The Wulff: Why Aussie retailers are so hungry to finish this year’s Black Friday

Black Friday, Down Under and the wolves are at the door of ASX retailers

The odds are frighteningly short that in the last 72 or so hours, you stopped whatever it was you usually do and either jumped online – or perhaps you even wandered into a genuine, real-life bricks-and-mortar shop and bought something – anything – for less than it usually goes for.

There’s no shame, you were among the circa 6 million Aussies who made a point of doing just that, lured by the promise of a spending spree we’ve come to accept like some Pagan ritual that must begin on the final (Black) Friday of November and continue across 4 fun filled days in to something even more bizarre that we’re calling Cyber Monday.

Like Halloween or Thanksgiving, it’s a tradition from the US: involuntarily inherited, little understood, obscured in meaninglessness… yet terrific fun and apparently a great success.

Rattled ASX retailers

Aussie retailers are hoping so.

Australian retail sales volumes have fallen for three consecutive quarters for the first time in 15 years, putting the industry under intense pressure.

The last time we saw three consecutive quarters of decline was in the Global Financial Crisis of 2008 – which gives us a concerning insight into the current economic climate. It’s not quite a recession, but it might feel that way for a klot of the ASX Retail Sector.

According to Stake market analyst, Megan Stals, soaring fuel prices, services inflation, increasing rents and interest payments are all hitting consumers hard.

“During recessionary periods, investors will often look to consumer staples stocks as a safe haven, but even Coles and Woolworths have seen recent falls, as increased theft, higher leasing costs and strikes place risk on profits… but that doesn’t mean there aren’t opportunities.”

And this weekend might help turn the tide – the experts reckon 2023 is likely going to break all the previous sales records by a fair bit.

According to the nation’s peak retail body, the Australian Retailers Association (ARA), we could burn burn through some $6.3bn, with the ARA forecasting a +3% countrywide bump in sales this season as the cost-of-living crisis ignites a cost-of-missing-out-crisis.

Last week, ARA CEO Paul Zahra said this splurge would account for more than 25% of all Xmas holiday shopping this year, as bargin hunters hunt out of necessity as much as pleasure.

Bell Direct’s Grady Wulff takes a look at what’s so special about Black Friday and Cyber Monday in 2023. She writes Australian retailers have been counting the days to the Bloodbath of Bargains for reasons particularly resonant with the 2023 we have all come to know and fear.

Shopping 101 with Grady

“As we close out 2023, Australian retailers will be eagerly awaiting the commencement of Black Friday and Cyber Monday sales for a number of reasons as we close out 2023,” Grady told Stockhead over the weekend.

“Firstly, it gives retailers an opportunity to move stock and reduce inventory levels through heavily discounted promotions. A key metric investors look for when choosing whether to invest in a retailer is the level of inventory the company holds. Fashion and retail businesses are cyclical in nature, therefore a company that holds a high level of inventory may find it difficult to sell down levels possibly leading to stock being written off or sold at a loss.

“Secondly, some retailers will use this sale period as a way of gaining insight into consumer sentiment toward discretionary spend in the current high-cost-of-living environment, as well as what areas retail consumers are still spending in, and which are falling out of favour with Aussie consumers.”

This period also allows retailers to gauge outlook toward consumer spend in the December holiday period, she says.

“If consumers spend big in the Black Friday and Cyber Monday sales, we may see a dip in spend over the traditionally high-spend busy holiday and Christmas period as consumers are likely to snap up bargains to reduce the hip pocket damage come Christmas,” Grady says.

Margin Call

“Investors, this sale season will be keeping a close eye on just how heavily some stock is discounted and what the implications are for the respective retailers in terms of revenue over the sale period compared to the Christmas season.

“An increase in retail sales is one contributor to increased inflation and while spend has remained resilient in 2023, clothing, footwear and personal accessory retailing rose just 0.3% in September from August, against food retailing rising 1% and department store retail rising 1.7%.”

Clothing, footwear and personal accessory retailing has experienced very marginal, if not stagnated growth, since January 2023, Grady says.

“Household goods retailing has come down from the recent peak in November 2022, which may prove a challenging headwind for the likes of Harvey Norman Holdings (ASX:HVN) , Nick Scali (ASX:NCK) and Temple & Webster (ASX:TPW) this holiday season.”

As for whether Santa’s sack will be full or empty this year… we will find out post promotional sales period and when October’s retail sales data is released early in December.

Temple of furniture

“On an inventory front, Temple & Webster boasts a key competitive advantage given 70% of its products are drop-shipped – i.e. avoid being held as inventory – thus complying to investor demand for lower inventory levels on hand.

Although easily outperforming moast of its peers, the online furniture retailer was among many in the sector to get caught in the noose of tightening budgets, posting a circa one-third pull back in FY23 profits back in August.

On the plus side, CEO Mark Coulter said that sales had picked up as consumers made the move into more affordable home goods.

