0.2 | 0.1 | -50% | Materials |

| MBX | Myfoodieboxlimited | 0.2 | 0.1 | -50% | Food & Staples Retailing |

| SMS | Starmineralslimited | 0.2 | 0.1 | -50% | Materials |

| LKY | Locksleyresources | 0.2 | 0.099 | -51% | Materials |

| DRA | DRA Global Limited | 3.95 | 1.95 | -51% | Capital Goods |

| BME | Blackmountainenergy | 0.2 | 0.098 | -51% | Energy |

| BUR | Burleyminerals | 0.2 | 0.096 | -52% | Materials |

| DAL | Dalaroometalsltd | 0.2 | 0.095 | -53% | Materials |

| DMM | Dmcmininglimited | 0.2 | 0.095 | -53% | Materials |

| HPC | Thehydration | 0.29 | 0.135 | -53% | Household & Personal Products |

| APS | Allup Silica Ltd | 0.2 | 0.09 | -55% | Materials |

| OMX | Orangeminerals | 0.2 | 0.09 | -55% | Materials |

| OZZ | OZZ Resources | 0.2 | 0.09 | -55% | Materials |

| SLM | Solismineralsltd | 0.2 | 0.09 | -55% | Materials |

| CTQ | Careteq Limited | 0.2 | 0.089 | -56% | Health Care Equipment & Services |

| AYA | Artryalimited | 1.35 | 0.595 | -56% | Health Care Equipment & Services |

| WGR | Westerngoldresources | 0.2 | 0.084 | -58% | Materials |

| S3N | Sensore Ltd | 0.85 | 0.355 | -58% | Materials |

| BBT | Bluebet Holdings Ltd | 1.14 | 0.46 | -60% | Consumer Services |

| BIO | Biome Australia Ltd | 0.2 | 0.08 | -60% | Household & Personal Products |

| FAL | Falconmetalsltd | 0.5 | 0.2 | -60% | Materials |

| KNB | Koonenberrygold | 0.2 | 0.08 | -60% | Materials |

| FDR | Finder | 0.2 | 0.079 | -61% | Energy |

| ROC | Rocketboots | 0.2 | 0.076 | -62% | Software & Services |

| X2M | X2M Connect Limited | 0.25 | 0.094 | -62% | Technology Hardware & Equipment |

| ATV | Activeportgroupltd | 0.2 | 0.075 | -63% | Software & Services |

| EQS | Equitystorygroupltd | 0.2 | 0.075 | -63% | Diversified Financials |

| AMM | Armada Metals | 0.2 | 0.071 | -65% | Materials |

| EBR | EBR Systems | 1.08 | 0.37 | -66% | Health Care Equipment & Services |

| ABE | Ausbondexchange | 0.65 | 0.21 | -68% | Diversified Financials |

| CU6 | Clarity Pharma | 1.4 | 0.45 | -68% | Pharmaceuticals, Biotechnology & Life Sciences |

| RTH | Ras Tech | 1.5 | 0.475 | -68% | Commercial & Professional Services |

| M2M | Mtmalcolmminesnl | 0.2 | 0.063 | -69% | Materials |

| TVL | Touch Ventures | 0.4 | 0.125 | -69% | Diversified Financials |

| OXT | Orexploretechnologie | 0.25 | 0.075 | -70% | Commercial & Professional Services |

| T3K | Tek Ocean Group | 0.5 | 0.15 | -70% | Energy |

| E33 | East 33 Limited. | 0.2 | 0.056 | -72% | Food, Beverage & Tobaco |

| DBO | Diabloresources | 0.2 | 0.055 | -73% | Materials |

| RAD | Radiopharm | 0.6 | 0.15 | -75% | Pharmaceuticals, Biotechnology & Life Sciences |

| BEZ | Besragoldinc | 0.2 | 0.05 | -75% | Materials |

| MRI | Myrewardsinternation | 0.2 | 0.05 | -75% | Commercial & Professional Services |

| BDX | Bcaldiagnostics | 0.25 | 0.06 | -76% | Pharmaceuticals, Biotechnology & Life Sciences |

