IPO Wrap: Lithium, uranium and drones – what more could you want in fresh listees?

IPO Watch

IPO Watch

Eight companies are set to list this fortnight, among them a lithium explorer and a uranium player, a drone security company, a glass company and even a software service.

But please note that these listing dates are extremely speculative.

If you’re interested, contact the company direct for a better idea of when they expect to start trading on the ASX.

With an IPO targeting $7.5m at $0.20, T92 holds some 775sqkm of the Athabasca Basin in Canada, which three projects – the HawkRock, Parker Lake and Pasfield Lake – containing what the blurb calls the world’s largest and highest-grade uranium deposits.

“We are targeting greenfield discovery and brownfield developments close to existing production infrastructure to play a role in a clean carbon free economy,” executive chairman Andrew Vigar said.

Terra’s plan is to explore and develop the projects as well as seek out further complementary mineral exploration and resource opportunities.

T92 opened some 60% higher from the moment it entered the club on September 8 and is currently sitting steady, up 82.5% from its listing price.

Listing: 16 September

IPO: $6m at $0.20

This lithium, Platinum Group Metals (PGMs), nickel sulphide and gold explorer has tenements in the Pilbara, with its flagship project the East Pilbara Talga lithium and gold project.

The recent successes by other exploration companies, like Global Lithium Resources (ASX:GL1), has shown that significant lithium bearing pegmatites are prevalent in the region.

Previous exploration at Talga has identified pegmatite within the southern area of Octava’s extensive farm-in and JV Talga lease, with a rock chip sample returning an elevated lithium assay of 0.22%.

This area is approximately 10km northeast of GL1’s Archer lithium deposit where they reported an inferred resource of 10.5mt at 1.0% Li20 in a similar geological setting.

The company also has the Panton North and Copernicus North nickel and PGMs projects as well as the Yallalong PGEs, gold and nickel sulphides project.

Australia Sunny Glass Group (ASX:AG1)

Listing: 21 September

IPO: $7.5m at $0.35

This Australian-based holding company, through its subsidiaries, operates a glass production and supply business for structural building facades.

The group has a fully automated processing plant which it says is highly-efficient, accurate and scalable and an R&D focus on the development of cyclone resistant glass using new laminating and bonding techniques.

Listing: 26 September

IPO: $13.25m at $0.58

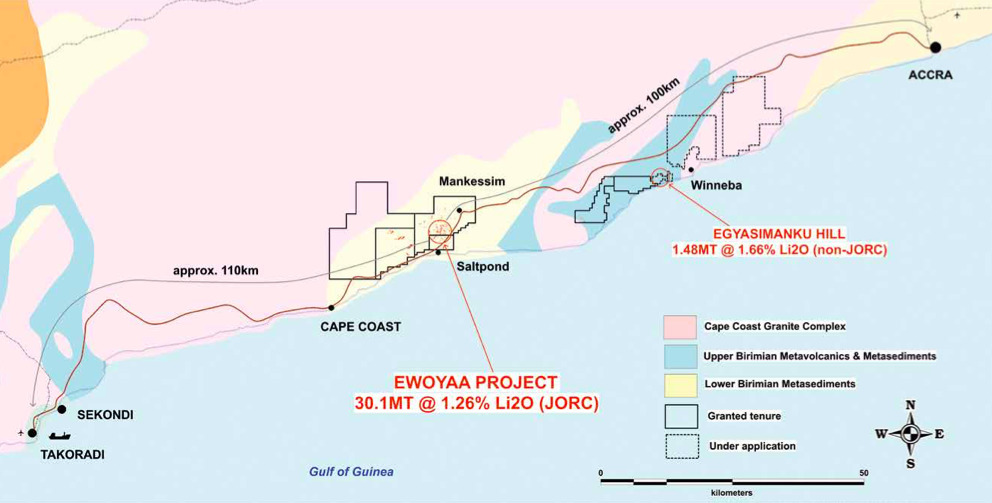

Atlantic’s main game is the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium (ASX:PLL).

Piedmont has the right to earn up to 50% at the project level for 50% SC6 spodumene concentrate offtake at market rates by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Atlantic completed a scoping study for Ewoyaa in December 2021 and in March, updated the mineral resource estimate by a massive 42% to 30.1 million metric tonnes at 1.26% lithium, including indicated resources of 20.5 million tonnes at 1.29%.

A project pre-feasibility study is due in the third quarter of CY2022 which will incorporate the expanded resource.

Atlantic also has two applications pending covering a combined 774km2 area for lithium in the Ivory Coast; Agboville and Rubino.

Critical Minerals Group (ASX:CMG)

Listing: 27 September

IPO: $5m at $0.20

The company holds the Lindfield vanadium project in Queensland, where it plans to complete bulk ore sample collection through its large diameter core drilling campaign, add to the existing JORC resource, and complete metallurgy and pilot plant test work and a scoping study.

CMG also holds the Figtree Creek and Lorena Surrounds, both greenfield copper-gold projects in the Cloncurry region.

Basin Energy (ASX:BSN)

Listing: 29 September

IPO: $9m at $0.20

This explorer is looking for uranium in the Athabasca Basin in Canada, with the exclusive right to earn controlling interests in three highly prospective projects strategically located in near high grade operating mines and milling operations.

The company intends to begin systematic exploration on its projects immediately post-listing, with initial drill testing planned for the upcoming winter field season.

Adrad Holdings (ASX:AHL)

Listing: 30 September

IPO: $22m at $1.50

The company designs and manufactures heat transfer solutions for OE customers globally.

They also manufacture, import and distribute automotive parts for the aftermarket in Australia and New Zealand.

Bridge SaaS (ASX:BGE)

Listing: 30 September

IPO: $4.5m at $0.20

This company provides Software-as-a-Service (SaaS) based Customer Relationship Management (CRM) and workflow solutions to employment, care and support industries. The software is a single platform that simplifies the unique data, compliance and documentary evidence requirements of major government-funded programs through a unified user interface, BGE says.

Nightingale Intelligent Systems (ASX:NGL)

Listing: 30 September

IPO: $10m at $0.35

This company develops and sells Unmanned Aerial Vehicles (UAVs) or drones for commercial applications – and there’s a bunch of them.

NGL says its tech has applications across solar farms, ports, O&G facilities, critical infrastructure like dams and power stations, in construction, border patrol, securing pipelines, fire and oil spills along with search and rescue, crowd control and for prisons.

Basically, the drones can respond to a threat; when a security alarm is triggered the system automatically dispatches a drone to the alarm location and streams live video to the security team.

They can also be scheduled for autonomous patrol missions based on day, time, path, altitude, hover duration, camera direction, and other mission details.

During a major event like an oil spill, chemical leak, or fire, you can manually dispatch a drone to monitor events as they unfold on the ground.

Plus, they can autonomously patrol areas of interest around the facility and send out alerts only when human and vehicle intruders are detected.