These ASX ag stocks focus on food security from climate change, El Niño and conflict

Pic: Getty Images

- Climate change, El Niño, conflict and increasing urbanisation is putting pressure on food security globally

- Graincorp continues to diversify its business to operate beyond the variations of Australian weather patterns

- Roots Sustainable Agriculture Tech focuses on plant climate management and limited water for irrigation

Temperature records continue to tumble as the northern hemisphere summer experiences extreme heatwaves, while Canada has seen the worst bushfire season in its recorded history with more than 24 million acres of land burning in 2023.

The World Meteorological Organization (WMO) declared the first week of July as the hottest week on record following the hottest June on record, with unprecedented sea surface temperatures and record low Antarctic sea ice extent.

The WMO said the record-breaking temperatures on land and in the ocean highlight the far-reaching changes taking place in Earth’s system as a result of human-induced climate change.

“The exceptional warmth in June and at the start of July occurred at the onset of the development of El Niño, which is expected to further fuel the heat both on land and in the oceans and lead to more extreme temperatures and marine heatwaves,” WMO director of climate services Professor Christopher Hewitt said.

“We are in uncharted territory and we can expect more records to fall as El Niño develops further and these impacts will extend into 2024,” he said. “This is worrying news for the planet.”

The WMO said according to provisional analysis based on reanalysis data from Japan named JRA-3Q, the average global temperature on July 7 was 17.24 degrees Celsius. This is 0.3°C above the previous record of 16.94°C on 16 August 2016, which was a strong El Niño year.

The US and Japan have already declared onset of El Niño conditions, as has the WMO. However, the Bureau of Meteorology (BOM) in Australia is yet to declare an El Niño onset. On Tuesday the BOM maintained its alert for El Niño because its criteria for the weather event are yet to be met.

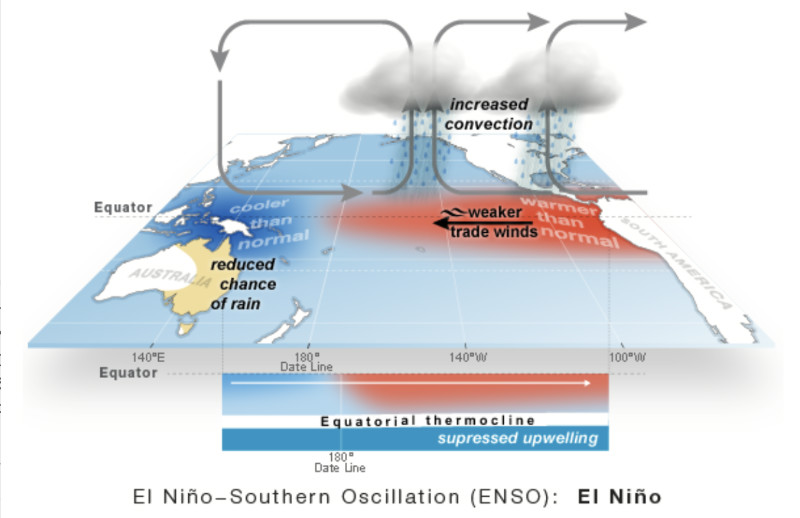

El Niño is natural weather pattern characterised by unusually warm water temperatures that periodically develop across the east-central equatorial Pacific.

Translated to “Little Boy” from Spanish, El Niño often leads to changes in global weather patterns including increased rainfall in some regions, and drought in other places like Australia.

Climate change and severe weather events like El Niño, along with conflict and growing urbanisation, are putting pressure on a world facing increased food insecurity.

According to The World Bank the number of people suffering acute food insecurity increased from 135 million in 2019 to 345 million in 82 countries by June 2022.

Here’s some of the ASX stocks we’ve noticed working to solve the challenges facing the agriculture sector and help ensure food security.

GrainCorp (ASX:GNC)

GNC can trace its origins back to 1916 with the establishment of 200 grain storage terminals and silos across New South Wales, which were connected by rail to shipping ports in Sydney and Newcastle.

In 1992, a collective of local growers united to acquire the company and its assets from the NSW Government and it listed on the ASX in 1998. GNC has since transformed to beyond grain handling with diversified revenue streams.

Head of corporate affairs Jess Simons told Stockhead out of all the major grain producing nations, Australia has always had the most variable productive climate, particularly on the east coast.

“That’s the nature of our industry and GrainCorp is well equipped to scale to production each year, with a network spanning from Central Queensland to Southern Victoria,” she said.

“The 10-year Crop Production Contract that we signed in 2019 is also a mechanism to help moderate the impact of the variability of cropping seasons in Australia.

“We also continue to diversify our business to operate beyond the variations of Australian weather patterns.”

Simons said its animal nutrition business manufactures feed solutions for producers and graziers, and they’re the leading oilseed crusher and refiner, and the leading refiner of edible fats and oils in Australia.

“GrainCorp’s global network of offices originates grain, pulses and oilseeds from different regions around the world, and our joint venture GrainsConnect Canada, in partnership with Zen-Noh, supports our ability to supply global customers from the northern hemisphere production cycle,” she said.

GNC recently upgraded its full FY23 expectations to a net result of $220-260 million, compared with the previous guided $180-220 million.

Roots Sustainable Agricultural Technologies (ASX:ROO)

ROO is actively engaged in advancement and commercialisation of solutions that tackle pressing challenges in the agricultural sector including plant climate management and the limited availability of water for irrigation.