| BDT | Birddog | 0.65 | 0.15 | -77% | Technology Hardware & Equipment |

| PLG | Pearlgullironlimited | 0.2 | 0.042 | -79% | Materials |

| HAL | Halo Technologies | 1.2 | 0.245 | -80% | Diversified Financials |

| TRP | Tissue Repair | 1.15 | 0.23 | -80% | Pharmaceuticals, Biotechnology & Life Sciences |

| W2V | Way2Vatltd | 0.2 | 0.035 | -83% | Software & Services |

| STP | Step One Limited | 1.53 | 0.255 | -83% | Retaiing |

| LDX | Lumos Diagnostics | 1.25 | 0.125 | -90% | Health Care Equipment & Services |

| B4P | Beforepay Group | 3.41 | 0.28 | -92% | Diversified Financials |

| GFN | Gefen Int | 1 | 0.077 | -92% | Software & Services |

The biggest IPO winners for FY22:

Listing Price: $0.20

Current Price: $0.75

The cobalt-nickel spinout from tin producer Metals X (ASX:MLX) – is now trading up a massive 288% at $0.75 per share.

Part of the reason could be the commodity focus.

NiCo owns one of the largest, undeveloped cobalt-nickel projects in the world, the Wingellina project in WA.

And nickel and cobalt are both in very high demand, with tight supply and strong fundamentals underpinning high prices.

Plus, Wingellina is more advanced than most projects.

A pre-feasibility study developed by MLX indicated that the laterite project should support an initial 40-year mine life at production rate of 40,000tpa Ni and 3,000tpa Co.

NC1 plans to review all previous works and studies, along with various exploration programs to determine “how best to mine and process the potential high-grade zones of nickel, cobalt and scandium at both the Wingellina and the Claude Hills deposits.”

Further metallurgical testwork and optimisation studies will also be undertaken.

Listing Price: $0.20

Current Price: $0.62

AR1 is the newest copper producer on the ASX at its ‘Mt Kelly’ project in northwest Queensland and is up 213% since listing last year.

Great timing, Barry Fitzgerald reckons.

“Assuming the project hits its straps, it has got to be said that 10,000tpa for an initial four years is a lot of copper for a company with a [$70m] market cap,” he says.

“In gross revenue terms, it equates to $A530m at the current copper price.

“Compare Austral’s market cap to the $150m-plus market caps of a crop of junior explorers that have recently reported copper exploration success in the same neck of the woods.

“Promising for sure, but they don’t have a proven resource, and they are certainly a long way off from producing, if at all.”

AR1’s plan is to plough back $10m into exploration over the next 12 months from project cash flow to build a bigger resource base — enough to make Mt Kelly a 10-year plus operation, potentially at a bigger production rate too given installed capacity is good for 30,000tpa of copper.

Drilling has kicked off at the first five or six priority targets.

Listing Price: $0.20

Current Price: $0.57

One of the hottest IPO’s of 2021, Vulcan Energy (ASX:VUL) spinout KNI gained 325% on its first day, before briefly peaking at a remarkable $3 per share shortly thereafter.

The company is now up 185%, having kicked off maiden diamond drilling last month at three cobalt-copper targets near a historic mine in Norway.

One of the targets, known as Middagshvile, was drilled with six holes back in 2018, which provided KNI the opportunity to acquire downhole geophysics data to “de-risk” the drill campaign.

“Drilling at our Skuterud Cobalt Project is running smoothy and efficiently, while our field exploration teams have been able to progress ahead of plan, enabling additional reconnaissance field work to be undertaken which has demonstrated the prospectivity for mineralisation at our other copper and nickel project sites,” CEO Antony Beckmand said.

The company says that with a prevailing and forecast undersupply for cobalt – plus current sources of supply being heavily reliant on Democratic Republic of Congo, Russia and China – “Kuniko is firmly focussed on the rapid development of Skuterud project to bridge the supply chain gap with ethically sourced, responsibly developed, net zero-carbon cobalt.”

