Party is over as Australia inflation equals 32-year-high and days of ultra-cheap money end

Experts

Experts

The party is over as the days of cheap money are behind us and the Reserve Bank of Australia grapples with reducing stubbornly high inflation.

That’s the view of Deakin University behavioural finance academic and Morningstar analyst Erica Hall who told Stockhead with consumer price index (CPI) inflation in Australia back to an equal 32-year-high consumers will be forced to change spending behaviours in 2023.

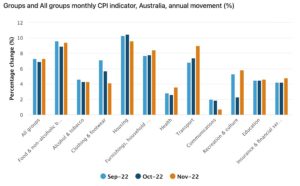

CPI rose 7.3% over the year to November, which was back up from 6.9% in October to the same level recorded in September, according to Australian Bureau of Statistics figures released yesterday.

The most significant price rises were housing, up 9.6%, food and non-alcoholic beverages, rising 9.4% and transport, up 9.0%

Also rising is retail turnover, which jumped 1.4% in November thanks to Black Friday sales

“We’ve had incredibly aggressive hiking of rates with eight rises over 2022 by the RBA and the latest figures suggest hikes are not done yet,” Hall said.

Australian Homeowners with fixed rates may not be feeling the impact yet, but this is forecast to change, soaking up a lot of discretionary income, in 2023.

It’s estimated ~$370 billion worth of Australian mortgages are due to come off fixed rates this year with concerns homeowners could face repayments climbing up to 65%.

“The halcyon days of ultra-cheap money is well and truly over and these aggressive rate hikes together with rising inflation will hit the budgets of many people particularly borrowers,” Hall said.

“Say goodbye to phone upgrades, new cars and eating out as we expect a dive in discretionary spend – the party is over.”

While there are many different behavioural biases which can come into play with finance, Hall said recency bias is one which seems to be common at present.

She said recency bias is where you extrapolate what is happening in the present and expect it to continue.

“There is some recency bias at the moment where people are thinking everything is just going to be fine and the situation I have now will continue indefinitely when the reality is there is change,” she said.

“There’s been a lot of economic change in the past 12 months, and it is about to hit.”

Throughout the covid-19 period the RBA provided guidance that interest rates wouldn’t be raised until 2024. It’s decision to do a backflip on rate rises led to a review on its approach to forward guidance.

“In late 2020 and for much of 2021, the RBA board indicated that the first interest rate increase was not expected for ‘at least three years’, and then not until ’2024 or later’,” the RBA review said.

“In hindsight … a less specific time frame, or one covering a shorter horizon, would have been preferable.”

Hall said a lot of homeowners were caught off guard by the rising rates, while the RBA underestimated the inflationary impact of massive stimulus, clogged supply chains and the war in Ukraine pushing up energy prices.

“They took out mortgages thinking they might have a couple more years of low interest rates up their sleeve,” she said.

“But to be fair the RBA has a mandate to manage monetary policy and inflation is a key part of that, which had been getting out of control in part because of cheap money.”

Volatile seemed to be the word to describe markets for 2022. I wanted to move away from using volatile or volatility this year (so 2022) but as Hall told me the adjectives are likely to remain as a market descriptor in 2023.

She said the R word is also going to be around this year (remembering a recession in Australia is technically described as two consecutive quarters of negative growth).

In the US the National Bureau of Economic Research determines when the US is in recession.

“I think it is going to be volatile and challenging and there’s definitely risk of recession, probably more so offshore but also here too,” Hall said.

“We’ve had inflation and interest rates rise at a global scale as we unwind this period of cheap money so some sectors are going to do better than others along with investment styles.”

She said growth investment styles have done well during a period of cheap money where the fundamentals didn’t seem to matter as much.

“Now we are seeing a swing back to more value style investing where fundamentals absolutely do matter and you want to buy assets at the right price,” she said.

Hall said bonds which have been out of favour for so long are also starting to appeal back to investors.

“Poor old bonds have been overlooked for so long but are looking much more attractive,” she said.

“Other asset classes which are good inflation hedges like infrastructure will probably do quite well too.”

Hall said volatility can test the most seasoned investor and as humans we tend to not do well in the face of uncertainty.

“Investors can make some crazy decisions because no one likes to lose or experience a loss, so the natural inclination is to stop the pain and cash out of what you are invested in,” she said.

“That would be a terrible decision because the cash rate is no way near the rate of inflation so it’s a certain way of losing money.

“Investors will need to work on taking a step back, trying to stay calm, not be emotional and let their heart rule their investing.”

She said one exercise investors could work on is reframing the narrative.

“It depends where you are in your investment journey but for young people for example it’s an opportunity to buy assets at a good price so that is a positive,” she said.

“You want to be buying assets cheaply not when they are expensive and conversely you don’t want to be selling them when they are dropping in price.

“There is a lot of research showing investors don’t capture the market return let alone beat it because they make poor decisions like selling low and buying high because of behavioural biases.

Hall said 2023 for investors is going to be about thinking long term, being diversified and doing your research.

“You can’t control as an investor what will happen with markets, but you can control where you invest, how diversified your portfolio, the price you pay and how often you rebalance and trade,” she said.

“If you have a strong opinion on a stock play devil’s advocate and ask what is the opposite that could happen as we can also be very overconfident in our capabilities and that too can result in poor decisions.

“It can be scary during times of volatility but there is always a silver lining.”