Here’s how the food industry is changing and the small caps in the blocks to capitalise

Food & Agriculture

Food & Agriculture

The food industry is seeing some rapid shifts and a few ASX small caps are jumping on them — but it’s not just plant-based meat and food delivery.

While these two trends are gaining momentum, they are part of a broader trend of making food more efficient as well as sustainable. And venture capitalists are jumping onboard.

Mary Sue Rogers is catalyst leader at ForPurposeCo – the innovation arm of food rescue charity OzHarvest.

She told Stockhead that $US16.9 billion ($24.9 billion) was invested in the food and waste technology market alone.

Rogers said it was just as much about cost savings as it was about helping the planet.

“New technologies can generate financial benefits for business,” she said.

“For example, Winnow Solutions, one of our partners, uses AI (artificial intelligence) to improve the accuracy in recording food waste.

“This innovative technology has collectively helped commercial kitchens save more than $33m in annualised food costs or 25 million meals going in the bin.”

Small caps on the ASX trying to make food more sustainable fall into three categories. The first is making the preparation and delivery processes more efficient. Second is making the planting process more sustainable. And third is plant-based meat.

There are two ASX-listed small caps in this line of business.

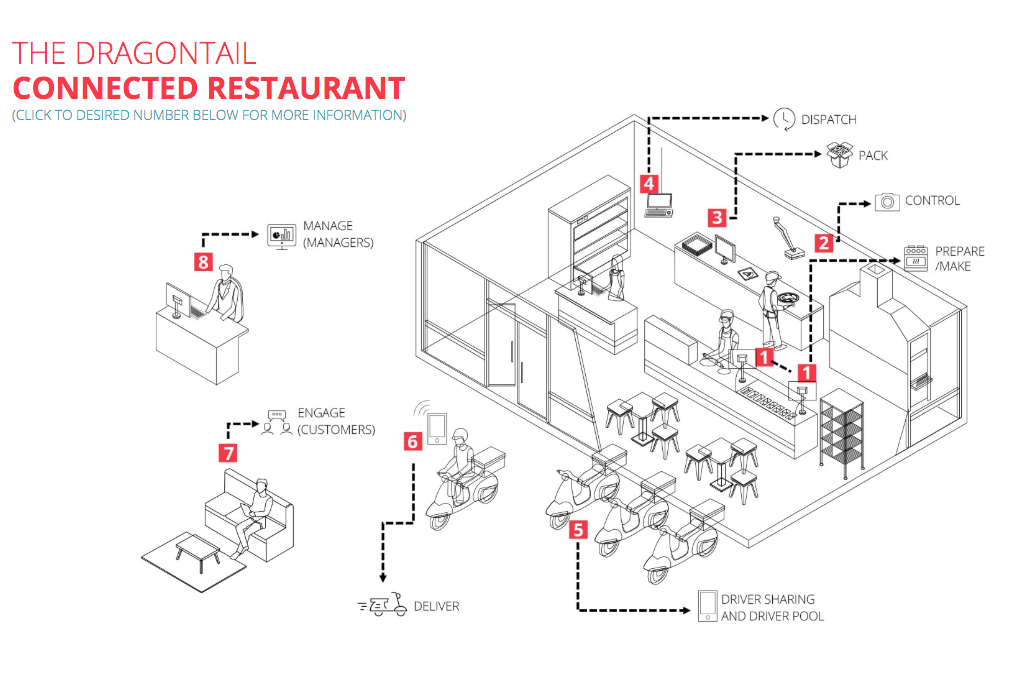

The first is Dragontail Systems (ASX:DTS), whose main game is software (Algo) that optimises food preparation and delivery from start to finish.

It helps restauranteurs monitor and track the cooking and delivery processes. It even manages the order of items that need to be prepared and can adapt when unusual events occur.

This also benefits the drivers. Its latest software upgrades help drivers find orders faster, which means they can earn more.

Dragontail claims its system is the first such system in the world and is in place at over 1,600 locations including 800 Dominos stores in Australia and New Zealand.

The second is Marley Spoon (ASX:MMM) and it delivers ingredients (in the form of meal kits) rather than the finished meals.

The stock has fallen 77 per cent since its IPO last year as it continues to make large losses. In 2018 it made a net loss of €41.2m ($66.8m).

Earlier this year it did a deal with Woolworths and told shareholders it aimed to be earnings positive by the end of 2020.

As the world’s population grows so does the need for more food. But companies are looking for ways to get more food from less resources.

Two stocks involved are cannabis growers. One is Roto-gro (ASX:RGI),which makes rotary “vertical farming” systems that it claims achieves greater yields with the same footprint.

The company also has software that monitors plant growth. It has told shareholders it is looking to expand beyond cannabis in the near future.

Roots Sustainable Agricultural Technologies (ASX:ROO) has a crop-cooling technology that it has found improves yields. While it has mainly been used on cannabis plants, it has been shown to work on various fruits and flowers including the famous South American species – Alstroemeria.

Abundant Produce (ASX:ABT) produces hybrid plants that have been cross-pollinated using two plant varieties. These are generally more resilient to pests and disease which can be big threats to plants.

Some might think of plant-based meat as a ‘feel good’ fad because it produces less emissions and does not involve killing animals. Beyond Meat surged as high as $US234 from $20 after its IPO before retreating to $77.34.

https://twitter.com/BettingBruiser/status/1171105326663438336

But US advocacy group Good Food Institute claims plant-based meat uses 72-99 per cent less water and contains 51 to 91 per cent less nutrient pollution.

Some estimates say that the amount of water needed to produce 1kg of beef can run upwards of 15,000 litres of water. Producing 1kg of Roots’ pulses, only needs about 4,000 litres of water.

Roots is at a relatively early stage but it conducted a trial of its technology on beans and peas, the key ingredients in plant-based meat, and yields were improved by 40 per cent. It is now undertaking a more formal test.

Two other small caps are involved in this space. Jatenergy (ASX:JAT) only entered the field last month and is collaborating with a Sydney food processor to develop plant-based meats. Ultimately it wants to focus on the Asian markets, particularly China.

Last month it told shareholders China was ideal because traditional meat and poultry could not keep up with growing consumer demand. The US-China trade war only exacerbated the problem.

The second small cap linked to plant-based meat is Wide Open Agriculture (ASX:WOA), which last year signed an agreement with regenerative beef producer Blackwood Valley Beef.

Rogers told Stockhead that in the 2020s she expected robotics, AI and big data to cause disruption.

Among the possibilities for business she named were 3D printing of food and drone deliveries. The former involves packing food into 3D moulds and then printing it.

The world’s first restaurant with this technology launched in London in 2016.

As for drones, there’s no shortage of stocks on the ASX, although none are yet focused on food delivery. There is a private drone-based food delivery firm, Wing, but it is still at the trial stage.

Rogers suggested that in the future analytics could also focus on the causes of food waste in order to take preventative actions.

Read More:

As Australian interest increases, just how big is the meat free meat opportunity