Listing Price: $0.25

Current Price: $0.58

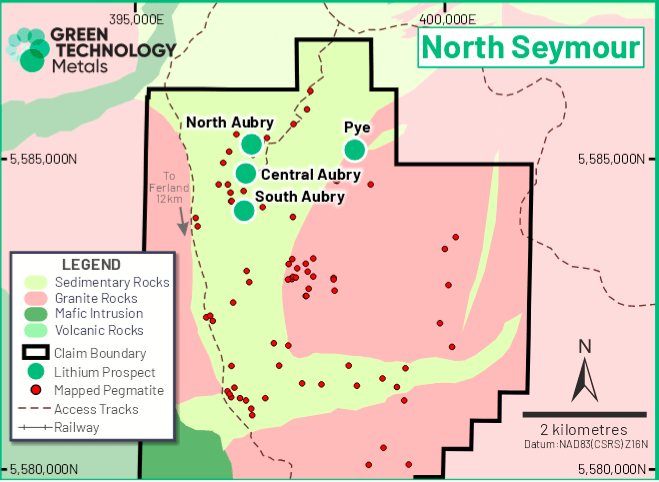

Up 132% from its listing price of $0.25, GT1 recently doubled the interim mineral resource estimate for its Seymour lithium project in Canada to 9.9 Mt at 1.04% Li2O, and increased the indicated category mineral resource to 5.2 Mt at 1.29% Li2O.

“The result is a demonstration of the clear potential that exists at our flagship Seymour asset, and we remain focussed on delivering further high-grade resource growth over the second half of 2022,” CEO Luke Cox says.

The company thinks there’s also substantial further resource growth across the Aubry complex and the broader Seymour Project, with specific step-out and exploration drilling targets set to be tested in H2 2022.

Listing Price: $0.25

Current Price: $0.58

This gold explorer is also up 132%, with its Alice River gold project in Queensland as its flagship.

The historic goldfield was mined as far back as 1903 but has only ever been the subject of shallow workings and limited exploration.

Pacgold picked the project up in late 2020 from private interests and came at it with a bunch of new geological ideas and the latest in remote sensing tools, the idea being that there could be a big and high-grade gold system hiding away at depth beneath the old scratchings.

The hunch has proved correct, Barry Fitzgerald says. Initial drilling last year indicated the company has cracked the top of a big system, with gold grades increasing at depth. Initial results included 17m grading 9.3g/t gold from 192m, and 43m grading 3g/t from 214m.

Step-out drilling is continuing to determine the extent of the high-grade gold mineralisation defining the F1a zone on the Central Target.

“Early visual indications are very encouraging; with drilling intercepting veining and alteration associated with the F1a zone up to 400m below surface and showing excellent continuity of the system extending to depth,” MD Tony Schreck said.

NC1, AR1, KNI, GT1 and PGO share prices today:

Listing Price: $0.20

Current Price: $0.44

This spinout of TSX-listed Mawson Gold explorer hit a solid 119m at 3.9g/t gold equivalent drill hit at the ‘Sunday Creek’ project in Victoria last month – and is up a nice 123% from its listing price.

MD Michael Hudson says this result is “unprecedented” and that this sort of width of high-grade mineralisation is rarely, if ever, seen in the Victorian goldfields.

“A result of 119.2m @ 3.9g/t AuEq places the Sunday Creek project into a new realm and builds on what was already a remarkably successful drill program,” he says.

“Continuity, with great width and grades, is now evident down to 335m vertical depth in the Apollo Shoot that remains open to depth, while multiple adjacent shoots remain to be drilled out.”

Priority drilling is now underway to target wide and high-grade extensions to the mineralisation found in the drill hole, plus, there’s a 10km mineralised trend at Sunday Creek that has yet to receive any exploration drilling and offers potential future upside, SXG says.

Listing Price: $0.20

Current Price: $0.43

NIM is up 115% from its listing price, and just this month flagged that its first diamond drill hole at the Dease prospect at the Mons nickel project in WA intersected the first of three interpreted anomalous Moving Loop Electromagnetic (MLEM) conductors.

The company says these results, along with the first two holes at the Godleyand Dease prospects, confirms that both areas contain extensive and thick ultramafic units hosting nickel and copper mineralisation. Downhole electro-magnetic surveys (DHEM) will commence in mid-July at Dease and Godley.

For context, DHEM surveying involves sending a probe attached to a wire cable down a completed drill-hole.

The probe is able to detect conductive sulphide mineralisation off-hole, with the potential to “see” mineralisation up to 75m away.

Listing Price: $0.20

Current Price: $0.41

The copper player is up 105% since listing, and this month intersected 17m at 2.2% copper from 84m including 8m at 4.3% copper from 84m at the King Solomon prospect at its Mt Isa East copper-gold project in Queensland.