ROO has several patented technologies which enable the adjustment of crop root temperatures as required, irrigation of crops with just humidity in the air and heating or cooling of plant substrates in pots, grow bags or soil.

CEO Boaz Wachtel told Stockhead recently he believes our window to address the future of sustainable food production is closing fast.

“There are no easy answers, but they exist,” Wachtel said.

“Governments usually fail to support climate mitigation technologies in agriculture.

“This needs to change rapidly in order to meet the food security challenge for next generations.”

Minbos Resources (ASX:MNB)

MNB was trading up 17% on Wednesday after inking a binding Memorandum of Understanding (MOU) with the Grupo Carrinho, Angola’s largest agro-industrial group, for the supply of Cabinda Phosphate Rock to be used as fertiliser.

MNB’s vision is to build a nutrient supply and distribution business that stimulates agricultural production and promotes food security in Angola and the broader Congo Basin.

It’s a significant milestone for the company and the first steps towards becoming Angola’s largest supplier of fertiliser.

CEO Lindsay Reed said to have so much of its initial production spoken for by one major partner enables MNB to plan for new stages and wider customer engagement.

“It’s hard to underestimate how important this offtake agreement is for Minbos and our plans to be Angola’s largest supplier of fertiliser,” he said.

“Angola is undergoing a fundamental economic overhaul as the government seeks to diversify its economy away from oil and gas and has agriculture firmly in its sights, with boosting crop yields inextricably linked to food security.”

The GNC, ROO, MNB share price today:

Bio-Gene Technology (ASX:BGT)

BGT specialises in creating patent-secured platforms, namely QCIDE and Flavocide, designed for the insecticides market.

The platforms use beta-triketones, a naturally occurring chemistry that shows promise in providing innovative insect management solutions for crop protection, including grain storage.

The discovery of the insecticidal properties of beta-triketone chemicals originated from a botanical screening program focused on identifying natural product-based insecticides in Australian flora.

BGT recently announced that Grains Research & Development Corporation (GRDC) is supportive of the continued development and registration of Flavocide for use in grain storage in Australia.

In a letter of support to the company GRDC said the development of Flavocide aligns well with its mission to create enduring profitability for Australian grain growers.

GRDC previously provided financial support as part of a collaborative testing project between GRDC, Bio-Gene, BASF and QDAF that concluded in mid-2022.

The project concluded that Flavocide combination treatments can effectively control five key stored grain pests (lesser grain borer, flour beetle, saw-toothed grain beetle, flat grain beetle and rice weevil) for up to 13 months.

RLF Agtech (ASX:RLF)

RLF Agtech is a technology-oriented company dedicated to enhancing plant nutrition through the development of innovative plant nutrition products.

Using RLF’s Plant Proton Delivery Technology, farmers can cultivate crops that yield higher outputs, exhibit improved quality, and possess enhanced nutritional value. Additionally, this technology aids in the natural carbon storage and reduction process within the plants.

Furthermore, RLF’s Accumulating Carbon in Soil System (ACSS) plays a vital role in capturing and sequestering CO2 by augmenting the organic matter present in soils worldwide.

The company in May announced it had entered into an agreement with Kona, one of Vietnam’s leading distributors of agricultural products, valued at $3.3 million over five years.

Elders (ASX:ELD)

ELD is another agri-stalwart which can trace its origins back to the 1800s. Travel to most rural areas of Australia and chances are you will see an Elders sign.

The diversified agribusiness serves rural and regional customers primarily in Australia and New Zealand. ELD’s comprehensive offerings include livestock services, real estate services, animal feed and processing solutions, wool agency services, financial planning services, and grain marketing services primarily in Australia and New Zealand.

Additionally, ELD has a significant presence in the international market, operating red meat supply chains in Indonesia and China. The company operates through three main divisions including Network, Feed, and Processing.

Shares in ELD slumped last year upon the announcement long-term CEO and managing director Mark Allison was retiring. But after a long search failed to find a suitable replacement, Allison has agreed to stay on.

No doubt he was persuaded by a $500k salary boost to $1.5 million and a $1 million bonus if he stays around for the next two years.

“While I had been intending to retire from Elders, it was never my intention to cease serving the interests of Australian agriculture, and this country’s farmers, after my departure,” he said in an ASX announcement.

Incitec Pivot (ASX:IPL)

IPL is a provider of industrial explosives, industrial chemicals, and fertilisers to the agriculture, mining, quarry and construction sectors.

IPL operates two customer-oriented divisions. Its explosive division Dyno Nobel serves customers in the Americas, Europe, Middle East, Africa (EMEA), and Asia Pacific regions while Incitec Pivot Fertilisers is a prominent integrated manufacturer and distributor of fertilisers catering to the east coast of Australia.

According to IPL’s website their fertiliser products play an important role in enabling sustainable food production to meet the rapidly rising demand for food around the world.

The company recently addressed a proposed structural separation of Incitec Pivot Fertilisers and Dyno Nobel and speculation that it may be considering a potential sale of its fertiliser business.

“IPL confirms that it has received a number of approaches for the potential acquisition of its fertilisers business,” IPL said in an announcement.

“The board’s assessment of a potential sale is being considered alongside the proposed demerger, which remains a strategic priority for the board.”

The BGT, RLF, ELD, IPL share price today:

At Stockhead, we tell it like it is. While Roots Sustainable Agricultural Technologies is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.