You might be interested in

Energy

QPM’s well workover program delivers 38pc increase to Moranbah project gas reserves

Energy

Queensland Pacific Metals embarks on gas adventure with spud of first new production well imminent

Energy

Experts

Peter Strachan is a capital markets veteran, resources analyst and lover of the oil and gas game. The brains behind the popular weekly StockAnalysis investment letter, which launched in 2003, Peter has worked in capital markets for over 35 years, and is a qualified metallurgist and geologist.

Fossilised sunshine, in the form of oil and gas are finite, non-renewable sources of high-density energy, and we are burning them at an increasing pace.

A barrel of oil contains about 6,000 gigajoules of energy, which is the energy equivalent of 10 man-years of labour. Remarkably, a barrel of oil or its energy equivalent, 6,000 cubic feet (cuft) of methane gas, can be purchased for around US$90, while 10 years of labour might cost $700,000!

Decarbonising modern society will be a long and financially expensive process. A modest gas flow of 17 mmcuft/d and a $200 million combined cycle gas turbine can deliver 100MW of electric power 24/7, 365 days per year, at a fuel cost of about $50 million or $57 per megawatt hour (MWh) if gas costs $8 per gigajoule.

By comparison, delivering that amount of secure power via wind turbines would require at least 60, 5MW turbines, or 100,000, 400-watt solar panels, plus many thousands of MWhs of power storage to ensure supply through those dark, windless nights. The entire system would require kilometres of copper wire with multiple power inverters. And let’s face it, such a low emissions network might need at least a 30MW, open cycle gas turbine as backup!

Despite rapid development of multiple alternative energy sources and storage technologies, demand for fossilised sunshine is expected to expand from current levels, driven by population growth and increasing affluence.

The US Energy Information Administration’s (EIA) October ‘23 update predicts that, by 2050 global liquid petroleum consumption will increase to 121.5 mmBOPD, while gas demand will increase 29% to 194.3 trillion cubic feet (Tcf) per annum. This expansion in demand comes even as renewable energy output lifts 119% to 219 quadrillion BTU.

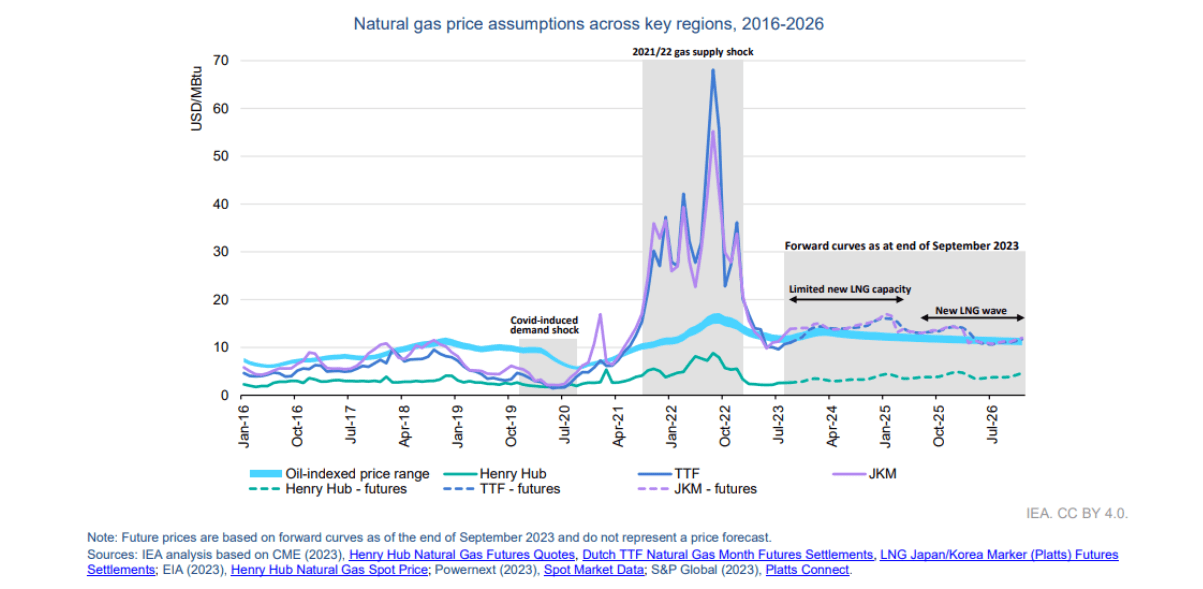

Since 2019 oil and gas prices have been disrupted, first by demand destruction from the Covid-19 pandemic and then by supply restrictions resulting from sanctions imposed on Russian oil and gas after its invasion of Ukraine.