Gold assays are still pending, but it’s worth noting the project is just 10km from Carnaby Resources’ (ASX:CNB) company-making Nil Desperandum IOCG discovery.

“Significant shallow copper and gold mineralisation has been intersected in eight holes spread out over a strike length of approximately 380m, and down to a maximum depth of approximately 100m,” MD Ian Warland says.

“Encouragingly mineralisation remains open at depth and to the south-southeast.

“The company will soon have assay results available for King Solomon 2 and 3 and will update the market with ongoing plans to capitalise on an exceptional start to exploration at the Mt Isa East Project.”

SXG, NIM and CPM share prices today:

The biggest IPO losers for FY22:

Listing Price: $1.00

Current Price: $0.07

Down 92% since listing is Gefen, an AI technology platform for the insurance and finance sectors.

The company says that across the financial services sector – most notably in insurance – AI technology has helped insurers to assess risk and detect fraud, and reduce human error in the application process.

Its technology effectively provides a distribution network of tools every insurance/financial advisor needs to personalise their service to clients, without the clients having to become experts – but the company says its in-house engine can be scaled across multiple industries.

“Our initial focus on the insurance brokerage and agent market continues to gain pace,” co-founder and co-CEO Orni Daniel said in the company’s March quarterly.

“Our strategy to acquire agent networks has been an extremely cost-effective way of acquiring customers, which increased to 410,000, up 531% on the last quarter.”

Listing Price: $3.41

Current Price: $0.28

Branded as the new Afterpay, fintech player Beforepay is also down 92% on its listing price, this comes after the company reported a “significant uplift” in net transaction margin in Q3 FY22.

Pay advances were $87.9m in the quarter, up 213% from pcp and the company’s net transaction loss declined to 2.2%, down 58% YoY and 29% QoQ, driven by ongoing refinements to the risk model according to the company.

It’s worth noting that the company’s business model isn’t the same as a traditional BNPL provider, but it essentially makes money the same way – by providing advanced payments to customers.

Where Afterpay and Zip advance funds to buy items, Beforepay lends money against the customer’s next pay cheque, charging a flat 5% for the service.

Beforepay’s app syncs with the end users’ bank account, which then automatically debits the customer’s wages (plus the 5% fee) when they land.

Sometimes called pay-day lending, this type of service has exploded during the pandemic, as more people grapple with financial difficulties.

According to CEO Jamie Twiss, roughly half of all Australians have little or no savings and live from pay cheque to pay cheque, which is the exact market segment that Beforepay is targeting.

Listing Price: $1.25

Current Price: $0.12

Down 90% on its listing price is LDX, who specialises in rapid, cost-effective and complete point-of-care (POC) diagnostic test solutions to help healthcare professionals more accurately diagnose and manage medical conditions.

In June, the company secured a contract with US-based Aptatek to develop a product to assist with screening for phenylketonuria (PKU) – a rare inherited disorder which causes an amino acid called phenylalanine to build up in the body and affects approximately 1 in 12,000 newborns.

Left untreated, this build-up can result in intellectual disabilities, seizures, behavioural problems and mental disorders.

The Aptatek product, developed under contract with Lumos, aims to provide a point-of-care/at-home screening test to allow PKU patients to directly measure their phenylalanine levels in real-time.

The initial phase of the partnership is expected to generate at least US$500,000 in revenue for Lumos.

The company also says that potential contracts for the purchase of its CoviDx SARS-CoV-2 Rapid Antigen Test are currently under consideration by government departments in Canada and Australia.

Listing Price: $1.53

Current Price: $0.25

The retailer is down 83% on its listing price, with the company reporting in May that it would miss its previous forecasts.

FY22 earnings (EBITDA) in the range of $7-8.5m and sales growth of 15-20% are now expected. Both are materially lower than previous guidance of $15m for earnings and 21-25% revenue growth.

The analysts at Morgans expect the firm to remain profitable and cash generative, although they slashed the Step One price target by over 70% to $0.60 from $2.40.

GFN, B4P, LDX, STP and W2V share prices today:

At Stockhead we tell it like it is. While Southern Cross Gold, Nimy Resources and Gefen, are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.