Money Talks: The proper gold bull run ‘could be just around the corner’

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Money Talks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to see what’s hot, their top picks and what they’re looking out for.

Today, we hear from Simon Popple of UK-based Brookville Capital.

What’s hot right now?

Popple sees huge potential in the gold/silver sector for two main reasons.

Firstly, negative yields on many bonds means the argument for not holding gold — because it does not yield anything — no longer holds true.

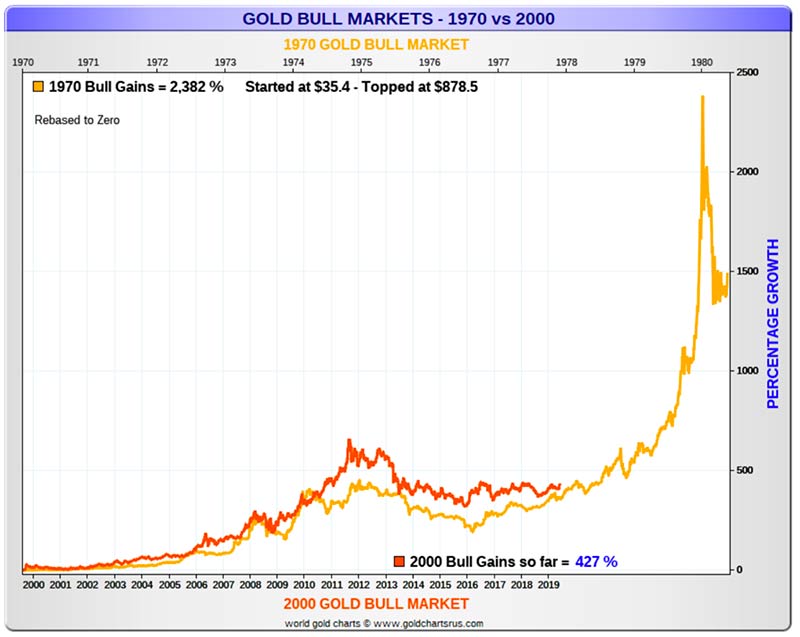

And secondly, if you compare this bull market with the 1970s there’s a good correlation, but “the main upside could be just around the corner”.

Check this out:

Top picks

Silver Lake Resources (ASX:SLR)

Market Cap: $819m

“I firmly believe that the merger between Silver Lake and Doray Minerals completed on 5th April 2019 was a game changer,” Popple says.

“It combines complementary operations and establishes Silver Lake as a multi-asset gold producer.

“In addition to this deal, they are also taking advantage of the weak prices in the juniors, taking some decent stakes in various companies that could turn out to be very lucrative.

“In April 2019 they invested in Sarama Resources (TSX:SWA) – spending $C2.5m ($2.8m) for a 12.5 per cent stake. Sarama’s management team have a proven track record of discovery and development in Africa.

“Then, in July, Silver Lake announced another strategic investment, this time in Encounter Resources (ASX:ENR) – giving them a 5.3 per cent stake. This investment only cost them $502,500, but it gives them a meaningful shareholding alongside Independence Group (ASX:IGO) (9.2 per cent).”

READ: EganStreet jumps 26pc on big Silver Lake takeover offer

Chalice Gold Mines (ASX:CHN)

Market Cap: $59m

“This is a really exciting exploration play,” Popple says.

“The Pyramid Hill project is located in the Bendigo Zone of Victoria, an area that has produced over 60 million ounces of high-grade gold.

“The general consensus is that the geology extends to the north where Chalice have a major land holding.

“Recent high-grade finds at both Fosterville and by Catalyst (ASX:CYL) have got tongues wagging and explorers very excited that there could be a very large deposit out there….waiting to be discovered.

“What I like about Chalice is that it’s not all about one project. A great discovery was recently made at the Merlin project, which is very near to Chalice’s King Leopold nickel project in WA.

“Buxton’s (ASX:BUX) Merlin discovery had drill intercepts with grades up to 8.14 per cent nickel, 5.26 per cent copper and 0.69 per cent cobalt – which are very high.

“If Chalice can find anything similar, they could be sitting on a very valuable deposit.”

READ: An interview with Chalice Gold Mines’ Alex Dorsch

Evolution Mining (ASX:EVN)

Market Cap: $8.23 billion

“Size also matters,” Popple says — “or so I’ve been told.”

“With a market capitalisation of circa $8 billion, net debt (as at 31st December 2018) of just $41m and a reserve life of around 10 years – Evolution are a large company.

“Some of you like lower risk, which invariably means lower production costs — if the gold price goes down they can still make a profit.

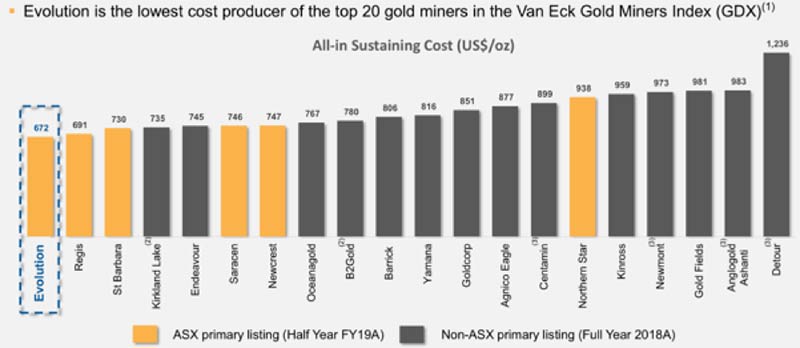

“In fact, they’re the lowest cost producer in the Van Eck Gold Miners Index. Take a look at the graph below:

“What I find particularly encouraging about these numbers is that all their mines are in Australia, which is not the case for several of the other companies in this chart.

“Several have low cost operations in other countries where there’s significantly higher political risk.”

READ: Has Evolution uncovered something at Andromeda’s Drummond project?

After completing his MBA at Birmingham University in 1993, Simon joined the corporate finance team at Singer & Friedlander working on small and mid-cap mergers and acquisitions. In 1997, he joined the senior banker team at ABN AMRO before moving into their corporate finance department in 1999, where he specialised in private equity. He then became head of investment management at Strutt & Parker’s Real Estate Financial Services before becoming a director of Topland, one of Europe’s largest private investment companies.

In 2008, he set up Brookville Capital, a capital-raising business which subsequently won mandates with, amongst others, Bunge, the Bank of China (Suisse) and Fleming Family & Partners.He now writes the Brookville Capital Newsletter which covers gold and silver mining stocks.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.