IPO to watch – NiCo (ASX:NC1) a battery metal player with a globally significant deposit

Mining

Mining

Listing on the ASX on Wednesday (Jan 19), NiCo Resources (ASX:NC1) may be a little different from the usual late-cycle resources IPOs.

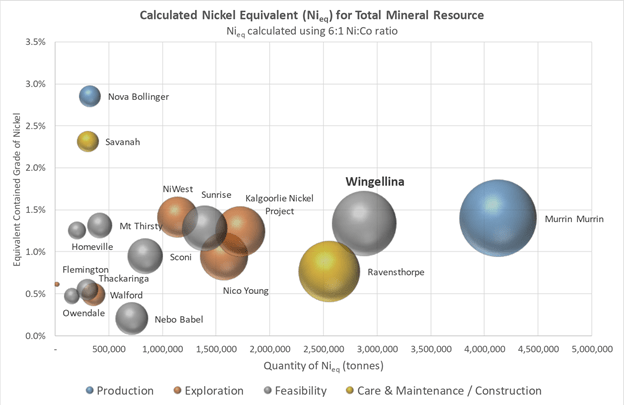

After spinning out the Wingellina project from Metals X (ASX:MLX), NiCo will now hold 100% ownership of one of the largest undeveloped cobalt nickel projects in the world.

NiCo is ‘development ready’ at a time when nickel and cobalt are both in very high demand, with tight supply and strong fundamentals underpinning the commodity prices.

With the deposit now housed in a single purpose vehicle, the company is expected to update the project feasibility and work on the metallurgy optimisation – with testwork underway to assess low capital start-up options.

It should be no surprise given the size of the project that it will need a large capital injection or a partner to develop it, but the pre-feasibility study developed by Metals X indicated that the project should support an initial 40-year mine life at production rate of 40,000tpa Ni and 3,000tpa Co, with a 1:1 strip ratio after 0.5:1 ratio for the first 20 years.

With all the key approvals in place – mining agreement signed with the Native Title holders, water testing and modelling completed, environmental approval received late 2016 – NiCo management are keen to hit the ground as soon as possible.

Even with its current scale, only 25% of the defined geological contact zone has been drilled so there is scope for extensions of the deposit. It is a deeply weathered intrusive, which corresponds with the much thicker and much larger ore body, and being almost 100% limonite means that treatment requires much lower acid consumption than the oft-maligned lateritic deposits.

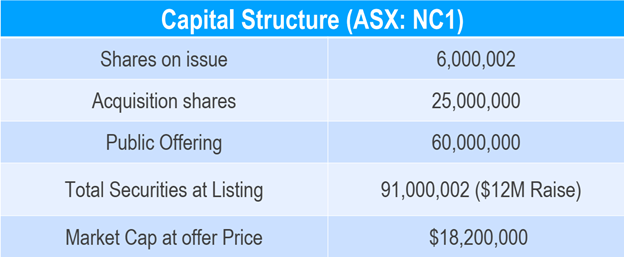

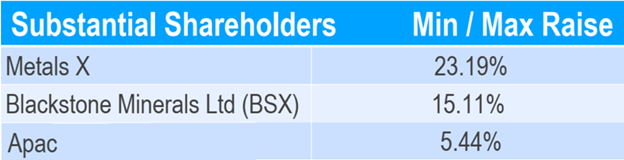

As well as securing an in-specie distribution for its shareholders, Metals X has elected to reinvest into NiCo with another nickel player, Blackstone Minerals (ASX:BSX) taking up a strategic shareholding. With APAC Resources maintaining their position through their holding in MLX, over 43% of the company will be owned by the top 3.

Raising the full $12m through Marketech and Blue Ocean Equities, the managing qirector of NiCo, Roderick Corps, is looking forward to ringing the bell.

“We believe Wingellina has the potential to be a Tier 1 project. A lot of the hard work was already done by Metals X, which is why they want to maintain exposure. Given the extensive development, in a project hosting some key commodities, we had no problem filling the book. And historically, the project has generated significant interest from major battery metals players including POSCO and Samsung.”

With an $18m market cap at listing (and an EV closer to $7m), and an old prefeasibility study valuing the project at over $3 billion, NiCo should certainly be one to watch, especially with the nickel price reaching a 10-year high last week.