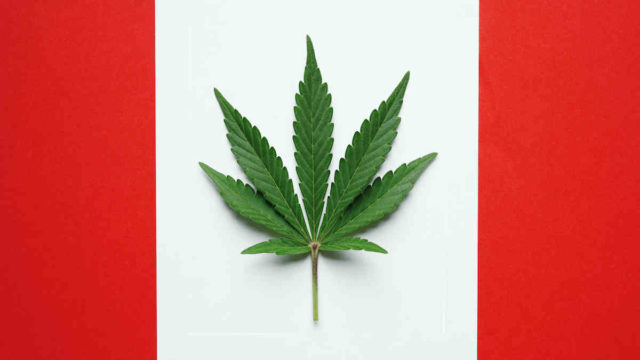

The merger with Red Light Holland will form a new company called The HighBrid Lab, which will be listed in Canada.

In a significant new development, global medicinal cannabis company, Creso Pharma (ASX:CPH), is gearing up to merge its business with Ontario-based Red Light Holland to create a global psychedelics and cannabis company called The HighBrid Lab.

The combined company is expected to have an implied pro forma equity value of C$347 million (A$371 million), and will be listed on the Canadian Securities Exchange under the ticker symbol TRIP.

The transaction results in a reverse takeover of Red Light Holland by Creso Pharma, and is expected to bring a number of significant synergies and opportunities for the combined company.

The new company will be led by a strong management team, who will have access to a world-class group of advisors.

Red Light Holland’s current Chief Executive Officer, Todd Shapiro, will lead the combined company as CEO and Director.

A number of former executives from Canopy Growth, a $20 billion Canadian-listed company, will also join the team including William Lay, who has been appointed as Executive Vice President and Chief Strategy Officer to assist in the new company’s growth trajectory.

Famed cannabis investor, Bruce Linton, who is currently a strategic advisor at Creso Pharma, has also been named as a non-executive chairman in the new company.

Quick take on Red Light Holland

Red Light Holland is a market leader in recreational psychedelics.

The company has taken a responsible approach to the sale of these products, including the introduction of the iMicrodose App, a virtual telecounseling membership program that allows individuals to find their appropriate dose, and offering telecounseling opportunities.

This, Creso says, is an approach aligned with its own mission to better the lives of humans and animals, and will continue within the combined company.

Rationale for the merger

The HighBrid Lab will focus on several key growth areas, including expanding the market and its brand leadership in recreational psilocybin, while crossing over to the cannabis sector.

This expansion will be supported by education, telecounseling and technology as new markets open.

The combined company will also use its innovation and science to support long-term opportunities in psychedelics, both naturally occurring and pharmaceutical grade, through controlled lab environments via the pending acquisitions of Halucenex and Mera Life Sciences.

It will focus on scaling up its recreational cannabis offering in North America by targeting increased market share in Canada.

This will be achieved by taking advantage of its imminent listing in Canada, in order to then progress its products into the US, a market which is expected to reach US$41 billion by 2025.

The merger will also enable the expansion of Creso’s human and animal CBD products in Europe through SR Wholesale, Red Light Holland’s wholly-owned Netherlands-based distribution company.

It is expected that new eye-catching recreational products will be released under the existing Red Light Holland brands, which will include ready-to-drink products with combined mushrooms, CBD and THC ingredients.

The company will also seek to focus on adding Red Light’s existing iMicrodose product lines with ingredients including CBD, THC and functional mushrooms, as and where permitted to do so.

There are also synergies to be gained in the merger that would eventually lead to higher margins.

This includes vertical integration synergies in growing, harvesting, brand packaging, and distribution to potential brick and mortar stores.

A combined and expanded e-commerce presence will also help boost future sales of CBD, THC, psilocybin, and functional mushroom products.

On the technology side, the combined company will be able to use biometric movement and scientific data from Radix Motion, to help find optimal dose and protocol for individuals.

This will also help it to work together with regulatory agencies towards expanding the legal and responsible use of psilocybin, THC and CBD in emerging countries focused on stricter controls.

Synergies will also be found in the management team, where Creso will bring in a wealth of scientific experience and pharmaceutical background, while Red Light Holland’s team has significant expertise in marketing, branding and recreational product offerings.

Creso Pharma CEO, Adam Blumethal, is excited about the new merged business.

“There are a number of synergies across the businesses, which will allow the combined company to considerably scale up operations in the near term.”

“Red Light’s CSE-listed vehicle will allow the combined company to enter the lucrative US market, and we anticipate that product sales through our recreational cannabis and CBD subsidiaries will scale up significantly in the short term, underpinning early cash generation and provide additional financial flexibility across the business,” says Blumenthal.

Opportunities in high growth markets

The HighBrid Lab is expected to be organised into four business units, allowing it to aggressively pursue high growth markets.

These business units are expected to comprise recreational cannabis (THC), CBD, recreational psychedelics, and psychedelic research.

Cash flow from recreational cannabis, CBD and Netherlands-based psychedelic operations will be used to support ongoing market expansion efforts in recreational psychedelics globally as opportunities are presented.

Currently, the combined company is expected to have a cash balance of approximately C$45 million, providing considerable financial flexibility to progress its growth strategy.

The HighBrid Lab also plans to conduct ongoing market reviews to expand Mernova Medical’s penetration and share.

Mernova Medical, owned by Creso, is a licensed cannabis producer in Canada with Craft Designation from the Ontario Cannabis Store, and operates a facility scalable to 200,000 square feet.

In Europe, the combined company will pursue growth plans for Creso’s suite of Swiss-developed and manufactured CBD products, covering therapeutics, nutraceuticals, animal health and cosmetics.

Looking ahead

The transaction will require the approval of 75% of Creso Pharma shareholders at a meeting which is expected to be held in the third quarter of CY21.

The transaction is also subject to approval from the Supreme Court of Western Australia.

The Red Light Holland Shares will continue to trade on the CSE, and the Creso Pharma shares and Creso Pharma listed options will continue to trade on the ASX prior to the approval of the deal.

This article was developed in collaboration with Creso Pharma, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

You might be interested in