It’s been a week to forget so far in both Small Caps Land (-1.47% at time of writing) and the ASX generally, although Resources is gathering steam, helped by uranium stocks after news Japan was back in the nuclear business.

Stockhead’s experts kept their chins up, thankfully, seeing only opportunity. Here’s what caught their eye this week.

Guy Le Page

RM Corporate Finance

Rare Earth Elements, commonly known as REEs, have enjoyed an almost unbroken run for the past two years. There are many REEs, but the focus is generally on Neodymium-Praseodymium (NdPr) – a critical element in magnets, which are a critical element in electric engines and wind turbines.

There is a problem though – data suggests that about 95% of the world’s heavy rare earths (there’s around 15 of them) come from China and neighbouring Myanmar.

We’re onto it. In Australia, there are about 9 listed companies already mining REEs. They’re popular with investors, because NdPr oxide has risen from US$40 a kilo to US$140 a kilo in the past two years, so they’re not cheap, ranging from around $200m market caps to the biggest, Lynas (ASX:LYC) sitting at a hefty $8 billion.

The bargains to be had are in the explorers, where a handful sit around an approachable – and takeover-friendly – $10-$100m mark.

Guy Le Page likes the look of a recently capitalised player in the emerging Gascoyne REE district, Lanthanein Resources (ASX:LNR). Progress is picking up, and it sits right next to a couple of established player with cap up to 10x bigger.

Right now, you’ll get LNR for the princely sum of 4.2 cents. And if you think that’s cheap, it’s nearly a 200pc rise on where it sat a month ago. Gah!

Barry Fitzgerald

We’ll tuck this one in here quickly, keep it on the down-low. It’s a Garimpeiro special, and it’s lithium, where deep value is getting hard to find.

Trading at 7.6c for a market cap of $10.2m is tiny northeast Vic copper-gold hunter Dart Mining (ASX:DTM). (Actually quite a promising copper-gold hunter.)

But somehow, the market’s missed the fact Dart’s about to go hunting pegmatite swarms, and has signed a big, big player to help fund it – Chile’s lithium king SQM. SQM is one of the lithium world’s “Big Three”, and Fitz is pretty sure it has an excellent reason to be chasing a potential 70% interest in a fledgling Victorian explorer…

James Whelan

VFS Group

So, where are we really at in the bull/bear cycle?

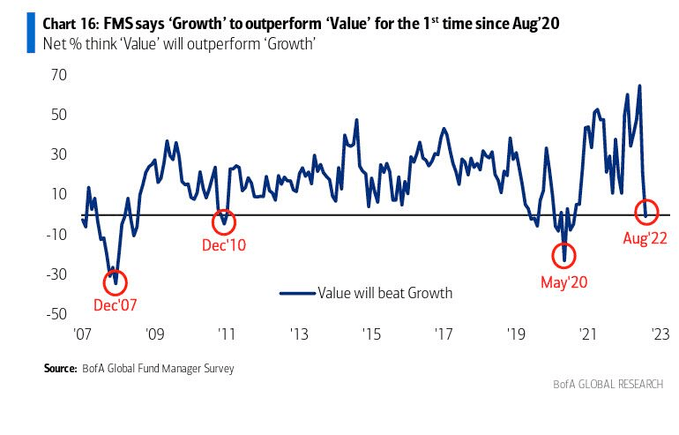

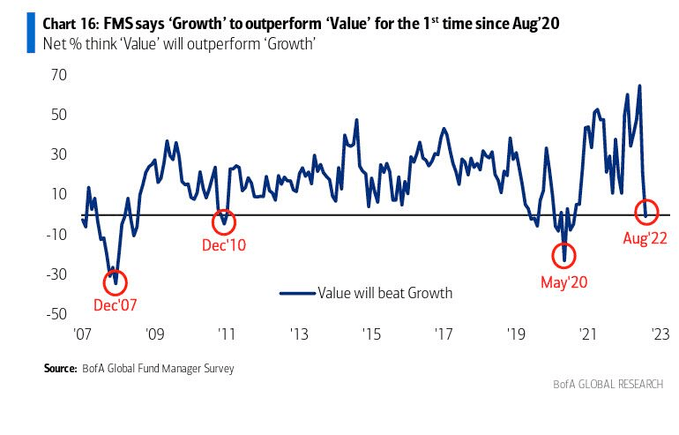

To be fair, it takes a lot of subdued data drops for fundies to concede the good times are over and a well-organised retreat is required. That may have come with last week’s BoFA Fund Manager Survey which was recently riding a 15-year high in favour of Value stocks to outperform Growth.

Now it’s a straight line down to Growth as the winner. That’s only happened twice since the big drop – the GFC – once in December 2010 and again in May 2020. Whelan’s thinking it might be time to move the Value ETF he holds “to the sidelines”.

He’s also watching for the imminent launch of a new ETF run by Nightshares in the us, which will buy futures on the close and sell at open the next day. You can check them out here, showing how their research on the “Night Effect” has risk-adjusted returns outperforming holding the market during the day.

Whelan’s also sticking with FOOD as La Nina threatens the Northern Hemisphere again. It’s up 17% off its July 15 lows, about halfway back to its April 21 high.

Quick picks

– VP Capital co-founder and portfolio manager John So likes energy stocks Terracom (ASX:TER), Karoon Energy (ASX:KAR), with oil production and exploration assets in Brazil, and Cooper Energy (ASX:COE)

– Tribecca and Regal Funds increased their positions in recent IPO Sierra Rutile (ASX:SRX) after it fell 33% from its 40c list price

– Credit Suisse likewise took advantage of an 88% fall in Melbourne biotech Hexima (ASX:HXM) to become a substantial holder

– VanEck Australia CEO and Managing Director Asia Pacific, Arian Neiron has a pretty thorough rundown on why he believes an actively managed fund is superior to passive management, topped off with a list of some smart Beta ETFs available in Australia right now.

– And Datt Group managing director Emanuel Ajay Datt thinks Myer’s on a roll and is a potential takeover target for Solomon Lew’s Premier Investments. Myer!

You might be interested in