MoneyTalks: ‘Tis retail season on the ASX, so Ivers and Younger are taking us shopping!

Experts

Experts

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Richard Ivers and Mike Younger who run the Prime Value Asset Management team which, BTW, won the Zenith Small Caps Award last year.

“We’re stock pickers who find generally find opportunities across a range of sectors within the focus area (small cap industrials),” says Mike. “It tends to be stock specific issues rather than macro factors that drive us to invest in a stock.”

Having said that, interrupts Richard, some of these sectors have been hit very hard recently and they may present an opportunity.

“One among many we’re watching closely is the Aussie retail sector.”

“We are keeping tabs on the retail sector for a couple of reasons,” Mike told Stockhead.

“Firstly, as a canary in the coal mine for how the broader economy is tracking, given consumers are increasingly feeling the pinch of rates rises.

“And secondly, as a sector of interest for investment when we do feel the economic risks are largely behind us given the significant valuation de-rating.”

Richard says that to-date the Aussie retail sector “continues to positively surprise with sales trends”.

“While most retailers are reporting like-for-like sales declines of up to 10% over the last couple of months, this is coming off a heightened base stimulated by COVID savings and border lockdowns.”

Additionally, Mike adds, gross margins are reducing from very high levels, but still tracking broadly in line or above long-term trends.

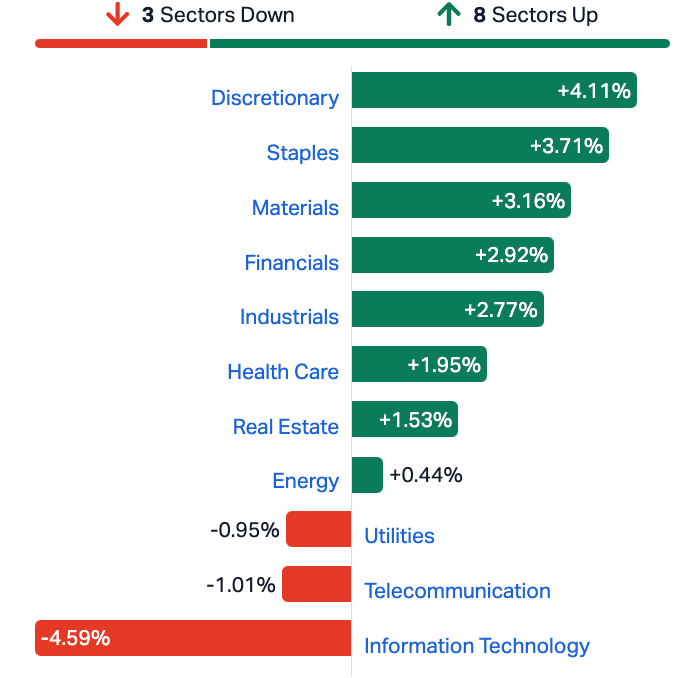

The last few weeks of trade have highlighted the diminished share price of some retailers both within the Consumer Discretionary and Consumer Staples Sector, but the most recent sessions show retail stocks have some genuine upside to offer.

“Right now we’ve very little exposure to the ASX Retailers or the Consumer Discretionary Sector, but that doesn’t mean we won’t,” according to Richard.

“There are three names in particular which we’re keeping very close tabs on and Lovisa Holdings is one of them.”

“This is a business with a strategic approach which we believe is well considered and offers strong global growth potential.”

Lovisa experienced comparable store sales growth of 6.3%, which the company told investors was a solid performance.

“I think, importantly LOV stuck to its guns with some price increases during the Q322 which had fairly negligible impact on sales volumes… and that’s emerged as one of the core growth-drivers into FY23,” Richard said.

And Lovisa just dropped FY23 numbers which we have here:

LOV cut its dividend, with the share price crashing last week on the news too – down about 7-8%.

Management says the business is now running with a new, more stable capital structure. And, after all, LOV’s literally splashed investors with cash the last few earnings drops, handing out the surplus on the company’s philosophy of providing dividends up to and according to what LOV only needs to work in terms of cash flow/balance sheet.

“And that’s part of what we like here – that LOV has a clever, simple but efficient business model. It does what it does with minimal fuss or bleed.”

Another stock which Mike and Richard have their eyes on is ARB Corporation, Australia’s largest manufacturer and distributor of 4×4 accessories.

Tuesday last week, the niche Aussie auto accessories maker and seller dropped its latest numbers, reporting a -3.4% dip in sales revenue and a 27.5% decline in profit after tax to $88.5m.

“The company is a fascinating one really – a home-grown designer and manufacturer of 4WD motor vehicle accessories, all under the ARB brand.”

Still, the stock price fell 4% on the day, following its profit miss and the trimming of its dividend.

But this is another solid business with a great track record, Ivers says.

“ARB is a proven high quality and innovative manufacturer and distributor. Its specialisation – across 4WD accessories – is a smart play, with what we believe is strong global growth potential.”

According to ARB, its export sales, which are mostly to the US, fell 8.7% for the year, with “export markets impacted by challenging market dynamics”.

But analysts – and management – reckon there’s some potential long-term tailwinds with the company anticipating both sales and profits to grow in the 2024 financial year.

The last retailer the Prime Value Asset Management team are keeping a close track of is BBN.

“What can I say, Baby Bunting is a category killer in a relatively more resilient part of the retail sector, with significant margin upside,” says Mike.

A little background for the childless or uninitiated: BBN is Australia’s largest specialty retailer of maternity and baby goods, largely catering to parents with children from newborn to three years. It’s a (ahem) growing market.

A few weeks ago the BBN share price jumped about 9 or 10%, after the company released its earnings report to say that while total sales were up 1.7% to $515.8 million, statutory NPAT is down 49.5% vs pcp to $9.9 million.

Yet, Richard notes, the brokers at both Ord Minnett and Morgans actually upgraded BBN, with an eye on a looming turnaround – noting that despite the profit slump, BBN’s total FY23 sales actually grew, up 1.7% on last year to $515.8 million.

“NPAT was $14.5 million, down 51% on the previous year while earnings before interest, tax, depreciation and amortisation (EBITDA) – at $31.2 million – were also down well over 38% on the prior 52-week period,” Richard says.

“While comparable store sales were down 3.6% from 5% last year, the online sales component of $103mn now represents 20% of total sales, and that’s an encouraging trajectory,” Mike notes.

The BBN FY23 gross margin was 37.4%, with the company reckoning that this improved through the second half, thanks largely to local international shipping cost reductions and new ranges of private label products as well as some changes to the loyalty program introduced at the end of 1H.

The company also launched its Baby Bunting Marketplace in June – just a few months back. This is an e-commerce store allowing third-party sellers to offer a curated range of products on the website (babybunting.com.au).

“It’s a smart play. It’s got legs, with BBN saying there’s already more than 5,000 SKUs available and their target is to finish FY24 with 20,000 SKUs from 150 retail partners.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.