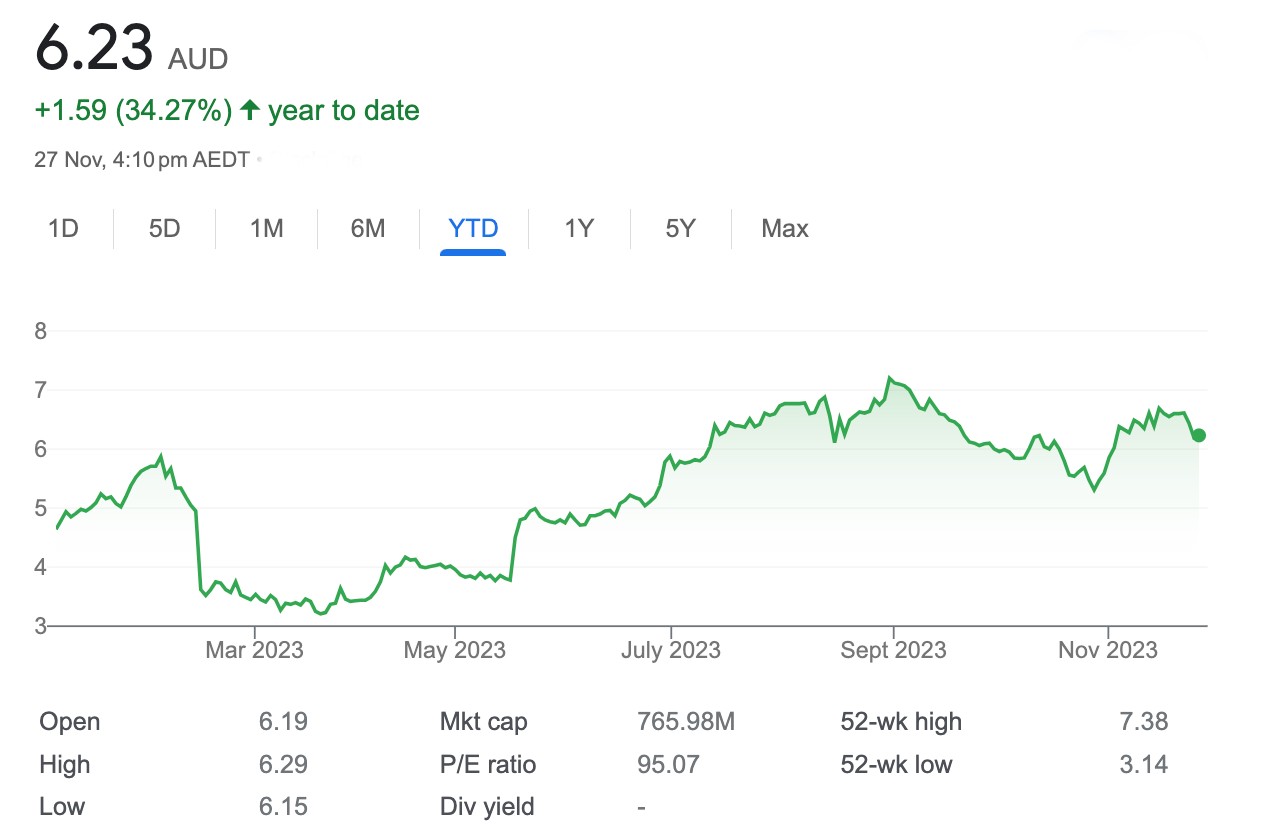

Temple & Webster shares have come off their September peak:

Grady says TPW has also recently made key strategic moves during the period of slowing demand though.

“By investing in AI TPW has looked to enhance the customer experience, and increased marketing spend to gain further market share in the furniture market.”

Go HVN

“Harvey Norman released a Q1 trading update late in October outlining aggregated sales revenue for the quarter fell 9.1% compared to the PCP.

One positive to come out of the Harvey Norman results was the strength in foreign currencies, Grady says while the company also announced a buy back for up to 10% of the company’s shares – a more than $440mn double down.

The buyback is kicking off this month and should be done within 12 months.

With a a strong bank balance, management is taking the opportunity to use an extended period of what they clearly see as undervaluation to consolidate while it they can.

Throughout 2023, HVN has tried to halt a share price slide that began pretty much when the pandemic stopped:

Via Google

“The consensus from the retailer results in the recent quarterly reporting period is pointing to a drastically slowing consumer spend environment as COVID-savings dry up, fixed mortgages turn to variable and the overall higher cost-of-living environment begins to really bite,” Grady adds.

Waiting for Lov

While we are seeing some retailers struggle through the high cost-of-living environment, others continue to remain resilient, says Grady.

“Included in this list is the fashion jewellery retailer Lovisa Holdings (ASX:LOV), which rallied 2% this week after releasing a trading update at its AGM outlining overall sales up strongly… driven by the company’s strong global rollout strategy with the first store in China on the horizon soon.”

While the stock price has taken a hit in 2023, the company’s fundamentals remain strong, Grady says.

Some traders are seeing LOV as the kind of buying opportunity created by the rate-rising decline of ASX retail stocks:

“Lovisa strategically targets a wide audience, offering affordable fashion jewellery and accessories for any occasion.”

And, Grady says, LOV has twin pillars to its success.

“The two key strengths of the business are its high-turnover, low ticket nature of products and free piercing offering for any purchase of earrings as this captures a new audience who may not have shopped with Lovisa previously.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.