IPO Watch: Atlantic Lithium lists next month with eyes on Ghana’s first lithium mine

Pic: Flashpop / Stone via Getty Images.

- Atlantic Lithium is funded through to production with the help of Piedmont Lithium

- A pre-feasibility study for the Ewoyaa project is due in the third quarter

- Freshly listed Heavy Rare Earths up 30% with sights on REE magnet market

This year has been a desolate wasteland for IPOs – unless you’re a battery metals stock.

A significant chunk of the 22 stocks currently trading above their IPO price in 2022 are battery or critical minerals explorers, led by Oceana Lithium (ASX:OCN), NiCo (ASX:NC1) and Lithium Plus Minerals (ASX:LPM).

Hoping to join the bourse soon is AIM-listed Atlantic Lithium, which lodged its ASX prospectus earlier this month.

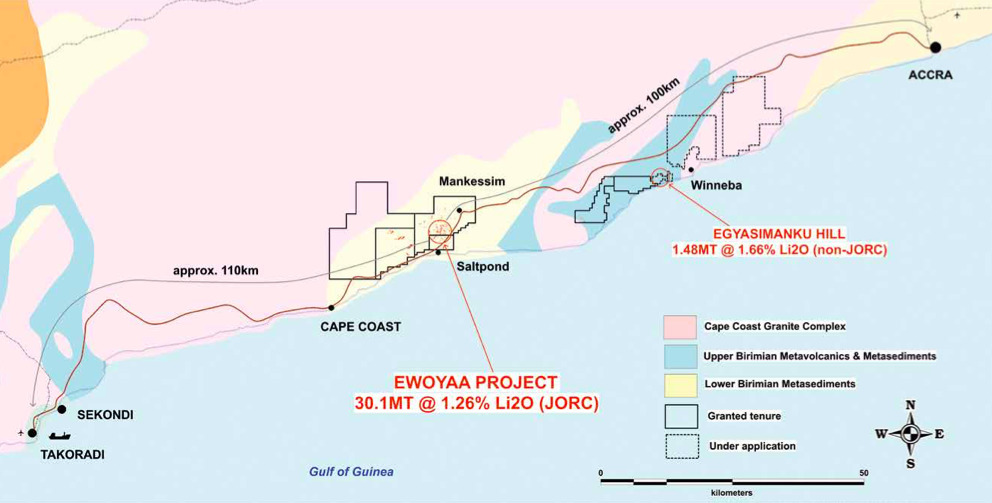

With an existing market cap of around $350m, Atlantic’s main game is the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium (ASX:PLL).

Piedmont has the right to earn up to 50% at the project level for 50% SC6 spodumene concentrate offtake at market rates by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Piedmont also subscribed in Atlantic’s shares, investing £11.52m (US$16.0m) to receive a 9.9% interest in the company.

The company expects to raise ~$13m by selling 22.85m shares at 58c each, with an approximate listing date of the 8th of September.

Pre-feasibility study due Q3

Atlantic completed a scoping study for Ewoyaa in December 2021 based upon a JORC 2012 resource of 21.3Mt at 1.31% Li2O and assuming US$900/t SC6 pricing and an 11.4-year mine life.

Plus, in March, Atlantic updated the mineral resource estimate at Ewoyaa by a massive 42%.

The project hosts an MRE of 30.1 million metric tonnes at 1.26% lithium, including indicated resources of 20.5 million tonnes at 1.29%.

A project pre-feasibility study is due in the third calendar year quarter of 2022 which will incorporate the expanded resource.

Piedmont COO Patrick Brindle said at the time that Ewoyaa is one of the best located spodumene projects in Africa.

“Its development is fundamental to our growth strategy as an important source of spodumene concentrate for our LHP-2 project,” he said.

Notably, Atlantic also have two applications pending covering a combined 774km2 area for lithium in the Ivory Coast; Agboville and Rubino

How are newly listed IPOs tracking?

Listed: 24 August

Lead by former Arafura Resources (ASX:ARU) executive Richard Brescianini, this explorer holds the Cowalinya clay-hosted rare earths project in the WA and two exploration licences in the NT which form the Duke project.

At Cowalinya, a JORC inferred mineral resource of 28 million tonnes at 625ppm TREO has been declared, with 25% being valuable magnet rare earths.

Notably, magnet rare earths (neodymium, praseodymium, dysprosium, and terbium) are important in the manufacture of electric vehicle motors and wind turbines.

And with the global rare earth market expected to triple from US$15.1bn this year to US$46.2b by 2035, Brescianini says the company is looking to catch the next wave of interest in securing REE supply.

Within the first year of listing the plan is to expand the resource base and advance a concept-stage metallurgical flowsheet for the project.

A 10,000m aircore drilling program comprising 300 holes will kick off in Q3 to explore for rare earths resources primarily to the west and southeast of the Cowalinya resource.

A program of prospecting and surface geochemistry is planned for the first half of 2023 to initially verify the exploration model at the company’s NT tenements.

Previous exploration in the area of the application has been undertaken for Tennant Creek-style ironstone hosted copper-gold-bismuth and Olympic Dam-type copper-uranium-gold deposits but this will be the first time the area has been subject to systematic exploration for rare earths – which are expected to be hosted in xenotime, a rare earth phosphate mineral that is enriched in strategically important heavy rare earths such as terbium and dysprosium.

Since listing its share price has jumped 30% from $0.20 to $0.26.

These companies are listing in the next fortnight:

Aeramentum Resources (ASX:AEN)

Listing: 1 September

IPO: $7m at $0.20

The company plans to explore the Treasure (Black Pine) Project, in the Republic of Cyprus, which has numerous occurrences of high-grade nickel, copper, gold and cobalt in sulphides associated with a major transform fault.

There is also evidence of past mining activity with multiple underground adits and shafts – probably because back in the days of the Roman Empire, Cyprus supplied much of the world’s copper requirements.

Plus, around 74 million tonnes of massive sulphide ore extracted from around 30 deposits on the island between 1920-1970.

AEN says previous exploration at its projects has returned grades up to 3% cobalt, 18% copper, 17g/t gold and 11% nickel – and that the first target orebody at Laxia remains open at depth and along strike.

Listing: 7 September

IPO: $7.5m at $0.20

The company holds three owned projects – the HawkRock, Parker Lake and Pasfield Lake – covering 775sqkm in the Athabasca Basin, Canada, which contains the world’s largest and highest-grade uranium deposits.

“We are targeting greenfield discovery and brownfield developments close to existing production infrastructure to play a role in a clean carbon free economy,” executive chairman Andrew Vigar says.

The plan is to explore and develop the projects as well as seek out further complementary mineral exploration and resource opportunities.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.