Oliver’s founder and his wife take back control as board resigns

Food & Agriculture

Food & Agriculture

All but one director of Oliver’s Real Food (ASX:OLI) has quit and the former CEO and his wife have joined the board.

A week after the chairman walked so has the CEO — 10 months after he signed on — and the two independent directors.

The shock resignations come a day after the founder and previous CEO, Jason Gunn, returned to the board along with his wife, Amanda.

Mrs Gunn is the operations manager at Oliver’s — the owner of those healthy fast food options you find at big servos usually next to a McDonalds or a KFC.

Only Kathy Hatzis remains, who is standing in as interim chair and company secretary, as the incumbent has also quit.

The changes come as the company “accelerates its optimisation effort”, the company said in a statement.

Mr Gunn sees its as “the beginning of the future” for the company but declined to comment for this story.

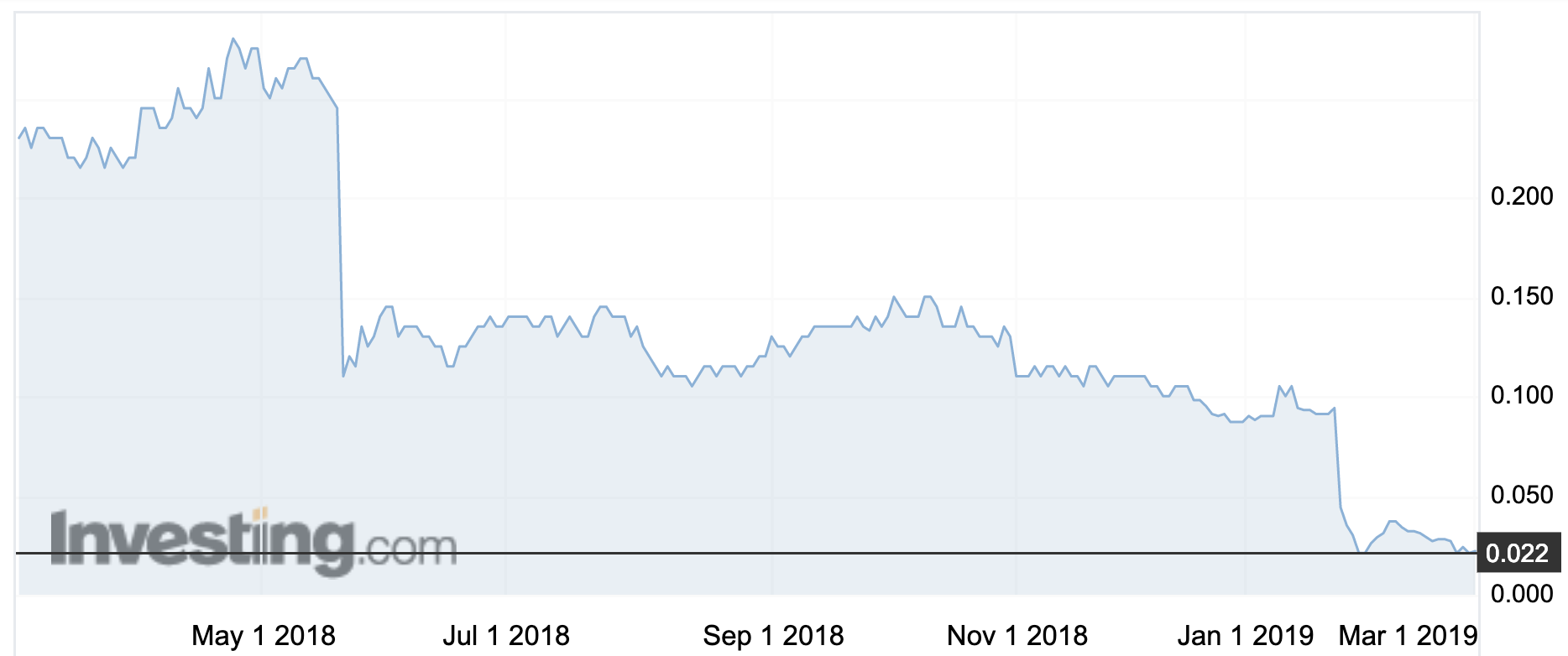

After a rough 18 months, this was news shareholders are getting behind: the stock is up 5 per cent to 2.2c.

Oliver’s has been a disappointment for investors since it listed in 2017.

It has offered shareholders a string of downgrades.

One came a month after it listed, saying it wouldn’t meet prospectus forecasts.

The second was last year when it said earnings were expected to drop 30 to 37 per cent.

The third was in January, when once again they said full year profits would be as soggy as a day-old tomato sandwich.

Outgoing CEO Gregory Madigan was brought in during March last year to stem the red ink, saying he had a plan to close non-performing stores, hire some trusty staff, and speed up a long-delayed roll-out of self-ordering systems.

And bring the menu up to scratch.

But yesterday the full year results were returned and while revenue rose 3.9 per cent, margins narrowed and the loss went from $127,000 to $11.5m, over half of which was from valuation write downs on assets, debts and inventory.

In particular, the company had to write off $2.6m in ‘goodwill’, an accounting term used to put a monetary value on a company’s reputation.

To top off the accounts, the auditor said that the massive loss means Oliver’s liabilities exceeded its assets by $1.2m and as a result, “a material uncertainty exists that may cast significant doubt on the group’s ability to continue as a going concern”.