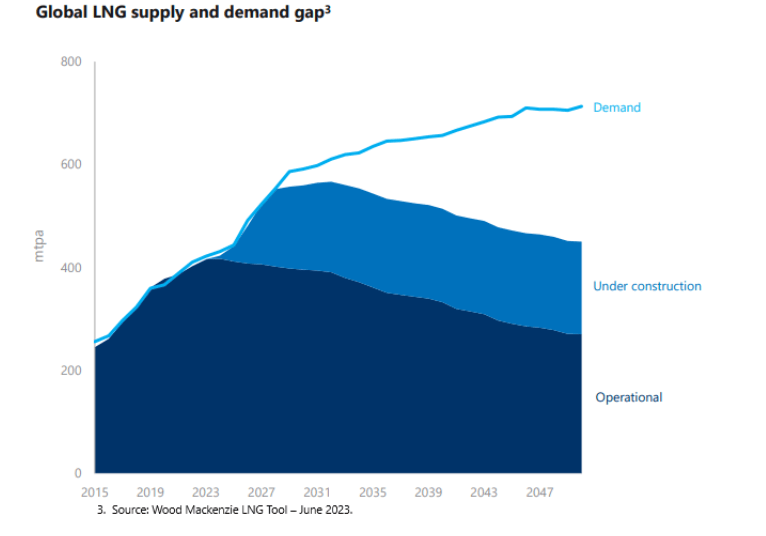

Industry analysts predict a rapid increase in demand for liquified natural gas, as a supply deficit appears after 2027, resulting in strong pricing for gas in Asia and Europe for the foreseeable future, especially since Europe has become more reliant on imported LNG.

In the current economic and social environment, petroleum explorers and developers need to be even more nimble and innovative to raise funding. Traditional markets for capital have all but dried up as larger funds fear stranded assets, but the business generates sufficient cash flow to be largely self-funding.

Companies that can self-fund from operating cash flow or by farming out and partial sale of development assets can survive and that is where value resides.

A $34m company, primed to lift oil production from about 330 BOEPD, to over 1,500 BOEPD from two oilfield development wells on its 50% held 5.2 million barrel, Anshof oilfield in Austria’s Molasse Basin. Funding for field development has been provided by industry partners, with a recent partner paying up to $19 million towards development, to earn a 30% interest at Anshof.

The first well at Anshof is planned for November 2023, testing a deeper and thicker section of the reservoir. Success would give a green light to a 4,000 BOPD production and transport facility to replace a temporary 120 BOPD test facility. An additional well will then be added in the second half of 2024, targeting oil production from all three wells to over 1,000 BOPD.

ADX has identified several oil and gas prospects near Anshof, where its success should attract further joint venture funding support, with the aim of fully utilizing production infrastructure.

The big upside for ADX comes this December ’23 with drilling of the relatively shallow Welchau exploration well, targeting a massive Prospective gas and condensate target of 807 Bcfe. ADX retains an 80% interest after attracting a partner who is earning a 20% interest by funding 50% of the exploration costs.

Generous terms for this deal speak for the quality and potential value of such a discovery in a market where undeveloped 2P + 2C gas has recently traded for around A$2/GJ in the Perth Basin.

Investors will not have to wait long to see drill bits turning and ADX’s leverage to success will have many eyes watching.

A $15m petroleum exploration company with interests in the Otway and Gippsland Basins, as well as the Bedout-Sub Basin, along trend from Carnarvon Energy’s Dorado oil and gas discoveries. The company estimates net Prospective (undiscovered) Resources to its account of 1,249 mmboe on all permits, including large gas targets close to infrastructure in the high value Eastern Australian gas market.

TDO has attracted mammoth energy company ConocoPhillips (CoP), as a joint venture partner to contribute ~$100 million towards two wells on TDO’s account, where TDO retains a 20% interest.

CoP is planning for up to six wells in a 2025 program on its Otway permits, depending on results from an initial two. With gas prices ranging from A$6 to A$12/GJ in this market, TDO shows significant leverage to success from an initial two funded wells.

A well-funded, $261 million market cap company holding cash and development funding commitments totalling $315 million.

In JV with operator Santos, the company will move towards development of the 389 mmboe Dorado and Pavo oilfields in 2024 with first oil at 100,000 BOPD possible in 2027.

CVN holds net Contingent Resources of 43 mmboe at the 10% held Dorado and 20% held Pavo oilfields as well as extensive gas and oil exploration targets with net Prospective Resources totalling 513 mmboe.

By any measure of value for undeveloped Contingent petroleum Resources, Carnarvon holds great appeal. The company has the equity required to support development as well as ongoing exploration and will easily attract debt to fund what should be a project with a net present value of over $700 million to the company’s account, at current oil pricing.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

At Stockhead, we tell it like it is. While ADX Energy is a Stockhead advertiser, it did not sponsor this article.